Defining PeopleSoft Payables Business Units

To set up your PeopleSoft Payables business units, use the Payables Definition component (BUS_UNIT_TBL_AP).

To load data into the tables for the Payables Definition component, use the EM_BUS_UNIT_AP component interface.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

BUS_UNIT_TBL_AP1 |

Create a new business unit, link it with a general ledger business unit, and assign a location code to the unit. Select the accounting template and posting options for the business unit. |

|

|

Business Unit ID Numbers Page |

BU_ID_NBRS_AP_SEC |

Specify ID numbers to associate with the business unit. |

|

OPEN_PERIOD_SINGLE |

Update the open periods for a business unit. |

|

|

BUS_UNIT_TBL_AP2 |

Specify sales and use tax options and VAT options for the business unit. |

|

|

BUS_UNIT_TBL_AP3 |

Specify default options for the Voucher Build Application Engine process (AP_VCHRBLD) for the business unit. |

|

|

BUS_UNIT_TBL_AP4 |

Specify the matching options for the business unit. |

|

|

BUS_UNIT_TBL_AP5 |

Specify payment options for the business unit. |

|

|

BUS_UNIT_TBL_AP6 |

Specify auto-numbering options for the business unit. |

|

|

BUS_UNIT_TBL_AP7 |

Specify summary invoice tolerance controls for the business unit. |

Use the Payables Definition - Definition page (BUS_UNIT_TBL_AP1) to create a new business unit, link it with a general ledger business unit, and assign a location code to the unit.

Select the accounting template and posting options for the business unit.

Navigation:

This example illustrates the fields and controls on the Payables Definition – Definition page.

To create a new PeopleSoft Payables business unit:

On the Add Search page in the Payables Definition component, enter the business unit ID for the PeopleSoft Payables business unit that you want to create, and click Add.

Note: Use business unit IDs that are five characters long to optimize system performance.

Enter a description and short description of the business unit and specify a default SetID.

The SetID can be the value of another existing business unit whose SetID you want to copy for the business unit that you are adding. Alternatively, by entering the ID of the new business unit that you are creating, you can also establish a new empty SetID having the same name as the business unit.

See TableSets.

Note: Most other fields on the page are unavailable and must be completed after you have finished creating the business unit.

Click Create BU to create the PeopleSoft Payables business unit and, if applicable, the new SetID.

The system automatically creates the business unit. If you have completed the general ledger business unit setup, the procurement controls, and other relevant control table data, you can continue to complete the business unit definition.

Use the Business Unit ID Numbers page (BU_ID_NBRS_AP_SEC) to specify ID numbers to associate with the business unit.

Navigation:

Click the ID Numbers link on the Payables Definition - Definition page.

Enter the general ledger business unit information on the Payables Definition - Definition page.

Accounting Information

Field or Control |

Description |

|---|---|

GL Business Unit (general ledger business unit) |

Select the general ledger business unit to which you want to assign the PeopleSoft Payables business unit. Each line of distribution that you enter for a voucher can be charged to this general ledger business unit—the charge to business unit. The charge to business unit automatically appears as the general ledger business unit associated with the PeopleSoft Payables business unit that owns the voucher. You can charge vouchers to general ledger business units other than the default of the vouching business unit for a given distribution line. When the charge to general ledger business unit differs from the general ledger business unit of the vouching business unit, PeopleSoft Payables automatically creates interunit payables and receivables entries to reflect the business transaction. ChartField values on the distribution line that you enter are validated against the ChartField tables valid for the charge to general ledger business unit. For payment accounting, each bank account has a cash and cash clearing account associated with it. These accounts are tied to a particular general ledger business unit. The system enables you to pay vouchers of multiple PeopleSoft Payables business units from one bank account. If you do this, the system creates interunit payables and receivables automatically based on the payment interunit account on the general ledger business unit. |

