Setting Up Automatic Maintenance Methods

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

AUTOMNT_METHOD |

Add a new automatic maintenance method or view a summarized list of the steps in an existing method. |

|

|

AUTOMNT_STEP |

Define the steps that the Automatic Maintenance process performs when you run a method. |

To set up automatic maintenance methods, use the Automatic Maintenance Method component (AUTOMNT_METHOD).

Automatic maintenance methods define rules for matching debits and credits and for handling remaining balances for each match group. The Automatic Maintenance process uses the method that you assign to the business unit for processing unless you override the method for all business units on the Automatic Maintenance run control page.

Each method contains a series of steps that the process executes sequentially. For each step, you specify:

One matching instruction.

As many conditions and actions as necessary.

Whether to exclude certain types of items, such as deductions.

You select one of these matching instructions for each step:

Have the process match a value in a field in the debit items to a value in a field in the credit items.

If an automatic maintenance method indicates that the process should exactly match items by their open amount and the One to One option is selected in the method, the items must be unique. For example, if you have two 1,000.00 EUR credits and one 1,000.00 EUR debit, the process does not place any of the items in a match group.

Have the process execute the #OLDEST or user-defined algorithm group.

The #OLDEST algorithm group matches open items by due date—matching the items with the oldest due dates first—until either all the available credits or all the available debits are matched. It uses the directions that you provide for the step to determine how to handle the remaining balance.

Have the process write off items with a specific entry type and reason that were not matched in previous steps.

The write-off amount must meet the write-off tolerances defined for the entry reason assigned to the automatic entry types associated with the Write-off a Credit (MT-02), Write-off a Debit (MT-03), Write-off Remaining Credit (MT-06), and Write-off Remaining Debit (MT-07) system functions.

For the first two instructions, you define the action that the process takes based on the remaining balance for the match group. The system populates the actions for the last instruction and you cannot change them. You also define whether to put the match group or write-off on a maintenance worksheet.

Designing Methods Based on Reference Values

It is essential that you have a thorough understanding of how your organization tracks reference information on credit items when you create your automatic maintenance methods.

Ideally, the methods that you define enable the Automatic Maintenance process to match the majority of your debits and credits and to write off the remaining balances, leaving only the exceptions to be matched or written off using the maintenance worksheet. The trick is to fit your methods to the way that your business processes populate reference information.

Place the steps that produce the greatest number of matches at the beginning of the automatic maintenance method. For example, if you are creating a method to resolve deductions, and the majority of your customers provide the claim number in the Claim Number field when they take the deduction, and you also enter it in the Claim Number field when you create the credit memo, use the Claim Number field in the first step.

As you work with methods during implementation, you will probably change them until you find the most efficient way to match items.

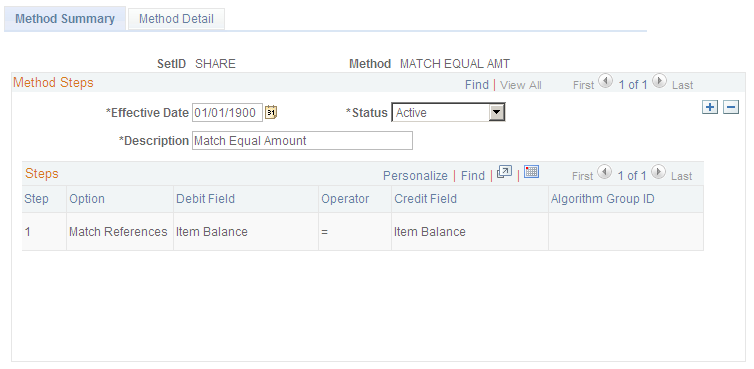

Use the Method Summary page (AUTOMNT_METHOD) to add a new automatic maintenance method or view a summarized list of the steps in an existing method.

Navigation:

Use the Method Summary page (Set Up Financials/Supply Chain, Product Related, Receivables, Credit/Collections, Automatic Maintenance Methods, Method Summary).

This example illustrates the fields and controls on the Method Summary page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Method |

Displays the unique code that identifies the automatic maintenance method. |

Steps

The Steps grid displays a list of all the steps in the automatic maintenance method. When you first add a new method, the list is blank.

