Understanding Revenue Plans

Revenue recognition can be managed by either PeopleSoft Contracts or PeopleSoft Billing. When PeopleSoft Contracts manages revenue for a contract line, you associate each contract line with a revenue plan. The revenue plan contains a list of events defining when revenue is recognized for each contract line assigned to that revenue plan.

When PeopleSoft Billing manages revenue for a contract line, you do not set up revenue plans. You only need to link the contract line to a billing plan. PeopleSoft Billing then recognizes revenue for that contract line as the contract line is billed.

This section discusses:

Revenue recognition setup.

Revenue plans.

Revenue recognition event types.

Revenue recognition methods.

Revenue plan and event statuses.

Revenue plan assignment rules.

Revenue preview.

PeopleSoft Contracts enables you to capture revenue information on a contract and allocate amounts to specific contract lines within the PeopleSoft Contracts system. As part of this process, you need to structure the accounting information. You associate a product or service defined on a contract line with a revenue recognition method, manage when the conditions for recognizing the revenue have been met, and generate journal entries to enter the revenue into your General Ledger system.

Setting up PeopleSoft Contracts to recognize revenue consists of several steps. Some steps are general and others are contract specific. The contract-specific steps are discussed later in this topic.

At the system level, you:

Select the revenue recognition method or contract liability overrides, if applicable.

Select revenue plan templates, if applicable.

Determine proration methods.

Set up the Journal Generator (General Ledger) template.

Set up distribution codes.

Set up distribution rules and distribution sets.

Associate distribution rules with PeopleSoft Contracts business units.

Associate distributions sets with products.

At the contract level, you:

Identify if revenue is separately managed from billing.

Enter the total revenue amount for the contract.

Allocate the total revenue amount across contract lines.

For each contract line, verify the distribution ChartFields—revenue, contract liability, and the contract asset accounting.

Create revenue plans, including specifying a revenue recognition method for each plan, and assign them to contract lines.

Or, verify revenue plans created by revenue plan templates, if applicable.

Once you have completed the previous steps, you are ready to begin managing revenue recognition. To manage revenue recognition:

Review or update events.

Run the processes to pick up and distribute revenue for "Ready" plans and events and post the revenue to ledgers.

PeopleSoft Contracts revenue plans enable you to define, administer, and maintain accounting schedules and rules for the products and services that you sell under a contract. Revenue plans are contract-specific; you cannot use the same revenue plan across multiple contracts.

After you have defined the revenue plans for a contract, data from PeopleSoft Contracts drives the creation of accounting entries for amount-based contract lines. Data from PeopleSoft Contracts and PeopleSoft Project Costing drives the creation of accounting entries for rate-based contract lines. In both cases, PeopleSoft Contracts creates accounting entries to send to PeopleSoft General Ledger and creates bill lines to send to PeopleSoft Billing. PeopleSoft Contracts generates the revenue entries and sends these to PeopleSoft General Ledger. PeopleSoft Billing generates the offsetting entries. PeopleSoft Billing also handles recurring revenue.

A contract can consist of multiple contract lines with complex and diverse revenue recognition requirements. In PeopleSoft Contracts you assign each product to its own contract line and then associate each contract line with its own set of accounting distribution codes. You then associate each contract line for which PeopleSoft Contracts manages revenue with a revenue plan. Revenue plans store the timing of revenue recognition, as well as any notes relating to individual revenue plan events. You can assign contract lines with similar revenue recognition requirements to the same revenue plan. When PeopleSoft Contracts manages revenue, each contract has at least one revenue plan, and it may have more.

Revenue plans are often made up of a series of dated revenue recognition events that are associated with percentages or revenue amounts. The percentage or amount reflects how much of the contract line's revenue amount will be recognized upon a certain date, milestone, or user-initiated action. Should a revenue plan be tied to several contract lines, then the revenue amount that is recognized for each event is based on the sum of revenue amounts of all contract lines associated with that revenue plan. The revenue amount will be same as the billing amount if billing and revenue are not separated on the contract.

You can optionally select revenue plan templates to automate the creation of revenue plans on your contract. You can also associate events with your revenue plan template depending on your plan method. Create revenue plan templates on the Billing/Revenue Plan Templates page and apply the templates to a contract line in one of these ways:

Associate the product with a revenue plan template when setting up the product definition.

