Defining External Account Information

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BANK_PNL2 |

Set up external accounts. |

|

|

Bank Branch Information Page |

BANK_BRNCHPNL |

Edit bank branch information associated with an external account. See the External Accounts Page for more information. |

|

Bank Account Other Identification Page |

BANKACCT_PNL_OTHID |

Specify values used in SEPA formats based on Rulebook 6.0, including issuer or originating bank. See the External Accounts Page for more information. |

|

BANK_ACCT_CURR_SEC |

Enter valid default currencies for an external account. |

|

|

BNK_CF_OPTIONS_SEC |

Specify inheritance rules for ChartFields for an account type. |

|

|

BANK_PNLSIGNATORYS |

Define account signatories. |

|

|

BANK_PNLCNTCT |

View the names and phone numbers of bank contacts. |

|

|

Bank Contact Notes Page |

BRANCH_CNT_DISP_SP |

Enter notes about the bank contact for an external account. See the Contacts Page for more information. |

|

External Accounts - Reconciliation Page |

BANK_PNLRECON |

Select a method of reconciliation to use for each external account. Specify reconciliation sources to be used by semi-manual reconciliation. For more information, see the documentation for the External Accounts - Reconciliation Page in the Configuring Bank Reconciliation topic. |

|

BANK_PNL3 |

Specify additional information for each bank account. |

|

|

COLLECT_BANK |

Associate different payment methods and collection options (for your receipts) with multiple bank accounts that you established with a particular bank. |

|

|

BANK_COLCT_SEC |

Specify a document type for document sequencing for each draft event. The Receivable Update process (AR_UPDATE) uses this to create document sequence numbers. The Document Type link appears only if Draft is selected in the Payment Method field. |

|

|

PYMNT_BANK |

Define the payment methods supported for an account, payment processing options, and EFT file attributes. For each account, you can enter multiple payment methods. |

|

|

PYMNT_BANK_DOC_SEC |

Set up tracking of individual documents. To access this page, document sequencing must be enabled on the Treasury Options page at the business unit level. |

|

|

BANK_ACCT_CFDR_SEC |

Enter details about the draft account ChartFields. |

|

|

PYMNT_BANK_LYT |

Review and update layout options for layouts settled through Pay Cycle Manager. |

|

|

BANK_PRENOTE |

Indicate whether prenotification files (used in Federal Schedule Reconciliation) must be generated. |

|

|

PMT_BANK_MTHD_PROP |

Review and edit values defined for a specific electronic format. |

|

|

BANK_PNLSETTLE |

Associate settlement instructions with a bank account. |

To define external accounts, use the External Bank Accounts component (BANK_EXTERNAL_GBL).

Use the TR_EXTERNAL_ACCOUNTS_CI component interface to load data into the External Bank Accounts tables.

This topic provides overviews to provide more information about the following:

Bank account ChartField inheritance for Education and Government.

Bank account payment methods.

IBAN check digit validation.

Value date for bank accounts.

In education and government organizations, you can associate bank accounts with a single fund (non-pooled) or group of funds (pooled). Pooled accounts may contain funding from many different grants or endowments, and this pooled fund is represented as a fully configurable ChartField:

As nonpooled accounts are associated with a single fund, you may explicitly enter the fund as a ChartField on the bank account and use it like the other ChartFields.

For pooled bank accounts, the ChartField must be derived at the transaction that references the bank account, because all of the activity in the account must be tracked back to a particular fund (per governmental requirements).

To correctly process transactional ChartFields for pooled bank accounts, use the Bank Account ChartField Inheritance feature. This feature provides a balancing methodology at the ChartField level rather than at the business unit level, which in turn facilitates the interunit and intraunit accounting entry functionality. To enable ChartField inheritance, select one of four inheritance options for each fully configurable ChartField (plus Department and Project ChartFields) on the External Accounts - ChartField Options page. Automatic processes cross-validate whether the specific ChartField supports the inheritance option; the cross-validation is dependent on the PeopleSoft applications and options selected on the External Accounts page.

The following tables illustrate the valid inheritance option combinations:

Table labels (except for valid inheritance options) relate to page fields and check boxes that appear on the External Accounts page.

You specify inheritance option values (listed in italics in the following tables, next to valid inheritance options) on the External Accounts - ChartField Options page.

Inheritance Option Code Key

This table displays the codes for inheritance options:

|

Inheritance Option |

Code |

|---|---|

|

Always Inherit |

A |

|

Do Not Inherit |

N |

|

Inherit Within Unit |

I |

|

Use Unit Default |

D |

|

Option not applicable |

N/A |

Note: The documentation defines inheritance options on the ChartField Options Page.

Receivables, Billing, and Cash

This table displays the inheritance options for Cash Management, Receivables, and Billing transactions:

|

Account Types |

Processing Options |

|||||||

|---|---|---|---|---|---|---|---|---|

|

Accounts Receivable - AR or Billing - BI |

Cash Clearing |

AR Draft Cash Control |

Dep in Transit |

|||||

|

Account Types |

Cash - AR |

Dep - AR |

AR OffSetDr. * |

AR OffsetCr. * |

Cntrl - AR |

Disc - AR |

Draft - AR |

Dit - AR |

|

Valid Inheritance Options |

N |

N |

N/A |

N/A |

N |

N |

N |

N |

|

D |

D |

N/A |

N/A |

D |

D |

D |

D |

|

|

I |

N |

I |

I |

I |

I |

I |

I |

|

|

I |

D |

I |

I |

I |

I |

I |

I |

|

|

A |

N |

A |

A |

A |

A |

A |

A |

|

|

A |

D |

A |

A |

A |

A |

A |

A |

|

*If any Cash - AR ChartField inheritance option is set to either A or I, and you select the Cash Clearing check box, these ChartFields appear on the External Accounts - ChartFields tab when you save.