Accounting Entry Template |

Select the template to associate with the PeopleSoft Payables business unit. The accounting entry template identifies the offset accounts that the system uses to balance payables transactions. It also identifies the accounts that the system uses to allocate nonmerchandise charges. You set it up on the Accounting Entry Template page. Other ChartField values can be inherited from the accounting entry template depending on the ChartField inheritance setup. |

Ship To |

Enter the default ship to location. The ship to location determines how the sales and use tax appear by default on the voucher in a sales and use tax environment, and how the VAT appears by default on the voucher in a VAT environment. You define ship to locations in the Ship To Locations component. You can override this default at lower levels in the PeopleSoft Payables control hierarchy. |

Update Open Periods |

Click to access the Open Periods Update page, where you can specify open and closed periods for this business unit that differ from that of the general ledger business unit. |

Copy PO Option

Field or Control |

Description |

|---|---|

Accounting Template |

If you select this check box then, when you copy purchase orders onto vouchers, the accounting template is copied from the Payables business unit. Deselect this check box to copy the accounting information from the purchase order. |

Payment Terms |

If you select this check box then, when you copy purchase orders onto vouchers, the payment terms are copied from the supplier. Deselect this check box to copy the payment terms information from the purchase order. |

Supplier Location |

If you select this check box then, when you copy purchase orders onto vouchers, the supplier location is copied from the purchase order. Deselect this check box to copy the supplier location information from the supplier default location. |

Note: The default value of these check boxes is deselected.

Posting Option

Field or Control |

Description |

|---|---|

Post Date Indicator |

Select to identify which transactions are eligible for posting. Options are: Post All Transactions: The system posts all transactions eligible for posting. Use Accounting Date: The system selects transactions for posting based on the accounting date option specified on the Payables Options - Payables Options Page. Use Current Date: The system selects transactions for posting based on the date of the transaction. Use Specific Date: The system uses the date that you enter on this page to select transactions for posting. Keep in mind that if you enter a specific date here, all voucher transactions entered for business units using this SetID have the same accounting date. |

Open for Voucher Posting |

Select to post any vouchers or payments in the business unit. |

Post Unapproved Vouchers |

Select to post vouchers regardless of their approval status. If you do not want to post vouchers before they have been approved, you must deselect this check box. |

Post Unmatched Vouchers |

Select to post vouchers regardless of their matching status. If you do not want to post vouchers before they have been successfully matched, you must deselect this check box. |

Miscellaneous

Field or Control |

Description |

|---|---|

Location |

Enter a code to indicate which address defined on the Location Definition page prints on payment forms for the business unit. |

ID Numbers |

Click to access the Business Unit ID Numbers page, where you can associate various ID numbers with the PeopleSoft Payables business unit. You select an identifier type, such as Dun & Bradstreet Number, from a drop-down list in the Standard ID Qualifier field, and enter the ID number for each identifier type that you select. |

Display GLN in Payables |

Select this check box to display the Global Location Number (GLN) fields on invoice entry, accounting entry, voucher, voucher inquiry and quick invoice pages. The display of all the GLN information related fields like Ship to GLN, Remit to GLN and Supplier GLN are enabled if you select the Display GLN in Payables check box. GLN is a globally unique GS1 identification number for legal entities, functional entities and physical locations. GLNs are unique identifier numbers for business locations in the Healthcare Supply Chain. |

Revaluation Posting Option

Field or Control |

Description |

|---|---|

Revalue Option |

Select to specify the level of detail for revaluation entries. Options are: Unit: The system groups entries by business unit. There is only one entry for the business unit. Supplier: The system groups entries by business unit and supplier. There are entries for each business unit and supplier combination. Voucher: There is an entry for each voucher. |

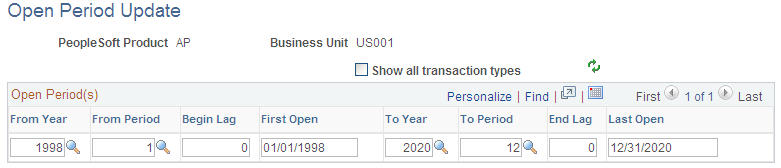

Use the Open Period Update page (OPEN_PERIOD_SINGLE) to update the open periods for a business unit.