The system creates the revenue plan automatically when you select the product onto a contract line.

Associate the product with a revenue plan template upon adding a product to a contract line.

Select a value in the Revenue Plan Template field on the Assign Revenue Plan page.

The system creates the revenue plan automatically when you assign the contract line to your plan.

The event type that you select determines which of the fields in the Events group box on the Revenue Plan page are relevant to the event. This table discusses the event types that you can select and the fields that are relevant to them:

|

Event Type |

Event Type Definition |

Associated Fields for the Event Type |

|---|---|---|

|

Milestone (Contracts) |

Select an event type of Milestone and a milestone origin of Contracts (PeopleSoft Contracts) to associate the revenue recognition event with a milestone that you have defined in PeopleSoft Contracts. |

Event Status MS Orig (milestone origin, also referred to as milestone source), Milestone Nbr (milestone number), Milestone Status, Description, Notes, Percentage Amount |

|

Milestone (Project Costing) |

Select an event type of Milestone and a milestone origin of Projects (PeopleSoft Project Costing), to associate the revenue recognition event with a milestone that you have defined in PeopleSoft Project Costing. |

Event Status, MS Orig (milestone origin, also referred to as milestone source), Notes, Project, Percentage, Amount |

|

Date |

Select an event type of Date to associate the revenue recognition event with a specific calendar date. |

Event Status, Date, Notes, Percentage, Amount |

The criteria for a revenue plan event to be valid for booking is based on the event type that you select.

Events tied to Milestone event types are valid for booking when all of the following items are true:

The revenue plan has a Ready status.

The event has an event status of Ready.

The milestone is complete.

The way in which the system evaluates that a milestone is complete varies by the milestone origin, either PeopleSoft Contracts or PeopleSoft Project Costing.

You have defined a percentage for the milestone event.

Events tied to a Date event type are valid for booking when all of the following items are true:

The revenue plan has a Ready status.

The event has an event status of Ready.

The revenue recognition date qualifies for the date selection criteria in the Amount-based Revenue process.

Revenue recognition methods define the criteria that must be met before revenue can be recognized. In PeopleSoft Contracts, you specify revenue recognition methods for products on the Product Definition component. The associated revenue recognition method appears when you select a product onto the contract line. In your PeopleSoft Contracts business unit setup, you define your revenue management options to enable or disable a revenue recognition method override. If you selected the override check box during setup, the revenue recognition method from the product appears by default onto the contract line. You can change the method when linking the contract line to a revenue plan. You must assign contract lines to revenue plans that share the same revenue recognition method. You can assign multiple contract lines with same revenue recognition method to a single revenue plan.

PeopleSoft Contracts supports four methods of revenue recognition: As-incurred, Apportionment, Percent Complete, and Milestone. An additional method is Billing Manages Revenue. You never associate the Billing Manages Revenue method with a plan because it indicates that PeopleSoft Billing, and not PeopleSoft Contracts, manages the revenue.

Term |

Definition |

|---|---|

As Incurred |

Use this method to manage revenue on an as needed basis. The As-incurred method is transaction based revenue recognition—as the activity is incurred and processed by PeopleSoft Project Costing, revenue is recognized. This is the only method used for rate-based contract lines. The advantage of managing as-incurred revenue through PeopleSoft Contracts is that you can separate revenue from billing to enable revenue recognition based on fulfillment rather than a billing schedule. Additionally, PeopleSoft Contracts enables you to place the as-incurred revenue plan on hold. This enables you to hold back revenue recognition without interrupting your billing process. You also have the option of defining events for as-incurred revenue plans. Once you have booked all revenue associated with an as-incurred revenue plan, you must manually set the revenue plan's status to Completed. |

