Processing Outbound IPAC Transactions

This section provides an overview of outbound IPAC processing in PeopleSoft Payables, lists prerequisites, and discusses how to:

Create outbound IPAC vouchers.

Enter outbound IPAC information.

Enter additional IPAC information.

Run the Pay Cycle process for outbound IPAC payments.

Perform schedule reconciliation for IPAC payments.

Inquire on IPAC payments.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

VCHR_EXPRESS1 |

Create outbound IPAC vouchers. |

|

|

AP_IPAC_SEC |

Enter information required for outbound IPAC processing for a voucher. |

|

|

IPAC_MISC_SEC |

Enter free-form text. |

|

|

PYCYCL_MGR |

Process the appropriate pay cycle. See also Running and Managing Pay Cycles. |

|

|

BNK_RCN_MAN_TRE |

Reconcile federal payment schedules. |

|

|

AP_SCHD_PYMNT_INQ |

View scheduled IPAC payments. |

For outbound IPAC processing, PeopleSoft Payables provides an IPAC EFT file layout, which can be used for payments, adjustments, post SGL, and zero-dollar transactions. Users enter vouchers for these IPAC transactions just as they would for any payment, but they enter additional IPAC-related information on theIPAC Page in the Voucher component. Vouchers must be copied from purchase orders.

The Pay Cycle processes IPAC vouchers like any other voucher: EFT File Creation (FIN2025.sqr) creates the payment flat files that you transmit to the federal IPAC system.

Note: If an IPAC voucher enters the system through the Voucher Build process, you must then create the IPAC data within the IPAC page. If you do not create IPAC data before running the Pay Cycle process, the payment is rejected. If the Pay Cycle process rejects the voucher, you can enter the required information on the IPAC page and resubmit the pay cycle.

Zero-dollar and Post SGL IPAC Transactions

Zero-dollar IPAC transactions are information-only adjustments to IPAC vouchers that have already been paid. You cannot change any monetary amounts. You can create zero-dollar transactions only after the original IPAC payment has been processed by the Pay Cycle process.

When you enter a zero-dollar IPAC transaction on the IPAC page, a payment record with an amount of 0.00 USD is automatically entered on the Voucher - Payments page. The due date and other payment values are automatically populated. When you run the Pay Cycle process for a zero-dollar IPAC transaction, the Pay Cycle process treats the payment as a zero-dollar payment and creates the IPAC flat file for the payment. Zero-dollar IPAC transactions are always flagged as separate payments.

You can create unlimited numbers of zero-dollar IPAC transactions associated with an IPAC voucher that has been paid, but you must enter them serially, when the previous one has been fully processed by the Pay Cycle process.

To set your system up for outbound IPAC processing, perform the following steps:

Enable Federal Payments on the Installation Options - Payables page.

View the IPAC EFT file layout on the EFT File Layouts page.

IPAC is a delivered file layout. You may want to indicate that the payment format applies to both employee payments and non-employee payments, although the system performs no edits for employee versus non-employee payments for the IPAC file layout.

Define a pre-fix and starting counter number (5 digits) in the ALC setup component for your assigned ALC. This pre-fix/bulk counter is then used to generate unique Doc Reference numbers.

Enable suppliers for federal processing on the Supplier – Federal page in the Supplier Information component (VNDR_ID) and enter the Agency Location Code. For each supplier (agency) you do business with and utilize IPAC, you must define their ALC in order to send or receive IPAC payments. The supplier ALC is required. All other federal-specific supplier detail is recommended.

Enter your assigned Agency Location Code on the Bank Information page.

Enter the Sender Disbursement Office (DO) symbol for the disbursing bank account on the External Accounts page.

Specify the payment method as EFT and the EFT layout as IPAC on the Payment Methods page for the disbursing bank account.

Funds must be defined to the appropriate TAS/BETC values used to make IPAC payments. See Defining Component TAS and BETC Elements in Compliance with Federal Reporting Requirements

Use the Voucher - Invoice Information page to create outbound IPAC vouchers.

Navigation:

Select Regular Voucher on the Add page.

Note: IPAC vouchers must have a voucher style of Regular.

Copy a purchase order.

Note: IPAC vouchers must be preceded by a purchase order.

