Defining General Bank Setup

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CREDIT_RTG_TBL |

Define rating agencies and their associated credit ratings. |

|

|

BNK_ID_QUAL_PNL |

View the ID qualifiers that the system uses to edit bank values. |

|

|

IBAN_FORMAT_TBL |

View IBAN formats and generate sample IBANs. |

|

|

PYMNT_FORM |

Enter attributes related to your forms of payment. |

|

|

PYMNT_FORM_SORT |

Select the grouping of fields used to sort your forms of payment. |

To define rating agencies and credit ratings, use the Credit Ratings/Rating Agency component (CREDIT_RTG_TBL_GBL).

To define bank identification qualifiers, use the Bank ID Qualifiers component (BANK_ID_QUALS_GBL).

To define payment forms, use the Payment Forms component (PYMNT_FORM_PYMNT_GBL).

To define IBAN formats, use the IBAN Formats component (IBAN_FORMAT_GBL).

Before you begin to define your banks, you must define the supporting data.

Use these components to establish the following:

Credit ratings.

Bank ID qualifiers.

IBAN formats.

Payment forms.

Payment sort fields.

Use the Credit Ratings/Rating Agency page (CREDIT_RTG_TBL) to define rating agencies and their associated credit ratings.

Navigation:

This example illustrates the fields and controls on the Credit Ratings/Rating Agency page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Value |

Displays the value by which to rank the ratings in ascending order. 1 is the highest rating. This value assigns a numeric equivalent to an alphanumeric rating so that you can implement any processes or credit reports needed for your organization. |

Rating |

Displays the actual alphanumeric rating that the rating agency assigns. |

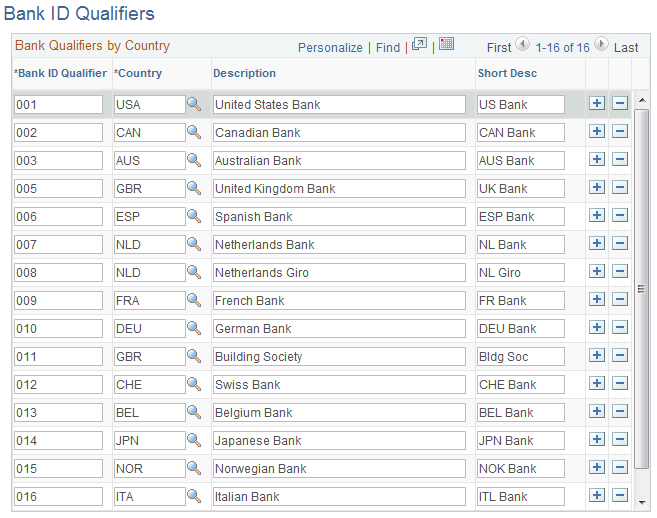

Use the Bank ID Qualifiers page (BNK_ID_QUAL_PNL) to view the ID qualifiers that the system uses to edit bank values.

Navigation:

This example illustrates the fields and controls on the Bank ID Qualifiers page. You can find definitions for the fields and controls later on this page.

Oracle’s PeopleSoft delivers predefined bank ID qualifiers, which you should typically not modify.

Field or Control |

Description |

|---|---|

Bank ID Qualifier |

Displays the country-specific numeric value for a bank. This value controls how the bank and counterparty pages edit and display bank information. This information drives bank account edits, which can vary by country for each bank type. In some cases, a country may have more than one ID. Each bank ID qualifier indicates a specific type of bank with specific identifying information. For example, when the system encounters a bank ID qualifier of 001 (indicating a U.S. bank), the system validates that you entered a valid check digit for an ABA transit routing number for the bank qualifier. Note: If you add a new bank ID qualifier, you must write PeopleCode to match the new value. This code appears in the record PeopleCode for FUNCLIB_LCINTFC.BANK_ID_QUAL in the FieldFormula event. Oracle suggests that you make this page a display-only page or use PeopleTools security to limit access to system administrators only. |

This table describes the system-delivered data.