Apportionment |

Use this method to recognize a fixed amount of revenue over a predefined period of time. The parameters that you define when you select Apportionment as the method include start date, end date, and schedule. You can apportion your revenue over any number of uniquely-defined time segments with a different percent applied to each period. To determine the accounting date and amount or percent of each event created, the Apportionment method also uses the system wide parameters of future period accounting date and proration method respectively; these are defined on the Contracts Definition - Processing Options page during system setup. When you click the Build Event button, the system generates the apportionment events and places them in the event grid on the revenue plan. If revenue recognition is not a straight line, you may update the percentages or amounts on the grid after the events are generated. You can define multiple proration schedules for a single revenue plan, as long as the total apportioned amount equals the total revenue plan amount. Once you have generated an apportionment schedule and built the revenue plan events for a revenue plan, the system can automatically recognize revenue according to these events. You can use the Review Revenue - Events page to view revenue activities, both booked and pending entries. You can optionally place revenue plans on hold from the Revenue Plan page. When you place a revenue plan on hold, events that would normally be booked in the next run of the Amount-based Revenue process are skipped. When you remove the hold, these events can be picked up in the next run of the process. Note: Use a schedule with a Day of the Month equal to the day of the start date that you define for your apportionment events if you want your events and schedules to be completely in sync. If the schedule's Day of the Month does not equal the day of the start date, the system will prorate the first event so that the From Date is the start date and the To Date is the day before the Day of the Month of the schedule. The system also prorates the last event, assuming you have selected an appropriate number of periods, so that the From Date is the Day of the Month of the schedule and the To Date is the end date. See Schedules Page. |

Percent Complete |

Use this method to recognize revenue based on a manually entered percentage of completion or a system updated percentage of completion based on your associated project or project and activity combination. Parameters include percent completed and the accounting date for amount completed but not yet recognized. Use this method for contract lines where you are entitled to book increments of revenue at different intervals, but there is no set list of intervals or percentages. A Percent Complete revenue plan can only have one New or Ready revenue plan event at a time. Over the life of the contract line, as you receive permission to book a percentage of revenue for that contract line, you navigate to the Percent Complete revenue plan and generate a new event. Then, the system marks it Ready. Any additions to the percent complete will only update the single percent complete event in the New or Ready status. Once the event is set to In Progress, subsequent events can be created. |

Milestone |

Use this method to recognize a fixed amount of revenue spread over time and triggered as each milestone is met. The milestone may be a milestone defined in PeopleSoft Contracts or in PeopleSoft Project Costing. You may associate multiple milestones with the revenue plan. When you do this, you need to specify the portion of revenue that is to be recognized upon the completion of each milestone. Parameters include milestone, percent or amount to recognize, and accounting date. When associating events with milestones, you have the option of leaving the event status as New Event or setting the event status to Ready. Which status you use depends upon how much control you want to exercise over revenue recognition for a particular event. When you leave the event status at New Event, after a milestone completes, you must use the Review Revenue - Events page each period to review and select those revenue plan events that are now eligible to be booked. When you set the event status at Ready, once the milestone completes, the system books the revenue associated with that revenue plan line the next time that you run the amount-based revenue process. |

Billing Manages Revenue |

Use this method when PeopleSoft Billing, not PeopleSoft Contracts, manages the revenue for a contract line. Only amount–based and recurring contract lines can use this method. You must always use this method with recurring price types. With this revenue recognition method, you do not set up a revenue plan. You assign the contract line to a billing plan only. PeopleSoft Billing then recognizes revenue for the contract lines that are billed. Note: For contracts with a contract classification of Internal, the system uses Billing Manages Revenue for the revenue recognition method. Note: This method is not available if the Separate Fixed Billing and Revenue check box is selected on the contract. |

This table discusses each available revenue recognition method:

|

As Incurred |

Percentage of Completion |

Milestone |

Apportionment |

|

|---|---|---|---|---|

|

Basis (how to recognize revenue) |

As-needed (can be scheduled). |

Event-based (percent revised over time). |

Event-based (percent or amount defined for each event). |

Schedule-based (start and end dates known). |

|

Amount |

Rate-based (amount is based on transactions). |

Fixed (amount defined in contract). |

Fixed (amount defined in contract). |

Fixed (amount defined in contract). |

|

Business examples |

Time & Material Consulting |

Fixed-Price Consulting |

Product or Fixed-Price Consulting |

Maintenance on a product. |

Associating a Product with a Revenue Recognition Method

When you define a product, you associate that product with a revenue recognition method. The revenue recognition method that you associate with the product depends upon the price type of the product. This table lists the four product pricing types that PeopleSoft Contracts supports:

|

Price Type |

Description |

Available Revenue Recognition Methods |

|---|---|---|

|

Amount |

Used for products that have a fixed price. |

Apportionment Percent Complete Milestone Billing Manages Revenue |

|

Percentage |

Used for products that are priced as a percent of one or more contract lines. For example, technical support is often priced as a percentage of the license price for the products being licensed under the contract. |