Field or Control |

Description |

|---|---|

Step |

Displays the step number. The process performs the steps in sequential order. |

Option |

Displays the type of task that the step performs. Values are: Match: Matches the values in a field for a debit item to the value in a field for a credit item. Algorithm: Matches or creates a write-off based on the algorithm that you selected. Write-Off: Writes off debit or credit items that the process did not previously match that have an amount that is less than the defined tolerances for either the business unit, customer, or automatic maintenance reason associated with the automatic entry type for the write-off item, such as Write off a Debit or Write off a Credit. |

Debit Field |

Displays the field whose value you are matching for debit items. |

Operator |

Displays the operator that the process uses to match the items. Values are: = (equals): Creates exact matches. LIKE: Creates partial matches. |

Credit Field |

Displays the field whose value you are matching for credit items. |

Algorithm Group ID |

Displays the name of the Application Engine section that the process runs for the step. |

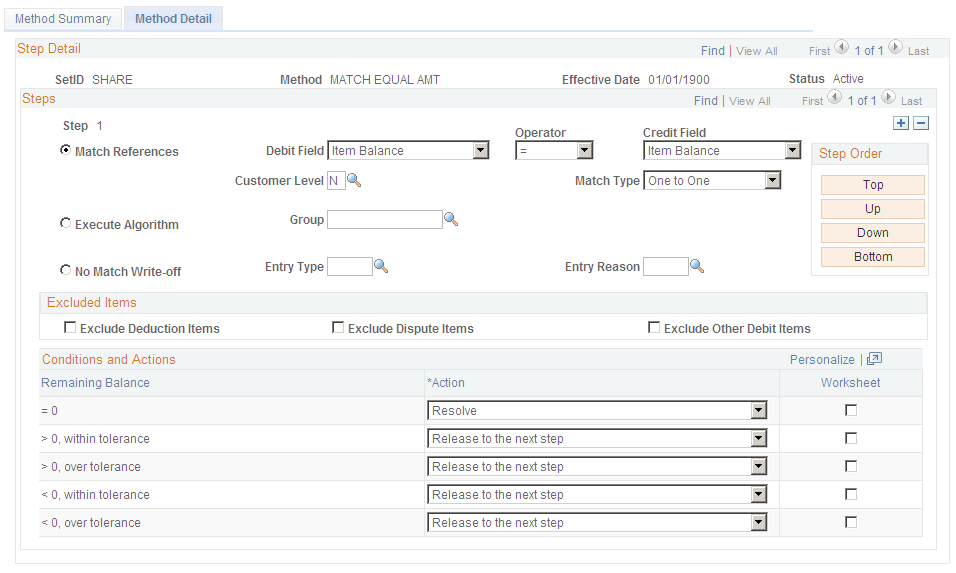

Use the Method Detail page (AUTOMNT_STEP) to define the steps that the Automatic Maintenance process performs when you run a method.

Navigation:

This example illustrates the fields and controls on the Method Detail page. You can find definitions for the fields and controls later on this page.

Steps

When the Automatic Maintenance process runs, it examines each debit item and performs the steps in the method in sequential order. The system automatically assigns the Step number.

Select one of these options for each step:

Field or Control |

Description |

|---|---|

Match References |

Matches the values in a field in a debit item to a value in a field in a credit item. For example, it could match the invoice for a debit item with the document ID for a credit item. When you select this option, you must specify the match criteria. |

Execute Algorithm |

Performs matching and write-offs defined in a Application Engine section. Each section is an algorithm group and each step in the section is an algorithm. The Automatic Maintenance process executes the actions based on the results of the algorithm. When you select this option, you must enter the name of the algorithm group in the Group field. Select a user-defined algorithm or select the system-defined #OLDEST algorithm, which matches all debits and credits in oldest first order by due date. |

No Match Write-off |

Writes off debit or credit items not matched by the previous steps that have an amount that is less than the tolerances that you defined. When you select this option, select one specific Entry Type and corresponding Entry Reason for the items that you want to write off. For example, enter DED for the entry type to write off deduction items. When you create the entry reason for the entry type, you might want to create the entry reason for a small amount, such as 5.00 USD. When you create an item, such as a deduction, assign the entry reason for small amounts to the item. Enter the entry reason for small amounts in the Entry Reason field. If you want to write off both debits and credits, you need to create two separate steps. Note: If you select No Match Write-Off for a step, the Automatic Maintenance process does not check the percentage tolerance, because the percentage will always be 100. |

If you selected Match References, specify the criteria for creating a match.

