Reconciling Billing and Revenue

This section provides an overview of reconciliation and discusses how to define reconciliation options, select criteria to reconcile, redistribute revenue to an alternate account and offset the contract asset distribution, summarize your reconciliations, and view the reconciliation summary results.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Reconciliation Options by User Page |

CA_RECON_DEFN |

Specify your Review By and Break On parameters for reconciliation.

|

|

CA_RECON_SEARCH |

Select a contract, contract line, project, or project/activity to reconcile. The fields that appear on this page depend on the parameters that you specified on the Contracts Reconciliation Definition page. You can change these parameters by clicking the Change Reconciliation Fields link. You can search only for rate-based contract lines (value-based or as-incurred billing plans; as-incurred revenue recognition method). |

|

|

CA_RECON_ENTRY |

Redistribute revenue to an alternate account and offset your contract asset distribution. You can book only to GL ChartFields that are included in the break on on the Contracts Reconciliation Definition page. ChartFields that you do not break on do not appear on this page. |

|

|

RUN_CA_RECON_SUM |

Summarize your reconciliations by running the Reconciliation Summary process. When the reconciliation process completes, it populates the CA_RECON_REV and CA_RECON_BI tables. |

|

|

CA_RECON_SUM |

View the reconciliation summary results. |

For contracts containing rate-based contract lines (with either value-based or as-incurred billing plans), you can view both the revenue recognized and the total amount billed-to-date for these levels:

Contract.

Contract line.

Project Costing business unit.

Project.

Project/Activity.

The level to which you can reconcile depends on the parameters specified on the Contracts Reconciliation Definition page and the information that you entered on the billing plan. You specify the search level (contract, contract line, project, or project/activity) and you specify how the data should be summarized. Your summarization choices are essential because these choices dictate how you can review and reconcile revenue transactions.

Revenue data is stored in the CA_ACCTG_LINE_PC table (where the accounting entries are stored), and billing data is stored in the BI_ACCT_ENTRY table. The data on the Reconcile Revenue and Billing page appears in the GL currency, but the accounting information is also available. The CA_ACCTG_LINE_PC table provides the revenue transactions in the actual amount currency booked to the GL, and it provides the interunit entries to reflect if revenue was transferred to another PeopleSoft General Ledger business unit (potentially in another currency).

With the reconciliation tool, you can initiate revenue adjustments. From the Reconcile Entry page, you can redistribute revenue from the ChartFields displayed on a row on the page to another revenue account (for example, department or affiliate). You can also do this through the Review Revenue - Plans page. The contract asset Distribution section provides you with the ability to book the contract asset entry as the offset when revenue is decreased or increased.

Note: You can reconcile only on the ChartFields that were selected on the Contracts Reconciliation Definition page. If you did not break on those ChartFields, they do not appear.

Note: The Reconcile Revenue and Billing feature does not support prepaid amounts.

Note: Although you can reconcile rate-based contract lines with either value-based or as-incurred revenue plans, the Reconciliation page is used primarily for contract lines with the value-based billing method.

Use the Reconciliation Search page (CA_RECON_SEARCH) to select a contract, contract line, project, or project/activity to reconcile.

The fields that appear on this page depend on the parameters that you specified on the Contracts Reconciliation Definition page. You can change these parameters by clicking the Change Reconciliation Fields link. You can search only for rate-based contract lines (value-based or as-incurred billing plans; as-incurred revenue recognition method).

Navigation:

This example illustrates the fields and controls on the Reconciliation Search page. You can find definitions for the fields and controls later on this page.

Search Criteria

Use the fields in the Search Criteria group box to filter the list of contracts or projects for which the system will search. When you leave a field blank, the system runs the process for all values for that field. The search fields that appear on this page depend on the criteria that you specified on the Contracts Reconciliation Definition page.

Field or Control |

Description |

|---|---|

GL Unit |

Enter the GL business unit for which you want to search. Note: If you are using interunit accounting, the reconciliation needs to be shown in one currency. Therefore, enter the GL business unit that you want to view on the Reconciliation Entry page. For interunit accounting:

|

Search |

Click to initiate your search. |

Summarize |

Click to start the summarization process. |

Change Reconciliation Fields |

Click this link to modify your review by and break on criteria. |

Reconciliation Summary |

Click to access the Reconciliation Summary page. |

Review Fixed Amount Billing |

Click to access the Review Billing - Plans page. |

Review Fixed Amount Revenue |

Click to access the Review Revenue - Plans page. |

Search Results

The fields that appear depend on the criteria specified in the Search Criteria group box.