Apportionment Percent Complete Milestone Billing Manages Revenue |

|

Rate |

Used for products, such as services, that have a rate-based pricing structure, such as $400 per hour worked. The actual monetary amount is not known until the hours have been worked and reported. |

As Incurred |

|

Recurring |

Used for products that have a recurring pricing structure where a start date and schedule are defined. |

Billing Manages Revenue |

Changing Revenue Recognition Methods

If, on the Contracts Definition - Processing Options page, you specified that the change of revenue recognition parameters is allowed, you can change a contract line's revenue recognition method when assigning a contract line to a revenue plan. If you did not enable this option, you cannot change a contract line's revenue recognition method and can only associate a contract line with a revenue plan that is of the same revenue recognition method. This restriction provides a control to keep the revenue recognition method for a particular product consistent across all contracts in which it is used for accounting purposes.

If you have enabled this option, users will be able to change the revenue recognition method of a contract line when assigning it to a revenue plan. You must make your changes on the Assign Revenue Plan page. Here are the rules regarding when you can and cannot make changes to a revenue recognition method:

You cannot change an as-incurred revenue recognition method (because price type equals rate, and rate has only one valid revenue recognition method).

You cannot change from or to the Billing Manages Revenue method if the contract is Active and tied to a bill plan with a status other than Pending or Ready (because PeopleSoft Billing has already begun processing).

You cannot change the revenue recognition method on a revenue plan.

You must first unassign the line on the Assign Revenue Plan page. Then, you can change the revenue recognition method when reassigning the line on the Assign Revenue Plan page.

You cannot change the Billing Manages Revenue revenue recognition method for a contract line with a Recurring price type, because Billing Manages Revenue is the only valid revenue recognition method for this price type.

You cannot change the Billing Manages Revenue revenue recognition method for a contract line with a Internal contract classification, because Billing Manages Revenue is the only valid revenue recognition method for this price type.

There are two areas related to PeopleSoft Contracts revenue recognition that have status fields: revenue plans and revenue plan events. Status fields exist for each area to initiate edit checking, enable processing, and indicate booking progress.

Understanding Revenue Plan Status

There are eight status values for a revenue plan:

Term |

Definition |

|---|---|

Pending |

Appears by default when you define a new revenue plan. When you save a revenue plan in Pending status, the system does not perform edit checking. This enables you to work on a revenue plan, save your work, and return to that revenue plan to finish your work at a later date. When you have completed entering data for a revenue plan, you manually set the status field to Ready. Note: If you are using templates and you selected the Activate Contract option on the template, the system automatically sets the revenue plan status to Ready upon contract activation. |

Ready |

You can select this status for a revenue plan when the contract has an Active status. If all required conditions are met (see Changing a Revenue Recognition Status to Ready below), the revenue plan status becomes Ready, and one of the Revenue Recognition Application Engines (CA_LOAD_GL1 for amount-based revenue recognition and PSA_ACCTGGL for rate-based revenue recognition) may now process this revenue plan. If you are using templates to automate your revenue plan process and you selected the Activate Contract option on the template, the system automatically sets the revenue plan status to Ready upon contract activation. |

In Progress |

Once revenue recognition has begun, the Revenue Recognition Application Engine changes the plan's status to In Progress. At this point, the revenue plan status becomes display only and the system restricts revenue plan changes to events that have not yet been processed. Plans with a revenue recognition method of % Complete have only one event in this state. |