Navigation:

Click the Update Open Periods link on the Payables Definition - Definition page.

This example illustrates the fields and controls on the Open Period Update page. You can find definitions for the fields and controls later on this page.

The normal default open period dates for each PeopleSoft Payables business unit are the same as the dates for the general ledger business unit with which it is associated. Use this page when you want an accounting period in PeopleSoft Payables to open or close at a different time from that of an accounting period in PeopleSoft General Ledger.

Field or Control |

Description |

|---|---|

From Year and To Year |

Define the open period dates by entering a fiscal year (or fiscal year calendar ID number) in the From and To fields. |

From Period and To Period |

Define the open periods by entering an accounting period in both the From Period and To Period fields. |

Begin Lag and End Lag |

Enter the lag days for the beginning and end of the open periods. Lag days must be entered as a negative number. To understand how PeopleSoft Payables calculates lag days, assume that period 2 begins February 1, 2006, and you enter −3 in the Begin Lag field. The system calculates the first open date to be January 29, 2006. If you were to define your lag days in this way, a voucher entered into the system on January 29, 2006 would get a default accounting date of February 1, 2006 instead of January 29, 2006. If you really want it to be January 29, you can override the default at entry time. The accounting date on the voucher is the accounting date the Voucher Posting Application Engine process (AP_PSTVCHR) and the Journal Generator Application Engine process (FS_JGEN) will use to calculate the accounting period. The system uses the end lag days to close the open period prior to the actual end of the period. Use lag days to close the accounts payable month to transactions before you close the general ledger month. Lag days only apply to the first and last open accounting periods. Important! Lag days functionality only applies when you use a voucher's current date as the accounting date. If you override the current date on a voucher, lag days functionality is disabled for that transaction. Likewise, if you select a specific accounting date at any of the following PeopleSoft Payables hierarchy levels—business unit (Payables Options), voucher origin, or control group—and that specific date prepopulates the voucher, lag days functionality is disabled for that voucher. |

First Open and Last Open |

The system calculates these dates based on the beginning and end of the open periods and the lag days. The system uses these dates to determine the first and last valid dates for transactions for the period. The first open date is based on the beginning date for the from year and from period, plus lag days. For example, suppose that the period starts April 1 and you specify –3 as the Begin Lag value, the system calculates the first open date of the period to be March 29. The last open date is calculated similarly. You can override the first open and last open dates. Changing the date does not change the lag days. This enables you to override the calculated period start date for one time only. When the next mass update occurs, the first open date is calculated as defined. |

Warning! The system issues a warning message if you select a closing date for the PeopleSoft Payables business unit that is later than the closing date for the general ledger business unit. If you do select a closing date for the PeopleSoft Payables business unit that is later than the closing date for the general ledger business unit, any transactions entered after the general ledger business unit closing date is not transferred to the general ledger.

Use the Payables Definition - Tax Options page (BUS_UNIT_TBL_AP2) to specify sales and use tax options and VAT options for the business unit.

Navigation:

This example illustrates the fields and controls on the Payables Definition – Tax Options page. You can find definitions for the fields and controls later on this page.

Sales and Use Taxes

Field or Control |

Description |

|---|---|

Hide Sales Use Tax |

Select to prevent the sales and use tax fields from appearing on any vouchers for the business unit. You can use this option if this business unit does not process sales and use tax transactions. |

Sales and Use Tax Edit Message |

This message appears if there is a discrepancy between entered and calculated sales tax amounts on the voucher. Options are: Error: The system displays an error message describing the exceeded tolerance amounts and the calculated sales tax amount, and it places the voucher in a recycle status. You must accept the calculated amount. No Message: No message appears. You can save the voucher, but tolerance checking is not performed. Warning: The system displays an informational message when sales tax tolerances have been exceeded, but you can still save the voucher with the exceeded amount. You set up sales tax tolerance amounts or percentages on the Payables Options - Tax Options page. |