Field or Control |

Description |

|---|---|

|

Click to run the Reconciliation Summary process for this particular contract, contract line, project, activity, or project and activity. You can also run the process from the Create Reconciliation Summary page. You can redistribute revenue or create offsets for a contract line. |

Last Updated |

Displays the date on which this contract, contract line, project, or project/activity was last summarized. |

This section discusses how to redistribute revenue to an alternate account and offset the unbilled distribution.

Use the Reconciliation Entry page (CA_RECON_ENTRY) to redistribute revenue to an alternate account and offset your contract asset distribution.

You can book only to GL ChartFields that are included in the break on the Contracts Reconciliation Definition page. ChartFields that you do not break on do not appear on this page.

Navigation:

Click from the Reconciliation Search page.

This example illustrates the fields and controls on the Reconciliation Entry page. You can find definitions for the fields and controls later on this page.

The values that you searched on appear at the top of the page for the line that you selected. These values depend on the review by and break on criteria specified on the Defining Reconciliation Options page. The currency appears in the PeopleSoft General Ledger currency.

To make an adjustment:

Enter the amount of the adjustment for your row.

Click the Calculate button.

Click the Create Entries button.

To redistribute revenue to an alternate account:

Enter the positive amount (debit revenue) for the row that you want to adjust.

Click the + button to add a new row.

Enter the new account, department ID, and affiliate on this new row, in addition to a negative amount (credit for revenue).

Click the Calculate button.

Click the Create Entries button.

Because the total adjusted amount equals 0.00 when you redistribute revenue (because the two rows net out), no contract asset offset is created.

Revenue

These values depend on the review by and break on criteria.

Field or Control |

Description |

|---|---|

Use |

Displays the type of accounting for this contract, contract line, project, or activity. Values are: REV: Revenue IUR: Interunit receivable IUP: Interunit payable |

Adjustment Amount |

To redistribute revenue to an alternate revenue account, enter the positive amount (debit revenue) in this field for the row that you want to adjust. To continue with the redistribution, click the + button to add a new row. Enter the new account, department ID, and affiliate on this new row, in addition to a negative amount (credit for revenue). Note: You can book only to GL ChartFields that were included in the break on in the reconciliation page. ChartFields that you do not break on do not appear on this page. Click the Calculate button, and then click the Create Entries button. Because the total adjusted amount equals 0.00 (because the two rows net out), no contract asset offset is created. |

Total |

Displays the total revenue booked for this contract, contract line, project or project/activity. |

Total Adj Amt (total adjusted amount) |

Displays the same value as in the Total field, when you first enter this page. This value changes as you make adjustments to this page. |

Billed Amount |

Displays the total amount billed to date. This value appears in the contract (or billing) currency, if the currency differs from the GL currency. |

Difference |

Displays the difference between the total adjusted amount and the billed amount. |

Accounting Date |

Displays the current date, which appears by default as the accounting date. You have the option of selecting a different accounting date. |

Calculate |

Click to calculate distribution credits. |

Create Entries |

Click to create accounting entries in the Contract Asset Distribution group box. |

Contract Asset Distribution

The Contract Asset Distribution group box provides you with the ability to book the contract asset entry as the offset when revenue is decreased or increased. For multiple contracts, contract lines, projects, or project/activities, you can offset to the same accounting distribution, or you can choose to offset each line separately. You may want to offset each line separately if you want to establish different accounting for each (for example, a different department ID). Select where the offset is applied.

The values under the Contract Asset Distribution group box appear by default based on whether you are reviewing by contract, contract line, project, or activity.

Field or Control |

Description |

|---|---|

Contract |

For a contract, displays the business unit by default. |

Contract Line |

Displays the contract asset of the contract line by default. |

Project |

If the all act (all activities) check box was selected on the Related Projects page for this project, then the project goes to one contract line, and the contract asset comes from that one line. If the project is split among multiple rows, then no value appears by default. |

Activity |

Because activities can belong to only one contract line, the contract asset from the contract line appears by default. |

The distribution code appears by default based on the contract line that you are reviewing. The distribution codes are restricted, and you are allowed to select only distribution codes with an contract asset account type. However, the general ledger ChartFields—Account, Alt Acct (alternate account), Oper Unit (operating unit), Fund, Dept (department ID), Program, Class, Bud Ref (budget reference), Product, Affiliate, Fund Affil (fund affiliate), and Oper Unit Affil (operating unit affiliate)—are not restricted to contract asset accounts. Therefore, you can change the account number under the Contract Asset Distribution group box to another type of account (for example, revenue), but it never appears in the revenue numbers in the Revenue region of this page. Use the Contract Asset Distribution group box to offset the adjustments with contract asset only.