Action Required |

The system sets a revenue plan to an Action Required status if a contract line amendment is processed or an event is reversed. You must review the event inserted by the amendment or reversal process and re-allocate the plan to account for the amendment or reversal. Once you have reviewed the revenue plan and made any necessary changes, click the Reviewed button to signify to the system that the plan is ready to continue with processing. The system validates that 100 percent of the revenue plan amount is defined on events and changes the status from Action Required to In Progress. Note: When you create an amendment for a revenue plan that has a status of Complete, the system sets the revenue plan status to In Progress instead of Action Required. Note: In the scenario where the contract line revenue amount associated with the revenue plan is amended, and the new revenue amount equals the total recognized amount for the revenue plan and all revenue events are in Completed status, when you click Reviewed, the system changes the revenue plan status from Action Required to Completed. This applies to Milestone, Apportionment, and Percent Complete revenue plans with events. |

Cancelled |

Revenue plans may be cancelled from a status of Pending or Reversed. Cancellation may occur due to the entire contract being terminated or superseded, a contract line being dropped, or to consolidate contract lines onto another revenue plan. Once cancelled, a revenue plan cannot be reopened. |

Completed |

For milestone, apportionment, and percent complete revenue recognition methods (amount-based revenue), once all revenue plan events are complete and total 100 percent of the plan's amount, the system updates the plan to Completed (through the Application Engine − CA_LOAD_UPD). This indicates that all revenue for this plan has been distributed. For as-incurred revenue recognition (rate-based revenue), you must manually select the Completed status because the system does not know when the last transactions were accumulated in PeopleSoft Project Costing and processed through to revenue recognition. If your as-incurred revenue plan has events associated with it, you must wait until all events are complete before you can select the Completed status. Note: For As-incurred revenue plans, the system allows you to change the status back to In Progress even though the status was manually set to Completed. |

Reversal In Progress |

When you initiate the reversal of a revenue plan, the system changes the status of the revenue plan to Reversal In Progress. |

Reversed |

You can reverse a revenue plan from the Review Revenue page or the Contract Reversal page. When you first reverse a plan, the plan receives a status of Reversal in Progress. When all events have been reversed, the system updates the plan status to Reversed. You cannot reopen reversed plans. Note: Pending and Ready revenue recognition events do not get reversed, so those events may appear on the revenue plan when the system sets the plan status to Reversed. |

Note: You cannot close a contract if any associated revenue plans have a status of In Progress or Action Required.

If the revenue plan status is Ready, In Progress, Action Required, or Reversal In Progress, you can select the Hold check box to temporarily hold the revenue plan from processing. The system stores the date on which you placed the revenue plan on hold for reference purposes.

The system performs specific edits when the revenue plan is moved from one status to another. A revenue plan must pass all edits for the status change to occur.

Auto Readying Revenue Plans

A check box on the revenue plan page indicates whether the system should mark the revenue plan Ready automatically upon contract activation. The value in this check box populates from the option defined on the Billing and Revenue Plan Template page. The default for this template option is to leave the plan Pending. Therefore, you must select this option on the template for the system to automatically set the revenue plan status to Ready upon contract activation. You also have the option to select this check box while in a revenue plan. Then, upon saving, the system automatically readies the plan.

Changing a Revenue Plan Status to Ready

When you move the revenue plan status to Ready and click the Save button, the system performs the following edit checks:

The contract status is mapped to a processing status of Active.

This ensures that the contract is fully captured, pricing is fully allocated, and all accounting distributions are defined and valid.

At least one contract line is attached to the revenue plan.

For Milestone and Apportionment method revenue plans, a minimum of one event is defined for the revenue plan and the sum of the events equals the plan amount.

Note: The same edits apply when the system automatically readies the revenue plan upon contract activation through the revenue template option.

Changing a Revenue Plan Status to Pending

You can manually move the status of a revenue plan from Ready to Pending. The system does not perform edit checking for this type of status change.

Changing a Revenue Plan Status to In Progress

For revenue plans containing events, the system automatically initiates a revenue plan status change from Ready to In Progress when the first revenue plan event status is moved to In Progress. The revenue recognition event status is moved to In Progress when you run the Revenue Recognition Application Engine (CA_LOAD_GL1 for amount-based revenue and PSA_ACCTGGL for rate-based revenue).

For as-incurred method revenue plans without events, the system automatically initiates a revenue plan status change from Ready to In Progress the first time that it processes billable lines for a project that is assigned to a contract line associated with that revenue plan. You cannot manually change the status to In Progress.

