Setting Up Rules for Overdue Charges

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

OVERDUE_CHG_TABLE1 |

Define overdue charge IDs and some basic rules for how to calculate overdue charges. |

|

|

OVERDUE_CHG_TABLE2 |

Define the conditions under which items should be excluded from overdue charges. |

To define rules for overdue charges, use the Overdue Charging component (OVRDUE_CHG_TABLE2).

Use this component to:

Define overdue charge IDs.

Define exclusions from overdue charges.

Overdue charge IDs enable you to define the overall processing rules for overdue charge invoices, such as:

Whether overdue charges should be added to the customer balance.

The number of days that must elapse before overdue charges are reassessed.

The overdue charge percentage rate.

What items should be excluded from overdue charges invoices, such as past-due items that are in dispute.

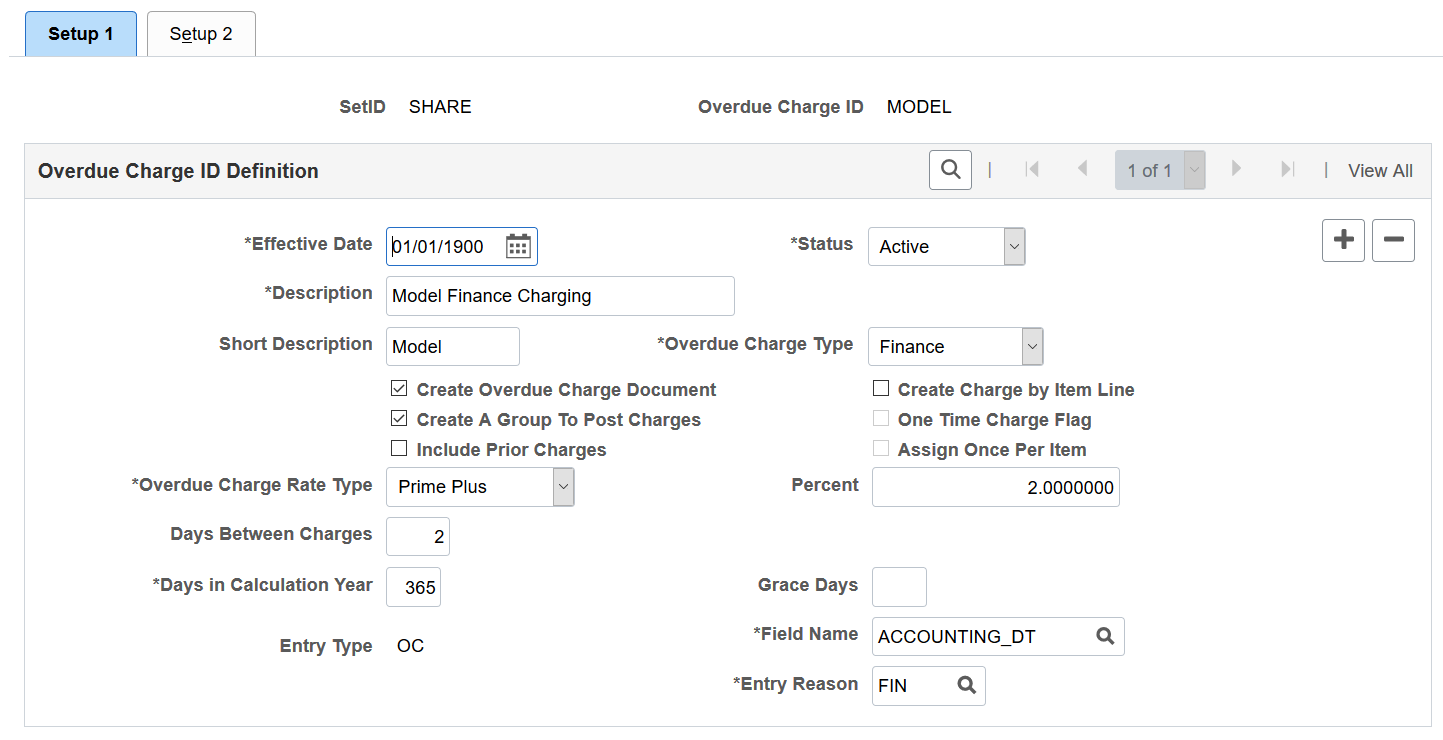

Use the Overdue Charging - Setup 1 page (OVERDUE_CHG_TABLE1) to define overdue charge IDs and some basic rules for how to calculate overdue charges.

