Defining Agency Location Codes

To set up agency location codes (ALCs) and Government-wide Accounting and Reporting (GWA) options for reporting, use the Agency Location component (AGENCY_LOC_CD)

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

AGENCY_LOC_CD |

Define agency location codes by SetID for federal payment schedules and reporting purposes and provide ALC name, location, address, and telephone information. |

|

|

AGENCY_LOC_CD2 |

Assign a Business Activity and one or more effective dated Reporter Categories to an Agency Location Code. When an agency system is ready to pass the BETC code to the U.S. Treasury, the agency will select the appropriate Reporter Category so that the data can be reported as required. |

|

|

ALC_IPAC_FLDS |

Define additional IPAC fields as required or optional. |

The Agency Location Code (ALC) is an identifier that is used to define agencies by SetID for federal payment schedules and reporting purposes.

PeopleSoft supports IPAC Payments (PeopleSoft Payables) and Collections (PeopleSoft Receivables) as well as IPAC adjustments and zero dollar transactions. The department of Treasury and the IPAC system utilize bulk file formats to send and receive IPAC transactions. These formats are flat files that contain the necessary information to accurately report and account for payments, collections, adjustments, and zero dollar (info only) IPAC transaction types.

See Processing Inbound IPAC Transactions.

See Processing Outbound IPAC Transactions.

See (USF) Submitting Transactions Between Agencies Using the IPAC System.

For General Ledger, by using the ALC field on the Journal Header page, agencies can record cash transactions by journal entry directly to the general ledger. The journal header ALC field can be used by the system to select cash entries that were entered directly to the general ledger for reporting purposes. Journal entries made directly to the general ledger are usually made for the recording of undeposited cash, or collections. However, they can also be used to record cash reclassification for payments or collections.

Undeposited collections are amounts received by an agency that have yet to be deposited with the U.S. Treasury. Some agencies receive small amounts of money that they deposit once a week. Agencies book these amounts to an undeposited collections account until they are officially deposited with the U.S. Treasury.

Common Terms Used for U.S. Government Agency Reporting

These terms are commonly used when referring to U.S. Government Reporting for Agencies:

|

Term |

Description |

|---|---|

|

TAS (Treasury Account Symbol) |

Federal agencies are required to use Treasury Account Symbols (TAS) when reporting cash transactions to the U.S. government. They must also use valid combinations of TAS and Business Event Type Codes (BETC) that the Department of Treasury publishes when entering and reporting GWA Transactions. See Defining Component TAS and BETC Elements in Compliance with Federal Reporting Requirements |

|

BETC (Business Event Type Code) |

This code identifies the business event type of a transaction for U.S. government reporting. |

|

IPAC Payment |

Originates from PeopleSoft Payables and provides the IPAC system with payment-specific information using bulk file formats. |

|

IPAC Collection |

Originates from PeopleSoft Receivables and provides the IPAC system with collection-specific information via bulk file formats. |

Use the Agency Location Code page (AGENCY_LOC_CD ) to define agency location codes by SetID for federal payment schedules and reporting purposes and provides for ALC name, location, address, and telephone information.

Navigation:

This example illustrates the fields and controls on the Agency Location Code page.

Field or Control |

Description |

|---|---|

Agency Location Code |

Enter an 8-digit numeric value for the ALC. |

Non-Treasury Disbursed ALC |

Click if the ALC does not use the US Treasury to carry out payments or if the ALC is authorized to create its own payments outside the U.S. Treasury. Note: If you set this option incorrectly for an ALC and save it, the incorrect ALC and option remains because you cannot delete the rows online. You must define a new ALC with the appropriate option. |

IPAC Document Reference Number

IPAC (Intra-governmental Payment and Collection system) is designed to transfer funds between government agencies and provide the capability to include descriptive information related to each transaction. This descriptive information assists with monthly reconciliation.

Field or Control |

Description |

|---|---|

IPAC Bulk Prefix |

Enter a 3-digit alphanumeric prefix to be used by PeopleSoft in creating unique document reference numbers (to differentiate from the Department of Treasury document reference numbers) for those Agency Location Codes that are used to send payments and collections. |

IPAC Bulk Counter |

Enter the beginning number from which to increment the sequential counter for the document reference number. |

See Processing Outbound IPAC Transactions.

See (USF) Submitting Transactions Between Agencies Using the IPAC System.