Field or Control |

Description |

|---|---|

GL Unit |

Displays the PeopleSoft General Ledger business unit for your contract line. You can select a different business unit for the offset. |

Distribution Code |

Displays the distribution code by default, based on whether you are reviewing by contract, contract line, project, or activity. You can select a different distribution code. The distribution codes are restricted to allow you to pick only distribution codes with an contract asset account type. |

Account |

Displays the values for this contract asset account field by default from various sources, depending on whether you are reviewing by contract, contract line, project, or activity. |

Use the Create Reconciliation Summary page (RUN_CA_RECON_SUM) to summarize your reconciliations by running the Reconciliation Summary process.

When the reconciliation process completes, it populates the CA_RECON_REV and CA_RECON_BI tables.

Navigation:

This example illustrates the fields and controls on the Create Reconciliation Summary page. You can find definitions for the fields and controls later on this page.

When the Reconciliation Summary (CA_RECON_SUM) process completes, it updates the CA_RECON_REV, CA_RECON_BI, and CA_RECON_SUM tables.

Program Name

Field or Control |

Description |

|---|---|

Process Frequency |

Specifies how often the Reconciliation Summary process runs. Values are: Always: Processes reconciliation every time the Reconciliation Summary process runs. Don't: Will not initiate the program, even if you click the Run button. Once: Runs reconciliation once; Don't appears in the Process Frequency field. |

Contract Options

Use the fields in the Contract Options group box to filter the list of contracts on which this process runs. When you leave a field blank, the system runs the process for all values for that field.

Project Options

Use the fields in the Project Options group box to filter the list of contracts on which this process runs. When you leave a field blank, the system runs the process for all values for that field.

Accounting Date Options

Use the fields in the Accounting Date Options group box to retrieve and reconcile transactions that fall between the specified dates. Select Acct Dt (accounting date), All, or Trans Dt (transaction date) in the Date Option field.

Purging Options

Field or Control |

Description |

|---|---|

Purge All Older Than |

Enter a number if you want the system to delete all reconciliation records that are older than a specified number of days. If you leave this field blank, the system overwrites only the existing data for the contract for which you are currently running this process. |

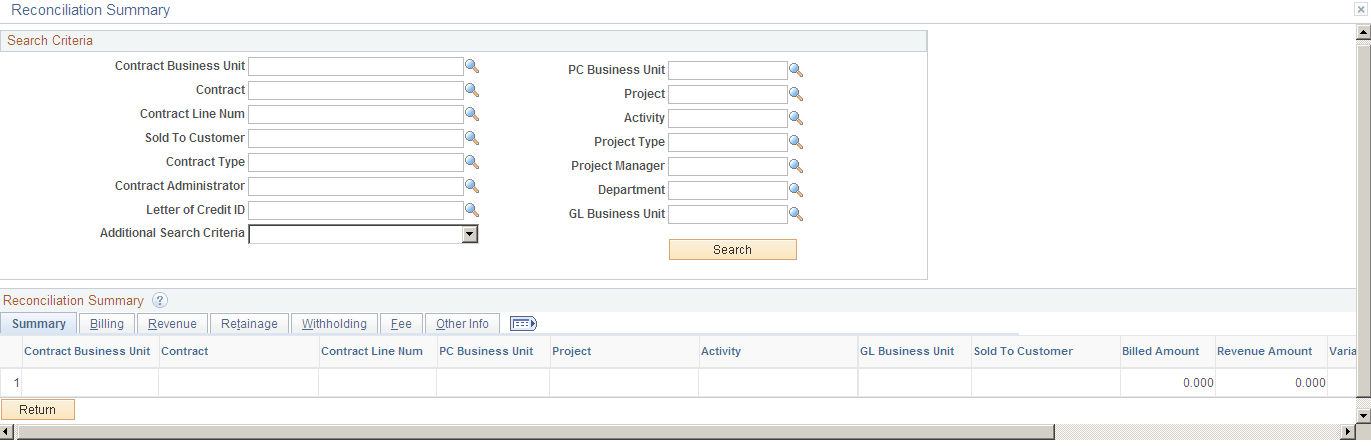

Use the Reconciliation Summary page (CA_RECON_SUM) to view the reconciliation summary results.

Navigation:

Click the Reconciliation Summary link from the Reconciliation Search page.

This example illustrates the fields and controls on the Reconciliation Summary page. You can find definitions for the fields and controls later on this page.

Use this page to view the results from the Reconciliation Summary (CA_RECON_SUM) process. This page provides the difference between billing and revenue at the detail level. Based on the information provided on this page, you can decide where to go to complete the remaining process or to make an adjustment.