Field or Control |

Description |

|---|---|

Debit Field |

Enter the field whose values you want to match in debit items. |

Operator |

Select the operator to use for matching. Values are: =: Creates exact matches. LIKE: Creates partial matches, including values that begin with the same characters or numbers. For example, the process would match a debit whose reference ID is 123 to a credit whose reference ID is 12345, or it would match a debit whose reference ID is 12345 with a credit whose reference information ID is 123. However, it will not match 12345 to 12378. If you want to create both exact and partial matches, enter one step to create exact matches and one to create partial matches. Because like matches also retrieve exact matches, always precede a Like match step with an Exact match step. |

Credit Field |

Enter the field whose values you want to match in credit items. You can match values in the following fields in the Item table (PS_ITEM) for either the debit or credit items. The field for the credit does not have to be the same field as the debit. Select from these values: AR Specialist, Bill of Lading, Broker ID, Carrier ID, Claim Number, Class of Trade, Collector, Contract number, Credit Analyst, Item Balance (open amount), Division, Document ID, Family, Invoice, Item ID, Major Classification, Order No, Open Amount, Proof of Delivery, Purchase Order Reference, Sales Person, Sales Person 2, or User 1 through User 10. |

Customer Level |

You can expand match groups to include items across all customers in a customer group. Select the customer level to use when creating match groups. Values are: C: Corporate customer group. N: No customer relationships considered. This is the default value. R: Remit from customer group. |

Match Type |

Specify how the process does the matching. Select one of these values: All: Places all items that meet the matching criteria in one match group. One to One: Matches only one debit to only one credit in a match group. If the matching criteria creates a match group with more than one debit or credit, the process does not match them. Matches debit and credit items of the same amount for a customer as long as the amounts are unique. For example, if you select Item Balance as the matching criteria in both the Debit Field and the Credit Field, and there are two 1,000.00 USD debits and one 1,000.00 USD credit, it does not match the items. |

Exclude Deduction Items |

Select to exclude deduction items from matching when processing the step. |

Exclude Dispute Items |

Select to exclude disputed items from matching when processing the step. |

Exclude Other Debit Items |

Select to exclude all items other than deduction and disputed items from matching when processing the step. |

Step Order

The buttons in the Step Order group box move a step up or down in the method. Place the steps that produce the greatest number of matches at the beginning of the method.

Conditions and Actions

If you select Match References or Execute Algorithm, you must select an action for each condition. Each step includes five remaining balance conditions.

If you select No Match Write-off, the system defines the conditions and actions, and you cannot change them. However, you can specify whether you want to place the write-off items on a worksheet.

Field or Control |

Description |

|---|---|

Remaining Balance |

Displays the condition for the remaining balance for a match group. Values are: = 0: The remaining balance is zero. > 0, within tolerance: The remaining balance is greater than zero and meets the write-off tolerances. > 0, over tolerance: The remaining balance is greater than zero and exceeds the write-off tolerances. < 0, within tolerance: The remaining balance is less than zero and meets the write-off tolerances. < 0, over tolerance: The remaining balance is less than zero and exceeds the write-off tolerances. Note: You define the write-off tolerances for each business unit and override them for individual customers or for the automatic maintenance reason that you assign to the automatic entry types associated with these system functions: Write-off a Credit (MT-02), Write-off a Debit (MT-03), Write-off Remaining Credit (MT-06), and Write-off Remaining Debit (MT-07). |

Action |

Select the action that you want the process to perform based on the remaining balance for the group. Values are: Resolve: The process matches the entire amount of the items. Select this when the balance is zero. Resolve, write off balance: The process matches the items and creates a write-off item for the amount of the remaining balance. Select when the remaining balance is within tolerances. Resolve, Create new item: The process matches and closes the items and creates a new item (either an MD or MC item) for the difference between the balances of the matched items. For example, if the process matches debit items totaling $200 to credit Items totaling -$145, the items are closed and a new MD item is created for $55. If the process matches debit items totaling $200 to credit items totaling -$233, the items are closed and a new MC item is created for -$33. Resolve, Item balance open:The process matches the items and closes the items with the smaller total absolute amount. The process also closes the items with the larger total absolute amount, except for the item with the latest due date, which remains open with a balance equal to the difference between the two amounts. The process does not create a new item. For example, the process matches debit items totaling $200 to credit Items totaling -$145, the credit items are closed, and the debit items are closed, except for the debit item with the latest due date, which remains open with a balance of $55. Note: If you select the No Match Write-off button, the Resolve, Item balance open actions are not available for selection. Release to next step: The process does not match the items. The debit and credit items are available for processing in the next step. Select for either a zero balance or a remaining balance. |

Worksheet |

Select to place the match group on a maintenance worksheet for online review. The worksheet displays the match groups and suggested write-off items or remaining open amounts. You can accept the results or make manual adjustments before posting the maintenance group. Note: You can select Worksheet only for a Resolve, write off balance action for a No Match Write-Off step. |

Accounts Receivables provides several sample methods in the database for you to review before you design your own methods. The following sections provide two examples of automatic maintenance methods.

This example provides instructions to use if the value in the Document field for a debit item does not exactly match to the value in the Document field for a credit item. Alternately, you can use sample data delivered with the LEAVE BALANCE method in the Automatic Maintenance component, which will leave the remaining balance on the item.

To create these instructions:

Select Match References and enter the following matching criteria:

Field or Control

Description

Debit Field

Select Document ID.