Difference Option |

Select to specify how discrepancies are addressed between tax amounts that are entered by users and tax amounts that are calculated by the system. Options are: Accrue: The system creates use tax charges for the voucher line whenever the calculated sales tax is greater than the sales tax input. This option enables both sales tax and use tax to be applied to a voucher line. N/A (not applicable): If sales tax is applicable, the sales tax amount that is entered on the voucher is applied to the voucher line, even if the amount is different from the calculated sales tax. The system does not calculate use tax. If you use Taxware or Vertex software, you must select this option. If sales tax is applicable and the tax amount is not entered on the voucher, the system will calculate use tax. |

Ultimate Use Code |

Enter a code to override the default tax rate that is based on the ship to location. Entering a value indicates that the final use of the taxed item results in a different tax rate within the same ship to or usage destination. |

Value Added Tax

Field or Control |

Description |

|---|---|

Hide Value Added Tax |

Select to prevent the VAT fields from appearing on any vouchers for the business unit. You can use this option if the business unit does not process VAT transactions. Note: Leave this check box deselected for all PeopleSoft Payables business units that are VAT-enabled by virtue of being mapped to a PeopleSoft General Ledger business unit that is part of a VAT entity. |

Value Added Tax Edit Message |

Select to determine whether a message appears when tolerances set at the payables options level are exceeded. Options are: Error Msg (error message): An error message appears when you save the voucher. None: No message appears, and you can save the voucher. Warning: A warning message appears, but you can save the voucher. |

VAT Default |

Click to access the VAT Defaults Setup page. The VAT Defaults Setup page is a common page used to set up VAT defaults for all PeopleSoft applications that process VAT transactions. You can define PeopleSoft Payables VAT business unit defaults, specifically, VAT apportionment control. Note: These settings can also be set by accessing the VAT Defaults component directly and selecting the AP Business Unit driver. |

Note: There is also VAT default setup by SetID on the Payables Options - Tax Options page.

Taxware or Vertex

If you have installed a third-party tax application, the Sales and Use Taxes group box contains a Tax Supplier check box. If you select this option, an additional group box appears, labeled either Taxware or Vertex, depending on the third-party application that you have installed and selected on the Installation Options - Overall page.

The Taxware or Vertex group box enables you to enter tax application data. In addition, a row of use tax liability ChartFields also appears. The values that you enter in these group boxes are passed to Taxware or Vertex and used in their respective tax calculation algorithms.

Field or Control |

Description |

|---|---|

Company and Division |

Enter the business unit in these fields. You must ensure that the business unit in the PeopleSoft system is identical to the company and division in Taxware or Vertex. |

Posting Option |

Select to designate which transactions are posted to the register in Taxware or Vertex. Options are: Accrued Transactions Only: Use tax transactions. All Transactions: All taxable and exempt transactions. Taxable Transactions Only: Sales and use tax transactions. |

Freight Terms Code |

Select to determine the point of order origin. This field is used only by Taxware. These codes are defined by the user on the Freight Terms page. You must ensure that the freight terms code is identical in Taxware and in the PeopleSoft system. |

Ship Via Code |

These codes are defined by the user on the Ship Via Codes page and are used by both Taxware and Vertex. You must ensure that the PeopleSoft code is identical to the code in Taxware or Vertex. |

Use Freight Product Code |

Select only if the tax supplier is Taxware. This field indicates that Taxware uses a freight product code from the Taxware application. |

Freight Product Code |

Enter a value only if the tax supplier is Vertex. Enter a code from the Vertex application. |

Use Tax Liability

This is used only when PeopleSoft Payables is integrated with Taxware or Vertex. All accrued use taxes are posted to one account, and you determine which tax agencies to pay by using the register in Taxware or Vertex. Enter the ChartField values that define the accounting distribution line for use tax.