Payables

This table displays the inheritance options for Payables (AP) transactions:

|

|

Account Types |

Processing Options |

||

|---|---|---|---|---|

|

|

AP |

Cash Clearing |

TRF Charge |

Drafts Payable |

|

Account Type |

Cash - AP |

Cntrl - AP |

Bank Charge |

Draft - AP |

|

Valid Inheritance Options |

N |

N |

N |

N |

|

D |

D |

D |

D |

|

|

I |

I |

I |

I |

|

|

A |

A |

A |

A |

|

Treasury

This table displays the inheritance options for Treasury (TR) transactions:

|

|

Account Types |

Processing Options |

||

|---|---|---|---|---|

|

|

TR |

Cash Clearing |

Stmt Accounting |

TR |

|

Account Type |

Cash |

Control |

Fees Interest |

Cash |

|

Valid Inheritance Options |

N |

N |

N |

N |

|

D |

D |

D |

D |

|

|

I |

I |

I |

I |

|

|

A |

A |

A |

A |

|

Expenses

This table displays the inheritance options for expense (EX) transactions:

|

|

Account Types |

Processing Options |

||

|---|---|---|---|---|

|

|

EX |

Cash Clearing * |

TRF Charge * |

Drafts Payable * |

|

Account Type |

Cash - AP |

Cntrl - AP |

Bank Charge |

Draft - AP |

|

Valid Inheritance Options |

N |

N |

N |

N |

|

D |

D |

D |

D |

|

|

I |

I |

I |

I |

|

|

A |

A |

A |

A |

|

* When you select the AP application check box on the External Accounts page, these ChartFields appear on the ChartFields tab. When you select only the EX application check box, no inheritance validation is enforced. However, when you select the EX and AP check boxes, the AP inheritance validation rules are enforced.

If you use Cash Management and Payables in your organization's banking processes, you can configure banking accounts to automatically process certain Cash Management settlements through either the Cash Management Payment Dispatch or Payables Pay Cycle Manager (PCM) functionality.

To enable this settlement integration, there are now two payment sources predefined in PCM:

TR: Payment source used for bank transfers, fees, and deal settlements.

TRET: Payment source used for EFT request transactions.

The following is a listing of supported and unsupported settlement options for Cash Management settlements:

You can settle ACH and EFT payment methods through either Treasury settlements pages or Pay Cycle Manager.

Checks are automatically configured to settle through Pay Cycle Manager.

As this is a system default value, you cannot access the External Accounts - Payment Methods settle through option.

You cannot settle direct debits through Pay Cycle Manager.

Note: All Cash Management settlements processed through PCM must use the same default currency of the account. For example, if a bank account has a default currency of USD, and you create a settlement from this account with a currency of JPY, PCM cannot process the settlement.

International Bank Account Number (IBAN) provides an international standard account identifier in order to facilitate automated processing of cross-border transactions. IBAN standards are established by the European Committee for Banking Standards (ECBS) and the International Standards Organization (ISO).

PeopleSoft provides a function that validates an IBAN for new account information and stores the IBAN and its check digit in a record. Clicking the View IBAN button on either the Beneficiary Bank page or External Accounts page, as well as various other PeopleSoft Financials application pages, starts a function that validates the IBAN check digit entry, using processes and functions that conform to ISO 13616, 3166, and 7064. If the check digit is successfully validated, the system concatenates the two-digit country code, IBAN check digit and the existing Basic Bank Account Number (BBAN) to create the IBAN:

|

Calculation Page |

Related Record |

|---|---|

|

External Accounts |

BANK_ACCT_DEFN |

|

Settlement Instructions |

STL_INSTRUCTION |

|

EFT Request Entry |

TR_WR_DETAIL |

|

EFT Template |

TR_WR_TEMPLATE |

For electronic formats, the IBAN includes the two-letter country code, two-numeral check digit, and existing BBAN. For paper formats, the IBAN is the same as the electronic format, and also includes the tag IBAN followed by a space, with the number separated into groups of four characters. The last group may vary in length, up to four characters.

Note: Besides the IBAN check digit functionality, users have the option of entering the IBAN manually. Which method is used is determined on a country-by-country basis on the IBAN Formats page.

Single Euro Payments Area (SEPA) Requires IBAN and Bank Identifier Code (BIC)

The European Commission (EC), and the European Central Bank (ECB) working with the Eurosystem, with the support of the European Payments Council (EPC), which brings together the European payments industry, created the Single Euro Payments Area (SEPA). SEPA enables citizens, companies and other economic actors to make and receive payments in Euros between and within national boundaries in Europe with the same basic conditions, rights and obligations, regardless of their location.

SEPA requires the use of BIC and IBAN codes to uniquely identify the creditor's and debtor's banks and bank accounts in all Euro cross-border payments. It is imperative that the IBAN and BIC codes are correct to avoid repair fees that the bank charges due to processing errors. In addition, the validation of the IBAN and BIC codes avoids delays in processing payments and collections due to the time-consuming correction of these errors. The system only validates BIC codes when payments are being settled or settled and dispatched as long as the currency is EUR and the layout is a predefined SEPA credit transfer layout.

See Understanding SEPA.

See the product documentation for PeopleSoft HCM: Global Payroll

Value dating transactions is a common practice in Western European countries, similar to the banking practice of float in the United.States. The value date of a transaction is the date on which funds are available (either as a deposit or a settlement). Banks negotiate this date to be a specified number of days before or after the business date of a transaction. For payments or settlements, the value date is calculated as a number of days before the business date, which means that the check must clear the bank prior to settling with the individual beneficiary. For deposits, the value date is calculated as a specified number of days beyond the business date.

You specify a value date (expressed as a positive or negative number) for a selected payment method. This functionality is available to you depending on how you configure Treasury Management. If you do not enable the value date functionality for a business unit, automatic processes enable the accounting date (or business date) to appear by default in the Value Date field. Using the Value Date option in PeopleSoft is mainly a setup step. After you specify value date parameters for a specific bank account on the External Accounts - Payment Methods page, automatic processes populate the calculated value date in the system and on applicable PeopleSoft reports.

Use the External Accounts page (BANK_PNL2) to set up external accounts.

Navigation:

This example illustrates the fields and controls on the External Accounts page (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the External Accounts page (2 of 2). You can find definitions for the fields and controls later on this page.