Changing a Revenue Plan Status to Action Required

The system set the revenue plan to a status of Action Required if a contract line amendment is processed or an event is reversed. The system also places the plan on hold. You must review the event inserted by the amendment or reversal process and reallocate the plan to account for the amendment or reversal. Once you have reviewed the revenue plan and made any necessary changes, click the Reviewed button to rebuild the revenue schedule and to signify to the system that the plan is ready to continue with processing. The system changes the status from Action Required to In Progress.

Note: When you create an amendment for a revenue plan that has a status of Completed, the system sets the revenue plan status to In Progress instead of Action Required.

Note: In the scenario where the contract line amount associated with the revenue plan is amended, and the new amount equals the total recognized amount for the revenue plan and all revenue events are in Completed status, when you click Reviewed, the system changes the revenue plan status from Action Required to Completed. This applies to Milestone, Apportionment, and Percent Complete revenue plans with events.

Changing a Revenue Plan Status to Completed

For amount-based revenue plans containing events, the system automatically changes the revenue plan status to Completed when all revenue plan events are Completed. The system does this when you run the Application Engine (CA_LOAD_UPD).

For as-incurred method revenue plans (both with and without events), you must manually initiate the status change because the system does not know when the last transactions were accumulated in PeopleSoft Project Costing, and processed through to PeopleSoft Billing. If your as-incurred revenue plan contains events, you cannot change the revenue plan status to Completed until all events have a status of Event Booked.

Note: For As-incurred revenue plans, the system allows you to change the status back to In Progress even though the status was manually set to Completed.

Changing a Revenue Plan Status to Reversed

You can reverse a revenue plan from the Review Revenue - Plans page or the Contract Reversal page. When you first reverse a plan, the revenue plan receives a status of Reversal in Progress. When CA_LOAD_UPD is run after the Journal Generator, the system sets the Reversal in Progress events to Reversed. When all events that were originally set to Reversal in Progress are updated to Reversed, the CA_LOAD_UPD process updates the revenue plan status from Reversal in Progress to Reversed.

Note: Pending and Ready revenue recognition events do not get reversed, so those events may appear on the revenue plan when the system sets the plan status to Reversed.

Changing a Revenue Plan Status to Cancelled

You can change the revenue plan status to Cancelled from a Pending or Reversed status.

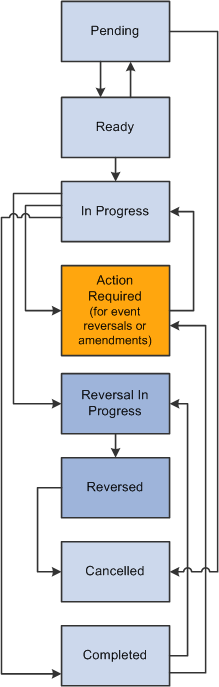

Revenue Plan Status Flow

This diagram depicts the flow between revenue plan status values:

The flow between revenue plan status values is depicted

Understanding Revenue Plan Event Status

The revenue plan event status acts as the final gatekeeper to determine if the event can be released. The system will not mark a revenue plan complete until all associated events are complete (booked).

There are seven revenue plan event statuses:

Term |

Definition |

|---|---|

Pending |

Appears by default status when you define a new revenue plan event. Revenue plan events with this status are not subject to system edit checking. |

Ready |

Setting an event to Ready makes it available for processing. The system sets apportionment and percent complete events to a status of Ready by default. |

In Progress |

Appears automatically once the revenue recognition event has been processed by the system by using the Revenue Recognition Application Engine process (CA_LOAD_GL1 for amount-based revenue and PSA_ACCTGGL for rate-based revenue). Events marked with this In Progress status are overlooked by future revenue processes. |

Completed |

Appears for both amount-based and rate-based revenue when you run the Application Engine (CA_LOAD_UPD) process. |

Reversal Initiated |

The system sets this status when you select the Reversal Initiated option and click the Update Event Status button on the Review Revenue - Events page. Selecting this option triggers the system to generate a reversal for the selected revenue plan events the next time that CA_LOAD_GL1 is run. At the same time that the system sets the event status to Reversal Initiated, the system also changes the revenue plan status from In Progress or Completed to Action Required. This indicates that you need to manage the revenue plan events to ensure that you update or define events for event level reversal amounts. |

Reversal In Progress |

The system sets this status when the application engine begins the reversal generation process. |

Reversed |

Appears when you have completed the revenue plan event reversal. You cannot reuse a reversed event (in other words, you cannot set the status back to Pending or Ready). Instead, you must add new events to the revenue plan. Note: You cannot reverse events for as-incurred revenue plans. |

Understanding the Relationship Between the Revenue Plan Status and Revenue Plan Event Status

The ability to edit revenue plan events depends on the status of your revenue plan:

When the revenue plan status is Pending, you can freely edit your revenue plan events.