Use the Payables Definition - Voucher Build page (BUS_UNIT_TBL_AP3) to specify default options for the Voucher Build Application Engine process (AP_VCHRBLD) for the business unit.

Navigation:

This example illustrates the fields and controls on the Payables Definition – Voucher Build page. You can find definitions for the fields and controls later on this page.

Recurring Voucher Release Date

Field or Control |

Description |

|---|---|

Contract Release Date Option |

Select to specify which date the system uses to determine whether to build vouchers for contracts. The Voucher Build process builds vouchers for contracts with dates on or before the date generated by the contract date option. Options are: Curr Dt (current date): Use the current date. No Date: Do not use any date option. Specify: Specify a date in the Contract Release Date field. |

Evaluated Receipt Settlement

You can override the default ERS settings for the business unit. The defaults are set on the Procurement Control - ERS Options page for the general ledger business unit associated with the PeopleSoft Payables business unit.

Adjustments

Field or Control |

Description |

|---|---|

RTV Debit Memo (return to vendor debit memo) |

Select to indicate how return to vendor debit adjustments are handled for the business unit. If you select this check box, specify one of the following options in the RTV Adjustment Option field: Create: Automatic RTV adjustments are made and vouchers are created in the voucher tables. The RTV vouchers are then available for payment as a credit with all of the other vouchers. No Adj (no adjustment): No automatic adjustments are created. You must manually create a voucher to create a credit payment. Stage: Vouchers with automatic adjustments are first staged in the quick invoice tables, enabling you to review the voucher for pre-edit errors prior to actual voucher creation. Note: With the Commitment Control feature enabled and the RTV Debit Memo check box selected, you cannot select No Adj (no adjustment). Doing so causes the system to generate an invalid combination warning message. Selecting options here also determines how the PeopleSoft Purchasing's RTV Reconciliation Application Engine process (PO_RTVRECON) handles asset retirement transactions to the Asset Management interface. If you select No Adj (no adjustment option), the RTV Reconciliation process generates the asset retirement transactions received by Asset Management. However, if you select Create (create adjustment) or Stage (stage to pending file), PeopleSoft Payables generates the asset retirement transactions received by Asset Management. |

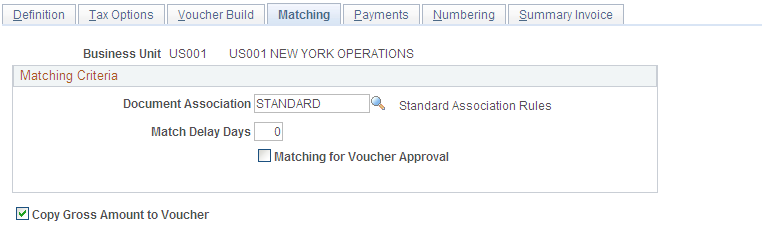

Use the Payables Definition - Matching page (BUS_UNIT_TBL_AP4) to specify the matching options for the business unit.

Navigation:

This example illustrates the fields and controls on the Payables Definition – Matching page. You can find definitions for the fields and controls later on this page.

Note: You must establish document association criteria on the Document Association Rules page before you can select options here.

Matching Criteria

Field or Control |

Description |

|---|---|

Document Association |

Enter a value to determine how the system associates purchase orders and receipts to vouchers. Set up the document association criteria on the Document Association Rules page. |

Match Delay Days |

Enter the number of days the system waits to include invoices in the Matching Application Engine process (AP_MATCH). The system adds the number of match delay days to the entry date to determine the match due date. The Matching process selects only the vouchers that are ready to be matched as of that date. Note: Match delay days are only applicable to EDI, XML, Document imaging, Spreadsheet vouchers, Online, Quick and Self Service invoices. Override the number of match delay days at the origin, control group, supplier, or voucher level. |