Operator

Select =.

Credit Field

Select Document ID.

Customer Level

Select N.

Match Type

Select All.

Enter the parameters for each condition as shown in this table:

Remaining Balance

Action

Worksheet

= 0

Apply, Remaining balance open

Clear to post the match group.

> 0, within tolerance

Apply, Remaining balance open

Select to review the match group on a maintenance worksheet.

> 0, over tolerance

Apply, Remaining balance open

Select to review the match group on a maintenance worksheet.

< 0, within tolerance

Apply, Remaining balance open

Select to review the match group on a maintenance worksheet.

< 0, over tolerance

Apply, Remaining balance open

Select to review the match group on a maintenance worksheet.

You may want to have several steps that exactly or partially match different references, because not all of your customers supply the same reference information. This example has four steps. Each step considers the remaining balance for the match group and provides an action based on the balance. This example:

Matches all items except deduction and disputed items that have matching unique open amounts.

Matches values in the Document field in the Item table for deduction items with the values in the Document field in the Item table for credit items.

The example has four steps. Each step considers the remaining balance for the match group and provides an action based on the balance.

Note: You may want to have several steps that exactly or partially match different references, because not all of your customers supply the same reference information.

Step 1 - Exact Match on the Open Amount

Step 1 provides instructions on creating a match group for each set of debit and credit items that have a unique open amount as well as instructions on resolving each group. For example, the open amount for a debit is 999.00 CAN and the open amount for a credit is –999.00 CAN. Each match group is set to post. You want to match items—except exception items—for all customers associated with the remit from customer.

To create these instructions:

Select Match References and enter the following matching criteria:

Field or Control

Description

Debit Field

Select Item Balance.

Operator

Select =.

Credit Field

Select Item Balance.

Customer Level

Select R.

Match Type

Select One to One.

Select Exclude Deduction Items and Exclude Dispute Items.

Select an action for each condition.

You must select Resolve when the remaining balance = 0. You can select any action for the other conditions, because the remaining balance is always zero for this matching criteria and none of the other conditions apply.

Deselect the Worksheet check box.

Step 2 - Exact Match of a Reference Value

Step 2 provides instructions for the Automatic Maintenance process to take if the value in the Document field for the deduction item is exactly the same as the value in the Document field for a credit item. The process matches items for all customers associated with the remit from customer.

To create these instructions:

Select Match References and enter the following matching criteria:

Field or Control

Description

Debit Field

Select Document ID.

Operator

Select =.

Credit Field

Select Document ID.

Customer Level

Select R.

Match Type

Select All.

Select Exclude Dispute Items and Exclude Other Debit Items.

Enter the parameters for each condition as shown in this table:

Remaining Balance

Action

Worksheet

= 0

Resolve

Clear to post the match group.

> 0, within tolerance

Resolve, Write off balance

Clear to post the match group.

> 0, over tolerance

Resolve, Item balance open

Select to review the match group on a maintenance worksheet.

< 0, within tolerance

Resolve, Write off balance

Clear to post the match group.

< 0, over tolerance

Resolve, Item balance open

Select to review the match group on a maintenance worksheet.

Step 3 - Partial Match of a Reference Value

Step 3 provides instructions to take if the value in the Document field for a deduction partially matches the value in the Document field for a credit item. The process matches items for all customers associated with the remit from customer.

To create these instructions:

Select Match References and enter the following matching criteria:

Field or Control

Description

Debit Field

Select Document ID.

Operator

Select Like.

Credit Field

Select Document ID.

Customer Level

Select R.

Match Type

Select All.

Select Exclude Dispute Items and Exclude Other Debit Items.

Enter the parameters for each condition as shown in this table:

Remaining Balance

Action

Worksheet

= 0

Resolve

Clear to post the match group.

> 0, within tolerance

Resolve, Write off balance

Select to review the match group on a maintenance worksheet.

> 0, over tolerance

Resolve, Item balance open

Select to review the match group on a maintenance worksheet.

< 0, within tolerance

Resolve, Write off balance

Select to review the match group on a maintenance worksheet.

< 0, over tolerance

Resolve, Item balance open

Select to review the match group on a maintenance worksheet.

Step 4 - No Match Write-Off

Step 4 provides instructions to take if the value in the Document field for a deduction does not match the value in the Document field for any credit items, when the entry reason for the deduction is SMALL. The write-offs will not be placed on a worksheet. Use this instruction when an item amount is too low to make investigating the open balance worthwhile.

To create these instructions:

Select No Match Write-Off.

Select Exclude Dispute Items and Exclude Other Debit Items.

Enter the entry type code for deductions, such as DED, in the Entry Type field.

Enter SMALL in the Reason field.