Defining VAT Use Types and Apportionment

To define VAT use types and apportionment, use the VAT Use Type component (VAT_USE_ID) and the VAT Apportionment component (VAT_APORT). If you are using coefficients of recoverability (FRA) for VAT apportionment, use the VAT Recoverability Attributes component (AM_VAT_ATTRIBUTES) and the VAT Recoverability Adjustments component (AM_VATRCVR_RQST).

This section provides an overview of VAT use type and apportionment setup .

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

VAT_USE_ID |

Add or modify VAT use types. |

|

|

VAT_APORT_BASE |

Define VAT apportionment. |

|

|

AM_VAT_ATTRIBUTES |

Define, review and amend VAT recoverability attributes to manage effective-dated VAT recoverability data by business unit, asset id, voucher and voucher line for those assets that are associated with a GL business unit that is flagged for VAT recoverability adjustments. |

|

|

AM_VATRCVR_RQST |

Run the process to evaluate, calculate and generate accounting entries for VAT recoverability adjustments. |

A VAT use type categorizes the use of a good or service by the tax status of the activity in which it is used—the tax status of the goods or services ultimately produced from those procured. VAT use is one of the main determinants in the recoverability of input VAT.

Note: If you are a public service organization in Canada and are eligible to receive a rebate on input VAT, you need to enter a public service body type. If more than one public service body type is applicable to your organization, at least one VAT use type is required for each public service body type selected.

You can specify the ratio of taxable activity to nontaxable activity directly on the use type, or you can specify that mixed apportionment be used to define the ratio of taxable to nontaxable activity at the ChartField level.

If you select the mixed apportionment check box, you must have completed VAT apportionment prior to entering transactions for the selection to be valid. When you select this VAT use type on a transaction, the taxable and exempt percentages apply to the calculation of recoverable and rebate VAT only if, on the transaction, either the business unit specified as the VAT apportionment control or one of the two ChartFields defined as priority ChartFields for VAT apportionment contains a value defined under VAT apportionment. If neither the business unit nor either of the ChartFields contains a value defined for VAT apportionment, the VAT recovery and VAT rebate percentages will be zero, resulting in all VAT being recorded as nonrecoverable. For this reason, you must specify enough VAT Apportionment data so that a match is always found.

VAT apportionment is a mechanism that enables recoverability to be determined based on either the VAT apportionment control business unit or one of the two priority ChartFields that you specify on the VAT Apportionment page and to which a transaction is posted. For each business unit, Priority 1, or Priority 2 ChartField value, you enter the percentage of activity that is taxable or exempt. The system automatically calculates the other value so that the total of the percentages equals 100. When this business unit or ChartField value is entered on a transaction together with a VAT use type that indicates that mixed apportionment is applicable, the corresponding taxable activity and exempt activity percentages are used to calculate recoverable, rebatable, and nonrecoverable VAT.

VAT apportionment setup is not required to establish your VAT environment. However, if you are unable to identify the taxable and exempt portions of a given activity for purposes of determining recoverability, it enables you to apportion that activity by general ledger business unit or ChartField. Typically, VAT apportionment is used by organizations with very complex recoverability issues. The concept behind VAT apportionment is that usage can be determined by business unit or ChartField, enabling usage to vary based on a business unit, department, or project in which the purchase is to be used. VAT apportionment is not a mechanism for distributing VAT across multiple VAT accounts.

When you set up your VAT environment, you need to consider whether VAT on a good or service is recoverable, and if so, to what extent.

Here's how you set up VAT rebates and recovery:

Define the VAT use type and indicate whether a given purchase will be used in an activity that is anywhere from 100 percent taxable to 100 percent exempt.

Specify the ratio of taxable activity to nontaxable activity directly on the use type, or you can specify that mixed apportionment be used to define the ratio of taxable to nontaxable activity at the ChartField level.

Define VAT apportionment if you require that recoverability be determined based on the business unit or ChartField to which the purchase or expense is being posted.

You must set up VAT apportionment if you have defined any VAT use types as using mixed apportionment. You must also make sure that you have specified the type of business unit to be used as the VAT apportionment control for each of your VAT-enabled PeopleSoft Payables, Purchasing, General Ledger, Expenses, and Treasury business units. You set this up for each applicable business unit VAT driver in the common VAT defaults table.