Matching for Voucher Approval |

Select to have the Matching process set matched vouchers to Approved and bypass the voucher approval process. Note: If you undo a matched voucher with this option selected, the Matching process updates the approval status on that voucher to Pending. |

Additional Page Elements

Field or Control |

Description |

|---|---|

Copy Gross Amount to Voucher |

Select to have the system copy the total merchandise amount from a purchase order or receiver to the gross amount field on the voucher when you use a copy worksheet or the Copy PO function to copy a purchase order or receiver to a voucher. By selecting this option, you indicate that, for all vouchers in the business unit, the system displays in the voucher header the corresponding total merchandise amount for the receiver or purchase order lines copied to the voucher lines. If you deselect this check box, the gross amount is blank for vouchers in this business unit after you copy predecessor documents to the voucher. In that case, you enter the gross amount from the supplier's invoice. Note: Sales tax, use tax, and VAT amounts are not included in the total amount copied to the voucher's gross amount field. |

Use the Payables Definition - Payments page (BUS_UNIT_TBL_AP5) to specify payment options for the business unit.

Navigation:

This example illustrates the fields and controls on the Payables Definition – Payments page. You can find definitions for the fields and controls later on this page.

Payment Calendar

Field or Control |

Description |

|---|---|

Specify Calendar at Bank Level |

Select to have the system use the payment calendar specified at the bank level to process all vouchers for the business unit. If you process payments for the business unit from multiple banks that use different calendars, this option provides more flexibility than specifying a calendar. |

Specify Calendar |

Select to have the system use the calendar that you specify here to process all payments for the business unit. |

Schedule Pay Date Validation

Field or Control |

Description |

|---|---|

Use Business Day |

Select to enable the Go Next or Prior Business Day option. |

Go Next or Prior Business Day |

Select Next or Prior to have the system schedule the date as the next or prior day if the scheduled due date of a voucher for the business unit falls on a nonbusiness day in the business calendar. Then, if the holiday option is also enabled, the system schedules the date as due after the holiday or due before the holiday, according to the holiday option that you select. When the Use Business Day check box is not selected but the holiday option is enabled, if the scheduled due date of a voucher in this business unit falls on a holiday, the system schedules the date as the next or prior business day according to the holiday option only. |

Payment Options

Field or Control |

Description |

|---|---|

Do Not Mix with other Units |

Select to keep the business unit separate from other business units when you make payments to suppliers. If you do not select this option, the PeopleSoft Payables system enables you to combine payments for vouchers that originate in multiple business units. In other words, you can print one check to a supplier to satisfy multiple vouchers from multiple business units. Important! This option applies only to payments handled through the regular pay cycle processes. During the Payment Selection process, the system checks for items marked with this option. As such, this option does not apply to express payments as they are created outside of the regular pay cycle schedule. |

Payment Terms Basis Date Type |

Specify a date that the system uses in conjunction with the voucher payment terms to calculate the net due date, discount due date (if applicable), and the scheduled due date. Options are:

Note: The system populates the appropriate date on the Payment Terms page. However, you are required to enter a basis date if you select User Date. |

Late Interest Charges

Field or Control |

Description |

|---|---|

Late Charge Option |

Select to determine whether late charges are applied. Options are: Compute Charges: The system calculates late charges. Not Applicable: The system does not calculate late charges. |

Late Charge Code |

Select a late charge code. The system uses the code you select here as the basis for calculating late charges. |

Early Payment Reason Code and Late Payment Reason Code |

Select an early and late payment reason code. You set these up on the Payment Reason Code page. |

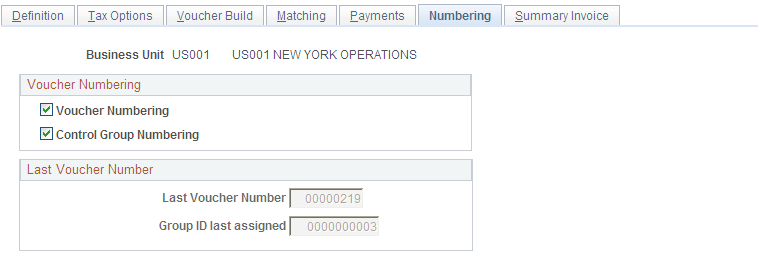

Use the Payables Definition - Numbering page (BUS_UNIT_TBL_AP6) to specify auto-numbering options for the business unit.