Navigation:

This example illustrates the fields and controls on the Overdue Charging - Setup 1 page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Create Overdue Charge Document |

Select to create an overdue charge document to send to a customer. This document contains only overdue charges, not any of the customer's existing open items, and does not affect the customer's balance. |

Create Charge by Item Line |

Select to create a separate line item for each overdue charge. This selection enables users to see a separate line for the principal and each overdue charge type on the payment worksheet. It also enables the user to pay each of the charges before reducing the principal of the item. If you deselect this check box, users will see a single line item that includes a lump sum amount of the principal and all overdue charges. |

Create A Group To Post Charges |

Select to create an overdue charge group to be posted and to increment the customer's account based on the charges. This option does not create a document of any kind, but creates one overdue charge group per business unit requested on the run control. The process creates a group that has a group type of F. If you need to create a statement that has new overdue charges invoices and the customer's existing open items:

|

One Time Charge Flag |

Select to indicate whether the Overdue Charges Application Engine process (AR_OVRDUE) should create an overdue charge only once or multiple times by checking for a last assessed date. If you select this check box, the process creates an overdue charge only once for an item; otherwise, the process continues to create overdue charges until the item is closed. |

Include Prior Charges |

Select to include prior overdue charges in the calculation of the current balance. |

Assign Once Per Item |

Select to have the system check to determine whether any overdue charges exist for any of the current items that qualify for overdue charging for this specific overdue charge ID. If a charge exists for one or more items, the system does not calculate a new charge; however, the system calculates this type of overdue charge for any qualified items that do not have any charges assessed against them. After these charges are assessed against these items, the system prevents them from being charged again. |

Overdue Charge Rate Type |

Select the value that determines how the system calculates the overdue charge. Values are:

|

Days Between Charges |

Enter the number of days that the system must wait before reassessing overdue charges for items that have already been evaluated for overdue charging. The Overdue Charges process uses this value differently depending on whether an item has already had an overdue charge assessed. If an item has a previous overdue charge, the system compares the value in the Days Between Charges field to the number of days between the date of the current overdue charge run and the date of the previous overdue charge. |

Grace Days |

Enter the number of grace days that the system uses in combination with the basis date to determine whether the item is overdue for items that has had no previous overdue charges. If you want the trigger for the overdue charges and the amount of the overdue charges to be calculated based on the same day, enter 0. Overdue charge calculations use the grace days that are defined here, not the grace due days that are associated with the business unit, customer, or item. Those grace days refer to the due date, which may not be the same as the overdue charge basis date. |

Days in Calculation Year |

Enter a number to determine the number of days in the year, such as 365 or 366, that represents an annual basis for the interest calculation. The system uses the basis date to determine how many days the item is overdue. |

Field Name |

Select the date field that is used as the basis date for calculating the overdue charges. Values are: ACCOUNTING_DATE: The date that the account entry was entered into the system. ASOF_DT: The as of date that is entered on the pending item. DUE_DT: The date that a transaction is due. USER_DT1 to USER_DT4: An additional date that is defined by the user. |

Entry Type |

Displays the entry type that you defined for overdue charges. All overdue charge items have this entry type. |

Entry Reason |

Select one of the entry reasons that is assigned to the overdue charge entry type. The system uses this entry reason for all overdue charge items that the Overdue Charges process creates using this overdue charge ID. The entry type and entry reason determine the correct accounting distribution for each charge. To process an overdue charge manually or automatically, the automatic entry type and reason code must be identical to the item entry type and reason code. |

Use the Overdue Charging - Setup 2 page (OVERDUE_CHG_TABLE2) to define the conditions under which items should be excluded from overdue charges.