Note: If your organization does not require tracking VAT recoverability at this level, you do not need to set up VAT apportionment information. VAT apportionment is used by organizations with very complex recoverability issues. The concept behind VAT apportionment is that usage can be determined by business unit or ChartField, enabling usage to vary based on a business unit, department, or project in which the purchase is to be used. VAT apportionment is not a mechanism for distributing VAT across multiple VAT accounts.

French VAT

Some French companies are required to use the VAT Use Type and the VAT Apportionment to store the temporary recoverable VAT at asset purchase time. In some cases, the recoverability of VAT is not definite. This is the case of adjustments applicable to assets, assets in service since January 1, 2008 and adjustments applicable to other goods or services. The final base is unknown until the end of the period. PeopleSoft provides for the calculation of recoverability adjustments to register the gap between the temporary and final VAT recoverability at the end of the year, as well as access to auditable data. The apportionment represents the product of three recoverability coefficients and the adjustments to the recoverable VAT amounts are recognized when final recoverability data reflects a significant difference from the estimated ratios that are used to determine recoverability

Prerequisites and required setup for French VAT include the following:

Assets that are expected to register VAT attributes information and be eligible for the adjustment process must have an asset class, which includes the VAT recoverability adjustment period.

See Asset Classes Page.

See PeopleSoft Enterprise Asset Lifecycle Management Fundamentals Documentation, Establishing Asset Processing.

The asset profile must be configured to point to asset classes with the number of years populated.

Define coefficients of recoverability for the VAT Use Type.

Enable coefficients of recoverability for VAT apportionment.

Define VAT recoverability attributes.

Use the VAT Use Type page (VAT_USE_ID) to add or modify VAT use types.

Navigation:

Enter an effective date, status, description, and short description.

Field or Control |

Description |

|---|---|

Use Type |

Indicate whether a given purchase will be used in an activity that is anywhere from 100 percent taxable to 100 percent exempt. Values are: Use: Select to base the VAT recovery percentage on the activity percentages from the VAT use type. Mixed App. (mixed apportionment): Select to base the VAT recovery percentage on mixed-use apportionment by general ledger business unit or ChartField. The taxable and exempt percentages apply to the calculation of recoverable and rebate VAT only if, on the transaction, the general ledger business unit or one of the two ChartFields that are defined as priority ChartFields for VAT apportionment contains a value that is defined under VAT apportionment. If neither the general ledger business unit nor either of the ChartFields contains a value that is defined for VAT apportionment, the VAT recovery and rebate percentages are zero, resulting in all VAT being recorded as nonrecoverable. For this reason, you must specify enough VAT apportionment data so that a match is always found. The VAT recoverability for each transaction line is determined by associating a VAT use type with that line. The VAT use type is supplied by the system for each transaction line through the VAT default hierarchy. |

Use Coefficients |

Select to use the coefficients for VAT recoverability (as required by French VAT legislation). The coefficients are used to calculate yearly adjustments or global adjustments for assets and to calculate the recoverable VAT amount at invoice time or import time. They can be modified over time based on well-identified events that justify reconsideration of status. Selection of the Use Coefficients check box indicates to PeopleSoft Payables to send VAT information to Asset Management. This control also keeps validations on the VAT Use Type to a minimum. If you select to use coefficients, enter the coefficients for the following three components of the recoverability formula:

|

VAT Taxable % |

If you selected a use type of Use, enter the percentage of activity that is taxable. This field is enabled only when the Use Coefficients check box is deselected. When you enter a value in the VAT Taxable % field (or if the system populates it), the system automatically populates the VAT Exempt % field so that the sum of the two fields is 100. This is the default method for VAT taxable activity percent. If you select the Use Coefficients check box and you enter the values for the three coefficients, the system automatically calculates the resulting coefficient of recoverability. |

VAT Exempt % |

When you enter a value in the VAT Taxable % field, the system automatically populates this field so that the sum of the two fields is 100. |

VAT PSB Type (VAT public service body type) |

If you are a public service organization in Canada and are eligible to receive a rebate on input VAT, enter a public service body type. The public service body type determines the rebate rate. Values are Charitable, Colleges, Hospital, Municipal, Non-Profit, School, and University. |

Note: If your organization consists of more than one public service body type, each public service body type requires at least one VAT use type.

