Using Operation Metrics in Receivables

PeopleSoft Receivables enables its users with a method to evaluate and manage operational efficiency within the PeopleSoft Receivables product. Using these indicators, you can determine the productivity of the Receivables operations as a whole as well as individual performance.

Users must be granted the appropriate permissions to access tiles and pages by assigning a permission list ID.

Credit to Cash Operations Home Page

The Credit to Cash Operations Home page displays the tiles to analyze the operational efficiency using metrics.

Navigation:

This example illustrates the fields and controls on the Credit to Cash Home Page as seen on a desktop.

This example illustrates the fields and controls on the Credit to Cash Home page as seen on a smart phone.

Note: As of date on the tiles indicates the date when the materialized view was last updated.

For the information on receivable materialized view, see Understanding Operation Metrics.

Tiles Used to Analyze Receivables Operations

You can use the following tiles to analyze the operational efficiency within PeopleSoft Receivables:

Receivables WorkCenter

Receivables

Operational Analysis

Unapplied Payments

Use the Operational Analysis tile to access these metrics:

Dispute Resolution Cycle Time

Past Due Items Assignments

Doubtful Items

On-Account Payments

Customer Aging

DSO (Days Sales Outstanding) Trend

Use the Receivables WorkCenter tile to access the Receivables WorkCenter page in the PeopleSoft Fluid User Interface.

For more information, see Using the PeopleSoft Fluid Receivables WorkCenter.

Use the Receivables tile to access a collection of Receivables components.

For more information, see Using the PeopleSoft Fluid User Interface to Navigate My Receivables.

Use the Operational Analysis tile to access the tiles used for analyzing receivables.

Navigation:

Click the Operational Analysis tile on the Credit to Cash Operations Home page.

This example illustrates the Operational Analysis tile.

The Operational Analysis tile includes the following tiles for Receivables:

Dispute Resolution Cycle Time

Past Due Items Assignments

Doubtful Items

On-Account Payments

Customer Aging

DSO Trend

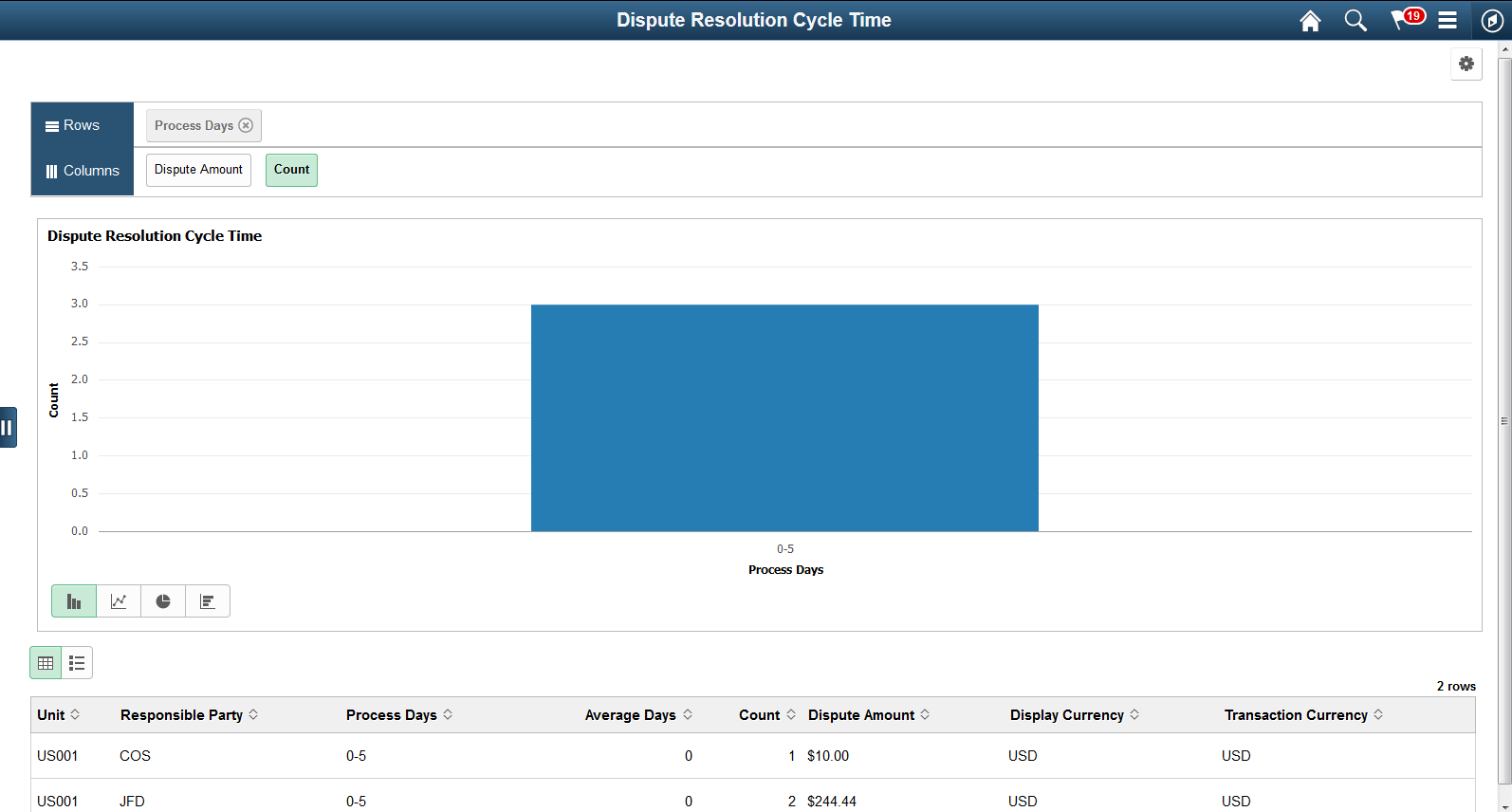

Use the Dispute Resolution Cycle Time tile to view the average number of days from customer-initiated dispute to resolution and the total dispute amount for disputed items resolved during the date range specified in the tile preferences, Resolution Date field.

Navigation:

This example illustrates the Dispute Resolution Cycle Time tile.

Select the Dispute Resolution Cycle Time tile to view the pivot grid. On the X-axis, the tile shows the Process Days and on the Y-Axis, it shows either the Dispute Amount or Item Count.

This example illustrates the fields and controls on the Dispute Resolution Cycle Time Pivot Grid.

Select the following facets to filter data displayed in the pivot grid:

Process Days

Business Unit

Responsible Party

Add, delete, or move the following pivot grid columns as desired:

Business Unit

Responsible Party

Process Days

Average Days

Item Count

Display Amount

Display Currency

Transaction Currency

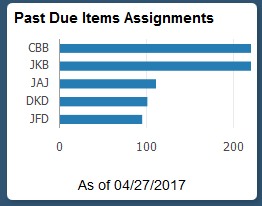

Use the Past Due Items Assignments tile to view the number of past due invoices and the users currently assigned to collect the invoices. This helps to distribute the workload appropriately to the users.

Navigation:

This example illustrates the fields and controls on the Past Due Items Assignments tile.

Select the Past Due Items Assignments tile to view the pivot grid. On the Y-axis, the tile shows the Responsible Party and on the X-axis, the tile shows the Item Count.

Select the following facets to filter data displayed in the pivot grid:

Business Unit

Responsible Part

Currency

Add, delete, or move the following pivot grid columns as desired:

Business Unit

Responsible Part

Currency

Item Count

Item Balance

Use the Doubtful Items tile to view the total amount and number of payments that you transferred to a doubtful receivables account.

Navigation:

This example illustrates the fields and controls on the Doubtful Items Tile.

Select the Doubtful Items tile to view the pivot grid. On the Y-axis, the tile either shows the Display Balance or Item Count. On the A-axis, the tile shows the Responsible Party.

Select the following facets to filter data displayed in the pivot grid:

Business Unit

Responsible Party

Currency

Add, delete, or move the following pivot grid columns as desired:

Business Unit

Responsible Party

Currency

Item Count

Item Balance

Display Balance

Display Currency

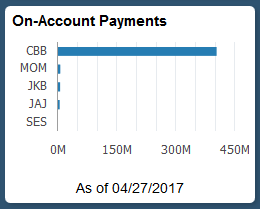

Use the On-Account Payments tile to view the amount of open on-account (WS-05) and prepaid (WS-04) payments and the users currently assigned to collect the payments. This helps to appropriately distribute the workload.

Navigation:

This example illustrates the fields and controls on the On-Account Payments Tile.

Select the On-Account tile to view the pivot grid. On the Y-axis, the tile shows either the Responsible Party or Entry Type. On the X-axis, the tile shows the Item Count or Display Balance.

Select the following facets to filter data displayed in the pivot grid:

Business Unit

Responsible Party

Currency

Entry Type

Add, delete, or move the following pivot grid columns as desired:

Business Unit

Responsible Party

Currency

Entry Type

Item Count

Item Balance

Display Balance

Display Currency

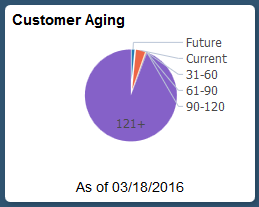

Use the Customer Aging tile to view a customer’s receivables balance based on the aging categories.