Bank Accounts

Field or Control |

Description |

|---|---|

Branch |

Select a branch. The branch determines the location of the account and the bank qualifier to use for bank account validation. Depending on the bank ID qualifier associated with the branch, you might need to specify a check digit for the account. Click the Bank Branch Information button to view and edit bank branch information on the Bank Branch Information page (BANK_BRNCHPNL). |

GL Unit |

Select the general ledger business unit associated with this account. |

|

Account # |

Enter bank account number. If you set up bank account encryption, account numbers are masked when you save the page. For more information about bank account number encryption and the National Automated Clearing House Association (NACHA) data security requirements, see Understanding Bank Account Encryption and Setting Up Bank Account Encryption. |

|

Unmask |

Select to unmask the bank account number and IBAN. |

RFC |

Enter the three-character value that identifies the RFC (regional finance center) to be assigned to the summary payment file. |

(USF) Sender DO (sender disbursing office) |

Enter the U.S. Federal government Intra-Governmental Payment and Collection (IPAC) System's Sender DO Symbol identifier for the agency that is sending the IPAC transaction. This five-character code is assigned by the U.S. Treasury to agencies enrolled in IPAC. |

DFI Qualifier and DFI ID |

Select the DFI qualifier (depository financial institution qualifier) and enter the associated DFI ID to identify the bank using its DFI ID. If you use intermediary routings, this bank represents the final bank into which funds are transferred. The DFI qualifier indicates the format—the number of characters and numerics—that is used in the bank's DFI ID. Each type has a specific number of digits that you can enter: Transit Number: Enter exactly nine numerics, plus check digit calculation. Swift ID: Enter 8 or 11 characters; positions 5 and 6 must be a valid two-character country code. CHIPS ID: Enter three or four numerics for a CHIPS ID (CHIPS Participant ID). CHIPS UID (CHIPS universal identification number): Enter six numerics for a CHIPS UID. Canadian Bank Branch/Institute: No validation. Mutually Defined: No validation. |

|

IBAN (international bank account number) |

Define the account's IBAN (International Bank Account Number) for transmittal with other account information for the bank account. This field and the View IBAN button appear only if the IBAN Enterable field is not selected on the IBAN Formats page. If you set up bank account encryption, IBAN is masked when you save the page. |

IBAN Digit |

Enter the two-numeral check digit code for the country and click View IBAN. If the system successfully validates the check digit, the IBAN for this account appears, and the system stores the IBAN check digit on the BANK_ACCT_DEFN table. |

Other Identification |

Click this link to access the Bank Account Other Identification page (BANKACCT_PNL_OTHID), where you can provide other ID information for the bank account used in ISO and SEPA formats. Other ID information consists of issuer, identification, and either an ISO Code List or a Proprietary Scheme Name under which the identification was issued. You must designate one issuer as the default that will be populated on the ISO and SEPA format. |

Important! For a specified Bank Account, the Bank ID and the Bank Account number must be unique. System returns an error message for duplicate entries. You can override the restriction by changing the message severity to Warning on the Message Catalog page.

See Understanding IBAN.

See IBAN Formats Page.

Valid Account Currencies

Field or Control |

Description |

|---|---|

Rate Type |

Select the exchange rate type that expresses the value of one currency in terms of another. |

Index |

Select the market rate index. |

Currency Code |

Click the Currencies button to access the Valid Currencies page, and designate multiple valid currencies and a single default currency for this external account. |

Account Use

Associate the account either with one or more PeopleSoft Financials applications or with PeopleSoft Global Payroll.

BI: Billing

AP: Payables

AR: Receivables

TR: Treasury

EX: Expenses

GP: Global Payroll

Select the appropriate check boxes to indicate which PeopleSoft Financials applications use this account. This determines which Ledger Account ChartFields you must establish. In addition, select the appropriate check boxes for the type of bank balance accounting used by this account.

The GP option designates an account that is used by Global Payroll for a SEPA credit transfer (SEPA_CT).

Important! If you are setting up bank accounts for bank account transfer functionality, you must select the TR check box. Doing this creates a Cash ChartField for the bank account. The system requires a cash account ChartField active at the bank account level to display the account in the bank account transfer feature.

Field or Control |

Description |

|---|---|

DD/AR Draft Cash Ctrl (direct debit/accounts receivable draft cash control) |

Select to record cash prior to actually receiving the funds in a draft. Available for entry only when you've selected the AR or BI bank check box. Selecting DD/AR Draft Cash Ctrl also generates the SQL object used to control ChartField inheritance for direct debits. |

Drafts Payable |

Available for entry only when you've selected the AP bank check box. |

Cash Clearing |

Available for entry only when you've selected the AR, AP,or TR bank check box. You must select this check box before you can select the Dep in Transit check box. If Cash Clearing check box is selected and Enable Federal Payment check box is not selected on the Installation Options - Payables page, payment posting will not create Cash Distribution Clearing entries for vouchers created with a payment method of ACH or EFT. Instead, it will create Cash Distribution entries. See also Setting Up Application-Specific Installation Options |

Stmt Accounting (statement accounting) |

Available for entry only when you've selected the TR bank check box. Statement accounting makes particular ChartFields available so that you can map where fees and interest go. This is important when you are installing Treasury to support bank reconciliation and Cash Management Bank Statement Accounting functionality, which supports generating accounting lines for fees and interest. |

TRF Charge (bank transfer charge) |

Available for entry only when you've selected the AP bank check box. |

Dep in Transit (deposits in transit) |

Select to associate a Deposit in Transit account with this external bank account; the system adds the DIT-AR row to the Bank Account Types grid. You must first select the Cash Clearing check box to enable this check box. |

Bank Account Ledger Types

This table displays the Bank Account Ledger Types that you must establish, depending on your selections in the Account Use group box. Enter the ChartField values to use for each account type.

Note: ChartFields and bank account ledger types are not applicable if you are setting up bank accounts for Global Payroll to facilitate SEPA credit transfers.

|

BI |

AP |

AR |

TR |

EX |

|

|---|---|---|---|---|---|

|

Required ChartFields |

Cash − AR Deposit-AR DIT-AR |

Cash − AP DIT-AR |

Cash − AR Deposit-AR |

Cash |

Cash − AP |

|

Drafts Payable ChartFields |

NA |

Draft − AP |

NA |

NA |

NA |

|

Cash Clearing ChartFields |

NA |

Control - AP |

NA |

Control |

NA |

|

DD/AR Draft Cash Control |

NA |

NA |

Draft − AR Control − AR Discount - AR |

NA |

NA |

|

Stmt Accounting ChartFields |

NA |

NA |

NA |

Interest Fees |

NA |

|

TRF Charge |

NA |

Bank Charge |

NA |

NA |

NA |

|

Dep in Transit |

NA |

NA |

If selected |

NA |

NA |

Field or Control |

Description |

|---|---|

|

Click to edit ChartField inheritance options for a specified account type. |

Previous in List and Next in List |

Select buttons to access the previous or next external account listed on the External Accounts search page. |

|

Click the Add button to add a new external account to the system. |

Note: You must specify the correct ChartField inheritance option combination to save the account information, depending on the Account Type options selected. Refer to the tables of valid inheritance option combinations listed in the Bank Account ChartField Inheritance section.