Use the VAT Apportionment page (VAT_APORT_BASE) to define VAT apportionment.

Navigation:

This example illustrates the fields and controls on the VAT Apportionment page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

ChartField Priority 1 |

The ChartField that you enter here is the first ChartField the system uses when it attempts to retrieve VAT recovery data from VAT apportionment. For example, if you define the priority 1 ChartField as Project, the system attempts to find a row in the VAT apportionment table where the priority 1 ChartField value resembles the project ID from the transaction. |

ChartField Priority 2 |

Enter the ChartField to use in a second pass when the first attempt to retrieve VAT recovery data from VAT apportionment is unsuccessful. |

You can equate ChartField priority 1 to the lowest level in the PeopleSoft control hierarchy, and ChartField priority 2 to the next highest level. Priority 1 takes precedence when found, then priority 2, while the business unit acts as the default.

Note: VAT apportionment does not use the combination of the priority 1 and priority 2 ChartFields and business unit. The system first looks for a match in the VAT apportionment data for the priority 1 ChartField value. If it finds no match, it looks for a match in the VAT apportionment data for the priority 2 ChartField. If it still finds no match, it looks for a match in the business unit.

VAT Apportionment Detail

Use this grid to specify values for the ChartFields for one or more business units. The business units may be transaction business units or PeopleSoft General Ledger business units. The system uses either the transaction business unit, the transaction's general ledger business unit, or the distribution line general ledger business unit to access VAT apportionment information, based on the type of business unit you define as the VAT apportionment control for the PeopleSoft Payables, Purchasing, General Ledger, Expenses, and Treasury business unit VAT drivers in the common VAT defaults table.

Field or Control |

Description |

|---|---|

ChartField Option |

Select either BU Only, Value 1 or Value 2. Selecting Value 1 enables you to enter a priority 1 value. Selecting Value 2 enables you to enter a priority 2 value. |

Priority 1 and Priority 2 |

If you selected Value 1 for the ChartField option, you can enter a value in the Priority 1 field. If you selected Value 2, you can enter a value in the Priority 2 field. The value that you enter can be any number of characters up to the length of the largest ChartField that the system uses when it attempts to find a match with the ChartField values on the transaction. The priority 1 and 2 values represent the significant beginning characters that must match exactly. For example, if the ChartField Priority 1 is Project ID and you enter a priority 1 value of 12, any project ID on a transaction starting with 12 matches this VAT apportionment row. |

The system looks at the transaction ChartField value, and then looks for a match. If it finds a match in VAT apportionment, it stops. If it does not find a match in VAT apportionment, it removes the last character of the transaction ChartField value and looks again for a match. It repeats this process until it finds a match or no more characters exist to remove. If it does not find a match in VAT apportionment for either the priority 1 or priority 2 ChartField, it then looks for an exact match for the business unit. If it still does not find a match, the VAT recovery and rebate percentages become zero by default, resulting in all VAT being recorded as nonrecoverable. For this reason, you must specify enough VAT apportionment data so that a match is always found.

Field or Control |

Description |

|---|---|

Use Coefficients |

Select to use the coefficients of recoverability as required for some companies to comply with French tax regulation. Upon saving the page, a validation occurs to ensure that the total of the three coefficients equals the taxable VAT percentage for each effective-dated record. This validation is in addition to the validation to ensure that the sum of the recovery activity and rebate activity equals one hundred (100) percent. |