Navigation:

This example illustrates the fields and controls on the Customer Aging Tile.

Select the Customer Aging tile to view the pie chart. It displays the aging balance by aging category according to the user-defined aging buckets.

Select the following facets to filter data displayed in the pivot grid:

Category

Business Unit

Currency

Add, delete, or move the following pivot grid columns as desired:

Business Unit

Aging ID

Aging Category

Item Count

Item Balance

Display Currency

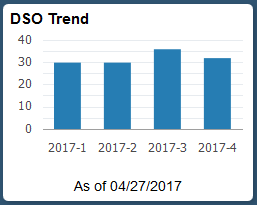

Use the DSO Trend tile to view the actual DSO30 over the prior 4 months (which excludes the current month).

This example illustrates the fields and controls on the DSO Trend Tile.

Select the DSO Trend tile to view the pivot grid. On the Y-axis, the tile shows the Accounting Period, or Days or Amount. On the X-axis, the tile shows Period Name.

To filter data displayed in the pivot grid, select an available period name.

Add, delete, or move the following pivot grid columns as desired:

Business Unit

Customer

Fiscal Year

Accounting Period

Days

Amount

Currency

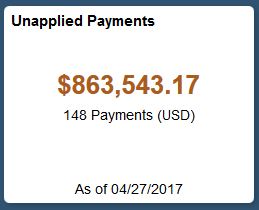

Use the Unapplied Payments tile to view the total amount and number of unapplied payments. This can also include the payments in the processing status.

Navigation:

This example illustrates the fields and controls on the Unapplied Payments Tile.

Select the Unapplied Payments tile to view the pivot grid.

On the Y-axis, the tile shows either the Display Balance Payment Count. On the X-axis the tile shows the Payment Status.

Select the following facets to filter data displayed in the pivot grid:

Payment Status

Deposit Unit

Payment Method

Currency

Add, delete, or move the following pivot grid columns as desired:

Payment Status

Deposit Unit

Payment Method

Payment Count

Payment Amount

Currency

Display Balance

Display Currency

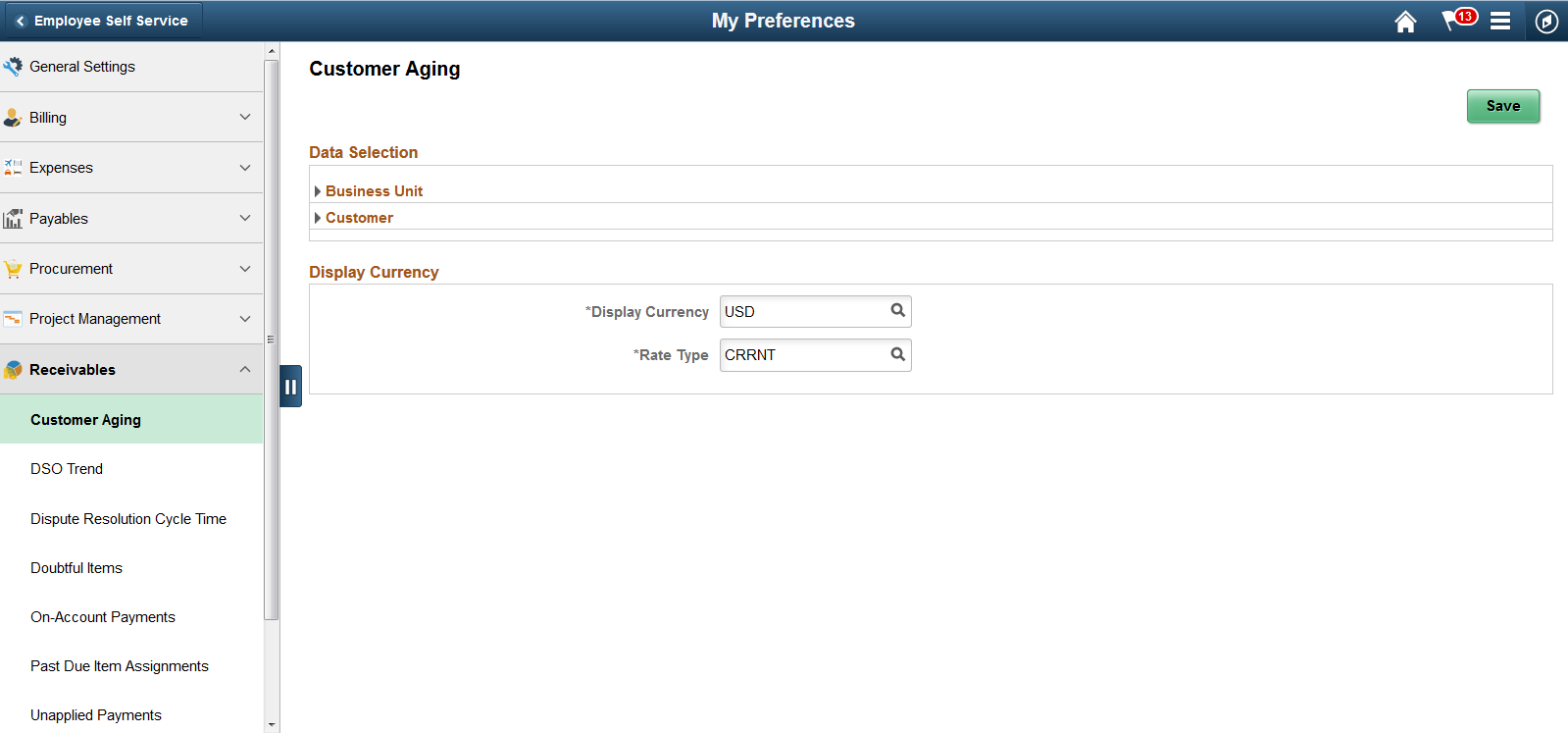

Use the My Preferences Page (PTGP_USER_PERS_FL) to set up the tile display content.

Navigation:

Select Receivables on the right pane.

This example illustrates the fields and controls on the Receivables Preferences page. You can find definitions for the fields and controls later on this page.

Preferences – Customer Aging

The following settings are required:

Field or Control |

Description |

|---|---|

Business Unit |

Select a unit. The default is the group unit or, if group unit is not defined, the business unit from the user preferences. |

Customer |

|

Display Currency |

Currency code and rate type are required. |

Preferences – DSO Trend

The following settings are required:

Field or Control |

Description |

|---|---|

Business Unit |

Select a unit. The default is the group unit or, if group unit is not defined, the business unit from the user preferences. |

Customer Set ID |

Required field. This field’s default is the SetID defined in the user preferences. |

Customer ID |

Required field. Select only one customer. |

Preferences – Dispute Resolution Cycle Time

The following settings are required:

Field or Control |

Description |

|---|---|

Resolution Date Option |

Select a date range option. Note: The selected date range must be within 180 days. Reporting views are utilized to improve performance by limiting the amount of data available to 180 days date range (6 months). A process must be configured and run to ensure the data displayed is current. This process is located under Setup Financials/Supply Chain > Operational Reporting > Operational Efficiency. |

Business Unit |

Select a unit. The default is the group unit or, if group unit is not defined, the business unit from the user preferences. |

Customer |

|

Responsible Party |

Required field. Select from Collector, AR Specialist, Credit Analyst, Broker, or Sales Person. This field defaults to Collector. |

Display Currency |

Currency code and rate type are required. |

Preferences – Doubtful Items

The following settings are required:

Field or Control |

Description |

|---|---|

Business Unit |

Select a unit. The default is the group unit or, if group unit is not defined, the business unit from the user preferences. |

Customer |

|

Responsible Party |

Required field. Select from Collector, AR Specialist, Credit Analyst, Broker, or Sales Person. This field defaults to Collector. |

Display Currency |

Currency code and rate type are required. |

Preferences – On-Account Payments

The following settings are required:

Field or Control |

Description |

|---|---|

Business Unit |

Select a unit. The default is the group unit or, if group unit is not defined, the business unit from the user preferences. |

Customer |

|

Responsible Party |

Required field. Select from Collector, AR Specialist, Credit Analyst, Broker, or Sales Person. This field defaults to Collector. |

Display Currency |

Currency code and rate type are required. |

Preferences – Past Due Item Assignments

The following settings are required:

Field or Control |

Description |

|---|---|

Business Unit |

Select a unit. The default is the group unit or, if group unit is not defined, the business unit from the user preferences. |

Customer |

|

Responsible Party |

Required field. Select from Collector, AR Specialist, Credit Analyst, Broker, or Sales Person. This field defaults to Collector. |

Preferences – Unapplied Payments

Field or Control |

Description |

|---|---|

Business Unit |

Select a unit. The default is the group unit or, if group unit is not defined, the business unit from the user preferences. |

Display Currency |

Currency code and rate type are required. |