Complete the voucher by entering all required fields on the Invoice Information, Payments, and Voucher Attributes pages.

Enter a payment Method of EFT and a Bank Account for which the EFT layout is IPAC.

Note: Multiple payment schedules are not allowed for IPAC vouchers.

Payment terms with discount or rebate are not allowed for IPAC vouchers.

You cannot include nonmerchandise charges on IPAC vouchers.

Save the voucher.

Since the EFT file layout for the bank account on the voucher has a file layout of IPAC, you receive a message prompting you to click the IPAC link on the Voucher - Payments page. The IPAC link is activated only after you save the voucher.

Click the IPAC link on the Voucher - Payments page to access the IPAC page.

Select the transaction type for the IPAC transmission.

Values are Payment, Post SGL, and Zero. Only Payment is available for selection the first time IPAC is processed. After a payment is processed, all values are available for selection.

Click the Create button to populate the required fields in the IPAC Details scroll area.

See IPAC Page.

Enter data in the fields not populated when you clicked the Create button.

The fields that require entry on the page vary based on the transaction type. These are not required by PeopleSoft Payables, but may be required by your organization.

Click OK to save the voucher.

Note: Any changes to the invoice ID, invoice date, or gross amount on the voucher after save require you to update the same data on the IPAC page.

Use the IPAC page (AP_IPAC_SEC) to enter information required for outbound IPAC processing for a voucher.

Navigation:

Click the IPAC link on the Voucher - Payments page.