Use the Valid Currencies page (BANK_ACCT_CURR_SEC) to enter valid default currencies for an external account.

Navigation:

Click the Currencies icon on the External Accounts page.

Field or Control |

Description |

|---|---|

Currency |

Enter all valid currencies for the external account. Select the Default check box to indicate the default currency of the bank account. The default currency drives certain PeopleSoft financial processes, such as reconciliation and transaction revaluation. Generally, the default currency is the same as the associated General Ledger business unit currency. However, there can be situations where a bank account's specified default currency is different than that of the associated General Ledger Unit currency, depending on the system processing requirements. |

Rate |

Select a currency conversion rate type code. |

Index |

Enter a market index rate from which to derive the defined currency conversion rate. |

Use the ChartField Options page (BNK_CF_OPTIONS_SEC) to specify inheritance rules for ChartFields for an account type.

Navigation:

Click the Edit Inheritance Options icon in the Bank Account Ledger Types grid on the External Accounts page.

Select an inheritance option for each ChartField.

Field or Control |

Description |

|---|---|

Always Inherit |

The system uses ChartFields from the offsetting entry. Entries are either explicitly derived (entered by user) or derived by way of substitution (entered by the system at run time). |

Do Not Inherit |

Appears by default. You specify ChartField values on the External Accounts page. |

Inherit Within Unit |

The system uses ChartFields from the offsetting entry within the same business unit or the system uses the ChartField value specified on the External Accounts page for interunit transactions. |

Use Unit Default |

The business unit value appears by default from values specified on the Business Unit Option page, regardless of the offsetting transaction. |

When you change inheritance from Do Not Inherit to another value, the specified ChartField appears as a read-only field on the External Accounts page. In the previous example, if you set the Department inheritance option to Always Inherit, the field is unavailable for entry on the External Accounts page.

Use the External Accounts - Signatories page (BANK_PNLSIGNATORYS) to define account signatories.

Navigation:

Enter the name of the signatory and the monetary ceiling (the signatory limit) that the signatory can approve.

This page is for informational purposes only. The system does not generate a required activity for the signatory (for example, the signatory's electronic signature on a system-generated check). You can use this for reports or configurations that you want to add.

Use the External Accounts - Contacts page (BANK_PNLCNTCT) to view the names and phone numbers of bank contacts.

Navigation:

Field or Control |

Description |

|---|---|

Contact ID |

Click a contact link to access that person's financial contacts page. |

|

Click the Bank Contact Notes icon to enter notes for the contact on the Bank Contacts Notes page (BRANCH_CNT_DISP_SP). |

Use the External Accounts - Account Information page (BANK_PNL3) to specify additional information for each bank account.

Navigation:

This example illustrates the fields and controls on the External Accounts - Account Information page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Holiday List ID |

Displays the EFT calendar associated with this bank. This field is used by EFT payments for Treasury, Expenses, and Payables. Enter a value only if you intend to use EFT as a payment method. Because this field is at the bank level, you cannot have two accounts for the same bank with different holiday lists. |

Account Information

Field or Control |

Description |

|---|---|

Preferred Language |

Select the preferred default language for the account. |

Charge Bank and Charge Acct (charge account) |

Select the bank and account that charges bank processing fees to this account, if applicable. |

Remitter ID |

Displays the remitter ID that the bank assigned to your account. This information is used by the receiving bank when you submit files by EFT. Depending on your country and bank, you could also define a remitter ID in the Company Identification Number field of the EFT Options page for Payment Methods. For French bank accounts, the Remitter ID field is used to store the French Numéro National d'émetteur (NNE) issued by the Banque de France. This information is required to issue direct debits in France and is used in processing the direct debits EFT layout, ETBDD. |

Payment Information

Only Payables uses the information in the Payment Information group box.

Field or Control |

Description |

|---|---|

Check# Len (check number length) |

Enter the number of digits in your check number during check printing, to a maximum of 10 digits. For example, if a check number has four digits, the system prints only those four digits, justified to the left, padded with leading zeros. For example, if the check number length is 4, then check #27 is 0027. |

Fract Rtg# (fractional routing number) |

Displays the number that the system uses to route checks to the drawee institution if the MICR line is illegible. The bank's routing number is usually printed twice on a check: on the MICR line and in the upper right corner as a fraction, such as 11-35/1210. Note: Both the routing number and the fractional routing number are assigned to the bank. In the U.S., the Rand McNally Corporation publishes these numbers, although they are actually assigned by the Routing Numbers Administrative Board of the American Bankers Association. |

Payment Handling

Only Payables uses the information in the Payment Handling group box.

Field or Control |

Description |

|---|---|

Override |

Select this check box to sort checks with large amounts during payment creation. Enter an amount in the Amount field to define the check amount that triggers an override. The payment handling code dictates the print order for these special checks. For example, if you specify an override limit of 50,000 USD with a handling code of HD, the system prints checks equal to or more than 50,000 USD in the sort sequence specified by the payment handling code. |

You define handling codes on the Payment Handling Codes page. When adding new codes, leave gaps between numbers in the sort sequence so that you can easily add more codes as necessary. This table lists some handling codes that you may want to implement:

|

Handling Code |

Name |

Sort Sequence |

|---|---|---|

|

HD |

High Dollar Payment |

99 |

|

IN |

Internal Distribution |

10 |

|

PO |

Route to Purchasing |

50 |

|

RE |

Regular Payments |

1 |

PayCycle Amount Limits

This functionality is integrated with the Payables bank replacement functionality.

The system is not enabled for amount splitting. If a voucher amount exceeds the maximum amount per pay cycle or the maximum amount per payment, the entire voucher amount is derived from another account. For example, you establish that Bank Account 001 has a 50,000 USD maximum and Bank Account 002 has a 25,000 USD maximum. A 10-voucher group to be paid totals 51,000 USD. The first nine vouchers total 47,000 USD and are paid from Bank Account 001. The number 10 voucher totaling 4,000 USD is paid from Bank Account 002.

