Editing VAT External Transaction Details

This topic discusses how to edit VAT external transaction details.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

External Transactions Page |

BNK_RCN_TRAN_UPDT |

Enter external transaction information and VAT information. See also Reconciling Externally Generated Transactions and the External Transactions Page. |

|

TRV_VAT_TRAN_SEC |

Specify VAT transaction details for an external transaction. |

Using the External Transactions page, you can add VAT-applicable external transactions, and specify VAT options for those transactions on the Treasury VAT Processing page. To access this page, you must complete the following fields on the External Transactions page:

Bank ID

Account # (account number)

Transaction amount

Transaction code

Transaction date

Transaction reference ID

Accounting template ID

See External Transactions Page.

When you click the VAT link, the system verifies that the business unit is VAT enabled, the Tran Code (transaction code) is Fee, and a VAT applicable accounting template is selected. (The system determines the default business unit and bank branch information for VAT by the specified bank account number, and uses this information to populate the Business Unit field on the External Transactions page.) The Treasury VAT Processing page displays only if these conditions are met.

The Treasury VAT Processing page displays VAT Defaults in descending order of impact. When you change multiple VAT defaults and click the Adjust Affected VAT Defaults button, specific fields will or will not be adjusted. You should work top-down, clicking Adjust Affected VAT Defaults at the appropriate time(s) to avoid adjustments to VAT Defaults that you overrode but not did not memorize.

For example, if you override Supplier Registration Country and click Adjust Affected VAT Defaults, the system adjusts all VAT Defaults except Supplier Registration Country and Supplier Registration ID. Then you override Place of Supply Driver and click Adjust Affected VAT Defaults again. The system adjusts all VAT Defaults except Service Type, Place of Supply Driver, Supplier Registration Country, and Supplier Registration ID.

Use the Treasury VAT Processing page (TRV_VAT_TRAN_SEC) to specify VAT transaction details for an external transaction.

Navigation:

Click the VAT link on the Transactions Detail tab of the External Transactions page.

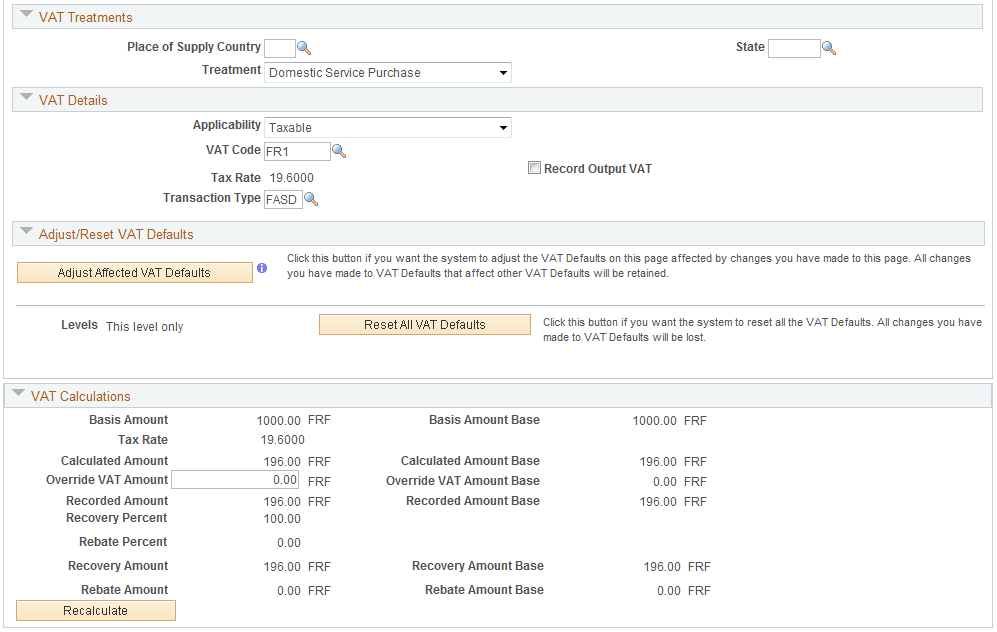

This example illustrates the fields and controls on the Treasury VAT Processing page (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Treasury VAT Processing page (2 of 2). You can find definitions for the fields and controls later on this page.