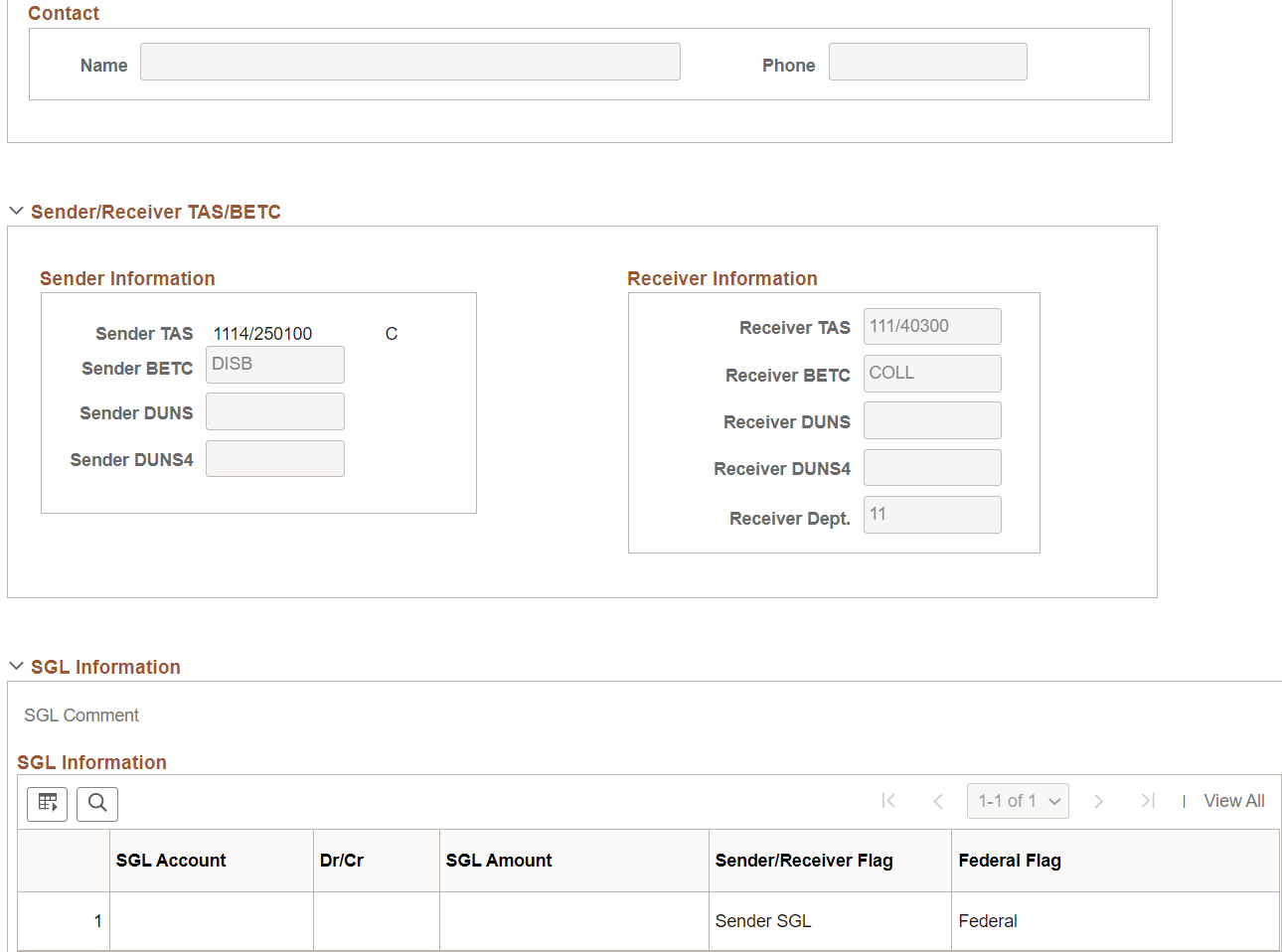

This example illustrates the fields and controls on the IPAC page

This example illustrates the fields and controls on the IPAC page after clicking create (1 of 2).

This example illustrates the fields and controls on the IPAC page after clicking create (2 of 2).

When you first enter this page, only the header information is displayed. After you select an IPAC type, and click the Create button, the rest of the page is displayed and some fields are populated. Next complete any required fields; this varies based on the selected IPAC transaction type.

Creating Post SGL and Zero-dollar IPAC Transactions

To create post SGL IPAC transactions:

Access the Voucher component for the IPAC voucher you want to adjust.

On the Voucher - Payments page, click the IPAC link to access the IPAC page.

Add a new IPAC header row in the Header Information scroll area and select an IPAC Type of Post SGL.

Click the Create button.

The system automatically populates fields in the SGL Information scroll area.

Enter an Orig Doc Ref (original document reference) and an Original DO (original disbursement office) in the Header Information scroll area.

Enter an Original Line # (original line number) in the Detail Information scroll area.

Click OK to save the voucher and make the Post SGL transaction available to the Pay Cycle process for processing.

To create Zero-dollar IPAC transactions:

Access the Voucher component for the IPAC voucher you want to adjust.

On the Voucher - Payments page, click the IPAC link to access the IPAC page.

Add a new IPAC header row in the Header Information scroll area and select an IPAC Type of Zero.

Click the Create button.

The system automatically populates specific fields in the Detail Information, Line Amount, and Invoice regions.

Enter an Orig Doc Ref (original document reference) in the Header Information scroll area.

Click OK to save the voucher and make the Zero-dollar transaction available to the Pay Cycle process for processing.

Header Information

Field or Control |

Description |

|---|---|

Sender ALC (Sender Agency Location Code) |

Displays the ALC values entered on the Bank Information page. |

Sender DO (Sender Disbursement Office) |

Displays the sender DO value entered on the External Accounts page. |

Receiver ALC |

Displays the receiver's (supplier's) ALC by default from the supplier. You assign the ALC to the supplier on the Supplier Information - Federal page. |

IPAC Type |

The first IPAC header row must be a Payment transaction type with one exception, the first row can be an Adjustment transaction type if the voucher was built from the accounts receivables refund process. Select from: Payment for new transactions that you are sending to the IPAC system. Post SGL to add or change the SGL account information for previous transactions that you sent for collection. This value is available only if the original IPAC payment to which it refers has a status of Processed, which indicates that the payment has been processed by the Pay Cycle process and the Outbound IPAC file has been sent to the IPAC system. Zero for zero-dollar, information-only IPAC transactions. This value is available only if the original IPAC payment to which it refers has a status of Processed, which indicates that the payment has been processed by the Pay Cycle process and the Outbound IPAC file has been sent to the IPAC system. Adjustment for vouchers that originated from the accounts receivables refund process. Users are required to enter at least one debit credit pair of SGL information if you select this value. Only one adjustment transaction can be included per voucher. |