Note: You must first define valid currency codes for the account before you can define Paycycle Currency Code and Payment Currency Code values.

Field or Control |

Description |

|---|---|

Maximum Amount Per Paycycle |

Enter the maximum amount that may be paid from a bank account per pay cycle run, and specify a pay cycle currency code. If the pay cycle amount exceeds the maximum limit set here, the system switches to the specified replacement bank accounts to pay the remainder. For example, the total pay cycle is 2,000,000 USD. You specify that:

|

Maximum Amount Per Payment |

Enter the maximum amount that may be paid for an individual amount out of a bank account. If the limit is exceeded, the payment program selects another bank. |

Receipt Information

Only Receivables uses the information in the Receipt Information group box.

Field or Control |

Description |

|---|---|

Deposit Type |

Select the type of deposits that this account receives, and also indicate the associated Deposit Unit. This information tells you the nature of the deposit and varies according to record keeping practices. Deposit types might categorize regions in which you do business or might separate deposits by source of income. You must establish deposit types on the Deposit Type page before you can select one in this field. |

Payment Predictor |

Select to enable the Payment Predictor process (AR_PREDICT) to process the deposits and payments that this account receives. If you select Payment Predictor for a bank account, the system sets the Payment Predictor process as the default method to apply all payments received from that bank account. You can disable the Payment Predictor process for individual payments during deposit and payment entry. |

Discount Evaluation Options

Payables uses the Discount Evaluation Rate feature. Processes (during pay cycle selection) on a federal invoice amount calculate money saved by taking an "early pay" supplier discount, versus money earned by interest accrued on the invoice amount to the full due date. You can specify the interest rate per account of a single bank. To enable interest accrual calculation, specify the interest rate and related information.

Field or Control |

Description |

|---|---|

Interest Rate |

Enter a percentage as a decimal. |

Days in Year |

Displays the number of days that the system uses to compute the annual effective discount rate specified by the supplier. The default value is 360. |

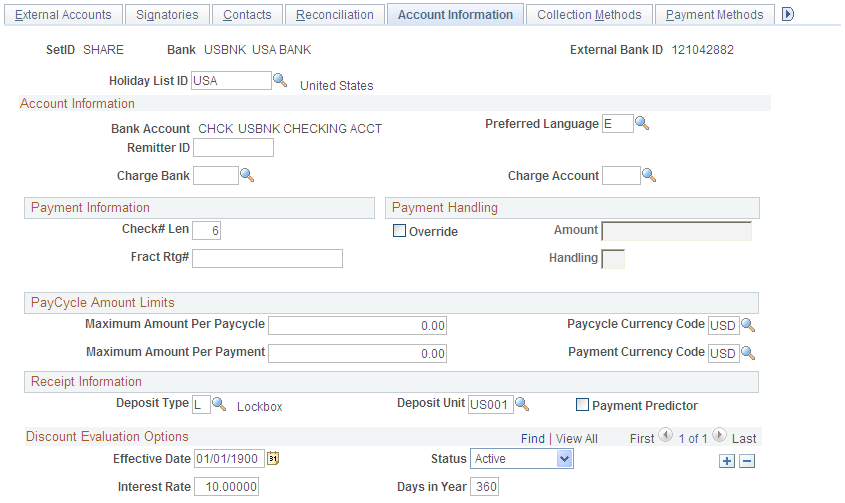

Use the External Accounts - Collection Methods page (COLLECT_BANK) to associate different payment methods and collection options (for your receipts) with multiple bank accounts that you established with a particular bank.

Navigation:

This example illustrates the fields and controls on the External Accounts - Collection Methods page. You can find definitions for the fields and controls later on this page.

Payment Information

Field or Control |

Description |

|---|---|

Payment Method |

Select the form of receipts reserved for a particular account. Options are:

If you select Direct Debit as the payment method, a Prenote Required check box appears. If you select this check box, the Create Direct Debit process in PeopleSoft Receivables creates a prenote that is sent to a customer's bank to confirm that the customer's account information is correct. The bank either confirms that the information is correct, or the prenote is automatically confirmed by the system after a specified number of days has elapsed. If you select the Direct Debit payment method, the Electronic Layouts grid appears, where you can select an EFT (electronic file transmission) Layout to use for the direct debit transactions. If you select the Prenote Required check box and select an EFT Layout code, the system verifies that the EFT Layout is valid for use with direct debits with prenotes. If you select the Draft payment method, and the bank account is assigned to a business unit that uses the document sequencing feature, you must set up document sequencing for draft processing. Click the Document Type link to specify the document types for each draft event. |

Direct Debit Lead Time Days |

Enter the days needed to process a direct debit payment. This field is used by PeopleSoft eBill Payments and PeopleSoft Receivables to determine the payment date. Payment Date is the day of the funds transfer. Payment Date is usually defaulted to item due date, however, if the due date subtracted from the direct debit lead time days is less than the current date, then the item should have already been selected for processing. In this case, the payment date is the current date plus the direct debit lead time days. |

See Understanding the Set Up and Processing of Direct Debits with Prenotes.

Collection Options

The fields that are available vary based on the payment method that you select on this page.

Field or Control |

Description |

|---|---|

Currency, Min Remit Amt (minimum remittance amount), and Draft Risk Days |

If you select Draft as the payment method, complete these fields. The system populates the Currency field with the default currency for the bank account. The system uses this currency for the credit limit amount for discounted drafts and for the minimum remittance amount. You can change the currency, if necessary. The Min Remit Amt field displays the minimum that the bank permits you to remit for discounted drafts. This value appears on the Draft Remittance worksheet. The Draft Risk Days field displays the number of days after the draft due date that the bank waits to notify you that a customer failed to pay for a draft. The system uses this information to trigger due-date processing for a discounted draft. For example, if a draft is due on January 6, and the number of risk days is 3, the Receivables Update process generates the accounting entries for due-date processing on January 9. |

Notice |

Enter a notice period for direct debits. In various countries, the notice period is sometimes mandated by law. It may be contractually established by you with your customer, or it may be a courtesy that you extend as a reminder that you will be transferring funds from your customer's bank account in a specified number of days. |

Clearing Method |

Select a clearing method for this particular account, if you are using cash-control accounting. The timing of the cash-control entry (debiting cash and crediting the cash clearing or control account) depends on your selection. Options are: Bank Recon (bank reconciliation): You recognize the cash as received (that is, cash is debited) when the payment is reconciled on the bank statement. European countries frequently use this method. Due Date: You recognize (debit) cash as received when payment is made. Most companies in the U.S. use the cash-control method. None: You have not implemented cash-control accounting or you want cash to update when you remit the direct debit to the bank. |

Discounted Draft Credit Limit

These fields are available only if you selected the Draft payment method.