When the revenue plan status is Ready or In Progress, you can edit revenue plan events with a status of Pending or Ready.

When you reverse an event and the status of the revenue plan changes to Action Required, you can add new revenue plan events or edit revenue plan events with a status of Pending or Ready.

In addition, the following relationships apply:

Once the first revenue recognition event status changes to In Progress, the status of the revenue plan also changes to In Progress.

An amount-based revenue plan cannot be set to Completed by the system until all associated events are either Reversed or Completed and the event totals sum to 100 percent.

A rate-based revenue plan cannot be set to Completed by the user until all associated events, if any, are Completed.

If you reverse a revenue recognition event, the status of the revenue plan changes to Action Required.

Changing a Revenue Plan Event Status to Ready

The process for changing a revenue plan event status from Pending to Ready differs based on the revenue recognition method you are using. The system sets the status of apportionment and percent complete events to Ready upon creation. For milestone and as incurred revenue recognition methods, you can change an event status to Ready from the Review Revenue - Events page. From this page you can view all events matching your search criteria, and then set individual events to Ready (or back to Pending).

For percent complete revenue plans, access the Revenue Plan page, where you can manually update the total percent complete as of the date on which you are making the entry. The system uses this entry to generate the event on the revenue plan. As a result, you must make this entry on the revenue plan itself.

Changing a Revenue Recognition Event Status to In Progress

The revenue recognition event status is moved to In Progress when you run the Revenue Recognition Application Engine (CA_LOAD_GL1 for amount-based revenue and PSA_ACCTGGL for rate-based revenue). The Journal Generator Application Engine books all revenue associated with a revenue plan event to PeopleSoft General Ledger.

Changing a Revenue Recognition Event Status to Completed

When you run the post-Journal Generator process (CA_LOAD_UPD), the system updates the revenue recognition event status to Completed for both amount-based and rate-based revenue. For amount-based revenue, if all events for a revenue plan are booked and the event total equals 100 percent, the system also updates the revenue plan status to Completed. For rate-based revenue, the user must manually update the revenue plan status to Completed. (All revenue recognition events must have a status of Completed.)

Changing a Revenue Recognition Event Status to Reversal Initiated

The system sets this status when you select the Reversal Initiated option and click the Update Event Status button on the Review Revenue - Events page. Selecting this option triggers the system to generate a reversal for the selected revenue plan events the next time that CA_LOAD_GL1 is run.

At the same time that the system sets the event status to Reversal Initiated, the system also changes the revenue plan status from In Progress or Completed to Action Required. This indicates that you need to manage the revenue plan events to ensure that you update and define events for event level reversal amounts.

Changing a Revenue Recognition Event Status to Reversal in Progress

The system sets this status upon the reversal process picking up the events with a status of Reversal Initiated for processing.

Changing a Revenue Recognition Event Status to Reversed

The system sets this status when you run the post-Journal Generator process (CA_LOAD_UPD). You cannot reuse a reversed event (in other words, you cannot set the status back to Pending or Ready). Instead, you must add new events to the revenue plan.

Note: You cannot reverse events for as-incurred revenue plans.

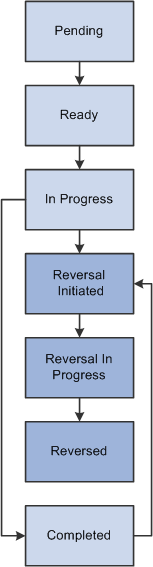

Revenue Event Status Flow

This diagram depicts the flow between revenue event status values:

This diagram depicts the flow between revenue event status values

You assign contract lines to revenue plans on the Assign Revenue Plan page. From this page, you can either assign contract lines to existing revenue plans for that contract or you can create a revenue plan and assign contract lines at the same time. You can assign multiple contract lines to a single revenue plan. Each contract line for which PeopleSoft Billing manages revenue, cannot be assigned to a revenue plan. These are the rules for assigning a contract line to a revenue plan:

The contract lines must be active.

