Defining Component TAS and BETC Elements in Compliance with Federal Reporting Requirements

To define component TAS and BETC elements for U. S. Federal government reporting and IPAC transactions, use the Define Agency Identifier component (TAS_AGENCY_ID), the Define Main Account component (TAS_MAIN_ACCT_DFN), and the Treasury Account Symbol Definition component (TAS_DEFN).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TAS_AGENCY_ID |

Enter the three-digit Agency Identifier code and description. |

|

|

TAS_MAIN_ACCOUNT |

Enter the Main Account and description. |

|

|

TAS_DEFN |

Define the Treasury Account Symbol (TAS), which is identified by selecting its component key field values, Agency Identifier and Main Account. Associate its components and attributes, such as BETC, Fund Code, and TAS Formats. |

|

|

BETC_DEFN |

Enter associated BETC codes and related information for the Treasury Account Symbol. |

|

|

FUND_CODE_DEFN |

Enter associated Fund Codes by SetID for the Treasury Account Symbol. |

|

|

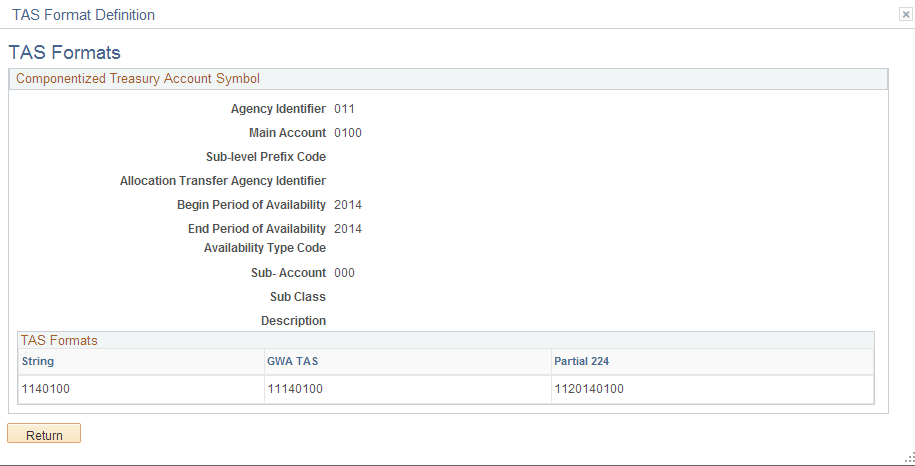

TAS_FORMAT_DEFN |

Displays the various derived TAS formats that are used as follows: String, GWA TAS, and Partial 224. |

Federal agencies are required to use valid combinations of the current Treasury Account Symbols (TAS) and Business Event Type Codes (BETC) as published by the U. S. Department of Treasury for cash transactions when entering and reporting IPAC transactions. The Treasury has adopted a componentized TAS and BETC.

Federal Agencies are required to begin using new formats for the Treasury Account Symbol (TAS) when reporting cash transactions through the FMS 224 Reports and IPAC transactions. Component TAS elements provide federal agencies and Treasury the ability to sort, filter, and analyze data based on each independent piece of the component TAS.

PeopleSoft GL provides a configurable solution to accommodate the valid combinations of TAS and BETC for reporting and when entering and reporting IPAC transactions to the Department of Treasury. This configuration also anticipates the handling of valid TAS and BETC combinations to be downloaded from the Treasury SAM website when the U S Treasury makes the information available.

PeopleSoft Financials supports the following for IPAC transactions:

CGAC (Common Government-wide Accounting Classification)-compliant Sender TAS for GWA reporters.

CGAC-compliant Receiver TAS for GWA reporters.

Sender BETC default.

Receiver BETC default.

The system also supports STAR string TAS for non-GWA Reporters.

See also Defining Agency Location Codes

Use the Define Agency Identifier page (TAS_AGENCY_ID) to enter the three-digit Agency Identifier code and description.

Navigation:

This example illustrates the fields and controls on the Define Agency Identifier. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Agency Identifier and Description |

Enter an agency identifier (three-digit numeric value) and description. This is one of two key fields (along with the Main Account) that identifies the Treasury Account Symbol (TAS). Valid values are 000 through 999. If you enter fewer than three digits, the system supplies leading zeros (left). This value populates the TAS_AGENCY record. |

Use the Define Main Account page (TAS_MAIN_ACCOUNT) to enter the Main Account and description.

Navigation:

This example illustrates the fields and controls on the Define Main Account page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Main Account and Description |

Enter a main account (four-digit numeric value) and description. This is one of two key fields (along with the Agency Identifier) that identifies the Treasury Account Symbol (TAS). Valid values are 0000 through 9999 and you must enter all four digits. This value populates the TAS_MAIN_ACCT record. |

Use the Treasury Account Symbol Definition page (TAS_DEFN) to define the Treasury Account Symbol (TAS), which is identified by selecting its component key field values, Agency Identifier and Main Account. Associate its components and attributes, such as BETC, Fund Code, and TAS Formats.