Field or Control |

Description |

|---|---|

Credit Limit |

Enter the maximum amount that you have available with the bank account for discounted drafts. When you remit a draft, you see whether the customer has exceeded the credit limit on the Available Credit page. |

Date |

Displays the date on which the bank account agreed to the credit limit. |

Review |

Displays the date on which the bank plans to review the credit limit. |

Value Date

A value date is a virtual date for a banking operation, generally not the real date for the operation. The practice of value date consists of recording a banking operation:

One or several days (two to five) before the operation date for a debit.

One or several days (two to five) after the operation date for a credit.

Field or Control |

Description |

|---|---|

Value Date |

Select to enable value dating for the bank account. |

Value Date Days |

Enter a value date (expressed as a positive or negative number) for the selected payment method. |

Payment Cutoff Time |

Enter the cutoff time, using AM or PM, or use the timestamp button to enter the current system time. Payments arriving by this time are processed by the bank that day. Payments arriving afterwards are processed on the next business day. |

Holiday Processing Options

Field or Control |

Description |

|---|---|

Holiday Options |

Select the rules for the bank that the system uses to calculate the estimated settlement date for drafts and direct debits. Treasury Management uses this date for cash forecasting. It defines how to change the date when it falls on a bank holiday. You define holidays on the Business Calendar page, and then you assign a calendar to a bank account on the External Accounts - Account Information page. Options are: Not Applicable: Does not change the estimated settlement date. Pay After Holiday: Changes the estimated settlement date to a day after the holiday. Pay Before Holiday: Changes the estimated settlement date to a day before the holiday. |

Days |

Enter the number of days that you want to move the date to accommodate the holiday. |

Allow due date in next month |

If you select the Pay After Holiday option, select Allow due date in next month to allow the new estimated settlement date to be in the next month. If you do not select this option, the system adjusts the date to the last business day prior to the original date. |

Electronic Layouts

This grid is available only if the payment method is Direct Debit or Draft. If draft is the specified payment method, then you can specify only one layout.

Field or Control |

Description |

|---|---|

Default Flag |

Select to make this layout the default layout for the specified payment method. |

Send to Financial Gateway |

Select to send the settlement through Cash Management's Financial Gateway. Only direct debits can be settled through Financial Gateway. If left unchecked, Pay Cycle Manager is used as the settlement method. Note: Financial Gateway is a component of Cash Management. Therefore, you must have Cash Management installed on your system to make settlements using Financial Gateway. |

EFT Layout Code (electronic file transfer layout) |

Select an EFT file format. Note: If you selected Direct Debit and the Required Prenote check box as the payment method, the system verifies that the EFT file format that you select here is valid for direct debit transactions with prenotes. See Understanding the Set Up and Processing of Direct Debits with Prenotes. |

Last File Number |

Displays a sequence number used to uniquely identify payment files generated by the Receivables Collection Methods process, when using EDI file layouts only. The system uses the last file number as part of the file name of the newly created payment file. It also automatically increases the last number by one to create the next file with a different file name. This prevents overwriting any other files. |

Layout Options |

Click to access the EFT Layout Codes and Details page. This icon is enabled only for layouts being settled through Pay Cycle Manager. |

Define Layout Properties |

Access a secondary page used for entering layout properties that are required by a particular bank. This field is available only if the settlement is processed through Cash Management's Financial Gateway. |

Bank Integration Layouts |

Access the Bank Integration Layouts page if the settlement is processed through Financial Gateway. |

Use the Draft Document Types page (BANK_COLCT_SEC) to specify a document type for document sequencing for each draft event.

The Receivable Update process (AR_UPDATE) uses this to create document sequence numbers.

Navigation:

Click the Document Type link on the External Accounts - Collection Methods page.

Note: The Document Type link appears only if Draft is selected in the Payment Method field.

Field or Control |

Description |

|---|---|

Event |

Displays the type of draft activity in the draft life cycle, such as draft remitted or draft created. |

Action |

Select the posting action for the draft. Options are: A (actual): Specify the document type for the actual draft business event. D (dishonor): Specify the document type to use when you dishonor the draft after the business event. |

Document Type |

Displays the document type that the Receivables Update process uses to create the document sequence numbers. |