Create |

Select an IPAC type and then click to display the detail IPAC information. |

|

IPAC Subcategory |

Select the IPAC subcategory. The IPAC Subcategory field is displayed when you click the Create button. This is a required field for IPAC payments. The subcategory field is available only when IPAC Type is Payment. The available subcategory options are the following:

|

Doc Reference (document reference) |

This value is created during Pay Cycle using the ALC bulk pre-fix/counter defined during set up. The counter is incremented by one for each IPAC payment. |

Status |

Indicates the status of the IPAC voucher: Processed: IPAC vouchers have gone through the Payment Selection part of the Pay Cycle process and cannot be modified. Not Processed: IPAC vouchers have not gone through the Payment Selection part of the Pay Cycle process and can be modified. |

Detail Information

Each row in the Detail Information scroll area displays one invoice line—distribution line combination. With the exception of Final Pay, the rest are optional. Fields required for zero-dollar transactions are noted below.

Field or Control |

Description |

|---|---|

Trace ID |

Displays the business unit code followed by the voucher ID. This auto-populated value enables back-end systems to match transactions. |

Misc Info |

Click to access the IPAC Miscellaneous Description page, where you can enter related free-form text, accounting code information and a fiscal year ID. |

Description |

Click to access the IPAC Description page, where you can enter a free-form description of the IPAC transaction. |

Cross Reference Document |

Displays the document reference number of the original IPAC payment for zero-dollar transactions. |

Original Line # |

Displays the original line number of the original invoice line being adjusted for zero-dollar and adjustment transactions only. |

Contact Name and Phone |

Enter the name and phone number of a contact person at your agency. |

Transaction Information

Field or Control |

Description |

|---|---|

Obligation Doc |

Displays the purchase order identifier. The default is the same as the value that appears in the PO ID field. |

Final Pay |

Select to indicate that payment is final. Deselect to indicate a partial payment. Required for original payment. |

Contract and Contract Line |

Displays the contract ID and contract line item number copied from the voucher, if present. |

Requisition |

Enter the ID of the request for goods or services. This value is not copied from the voucher. |

Sender/Receiver TAS/BETC

Field or Control |

Description |

|---|---|

Sender TAS (Sender Treasury Account Symbol) |

Displays the Sender TAS based on the fund code entered on the distribution line. You associate Treasury Account Symbols with fund codes on the TAS/BETC setup component. Required for original payment. The Sender TAS automatically defaults based on the fund code at the distribution line level. |

Sender BETC (sender business event type code) and Recvr BETC (receiver business event type code) |

Sender and Receiver BETC values are optional if both the Sender or Receiver Agency are not GWA Reporters. If either the Sender and/or Receiver Agency are GWA Reporters, BETC is required. |

Receiver TAS (Receiver Treasury Account Symbol) |

Represents the appropriation of the agency receiving payment. Receiver TAS is required if the Receiver Agency is a GWA reporter. |

Sender DUNS (sender Dun and Bradstreet number) and Recvr DUNS (receiver Dun and Bradstreet number) |

Enter the Dun and Bradstreet number used to identify the sender (your agency) or the receiver (the customer's agency). |

Sender DUNS4 and Recvr DUNS4 (receiver DUNS4) |

Enter the four-character identifier that, along with the DUNS number, identifies individual business locations for federal suppliers and federal customers. |

Receiver Dept. |

Represents the two-digit code assigned by the U.S. Department of Treasury to the agency receiving the transaction. Required for original payment. |

Every IPAC Payment has both a sender and receiver ALC. If the Sender ALC is set up as a GWA Reporter, the TAS/BETC setup allows multiple combinations of SetID and Fund. If a GWA TAS is set up for the fund used on the distribution, the TAS is automatically defaulted. An error message is displayed if GWA TAS is not found for the SetID/Fund Code value. If the Receiver ALC is set up as a GWA reporter, the prompt lookup displays all GWA TAS values. For a Receiver ALC set up as a GWA reporter, Receiver TAS is required. An error message is displayed if a valid TAS/BETC value is not entered.

Receiver TAS is manually entered for the receiver agency. Each TAS has associated BETC codes set up to support GWA reporters. All BETC codes are retrieved for the specified TAS. BETC is required entry for GWA Reporters.

Note: BETC prompt lists cannot be created until the user has selected a TAS value.