Field or Control |

Description |

|---|---|

Additional Search Criteria |

Select one of these options to reduce the search results:

|

Summary Tab

Field or Control |

Description |

|---|---|

Billed Amount |

This field is calculated as the sum of (billed (BLD), billing adjustment (BAJ), retainage release (RRT), withholding release (WRL) and withholding release adjustment (WRJ)) rows minus the sum of (retainage (BRT), withholding (WTH) and withholding adjustment (WAJ)) rows. The FEE rows are excluded when calculating the billed amount. |

Revenue Amount |

This field is calculated as the sum of all rows from the CA_RECON_REV table. |

Variance Amount |

This field is calculated as the sum of Revenue Amount plus Billed Amount. |

Total Cost |

This field is calculated as the sum of all cost rows where the analysis type is in the PSCST analysis group. For example, analysis types ACT, MMC, and so on. |

Billing Tab

Field or Control |

Description |

|---|---|

Prepaid Amount |

Click to access the Prepaids page, where you can access information on the prepaid purchased amount, utilized amount, and remaining amount for the contract. |

Billed Amount |

This field is calculated as the sum of (billed (BLD), billing adjustment (BAJ), retainage release (RRT), withholding release (WRL) and withholding release adjustment (WRJ)) rows minus the sum of (retainage (BRT), withholding (WTH) and withholding adjustment (WAJ)) rows. The FEE rows are excluded when calculating the billed amount. |

Unbilled Billable Amount |

This field is calculated as the sum of the billable (BIL) rows. The FEE rows are excluded while calculating the billable amount. |

Billing Adjustment Amount |

This field is calculated as the sum of the billing adjustment (BAJ) rows. |

Billing Deferred Amount |

This field is calculated as the sum of the deferred billing (DEF) rows. |

Billing Limit Amount |

Click to access the Review Limits page, where you can access information about the limit amount that is assigned to the contract and contract line. |

Billing Over the Limit Amount |

This field is calculated as the sum of the over the limit (OLT) rows. |

Total Billable Amount |

This field is calculated as the sum of the billable amount, billing deferred amount, retained amount, and withholding amount from the CA_RECON_SUM table. |

Revenue Tab

Field or Control |

Description |

|---|---|

Revenue Amount |

This field is calculated as the sum of all rows from the CA_RECON_REV table. |

Unrecognized Revenue Amount |

This field is calculated as the sum of the billable (BIL), billed (BLD) and billing adjustment (BAJ) rows. However, if the Separate Billing and Revenue option is selected at the installation level, the contract is a government contract, and the contract line is a cost plus line, then the revenue (REV) rows are summed instead of the BIL, BLD, and BAJ analysis types. |

Revenue Limit Amount |

Click to access the Review Limits page, where you can access information about the limit amount that is assigned to the contract and contract line. Note: This column will always be visible irrespective of the Separate As Incurred Billing and Revenue check box on the contract. If the contract does not Separate As Incurred Billing and Revenue, then amounts will match those used for billing. |

Revenue Over the Limit Amount |

This field is calculated as the sum of the revenue over the limit (ROL) rows. Note: This column will always be visible irrespective of the Separate As Incurred Billing and Revenue check box on the contract. If the contract does not Separate As Incurred Billing and Revenue, then amounts will match those used for billing. |

Retainage Tab

Field or Control |

Description |

|---|---|

Retainage Amount |

This field is calculated as the sum of the retainage (BRT) rows. |

Retainage Release Amount |

This field is calculated as the sum of the retainage release (RRT) rows. |

Retainage Written Off Amount |

This field is calculated as the sum of the retainage written off (WTO) rows. |

Withholding Tab

Field or Control |

Description |

|---|---|

Withholding Amount |

This field is calculated as the sum of the withholding (WTH) rows. |

Withholding Release Amount |

This field is calculated as the sum of the withholding release (WRL) rows. |

Withholding Written Off Amount |

This field is calculated as the sum of the withholding written off (WWO) rows. |

Fee Tab

Field or Control |

Description |

|---|---|

Billing Fee Amount |

This field is calculated as the sum of the billed (BLD) rows, where the CA_FEE_STATUS is Billing Actual Fee or Billing Additional Award Fee. |

Billing Fee Accrued Amount |

This field is calculated as the sum of the billable (BIL) rows, where the CA_FEE_STATUS is Billing Actual Fee or Billing Additional Award Fee. |

Billing Fee Limit Amount |

Click to access the Contract Terms page, where you can access information about the fee limit amount that is assigned to the contract and contract line. |

Revenue Fee Amount |

This field is calculated as the sum of the revenue (REV) rows, where the CA_FEE_STATUS is Revenue Actual Fee or Revenue Additional Award Fee and the GL_DISTIB_STATUS is Distributed or Generated. |

Revenue Fee Accrued Amount |

This field is calculated as the sum of the revenue (REV) rows, where the CA_FEE_STATUS is Revenue Actual Fee or Revenue Additional Award Fee and the GL_DISTIB_STATUS is Available to Contracts. |

Revenue Fee Limit Amount |

Click to access the Contract Terms page, where you can access information about the fee limit amount that is assigned to the contract and contract line. |