Note: Qualifiers marked with (no field validation) have no rule validation. If you want the system to automatically perform rule validation routines, you must write the appropriate PeopleCode. For more information, refer to the European Committee for Banking Standards website at http://www.ecbs.org. You can access various countries' bank account numbering conventions and specifications at http://www.ecbs.org/tr201country.htm.

|

Bank ID Qualifier |

Bank ID (Defining Banks) |

Bank Account Number (Bank Accounts) |

Branch |

Check Digit |

|---|---|---|---|---|

|

001 U.S. Bank |

9-digit transit routing number. Exactly 9 numerics with check digit calculation. |

NA |

NA |

NA |

|

002 Canadian Bank |

Exactly 4 numerics. |

Between 7 and 12 numerics. |

Branch routing number Exactly 5 numerics. |

NA |

|

003 Australian Bank |

Exactly 3 numerics. |

Max 9 numerics. |

Exactly 3 numerics. |

NA |

|

005 Great Britain Bank |

Exactly 6 numerics. (Sort Code) |

Max 10 numerics. |

NA |

NA |

|

006 Spanish Bank |

Exactly 4 numerics. |

Exactly 10 numerics. |

Exactly 4 numerics. |

Exactly 2 digits with check digit algorithm. |

|

007 Netherlands Bank |

NA* |

Exactly 10 numerics with modulus 11 check. |

NA |

NA |

|

008 Netherlands Giro |

NA* |

Max 7 numerics. |

NA |

NA |

|

009 French bank |

Exactly 5 numerics. |

Max 11 characters. |

Exactly 5 numerics. |

Check digit algorithm. |

|

010 German Bank |

Exactly 8 numerics. |

Max 10 numerics. |

NA |

NA |

|

011 Great Britain Building Society |

Exactly 6 numerics. (Sort Code) |

Max 10 numerics. |

NA |

NA |

|

012 Swiss Bank |

Between 3 and 5 digits. |

Max 16 characters. |

NA |

NA |

|

013 Belgian Bank |

Exactly 3 numerics. |

Max 7 numerics. |

NA |

2 numerics with 97 modulus check. |

|

014 Japan Bank |

Exactly 4 numerics. |

Max 7 numerics. |

Exactly 3 numerics. |

NA |

|

015 Norwegian Bank (no field validation) |

NA |

NA |

NA |

NA |

|

016 Italian Bank |

Exactly 5 numerics. |

Max 12 alphanumerics. |

Exactly 5 numerics. |

1 alpha with check digit algorithm. |

|

020 Swiss PPT(no field validation) |

NA |

NA |

NA |

NA |

See the product documentation for PeopleTools: Security Administration.

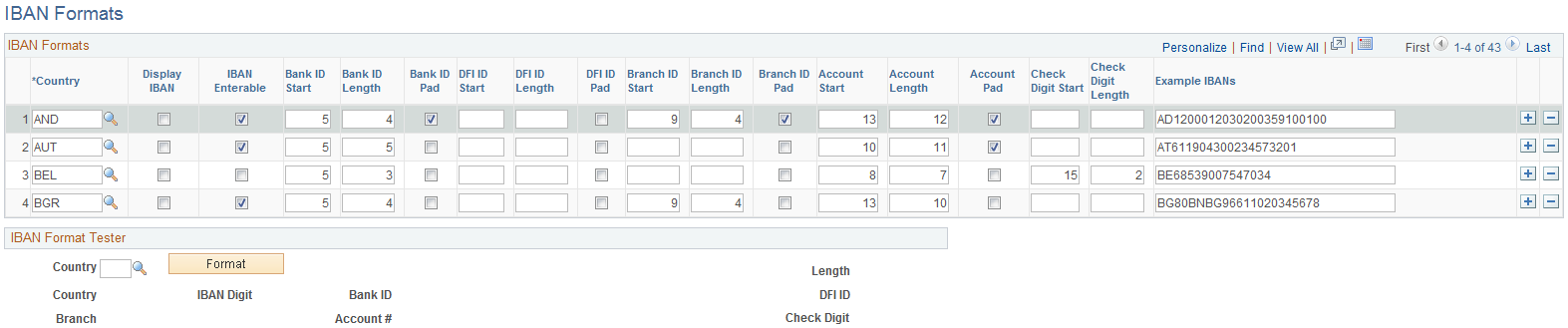

Use the IBAN Formats page (IBAN_FORMAT_TBL) to view IBAN formats and generate sample IBANs.

Navigation:

This example illustrates the fields and controls on the IBAN Formats page. You can find definitions for the fields and controls later on this page.

This page displays the formatted components of the International Bank Account Number (IBAN) based on the three-character, European country code selected in the first column. The IBAN is composed of a country code, IBAN check digits, and the Basic Bank Account Number (BBAN)—all the information needed to route a payment through any national clearing house. PeopleSoft supports and provides sample data for 38 countries.

Note: Because the two-character, country code and IBAN check digits are always the first four characters of an IBAN, it is not necessary to include columns defining their position and length on this page.