Note: You can edit fields on this page only if the accounting entry has not been reconciled.

Field or Control |

Description |

|---|---|

IBAN |

Displays the international bank account number (IBAN) in addition to the local, domestic bank account number when the country has been set up to display the IBAN on the IBAN Formats Page. |

Expanding and Collapsing Sections

To manage your VAT data more efficiently, you can expand and collapse sections on this VAT page.

Field or Control |

Description |

|---|---|

Expand All Sections |

Click the expand button to scroll to and access every section on the page. You can also expand one or more sections by clicking the arrow next to the section's name. |

Collapse All Sections |

Click to collapse all sections displaying only the header information. If you expand one or more sections, you can click the arrow next to the section's name to collapse the section. |

Drivers

Field or Control |

Description |

|---|---|

Physical Nature |

Displays Services, as all Treasury VAT processing is only performed on services. |

Bank Location Country |

Displays the country in which the bank is located. The default value is the country that you specified for the bank branch location. This is analogous to the Ship From country. |

Registrations

Field or Control |

Description |

|---|---|

Reporting Country |

Displays the VAT registration country of the beneficiary (buyer) of the service. The VAT defaulting routine retrieves the country value from the VAT entity, as either the service country, the business unit location country, or the country set as the home country. |

Defaulting State |

Specify a state within the Reporting Country. If the Reporting Country tracks VAT by state, then VAT default values may be defined at the state level. |

Bank Registration Country |

Displays the VAT registration country of the provider (seller) of the service—the registration country of the bank branch. The default value comes from the bank branch. |

Bank Registration ID |

Displays both the country code and VAT registration number. The two-character country code for the VAT registration country is display only. In addition to the three-character code (for example, Bank's Country) this two-character code is often required as part of the actual registration ID. The system derives the default VAT registration ID number from the applicable bank branch. You can override this number. However, PeopleCode validation routines ensure the number is valid according to country-specific checksum algorithms. |

Exception Type |

Select from the following:

|

Certificate ID |

Enter the VAT certificate ID number issued by certain governments to show proof of an exception. |

VAT Controls

Field or Control |

Description |

|---|---|

Calculation Type |

Indicates whether the amount that you enter on a transaction is Inclusive (default value) of the VAT or Exclusive. If Exclusive is selected, the system calculates the VAT charge and adds it to the transaction amount. However, if the calculation type is Exclusive, and if you change the VAT amount on the detail transaction, the system changes the transaction amount according to the calculation type. The system retrieves the field value using the VAT default hierarchy, but you can override it. |

Rounding Rule |

Specify the rule you want to use:

The VAT rounding rule you specify affects the currency numbers stored in the database as well as how currency numbers print on the reports. The VAT rounding rule affects only VAT amounts. |

Allocate Non-Recoverable VAT |

If selected, indicates that the system allocates nonrecoverable VAT using ChartField Inheritance logic. |

Prorate Non-Recoverable VAT |

If selected, indicates that the system records nonrecoverable VAT to an expense account. |

Use Type |

Defaults from the VAT defaulting hierarchy. You can override the values in this field. The field is mandatory when Applicability is set to Taxable. |

Recovery Source |

Options specified on the VAT Default Setup page at the business unit level determine if you can edit this field.

|

Rebate Source |

Options specified on the VAT Default Setup page at the business unit level determine if you can edit this field.

|

VAT Treatments

Field or Control |

Description |

|---|---|

Place of Supply Country |

Displays the country that is the supplier of record for the service. |

State |

Select a state within the defined Place of Supply Country. If the Place of Supply Country tracks VAT by state, then VAT default values may be defined at the state level. |