The revenue recognition method must be valid for the price type.

The contract lines must be of the same revenue recognition method as the revenue plan unless you have selected the revenue recognition override option for the associated business unit on the Contracts Definition - Processing Options page.

When assigning an existing revenue plan, the revenue plan status must be Pending.

You can assign contract lines to revenue plans for contracts in Pending and Active statuses. When a contract is in Pending status, contract lines are still available for amount allocation. Assigning a contract line to a revenue plan does not impact your ability to perform amount allocation on that contract line. The system stores all amounts related to revenue plans and revenue plan events as a percentage of the revenue plan total. You can define events by percentage or amount. If you define by amount, you must manually update those amounts after making changes to the contract line amount. If you define by percentage, the changes to contract lines amounts made during the amount allocation step are automatically reflected on the revenue plan and revenue plan event amounts.

Note: You do not assign recurring contract lines to a revenue plan. Recurring contract lines use the Billing Manages Revenue method.

Note: If the Separate Fixed Billing and Revenue check box is selected on the contract then Billing Manages Revenue method is not available for assigning to the contract lines.

Note: If you want to assign a revenue plan template with a basis date source option of Contract Line Start Date to a contract line, you must have already defined the start date for the contract line on the Contract – Lines page.

If you select multiple contract lines and select a revenue plan template with the basis date source option of Contract Line Start Date, the system assigns the same revenue plan only if the start dates for all the selected contract lines are identical. If you want to assign separate revenue plans to the contract lines using a revenue plan template with a basis date source option of Contract Line Start Date, then assign a revenue plan template separately for the individual contract lines.

Assigning Revenue Plans

The following steps provide a high-level sequence of the activities that you need to perform when assigning contract lines to revenue plans.

To assign contract lines to revenue plans:

Create a new contract in Pending status.

Select products onto contract lines.

Note: If you associated revenue plan templates with your products, upon selecting those products onto contract lines and clicking Save, the system creates revenue plans and assigns them to contract lines automatically.

Assign the active contract lines to revenue plans (could be step 5).

You can assign a contract line to either a new revenue plan or a revenue plan that you have previously defined for the contract. You can define events for apportionment- and milestone-based revenue plans either before or after activating the contract.

Complete the amount allocation for all active contract lines.

This could change the amount on any active line.

Repeat steps 2–4 as needed.

Activate the contract.

It is possible to activate the contract prior to assigning any or all of the active lines to revenue plans.

Ready the revenue plans.

Note: If you selected the autoready option for this revenue plan, the system automatically changes the revenue plan status to Ready upon contract activation.

Unassigning Revenue Plans from Contract Lines

For a contract line to be unassigned from a revenue plan, its associated revenue plan status must be Pending, Reversed, or Cancelled to ensure that no processing has occurred. The revenue plan cannot have a status of Ready or In Progress.

Note: If you wish to delete a contract line that is associated with a revenue plan with a basis date source of Contract Line Start Date, you cannot delete the contract line until you unassign the associated revenue plan.

Preview Revenue is a read-only page that provides a view of amount-based revenue recognition events and their corresponding accounting entries before they are processed. The Preview Revenue page displays your accounting entries for a specific revenue plan on a specific contract. In addition, the Preview Revenue page displays amendment accounting entries.

The system builds and updates the schedule automatically whenever changes are made that impact the revenue plan's accounting entries. Once a line is distributed from the schedule, it is marked as distributed. If the schedule is rebuilt, that line does not change.

The schedule is rebuilt when:

A revenue plan status is changed to ready (due to a reversal of an event).

A new effective dated accounting distribution is added.

A new accounting date is entered for an event, which changes the accounting distribution.

The accounting distribution is changed on the Accounting Distribution page.

An event is deleted from the revenue plan.

Note: If the revenue plan status is Action Required or Reversal In Progress, then the amounts on the Preview Revenue page are not up-to-date until the plan has been reviewed or processing is completed.