Navigation:

This example illustrates the fields and controls on the Payables Definition – Numbering page. You can find definitions for the fields and controls later on this page.

Voucher Numbering

Field or Control |

Description |

|---|---|

Voucher Numbering |

Select to have the system number all vouchers automatically. When you add a voucher, the ID field appears automatically as NEXT; when you save the voucher, the system assigns the next sequential number. |

Control Group Numbering |

Select this option to have the system number all control groups automatically. When you add a control group, the ID field appears automatically as NEXT; when you save the control group, the system assigns the next sequential number. |

Last Voucher Number

Field or Control |

Description |

|---|---|

Last Voucher Number |

Displays the last voucher number assigned in the PeopleSoft Payables system. |

Group ID last assigned |

Displays the last control group ID assigned in the PeopleSoft Payables system. |

Note: Suppose that you have a legacy system, and you want to adjust the auto-numbering to begin at a specific ID to accommodate this. To do so, write-enable the Last Voucher Number field, the Group ID last assigned field, or both. Use PeopleSoft Application Designer to open the BUS_UNIT_TBL_AP6 page and use the Change Use dialog box to deselect Display Only. Save the changes. Return to the Payables Definition - Numbering page, and enter the number or numbers at which you want the system to start auto-numbering. Return to PeopleSoft Application Designer and reselect Display Only. The auto-numbering function begins at the number that you entered, and the system increments it by one for the next voucher or control group that you enter.

(USF) Treasury Symbol Attribute

Field or Control |

Description |

|---|---|

Treasury Symbol Attribute |

Enter the treasury symbol ChartField attribute to associate treasury account symbols with specific fund codes. Use the ChartField Attribute and ChartField Attribute Values pages to define the treasury account symbols. When you perform this setup, treasury account symbols are stored for all transactions that are associated with fund codes. Treasury account symbols represent summary accounts established by the U.S. Treasury Department for each appropriation and fund showing transactions to such accounts. Each account provides the framework for establishing a set of balanced accounts on the books of the respective federal agency. |

Use the Payables Definition - Summary Invoice page (BUS_UNIT_TBL_AP7) to specify summary invoice tolerance controls for the business unit.

Navigation:

This example illustrates the fields and controls on the Payables Definition – Summary Invoice page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Tolerance Percent Over |

Specify the percent acceptable for the input merchandise amount to exceed the merchandise amount copied from the source document. |

Tolerance Percent Under |

Specify the percent acceptable for the input merchandise amount to be less than the merchandise amount copied from the source document. |

Tolerance Amount Over |

Specify the amount acceptable for the input merchandise amount to exceed the merchandise amount copied from the source document. |

Tolerance Amount Under |

Specify the amount acceptable for the input merchandise amount to be less than the merchandise amount copied from the source document. |

Tolerance Currency Code |

Specify the currency code for the tolerance amounts. Foreign currency transactions will be converted to the specified currency for tolerance comparison. |

Rate Type |

Specify the currency rate type to use for converting foreign currency transactions to the specified tolerance currency code. |

Tolerance Misc Charge Code (tolerance miscellaneous charge code) |

Specify the miscellaneous charge code to use for applying differences that are within tolerance. The miscellaneous charge code defines whether the tolerance amount is a nonprorated charge or prorated to the expense distribution lines. |

Note: You must define a unique miscellaneous charge code on the Misc Charge/Landed Cost Defn page prior to specifying the tolerance miscellaneous charge code. If you define the miscellaneous charge code as nonprorated, define the ChartField to distribute the tolerance amounts on the Accounting Template Entry page.