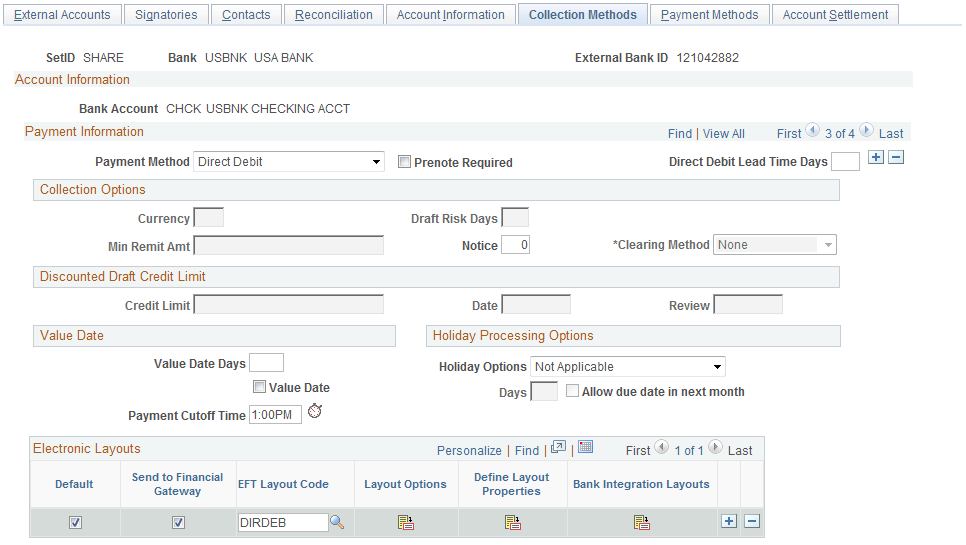

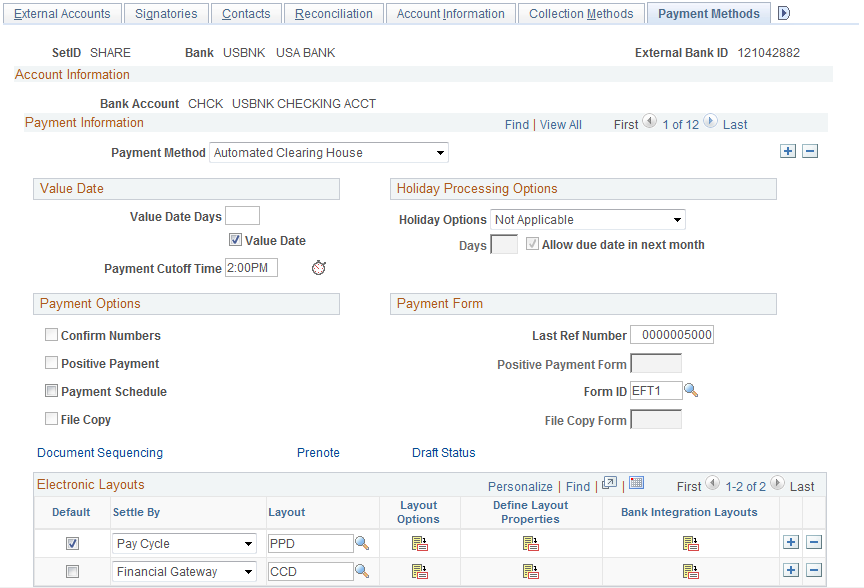

Use the External Accounts - Payment Methods page (PYMNT_BANK) to define the payment methods supported for an account, payment processing options, and EFT file attributes.

For each account, you can enter multiple payment methods.

Navigation:

This example illustrates the fields and controls on the External Accounts - Payment Methods page. You can find definitions for the fields and controls later on this page.

Payment Method

Select a payment method, which determines the additional attributes that you specify on the page. Also, the links available on this page change depending on the selection.

For most of the payment methods, you must specify a form ID and last reference number in the Payment Form group box. Values are:

Automated Clearing House

Direct Debit

Draft-Customer EFT

Draft-Customer Initiated: (Bill of Order) You must also specify a form ID and last reference number.

Draft-Supplier Initiated: (Bill of Exchange)

Electronic Funds Transfer

Giro - EFT (giro - electronic funds transfer

Giro - Manual

Letter of Credit

Manual Check

System Check

Wire Transfer

Important! If you are establishing a payment method of ACH, EFT, or IAT (International ACH Transactions) for U.S. Federal payment formats for an employee, or a supplier, or both an employee and supplier, you must select specific ACH, EFT, or IAT layouts, depending on the specified payment method.

|

Format |

Layout Name |

|---|---|

|

CTX (Corporate Trade Exchange) flat file payment order |

CTX |

|

CTX ASC X12 820 payment order |

CTX820FED |

|

SPS vendor check payment |

SPSCHK |

|

SPS vendor ACH payment (CCD+) |

SPSVNDR |

|

SPS vendor ACH payment (CCD+) - Same Day |

SPSVNDRSDA |

|

Bulk vendor ACH payment (CCD+) — Same Day |

PAMVNDRSDA |

|

SPS travel ACH payment (PPD+) |

SPSTRVL |

|

SPS travel ACH payment (PPD+) - Same Day |

SPSTRVLSDA |

|

Bulk travel ACH payment (PPD+) — Same Day |

PAMTRVLSDA |

|

SPS Miscellaneous payment |

SPSMISC |

|

SPS Miscellaneous payment - Same Day |

SPSMISCSDA |

|

Bulk Miscellaneous ACH payment — Same Day |

PAMMISCSDA |

|

SPS IAT Travel |

SPSIATTRVL |

|

SPS IAT Vendor |

SPSIATVNDR |

|

SPS IAT Miscallaneous |

SPSIATMISC |

|

SPS Same day payment request |

SPSSDPR |

|

IPAC (Intra-Governmental Payment and Collections) |

IPAC |

|

Bulk vendor check payment |

PAMCHK |

|

Bulk Misc IAT ACH Payment |

PAMIATMISC |

|

Bulk Travel IAT ACH Payment |

PAMIATTRVL |

|

Bulk Vendor IAT ACH Payment |

PAMIATVNDR |

|

Bulk Misc ACH Payment |

PAMMISC |

|

Bulk Travel ACH Payment |

PAMTRVL |

|

Bulk Vendor ACH Payment |

PAMVNDR |

|

Federal PAMCTX |

PAMCTX |

Refer to the following section for a discussion of delivered federal ACH, EFT, and IAT layouts and their uses.

Note: When defining multiple payment methods for one bank account, you cannot define multiple Electronic Funds Transfer payment methods with different EFT layouts.

Note: The ETEBAC and ITAPYMT EFT layouts must be associated with the Electronic Funds Transfer payment method, not the Giro - EFT method.

Value Date

A value date is a virtual date for a banking operation, generally not the real date for the operation. The practice of value date consists of recording a banking operation:

One or several days (two to five) before the operation date for a debit.

One or several days (two to five) after the operation date for a credit.

Field or Control |

Description |

|---|---|

Value Date |

Select to enable value dating for the bank account. |

Value Date Days |

Enter a value date (expressed as a positive or negative number) for the selected payment method. |

Payment Cutoff Time |

Enter the cutoff time, using AM or PM, or use the timestamp button to enter the current system time. |

Holiday Processing Options

Field or Control |

Description |

|---|---|

Holiday Options |

Select the rules for the bank that the system uses to calculate the estimated settlement date for drafts and direct debits. Treasury uses this date for cash forecasting. It defines how to change the date when it falls on a bank holiday. You define holidays on the Business Calendar page, and then you assign a calendar to a bank account on the External Accounts - Account Information page. Options are: Not Applicable: Does not change the estimated settlement date. Pay After Holiday: Changes the estimated settlement date to a day after the holiday. If you select this option, select Allow due date in next month to allow the new estimated settlement date to be in the next month. If you do not select this option, the system adjusts the date to the last business day prior to the original date. Pay Before Holiday: Changes the estimated settlement date to a day before the holiday. |

Days |

Enter the number of days that you want the date moved to accommodate the holiday. |

Payment Options

Select check boxes in the Payment Options group box, if you selected Manual Check or System Check as the payment method.

