Reevaluating Deals Analytics

This topic describes how to define the parameters for deal analysis.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

MTM_DEALVAL_PNL |

Set up analytics for the deal. Override the analysis results by manually entering values. View a history of values that were created during the lifetime of the deal. See also Understanding Fair Value Accounting. |

|

|

Deal Risk Measures Page |

MTM_DEAL_RSK_SEC |

View the various types risk metrics for the deal. |

Mark to market accounting entry is utilized to reflect the current market value of securities, equities, or investments. The unrealized gain or loss on the mark to market event can be determined as these values:

Per Period Fair Value - The difference between the prior recorded market value and the current market value.

Cumulative Fair Value - The difference between the original cost and the current market value.

The choice of fair value adjustment type (Per Period Fair Value or Cumulative Fair Value) can be configured in the Instrument Analytics component.

Mark to market accounting for securities, equities, or investments can be calculated daily or at different intervals. In addition, you can initiate multiple runs of mark to market accounting to capture late price adjustments that are not captured in the previous run or undo a mark to market adjustment in the Deal Analytics component.

Mark to market gain or loss is calculated and captured for each individual deal through the Mark to Market accounting event configured on the associated instrument type. A mark to market accounting event is created when a new fair value adjustment is processed through:

the Deal Analytics component,

the Equity Valuation process, or

the Security Mark to Market process.

Loss on Mark to Market values can be calculated and accounted separately from gain on Mark to Market values by configuring Amount Calc Types 09G and 09L on the Mark to Market Accounting Templates. Treasury Accounting processing uses the accounting reversal program to reverse the cumulative fair value accounting entries generated during the previous process instance. The user can also manually reverse a cumulative fair value accounting entry.

Mark to Market adjustments in the Deal Analytics component can be reviewed on the Event Log page.

Setting Up Deals for Fair Value Accounting

Before you can create fair value accounting adjustment entries, you must set up the following:

Create an Accounting Template with Amount Calc Types 09G and/or 09L to create Mark to Market accounting lines on the Accounting Templates page ().

Configure the Instrument Type to process the Mark to Market Accounting Event in the Define Instruments component ().

Associate the fair value adjustment type with the instrument on the Instrument Analytics page (). The following fair value adjustment types are currently available:

Cumulative Amortized Cost

Cumulative Fair Value

Per Period Fair Value

Create a securities deal, an equities deal, or an investment deal.

For a securities deal: Enter security market values manually or import security market values.

For an equities deal: Enter equity market values manually or import equity market values.

Enter the market value for the deal on the Deal Analytics page.

Use the Deal Analytics page (MTM_DEALVAL_PNL) to set up analytics for the deal.

Navigation:

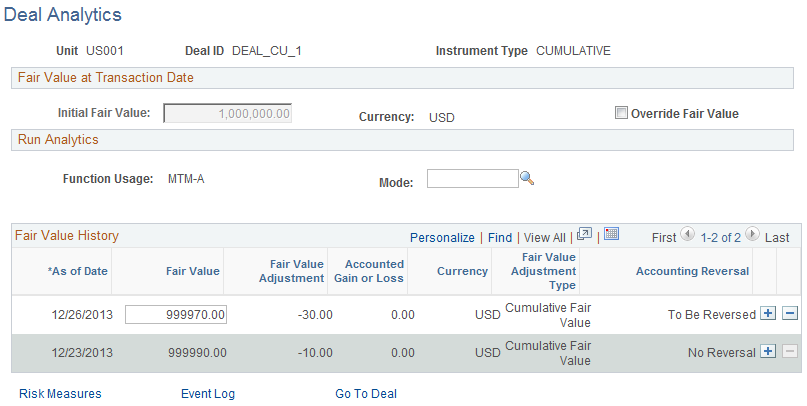

This example illustrates the fields and controls on the Deal Analytics page, using an instrument type to calculate cumulative MTM.

Analytic functions based on the instrument type can also be set on a specific deal to track the effects of various types of market risk against the deal's fair value.

Field or Control |

Description |

|---|---|

Initial Fair Value |

Displays the deal value as defined on the Deal Detail page (). |

Override Fair Value |

Select to override the initial fair value amount. |

Function Usage |

Displays the function usage, which is limited to a Mark to Market Adjustment. In the future, this field can be enabled to process function usages from third-party systems. |

Mode |

Represents a more granular method by which to establish diverse analytics function usages. |

Risk Measures |

Click this link to display values of risk measures calculated by analytic functions. |

Event Log |

Click this link to open the Event Log page, where you can review the details of events recorded on the deal. |

Fair Value History

Note: When you manually add a row to the Fair Value History grid, you should always click the Add button for the maximum As of Date row.

Field or Control |

Description |

|---|---|

As of Date |

Enter a date for the fair value. |

Fair Value |

Enter the market value as of the indicated date. |

Fair Value Adjustment |

Displays the system-calculated fair value adjustment. |

Accounted Gain or Loss |

Displays the accounted value that has been updated by the Treasury Accounting process. |

Currency |

Displays the currency used in the deal. |

Fair Value Adjustment Type |

Displays the fair value adjustment type associated with the deal, as defined on the Instrument Analytics page. |

Accounting Reversal |

Displays the status of the accounting reversal. |

|

Click the Delete Row icon to delete a mark to market adjustment only for the maximum dated row. If an accounting entry has already been created for that row, then the system schedules a reversal of the accounting entry at the end upon saving. You can delete only one row at a time. |

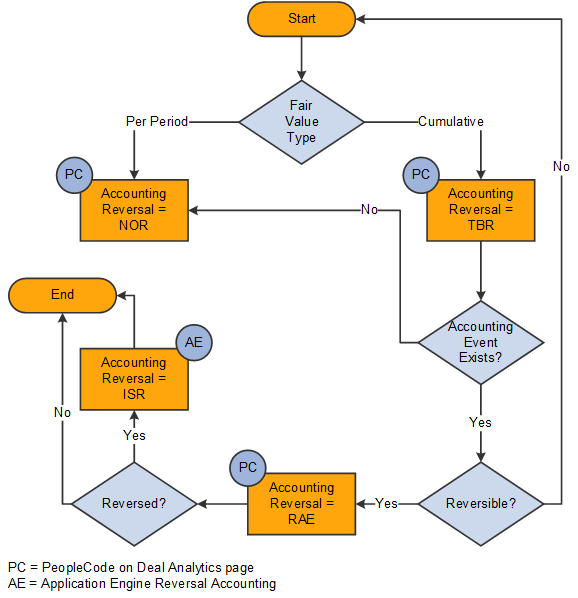

The diagram here illustrates the Mark to Market (MTM) Accounting process on the Deal Analytics page.

This diagram shows how the system updates the accounting reversal flag for mark to market adjustments.

The system populates the Accounting Reversal field programmatically through code associated with the Deal Analytics component and the Reversal Accounting process. The following values in the Accounting Reversal field identify fair value adjustment rows that should be reversed or not:

No Reversal: The system uses NOR to identify all fair value adjustment rows that do not require reversal or no accounting event.

To Be Reversed: The system uses TBR to identify all cumulative fair value adjustment rows that will be reversed in future.

Reverse Accounting Entry: The system uses RAE to identify all cumulative fair value adjustment rows that have to be reversed in the next Reversal cycle.

Is Reversed: The system uses ISR to identify all cumulative fair value adjustment rows that have already been reversed.