Defining Settlement Instructions

This topic discusses how to define beneficiary bank accounts and EFT options for settlements.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

STL_INSTRUCTION |

Create settlement instructions for use by Treasury Management. Associate the instructions with appropriate accounts or counterparties. |

|

|

STL_ADDRESS |

Capture bank address information on your settlement instructions. |

|

|

TR_EFT_OPT_SEC |

Define specifics for EFT transmissions when using these settlement instructions. |

|

|

Identification Information Page |

TR_OTHID_SP |

Provide other identification for Name1, Bank, and/or Bank Account values, respectively. Available only for a Partner Instructions/Pay Into settlement type. See the Beneficiary Bank Page for more information. |

Use the Beneficiary Bank page (STL_INSTRUCTION) to create settlement instructions for use by Treasury Management.

Associate the instructions with appropriate accounts or counterparties.

Navigation:

This example illustrates the fields and controls on the Beneficiary Bank page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Our Instructions/Receive Into |

Select if these instructions dictate receipt of funds from a counterparty. Generally, information entered here matches external bank account information already defined in the PeopleSoft system (on the External Accounts page). |

Partner Instructions/Pay Into |

Select if these instructions dictate payment of funds to a counterparty. Generally, information entered here enables electronic payment to an account not defined in the PeopleSoft system. |

|

Click the Identification icon next to the Name1, Bank, or Bank Account fields to access the Identification Information page (TR_OTHID_SP), where you can where you can provide other identification for Name1, Bank, and/or Bank Account values, respectively. This icon appears only on Beneficiary Bank pages for a Partner Instructions/Pay Into settlement type. |

|

Account # |

Enter bank account number. If you set up bank account encryption, account numbers are masked when you save the page. For more information about bank account number encryption and the National Automated Clearing House Association (NACHA) data security requirements, see Understanding Bank Account Encryption and Setting Up Bank Account Encryption. |

|

Unmask |

Select to unmask the bank account number and IBAN. |

Account Information

Complete the fields to identify the bank that receives funds when using these settlement instructions:

If the Partner Instructions/Pay Into radio button is selected, the bank account that you describe here is the counterparty's bank account into which you're transferring funds.

Because bank accounts are defined by currency, you must insert additional rows for each currency used for fund settlement.

If the Our Instructions/Receive Into radio button is selected, the bank account that you describe here is your bank account for receiving funds in the referenced currency.

Field or Control |

Description |

|---|---|

Currency |

Select the currency. Oracle recommends that you set up settlement instructions for each currency defined for the bank account. |

Name 1 and Name 2 |

Enter the beneficiary names, if required. |

Bank ID Qualifier |

Select an ID to enable the bank information to be edited online. For certain bank ID qualifiers, you must specify a check digit. |

IBAN Digit |

Enter the check digit and click View IBAN. If the system validates the check digit, the IBAN (international bank account number) for this account appears next to the View IBAN button, and the system stores it on a record. This field and the View IBAN button appear only if the IBAN Enterable field is not selected on the IBAN Formats page. For the specified settlement instructions, define the account's IBAN for transmittal with other settlement information. |

IBAN |

Enter the IBAN (international bank account number). This field appears only if the IBAN Enterable field is selected on the IBAN Formats page. |

DFI Qualifier and DFI ID |

Select the DFI qualifier (depository financial institution qualifier) and enter the associated DFI ID to identify the bank using its DFI ID. If you use intermediary routings, this bank represents the final bank into which funds are transferred. The DFI qualifier indicates the format—the number of characters and numerics—that is used in the bank's DFI ID. Each type has a specific number of digits that you can enter: Transit Number: Enter exactly nine numerics, plus check digit calculation. Swift ID: Enter 8 or 11 characters; positions 5 and 6 must be a valid two-character country code. CHIPS ID: Enter three or four numerics for a CHIPS ID (CHIPS Participant ID). CHIPS UID (CHIPS universal identification number): Enter six numerics for a CHIPS UID. Canadian Bank Branch/Institute: No validation. Mutually Defined: No validation. |

Mandate Details

The Mandate Details options only apply if a SEPA direct debit is being performed for the payment.

Routings

Use the Routings page (TR_INTR_TBL_SEC) to set up the payment routing information for this beneficiary bank.

Navigation:

Click the Routings link on the Beneficiary Bank page.

Remittance Advice Attributes

Use the Remittance Advice Attributes page (PMT_ADVISE_ATTR) to identify remittance advice information related to these settlement instructions.

Navigation:

Click the Remittance Advice Attributes link on the Beneficiary Bank page.

Use the Beneficiary Address page (STL_ADDRESS) to capture bank address information on your settlement instructions.

Navigation:

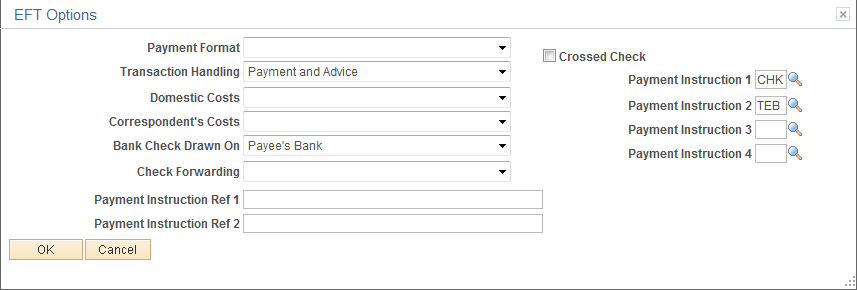

Use the EFT Options page (TR_EFT_OPT_SEC) to define specifics for EFT transmissions when using these settlement instructions.

Navigation:

Click the EFT Options link on the Beneficiary Bank page.

This example illustrates the fields and controls on the EFT Options page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Payment Format |

Select a payment format for this settlement instruction's EFT option. You can create your own payment formats or modify the delivered formats, such as Check Std, Pay & Dep, and Wire. |

Transaction Handling |

Select an option that determines the parts of the payment that are included in the EFT file when you send it to the bank. Options are: (Blank): No information is sent. Pay+Advice: Both the actual payment and the advice are transmitted. Prenote: Test run to verify that all EFT information is correct before sending out an actual payment and advice. Pymnt Only: Only the payment is sent with the EFT file. |

Domestic Costs and Correspondent's Costs |

Depending on the country in which an EFT takes place, there may be costs involved in executing such transactions, especially if there is a transfer between two different countries. The Domestic Costs field designates who pays for the bank costs of the EFT. If there are any other third parties to the transfer, the correspondent's costs are also assessed. When there are domestic costs or correspondent's costs tied to an EFT transaction, select the source from which these costs are paid. Options are:

|

Bank Check Drawn On |

Select where a check comes from, if it is necessary to generate a check for this EFT transaction. Options are: (None), Payee Bank, or Payer Bank. |

Check Forwarding |

Select where the check should go. Options are: (None), Payee Bank, Payee, Payer, or Pyr Bank. |

Crossed Check |

Select if the EFT involves a check that cannot be signed over to a third party. |

Payment Instruction 1, Payment Instruction 2, Payment Instruction 3, and Payment Instruction 4 |

Select additional payment instructions for the employee's EFTs. These fields contain standard EFT instruction codes that are delivered with your system. |

Payment Instruction Ref 1 and Payment Instruction Ref 2 |

Enter any additional comments regarding EFT transactions. |