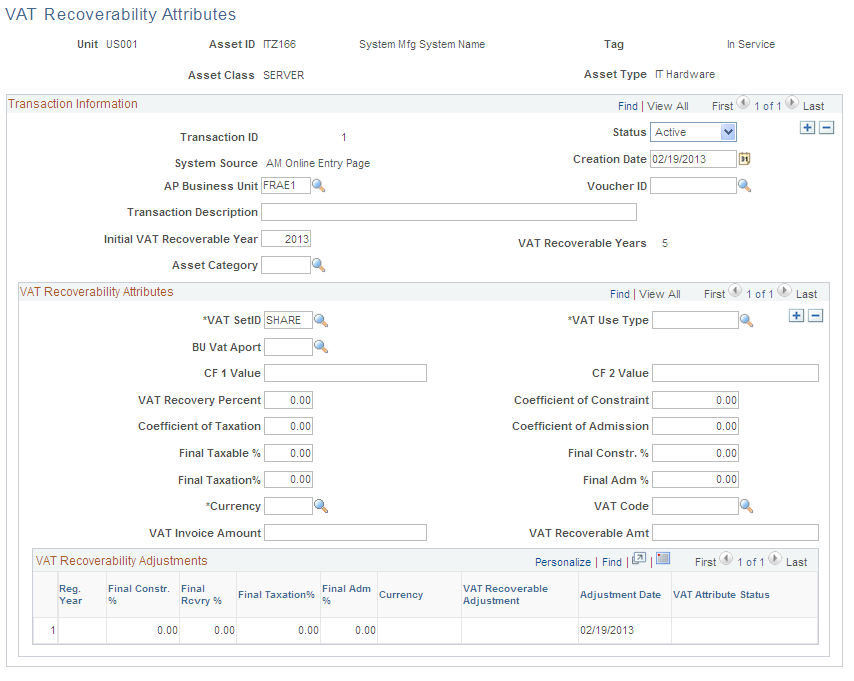

Use the VAT Recoverability Attributes page to manage effective-dated VAT recoverability data by business unit, asset id, voucher and voucher line for those assets associated with a GL business unit that have been flagged for VAT recoverability adjustments. The AP/AM integration passes VAT recoverability attributes to PeopleSoft Asset Management for asset-applicable vouchers that are eligible for VAT recoverability adjustments. The VAT recoverability attributes that are captured during the AP/AM integration populate the Asset Management VAT Recoverability Attributes record.

Use the VAT Recoverability Attributes page (AM_VAT_ATTRIBUTES) to define, review and amend VAT recoverability attributes to manage effective-dated VAT recoverability data by business unit, asset id, voucher and voucher line for those assets that are associated with a GL business unit that is flagged for VAT recoverability adjustments.

Navigation:

This example illustrates the fields and controls on the VAT Recoverability Attributes page. You can find definitions for the fields and controls later on this page.

The VAT Recoverability Attributes and VAT Recoverability Adjustments display in the respective grids based on the transaction information that you select.

The Update Final Coefficients option for the VAT Recoverability Adjustments process (AM_VAT_RCVR) reads all active VAT Use Type records with an effective date greater than the regularization year and updates active rows on the Asset Management VAT Recoverability Attributes record with the final coefficient of constraint, coefficient of taxation, coefficient of admission and recoverability coefficient for the specified regularization year (spans from January 1 to December 31). Prior to executing the yearly final coefficients update, manually update the VAT Use Type and the VAT Apportionment records with the final coefficients at the beginning of the calendar year. Coefficients entered with an effective date of 2009, for example, represent the final coefficients for the 2008 regularization year and temporary coefficients for 2009.

Field or Control |

Description |

|---|---|

Initial VAT Recoverable Year |

Enter the year of asset creation (acquisition or capitalization). |

VAT Recovery Percent |

Used to calculate yearly adjustments or global adjustments for assets; it is made of the product of the reference coefficient of constraint, coefficient of taxation, and coefficient of admission. Those reference coefficients are the ones used to calculate the recoverable VAT amount at invoice time or import time. They can be modified over time based on well-identified events justifying reconsideration of status. |

Final Taxable % |

Final Recoverability Coefficient - is retrieved from the VAT Use Type or the VAT Apportionment record. |

Final Constr. % (final constraint percentage) |

Final Coefficient of Constraint - is retrieved from the VAT Use Type or the VAT Apportionment record. |

Final Taxation % (final taxation percentage) |

Final Coefficient of Taxation - is retrieved from the VAT Use Type or the VAT Apportionment record. |

Final Adm %(final admission percentage) |

Final Coefficient of Admission - is retrieved from the VAT Use Type or the VAT Apportionment record. |

VAT Invoice Amount |

This amount is the VAT amount that is paid at the time of purchase, import, or receipt of goods or services and stated on the invoice or certificate (in case of transfers/sales). This amount is used in the adjustment calculation. |

VAT Recoverable Amount |

This is the VAT amount for which a company exercises its right to deduct by applying the temporary recoverability coefficient. This is the VAT amount that is subject to adjustment. |

VAT Recoverability Adjustments

This group box displays the VAT recoverability adjustments by adjustment date as well as final coefficients resulting from the VAT Recoverability Adjustments process (AM_VAT_RCVR).