Navigation:

This example illustrates the fields and controls on the Overdue Charging - Setup 2 page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Add An Item, Minimum Item Charge, and Minimum Business Unit Charge |

Select either a detail level or summary level for overdue charges. If you want a detail level, deselect the Add An Item check box and enter a minimum item charge. The overdue charges appear as activity against the original item, and one overdue charge appears for each open item using the same item ID as the open item. This method has the effect of adding the overdue charge to the original item and increasing its balance. If you want a summary level, select the Add An Item check box and enter a minimum business unit charge. The system combines all overdue charges in one new item that posts to the customer's account. For example, if a customer has 10 past-due items that qualify for overdue charges, the system creates one overdue charge. This method increases the customer's balance without affecting the balance of the original item. This method enables you to increase the calculated charge to a minimum amount for a customer and business unit combination. |

Currency |

Select a currency for the Minimum Item Charge and Minimum Business Unit Charge fields to calculate overdue charges. |

Item Exclusion Options

Field or Control |

Description |

|---|---|

Exclude Collection Items and Exclude Disputed Items |

Select to prevent items from appearing on overdue charges invoices if they are marked for collection or dispute. |

Exclude Credit Items |

Select to prevent credit memos, on-account payments, and prepayments from appearing on overdue charges invoices. |

Exclude Deduction Items |

Select to prevent deduction items from appearing on overdue charges invoices. |

Exclude Items < Amount (exclude items less than amount) |

Select to prevent items from appearing on overdue charges invoices if they have a small balance. |

Cancel Document Options

Field or Control |

Description |

|---|---|

Cancel Collection Customer and Customer Is In Dispute |

Select to prevent the generation of overdue charges invoices for customers who are marked for collection or dispute on the Credit Profile page. The system creates an invoice if the correspondence group to which the customer belongs has other eligible open items. The system does not create an invoice if the correspondence customer itself is in collection or dispute. |

Document Has Credit Total |

Select to have the Overdue Charges process bypasses invoices with a negative total. |

Document Total < (document total less than) |

Select this check box and enter a monetary limit to prevent the system from generating invoices when the total of items on the invoice is less than a certain amount specified. The Document Has Credit Total and Document Total < check boxes apply to the balance of the invoice, which is always at the correspondence customer level. Therefore, a customer with a small debit balance is overridden by a customer with a larger credit balance if both customers belong to the same correspondence customer, and the system creates the invoice. |

Suspend Overdue Charge Options

Field or Control |

Description |

|---|---|

Suspend Overdue Charge |

Select this option to suspend overdue charges for a specified period of time. When you select this option, the From/To date fields appear. Use these fields to define the period of time to suspend overdue charges. You must enter values for the date fields. |

From/To (date) |

Use the date fields to define the period of time to suspend overdue charges The To date must be of greater or equal value to the From date. You must enter values for the date fields. |

Suspend Future Charge |

Select this option to suspend any future overdue charges that may occur. Items entered during the suspended period (From/To dates) do not incur overdue charges. The system uses the accounting date to determine when the item is entered. |

Note: The fields in this group box work together with the Overdue Charge Rate Type field on the Overdue Charging - Setup 1 Page.

The following table describes how overdue charges are determined when the Suspend Overdue Charge option is selected.

|

Overdue Charge Rate Type |

Result When Suspend Overdue Charge Is Selected |

|---|---|

|

Interest Percentage or Prime Plus |

When Suspend Overdue Charge is selected and the Overdue Charge Rate Type is Interest Percentage or Prime Plus, the number of overdue days to be charged are determined as such: Exclude suspended dates from overdue dates For example, a customer may have a past due item with a balance of $1000 USD and an accounting date of March 1. The item is 90 days overdue (March 1 to May 30), and the Overdue Charge Rate Type is Interest Percentage, set at 10%. When Suspend Overdue Charge is selected and the suspended date range is defined as April 1 to April 30, the FIN charge is (1000*10%)/365 * 60 overdue charge days = $16.44 USD. The overdue charge days in the previous equation was determined by excluding the suspended dates (30 days, April 1 to April 30) from the original overdue charge dates (90 days, March 1 to May 1) |

|

Fixed Amount or Item Amount Percentage |

When Suspend Overdue Charge is selected and the Overdue Charge Rate Type is Fixed Amount or Item Amount Percentage overdue charges are determined as such: If overdue charge dates overlap with suspend overdue charge dates, then no overdue charge For example, a customer may have a past due item with a balance of $1000 USD and an accounting date of March 1. The item is 90 days overdue (March 1 to May 30), and the Overdue Charge Rate Type is Fixed Amount, set at $10 USD. When Suspend Overdue Charge is selected and the suspended date range is defined as April 1 to April 30, there is no FIN charge because the overdue dates overlap with the suspended overdue charge dates. |