Field or Control |

Description |

|---|---|

Confirm Numbers |

Select to activate the Confirm Payment Reference capability in the Pay Cycle Manager. This feature enables you to use prenumbered payment forms and to ensure that the check numbers and the system payment reference numbers agree. If they do not agree, you can renumber the system references to accurately mirror the printed forms. |

Payment Schedule |

For reconciliation of Federal Schedule ID payments, select this check box to generate the correct federal payment schedules for submission to the U.S. Treasury for payment. |

Positive Payment |

Select to enable the system to create a payment file for every pay cycle using this bank account. The system formats the file to the specifications of the positive payment form that you select. This file format is defined in the APY2055 Application Engine. The system provides a default positive pay report called POS1. The Application Engine generates a positive payment form depending on whether a form is associated with the bank. Modifications to the form can be introduced to modifications of the Application Engine. The positive payment file provided is a text (.txt) document with no spacing between lines. If you select this check box, you also must specify a value in the Positive Payment Form field in the Payment Form group box. |

File Copy |

Select to enable the Pay Cycle Manager to generate a duplicate set of checks for your files. Like Checks, this method uses a report form that must match the form ID. For instance, you can specify report Copy 1 as a file copy form. If you select this check box, you also must specify a value in the File Copy Form field in the Payment Form group box. |

Document Sequencing |

This link is available if this bank belongs to a GL business unit that is set up for document sequencing. Click to access the Document Sequence page to assign the default document types for each payment method. |

Prenote |

Click to access the Prenotification page, and indicate that the system must generate Federal Schedule ID prenotification files. |

Draft Status |

Click to access the Bank Account Draft ChartFields page and define Draft ChartFields. |

Payment Form

Field or Control |

Description |

|---|---|

Last Ref Number (last reference number) |

Select the check reference that Payables uses when printing payments. The system increments this number for each payment that it makes on the specified bank account. The system also increments this number when you record a manual payment for this account. |

Form ID |

Enter a form ID, which defines the payment layouts for your ACH, system check, wire transfer, customer draft, and EFT files. Payables has predefined forms: CHECK1 - 3, EFT1 and EFT2, and WIRE1. You specify which payment forms to use for a bank account. If you do not set up a specific form before you define your banks, you can use one of the defaults and adapt it later. Note: Do not enter a form ID for manual checks or supplier drafts. |

Positive Payment Form |

Enter a pay form if the Positive Payment check box is selected. |

File Copy Form |

Enter a form is the File Copy check box is selected. |

Electronic Layouts

This table lists the payment methods that can be used for making settlements using Pay Cycle Manager or Financial Gateway. The Electronic Layouts grid appears only for the payment methods listed in the table:

|

Payment Method |

Settle Through Method |

|---|---|

|

Automated Clearing House |

Both |

|

Direct Debit |

Financial Gateway only |

|

Electronic Funds Transfer |

Both |

|

Giro - EFT |

Pay Cycle Manager only |

|

Wire Transfer |

Both |

Note: Financial Gateway is a component of Cash Management. Therefore, you must have Cash Management installed on your system to make settlements using Financial Gateway.

Field or Control |

Description |

|---|---|

Default Flag |

Select to make this layout the default layout for the specified payment method. |

Layout |

Select an EFT file layout. This field is unavailable if Wire Transfer is the selected payment method. |

Layout Options |

Click to access the EFT Layout Codes and Details page. This icon is enabled only for layouts settled through Pay Cycle Manager. |

Define Layout Properties |

Accesses a secondary page used for entering layout properties that are required by a particular bank. Only available if the settlement is processed through Financial Gateway. |

Bank Integration Formats |

Accesses the Bank Integration Formats page if the settlement is processed through Financial Gateway. |

Note: Add the desired layout in order to create a voucher for which PAM EFT layout codes are used.

Use the Document Sequence page (PYMNT_BANK_DOC_SEC) to set up tracking of individual documents.

Navigation:

Click the Document Sequencing link on the External Accounts - Payment Methods page.

Field or Control |

Description |

|---|---|

Document Type |

Displays the document type that the system uses to assign document sequence numbers. |

Manual Document Type |

Displays the default document type on pages where you specify the document sequence number manually. |

Use the Bank Account Draft ChartFields page (BANK_ACCT_CFDR_SEC) to enter details about the draft account ChartFields.

Navigation:

Click the Draft Status link on the External Accounts - Payment Methods page.

Field or Control |

Description |

|---|---|

Accounting Template |

To create balanced accounting entries, select one of the templates that you defined on the Accounting Entry Template page. |

Enter the appropriate ChartField values.

Use the EFT Layout Codes and Details page (PYMNT_BANK_LYT) to review and update layout options.

Navigation:

Click the Layout Options icon in the Electronic Layouts grid on the External Accounts - Payment Methods page.

Field or Control |

Description |

|---|---|

Originating DFI ID (originating depository financial institution ID) |

(Optional) Displays the DFI ID of the bank issuing the specified payment method. |

Use the Prenotification page (BANK_PRENOTE) to indicate whether prenotification files (used in Federal Schedule Reconciliation) must be generated.

Navigation:

Click the Prenote link on the External Accounts - Payment Methods page.

Select the Prenotification Required check box. This generates the correct prenotification files used in Federal Schedule ID reconciliation.

Use the Define Layout Properties page (PMT_BANK_MTHD_PROP) to review and edit values defined for a specific electronic format.

Navigation:

Click the Define Layout Properties icon in the Electronic Layouts grid on the External Accounts - Payment Methods page.

Note: Contact your system administrator before editing any fields on this page. The system displays layout values defined on the Layout Catalog and Layouts pages that normally do not need to be changed.

Use the Account Settlement page (BANK_PNLSETTLE) to associate settlement instructions with a bank account.

Navigation:

Field or Control |

Description |

|---|---|

Instructions |

Select the settlement instructions to use for this account, if you selected the TR check box in the Account Use group box on the External Accounts page. |