Treatment |

VAT treatment determines which default values should be applied, and also controls, to some extent, the availability of some VAT-related fields. See VAT Defaults. Select from the following:

|

VAT Details

Field or Control |

Description |

|---|---|

Applicability |

Displays a default value derived from the accounting template. You can override the values in this field. See Taxable Status and VAT Rates.

|

VAT Code |

Displays the default value derived from the appropriate VAT defaulting hierarchy depending on the defined Treatment and/or defined Applicability. You can override the values in this field. When you click the Recalculate button, the system uses the VAT defaulting hierarchy to update fields in the Calculations group box. |

Record Output |

The default comes from the accounting template. You can edit this field. Select this option to record and report one or more types of output VAT (Output, Output Intermediate, Output for Purchases) on transactions containing this VAT driver value. |

Transaction Type |

Displays the assigned VAT transaction type. VAT transaction types classify and categorize transactions at a more detailed level for both VAT reporting and accounting. |

See VAT Reporting and Accounting.

Adjust or Reset VAT Defaults

Adjusting or resetting VAT defaults will only affect the fields within this VAT Defaults group box:

Adjust Affected VAT Defaults

If you changed any fields on this page, these changes may impact VAT defaults on this page. For accuracy and consistency, click this button if you want the system to adjust the VAT defaults that are affected by your changes. All changes you have made to VAT Defaults on this page that affect other VAT Defaults on this page will be retained.

Click the i (information) button to list the fields that will be adjusted.

Note: PeopleSoft recommends that you always click the Adjust Affected VAT Defaults button after changing any defaults on the VAT page.

Levels

The levels affected when you click the Reset All VAT Defaults button may be different depending the application you are working with and the type of VAT page you are working on.

Select the level:

All lower levels

Select this field value to reset all VAT defaults at lower levels for this page.

Note: Reset completely redetermines the VAT defaults. This does not necessarily mean they will be reset to their original values. For example, the user may not have changed any VAT default values, but if a VAT driver field was changed, pressing Reset will redetermine all defaults based on the new driver value.

This and all lower levels

Select this field value to reset all VAT defaults on this VAT page and at any lower levels of this page.

This level only

Select this field value to reset all VAT defaults on this VAT page.

Reset All VAT Defaults

Click this button if you want the system to reset the VAT defaults based the Levels value you selected. Any changes you have previously made to VAT defaults will be lost.

VAT Calculations

Except for Entered Amount, all fields in this section are display only and the Recalculate function populates them.

Field or Control |

Description |

|---|---|

Basis Amount |

Displays the VAT basis amount in transaction currency. |

Basis Amount Base |

Displays the VAT basis amount in the base currency. |

Tax Rate |

Displays the VAT tax rate. |

Calculated Amount |

Displays the calculated VAT amount in the transaction currency. |

Calculated Amount Base |

Displays the calculated VAT amount in base currency. The system uses the transaction currency for the entered VAT amount, based on the exchange rate that is applicable to the transaction. |

Override VAT Amount |

Enter the override amount to recalculate the VAT amount. This amount displays in the transaction currency. |

Override VAT Amount |

Displays the recalculated override VAT amount in the base currency. |

Recorded Amount |

Displays the transaction currency amount stored in the system VAT tables. |

Recorded Amount Base |

Displays the base currency amount stored in the system VAT tables. |

Recovery Percent |

Displays a system-calculated value, based on the selected Use Type. |

Rebate Percent |

Displays a system-calculated value, based on the selected VAT Use Type. |

Recovery Amount |

Displays the VAT recovery amount in the transaction currency. |

Recovery Amount Base |

Displays the VAT recovery amount in the base currency |

Rebate Amount |

Displays the calculated VAT rebate amount in the transaction currency. |

Rebate Amount Base |

Displays the calculated VAT rebate amount in the base currency. |

See VAT Recoverability.