If Sender ALC is not set up as a GWA Reporter, the TAS/BETC setup allows only one componentized String TAS to be defined to one unique SetID/Fund code value combination. If a GWA String is setup for the fund used on the distribution, the TAS is automatically defaulted. An error message is displayed if the String TAS value is not found for the SetID/Fund Code value. If the Receiver ALC is not set up as a GWA reporter, the prompt lookup displays all TAS values. Receiver TAS is optional entry for non-GWA Reporters. A prompt lists all BETC codes for the default TAS string value. BETC is an optional value for non-GWA reporters and no error message is displayed if values have not been setup for the TAS.

For more information, see Defining Component TAS and BETC Elements in Compliance with Federal Reporting Requirements

SGL Information

(Optional) Enter Standard General Ledger information. Bear the following in mind:

If you enter data in any SGL Information field, you must enter data in all of the fields.

SGL amounts must balance with the IPAC line amount, and you must have offsetting debit and credit entries.

You must enter SGL account information for Post SGL transaction types, and—optionally—you can enter SGL account information for collection. The SGL information fields are not available for zero-dollar transaction types.

Field or Control |

Description |

|---|---|

Sender/Receiver Flag |

Select a value to indicate whether the SGL account information for the line is for the Sender (your agency) or the Receiver (the customer's agency). |

Federal Flag |

Select a value to indicate whether the SGL account information for the line is Federal or Non-Fed (non-federal). |

SGL Action |

Select a value that indicates the action for the line. Values are: Add: Indicates this is a new line. Edit: Indicates this is a changed line. For Post SGL transaction types, the action is Edit for existing lines and Add for new lines. |

Use the IPAC Miscellaneous Description page (IPAC_MISC_SEC) to enter free-form text related.

Navigation:

Click the Misc Info link on the IPAC page.

Field or Control |

Description |

|---|---|

Fiscal Year Obligation ID |

Select a value to indicate the fiscal year of the obligation. Values are: Not Applicable, Current Fiscal Year, and Prior Fiscal Year. |

ACL/CD (Accounting Classification Code), ACRN (Account Classification Reference Number), Job (Job Order Number), and JAS |

Displays the identification codes. The JAS code consists of a combination of Job Order Number, Accounting Classification Reference Number, and Site ID. |

FSN (Fiscal Station Number) |

Enter the eight-digit number identifying the subdivision of the sender ALC. |

DoD |

Enter the DoD Activity Address Code. |

The fields that are available on this page vary based on the IPAC transaction type. This table shows the fields that are available based on the IPAC type:

|

IPAC Transaction Type |

Available Fields |

|---|---|

|

Payment |

All fields available. |

|

Zero Dollar |

Only the text box. |

|

Post SGL |

Only the text box. |

Use the Pay Cycle Manager page to process the appropriate pay cycle.

Navigation:

The following processing is specific to outbound IPAC payments:

The Pay Cycle creates a file of outbound IPAC payments for submission to Treasury's IPAC system.

The Pay Cycle changes the status of all included IPAC vouchers to Processed on the IPAC page.

The Pay Cycle process rejects and creates an error for any vouchers whose payment method is EFT and EFT layout is IPAC and for which no data is entered on the IPAC page.

View errors on the Pay Cycle Error page. The Pay Cycle process does not process the payment until you enter the proper IPAC data.

The Pay Cycle processes zero-dollar and post SGL IPAC transactions (for non-monetary adjustments to original IPAC payment transactions).

Canceling IPAC Payments

Since IPAC payments are made by the Department of Treasury's IPAC system once they receive the EFT file created by the Pay Cycle process, you should not cancel IPAC payments that have been processed by the Pay Cycle process. If you try to cancel an IPAC payment on the Payment Schedule Cancellation page, you receive a warning message.

Use the Schedule ID Reconciliation page (BNK_RCN_MAN_TRE) to reconcile federal payment schedules.

Navigation:

Use the Scheduled Payment Inquiry page (AP_SCHD_PYMNT_INQ) to view scheduled IPAC payments.

Navigation:

Click the Scheduled Payments button for the voucher on the Voucher Inquiry page.

Select IPAC Payment in the Search Criteria and click the Search button to view IPAC payments.