Exporting Ledgers as Flat Files

This section discusses how to generate a flat file of ledger data for export to another system.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUN_GLS7500 |

Create a ledger file for export to another system. Generates a flat file based on the ETAFI (ETAFI5), ETAFI6, and ACCON file layout specifications. |

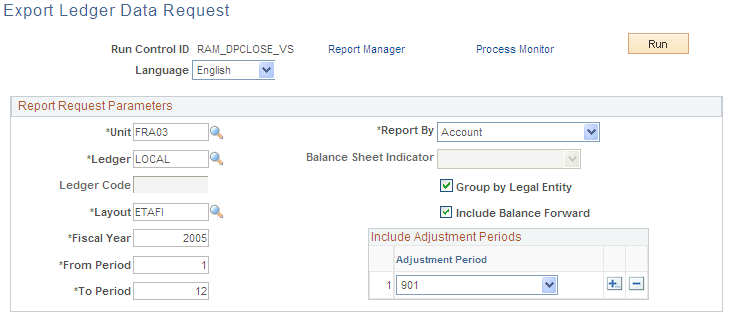

Use the Export Ledger Data Request page (RUN_GLS7500) to create a ledger file for export to another system.

Generates a flat file based on the ETAFI (ETAFI5), ETAFI6, and ACCON file layout specifications.

Navigation:

This example illustrates the fields and controls on the Export Ledger Data Request page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Language |

Select for account and alternate account descriptions. |

Unit |

Select the applicable report business unit with consideration for Group by Legal Entity field, and select only business units with the same base currency. |

Ledger |

Select the ledger for the reporting business units. |

Ledger Code |

Select to filter data for the book codes that you define for this ledger code. |

Format ID |

Select the system output format from the following options:

|

Fiscal Year |

Indicate the year to be reported. |

From Period and To Period |

Select the periods within the fiscal year that are to be reported. |

Report by |

Report by Account or Alternate Account. Note: If you configure these ChartFields, the field length of the ACCOUNT or ALTACCT (alternate account) ChartFields cannot exceed the established file layout. For ACCON it is eight characters, ETAFI (ETAFI5) is 12 characters, and ETAFI6 is 16 characters. |

Balance Sheet Indicator |

Select to report on Balance Sheet or Off Balance Sheet accounts. |

Group by Legal Entity |

Select to report for all business units that recognize the report business unit as the legal entity. For example, if the report business unit is FRA01 and you define it as the legal entity for FRA98 and FRA99, the report pulls ledger data for the business units FRA01, FRA98, and FRA99. If the report business unit is a legal entity and the check box is deselected, data is extracted only for the report business unit. If the report business unit is not a legal entity and you select this check box (or if you do not enable the Legal Entity option at the installation level), an error message alerts you that this check box is not available for nonlegal entities. If you override the message, the system subsequently extracts data for the report business unit only. |

Include Balance Forward and Adjustment Period |

Check this check box if you want the process to include any balance forward for a specific account and adjustment period. Such amounts are accumulated in the total amount that is reported in the flat file for the fiscal year. |

Click Run to initiate the GLS7500 process.

Note: Legal entity and balance sheet indicator are activated on the Overall page (Set Up Financials/Supply Chain, Install, Installation Options, and select the Overall link).

Note: For the GLS7500 process to separately extract debit and credit balances to the file, the business unit for which data is to be extracted must be set up for separate debit/credit processing.