Sender DUNS

Field or Control |

Description |

|---|---|

Sender DUNS and Sender DUNS Plus 4 |

Enter a Sender DUNS and optionally a Sender DUNS Plus 4 value for the Sender Agency Location Code (ALC). These fields may be required as defined on the IPAC Fields page. (The Receiver DUNS and DUNS Plus 4 values are stored on the Customers - Additional General Information page). If the Sender DUNS and Sender DUNS Plus 4 are defined as required on the IPAC Fields page, the system uses these values as the Sender information defaults on the Receivable IPAC Transactions page. Note: The Sender and Receiver DUNS and DUNS Plus 4 fields will only appear as defaults on the IPAC transactions if they are marked as required on the IPAC Fields Page. This applies to items created online and from an external interface (therefore derived from the AR Posting program). |

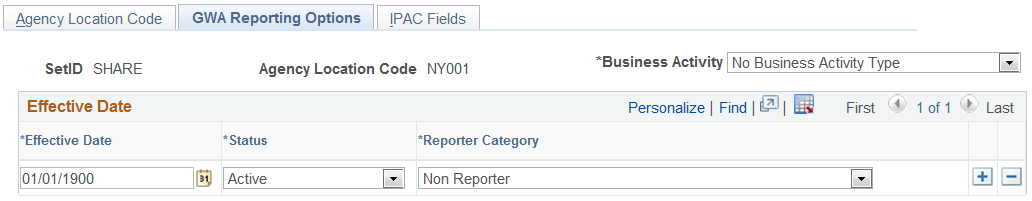

Use the GWA Reporting Options page (AGENCY_LOC_CD2) to assign a Business Activity and one or more effective dated Reporter Categories to an Agency Location Code.

When an agency system is ready to pass the BETC code to the U.S. Treasury, the agency will select the appropriate Reporter Category.

Navigation:

This example illustrates the fields and controls on the GWA Reporting Options page.

Field or Control |

Description |

|---|---|

Business Activity |

Select the business activity type for this agency location code. Values are:

The GWA Business Activity that you specify for each ALC drives the following functionality related to the Partial SF 224 and CTA reports:

|

Reporter Category |

Select a GWA reporter category code for this agency location code. The reporter category can be equivalent to the business activity type, a subset of the business activity type, or a nonreporter. For example, if you select the IPAC and AP Payments business activity type, the valid selections are IPAC Only, AP Payments Only, IPAC and AP Payments, or Non Reporter. If either the Sender or Receiver ALC has one of the following four IPAC Reporter Category values, then that ALC agency is a GWA reporter for IPAC:

The GWA Reporter Category code is specified to identify those interfaces, such as IPAC, CA$HLINK and SPS/PAM, that have been modified to interface the Business Event Type Code (BETC) to cash activity with the U.S. Treasury. The GWA Reporter code that you define for each ALC drives functionality in the software related to the Partial SF 224 that:

The GWA Reporter category has no impact on CTA reporting. |

Business Activity and Reporter Category Combinations

The system requires that the business activity type and reporter category codes are a valid combination. The system displays a warning message if the combination is invalid.

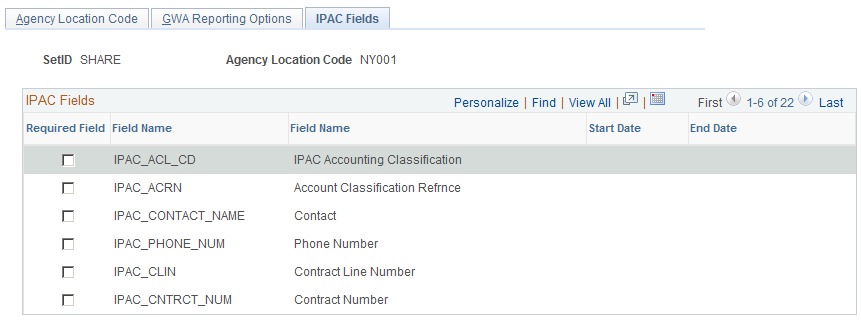

Use the IPAC Fields page (ALC_IPAC_FLDS) to assign a Business Activity and one or more effective dated Reporter Categories to an Agency Location Code.

When an agency system is ready to pass the BETC code to the U.S. Treasury, the agency will select the appropriate Reporter Category so that the data can be excluded from the SF224 report.

Navigation:

This example illustrates the fields and controls on the IPAC Fields page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Required Field and Field Name |

Select the Required Field check box to define the selected field as required for this ALC. The IPAC fields available here are delivered as optional; fields that are by default required in PeopleSoft Financials are excluded. |

Start Date and End Date |

For each Required Field that you select, you must also enter Start Date and End Date values. Effective dating enables an agency to designate fields as optional or required in the future, based on the agency’s business case needs. If you deselect a Required Field check box, the system clears the start and end dates. |