Field or Control |

Description |

|---|---|

Country |

Select the three-letter country code for a specific European country. |

Display IBAN |

Select to enable IBAN functionality for a specific country to show the IBAN in addition to the bank account number on pages and reports. The Display IBAN check box is deselected by default. If deselected, local bank account numbers will be displayed on pages and reports related to the country. |

IBAN Enterable |

This box determines how the IBAN is entered on various PeopleSoft Financials application pages. If Selected, the user enters the IBAN manually. If left unchecked, the user enters a two-character, IBAN, check digit and clicks a View IBAN button to have the system generate it. Note: Previous to Release 9 of PeopleSoft Financials, IBAN was supported only for Belgium, France, Germany, Ireland, Italy, Netherlands, Spain, Switzerland, and the United Kingdom, and only by using the check-digit entry method. For those nine countries, the default setting for the IBAN Enterable field is unchecked. Any of these countries can be configured to support entering the IBAN manually by selecting this box. |

Bank ID Pad, DFI ID Pad, Branch ID Pad, and Account Pad |

If selected, leading zeroes will be prefixed to the ID value to extend it to its maximum length. |

Bank ID Start |

Enter where the first alphanumeric character of the bank identification value will appear in the IBAN. |

Bank ID Length |

Enter the number of characters making up the bank identification value. |

DFI Start |

Enter where the first alphanumeric character of the DFI code will appear in the IBAN. The DFI is a bank identifier that may be included in the IBAN ID when the DFI Qualifier is set to SWIFT on bank-account related pages (for example, the Beneficiary Bank page). |

DFI Length |

Enter the number of characters making up the DFI code. |

Branch ID Start |

Enter where the first alphanumeric character of the branch ID code will appear in the IBAN. |

Branch ID Length |

Enter the number of characters making up the branch ID code. |

Account Start |

Enter where the first alphanumeric character of the bank account will appear in the IBAN. |

Account Length |

Enter the number of characters making up the bank account. |

Check Digit Start |

Enter where the first alphanumeric character of the bank check digit will appear in the IBAN. Note: This is the check digit used in the formal validation of the domestic bank account, not the IBAN check digit. |

Check Digit Length |

Enter the number of characters making up the bank check digit. |

IBAN Format Tester

Select a country code and click Format to generate a sample IBAN for any of the PeopleSoft-supported countries.

Note: Oracle is not responsible for the validity of IBANs manually keyed in any of the bank-account related pages. The IBAN should be provided by a financial institution.

See EFT Request - Destination Page.

Use the Form Information page (PYMNT_FORM) to enter attributes related to your forms of payment.

Navigation:

For the form ID that you select, the system displays a payment form image in the Preview group box.

Form Attributes

Field or Control |

Description |

|---|---|

Form Type |

Indicates whether the payment prints on check stock or is an electronic file. Select one of these options: System numbered form: The system generates check numbers to print on the payment forms. Pre-numbered form: The check stock has preprinted check numbers. The system does not generate check numbers, but keeps track of the payment references and can warn you of any discontinuity in reference numbers. ASCII file: EFT or positive payment files. Remittance Advice only: Wire transfers (through Pay Cycle Manager) and letters of credit. |

Form Alignment Count |

Aligns the printer head with the first row of the form so that checks and advice print correctly. You use this field only with system-numbered forms. |

Advice Attributes

Field or Control |

Description |

|---|---|

Advice Location |

Select where the payment advice prints. Options are: Same report as check: Below or above the check on the same form. Separate advice report: Separate job from the check. You must load two different forms: one for the checks and one for the advice. No advice: No advice lines. |

Overflow Location |

Select where information prints, if it does not fit on one page. Options are: Same report as check: If more advice lines are required than the number of lines on the check form, the system uses a second check form for advice lines and voids the check. Separate advice report: The system uses a separate advice form for overflow. You must load two different forms: one for the checks and one for the advice. The system creates two separate reports. No advice report: No advice lines. |

Advice Lines |

Displays the total number of lines that print on your advice. Enter the number of lines available for the advice. This differs depending on whether the advice is on the same report as the check or on a separate report. The information that you assign must fit on the check space. |

Advice Layout |

Displays where the check and advice are positioned on the printed page. The report determines the layout, so this field is only informational. Match the description to how you define the report. Options are: Check over stub: Positions the check over the advice. Full page: Sends the advice lines to a separate page from the check and a separate file. Giro layout: Sends the advice lines in a Giro-EFT file. Stub over check: Positions the advice over the check. |

Use the Sort Fields page (PYMNT_FORM_SORT) to select the grouping of fields used to sort your forms of payment.

Navigation:

This example illustrates the fields and controls on the Sort Fields page.

Select the fields that you want to use to sort your check output. Enter sequence numbers for sorting priority.