Navigation:

This example illustrates the fields and controls on the Define TAS search page. You can find definitions for the fields and controls later on this page.

To find an existing value or add a new Treasury Account Symbol, select an Agency Identifier and a Main Account TAS that serve as key fields to identify the TAS.

Field or Control |

Description |

|---|---|

|

Click to add a new TAS after selecting the agency identifier and main account. Upon adding, or after searching for an existing value, you are directed to the Components tab. |

Access the Treasury Account Symbol Definition page - Component tab (click the Add button on the Define TAS search page).

This example illustrates the fields and controls on the Treasury Account Symbol Definition page - Component tab. You can find definitions for the fields and controls later on this page.

Supply components information for the Treasury Account Symbol.

Field or Control |

Description |

|---|---|

Sub Class (government online accounting link system file type) |

Enter a two-digit numeric sub class value or leave blank if not applicable. Valid values are 00 through 99. |

Sub-level Prefix |

Enter a two-digit numeric sub-level prefix value or leave blank if not applicable. Valid values are 00 through 99. |

Allocation Transfer Agency (government online accounting link system file type) |

Enter a three-digit numeric allocation transfer agency identifier value or leave blank if not applicable. Valid values are 000 through 999. You can enter only one digit and the system fills in leading zeros. |

Field or Control |

Description |

|---|---|

Begin Period of Availability and End Period of Availability |

Enter a four-digit year for beginning and ending availability. |

Availability Type |

Select the availability type value if you do not select a period of availability. Values are:

|

Sub Account |

If you select this check box, you must configure an associated Fund Code for the TAS. |

Start Date and End Date |

Select a start and end date for future use. |

Internal TAS (internal Treasury Account Symbol) |

If you select this check box, you must configure an associated Fund Code for the TAS. This field is required for IPAC transactions. |

Use the Treasury Account Symbol Definition page - Attributes tab.

This example illustrates the fields and controls on the Treasury Account Symbol Definition page - Attributes tab. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Treasury Account Symbol Description |

Enter up to a sixty-character componentized TAS description. |

BETC (business event type code) |

Click this link to access the BETC page where you associate BETC codes with the TAS. |

Fund Code |

Click this link to access the Fund Code page where you associate fund codes with the TAS. |

TAS Formats |

Click this link to access the Fund Code page where you associate fund codes with the TAS. |

Use the Business Event Type Code page (BETC_DEFN) to enter associated BETC codes and related information for the Treasury Account Symbol.

Navigation:

This example illustrates the fields and controls on the Business Event Type Code page. You can find definitions for the fields and controls later on this page.

Use this page to configure the Business Event Type Code information associated with the componentized TAS.

Field or Control |

Description |

|---|---|

BETC (business event type code) |

Enter up to an eight-character BETC code. The selected TAS determines the available BETC codes. Most TAS will have the following four BETC codes:

|

Description |

Enter up to a 50-character description of the BETC code. |

Payment Or Collection |

Select either Payment or Collection to designate the nature of the associated business event type code. |

Adjustment |

Select this check box to designate this BETC code as an adjustment. |

Active/Inactive |

Select Active or Inactive to indicate whether this BETC code is currently applicable. |

Use the Fund Code page (FUND_CODE_DEFN) to enter associated Fund Codes by setID for the Treasury Account Symbol.

Navigation:

This example illustrates the fields and controls on the Fund Code page. You can find definitions for the fields and controls later on this page.

Use this page to associate fund codes for the componentized internal TAS. Select a Fund Code by SetID.

Note: You can link more than one Fund Code to each componentized TAS (provided each Fund Code has a different setID); however, a Fund Code can be related to only one componentized TAS. You will receive the following error messages if your setup is incorrect: "Set ID xxxx has been entered" or "Fund Code xxxx has already been used".

Use the TAS Formats page (TAS_FORMAT_DEFN) to displays the various derived TAS formats that are used as follows: String, GWA TAS, and Partial 224.

Navigation:

This example illustrates the fields and controls on the TAS Formats page. You can find definitions for the fields and controls later on this page.

This page displays the various TAS formats that are required to accommodate the U.S. Treasury's componentized TAS. This allows for the reporting of the TAS that is required when reporting cash transactions, using valid combinations of TAS/BETC that the Department of Treasury publishes when entering and reporting IPAC transactions.

Field or Control |

Description |

|---|---|

String |

Displays the TAS format that is required for the current FMS 224 report. The TAS/BETC setup allows only one componentized TAS to be defined for a unique setID and Fund Code combination, which comprises the string. |

GWA TAS (Governmentwide Accounting and Reporting Modernization Project) |

Displays the component-based GWA TAS representing the agency appropriation in GWA. |

Partial 224 |

Displays the expanded 27 character concatenated string format that is required for Partial 224 reporting. |