Field or Control |

Description |

|---|---|

VAT Attribute Status |

Displays one of the following VAT Attribute Status values:

|

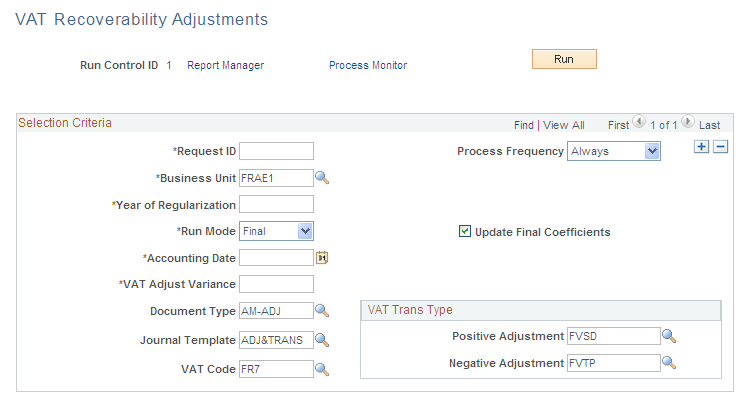

Use the VAT Recoverability Adjustments page to run the French VAT Recovery process (AM_VAT_RCVR) that evaluates, calculates and generates accounting entries for VAT recoverability adjustments. This process enables retroactive recording and reporting of adjustments.

This example illustrates the fields and controls on the VAT Recoverability Adjustments page. You can find definitions for the fields and controls later on this page.

When you run the VAT Recoverability Adjustments process in Draft mode, if a significant variance is calculated, an adjustment row is generated in the AM_VATT_ATTR_L2 table (displays in the grid at the bottom of the VAT Recoverability Attributes page) for the designated regularization year with a Temporary status. When you run the VAT Recoverability Adjustments process in Final mode, if running for the first year, the Final Coefficients are updated in AM_VAT_ATTR_L1. The row in AM_VAT_ATTR_L2 then shows a status of Posted and becomes unavailable. This process also updates the reference set of coefficients if the regularization year that you specify on the run control equals the initial recoverability year. In Final mode, VAT adjustments are generated in the AM VAT Transaction record (AM_VAT_TRANS) and accounting entries are posted (DIST_LN). You can also create queries to review the VAT attributes and recoverability adjustments that are generated in the respective records.

Field or Control |

Description |

|---|---|

Business Unit |

Enter the Asset Management business unit, which is required for processing. |

Year of Regularization |

Enter the year for which the VAT recoverability adjustments are to be made. Note that for each VAT Use Type and Apportionment, there must be an entry for the year following the regularization year. For example, if the process runs for regularization year 2008, there must be an entry in the coefficients tables with an effective date in 2009. This process records adjustments when there is a difference between the initial and final coefficients that is greater than the designated minimum percent. This percent is specified in the VAT Adjust Variance field. |

Run Mode |

Select to run the process in one of the following modes:

|

Update Final Coefficients |

Select to update the final set of coefficients when running this process. Final coefficients are only updated when the regularization year is equal to the initial year of recoverability. |

Accounting Date |

Enter the accounting date of the VAT adjustment accounting entries that are to be generated by this process. The year of this date is used to retrieve the final set of coefficients. |

VAT Adjust Variance |

Enter the minimum yearly VAT adjustment variance (commonly 10 percent). If the difference between the initial and final coefficients is greater than this variance, it is considered significant and an adjustment is recorded. |

Document Type |

Available only when running the process in Final mode, select the document type if using document sequencing for accounting entry processing. |

Journal Template |

Available only when running the process in Final mode, select the journal template to be used for accounting entry processing. |

VAT Code |

Available only when running the process in Final mode, select the default VAT Code to be used for accounting entry processing. |

VAT Trans Type |

Available only when running the process in Final mode, select the default VAT Transaction Types for positive and negative yearly VAT adjustments. |