Setting Up Risk Analytics

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

MTM_STRUCTDEFN_PNL |

Define the analytic structures that your organization uses when assigning valuation parameters. |

|

|

MTM_SQLCNTRL_PNL |

Assign SQL statements to retrieve the discrete deal and market rate information. PeopleSoft tables store this data. |

|

|

MTM_PRODNM_PNL |

Enter general information about third-party analytics suppliers. |

|

|

MTM_PARMNM_PNL |

Establish parameters used by functions associated with a specific supplier. |

|

|

MTM_FUNC_HDR_EXL_P |

Map your analytics to Microsoft Excel formatting. |

|

|

MTM_FUNC_DFN_EXL_P |

Assign parameters to the Microsoft Excel-based analytics. |

|

|

MTM_FUNC_HDR_COM_P |

Set up analytics using the Component Object Model (COM) format. |

|

|

MTM_FUNC_DFN_COM_P |

Assign parameters to COM-based analytics. |

|

|

Analytic Functions (File Exp) Page |

MTM_FUNC_HDR_FSI_P |

Set up analytics using file export. This method uses analytic functions provided by third-party tools. If you specified an interface method of File Export for either supplier, you can add extra functions to apply to the same or different parameters, thereby increasing the complexity of analysis. |

|

Analytic Functions (File Exp) - Parameters Page |

MTM_FUNC_DFN_FSI_P |

Assign parameters to the analytic functions using file export. |

|

Analytic Calculations - Program Page |

MTM_PROGRAM_DEFN |

Create arithmetical functions to identify and measure risk as well as conduct macroeconomic analyses. For example, you can create what-if cases for which interest rate changes cause variations in demand. |

|

MTM_PROG_STEPS |

Establish instrument to analytic program mapping. |

|

|

MTM_PROG_FUNC_DETL |

Establish evaluation type values for functions. |

|

|

INSTR_MTMDEFN_PNL |

Map analytic functions to specific instrument types. |

To define risk analytics, use the following components:

Instrument Analytics (INSTR_MTMDEFN_PNL_GBL).

Analytic Calculations (MTM_PROGRAM_DEFN_GBL).

Analytic Functions (COM) (MTM_FUNC_HDR_COM_GBL).

Analytic Functions (Excel) (MTM_FUNC_HDR_EXL_GBL).

Analytic Functions (File Exp) (MTM_FUNC_HDR_FLE_GBL).

Analytic SQL (MTM_SQLCNTRL_PNL_GBL).

Analytic Structures (MTM_STRUCTDEFN_PNL_GBL).

Supplier Information (MTM_PRODNM_PNL_GBL).

Supplier Parameters (MTM_PARMNM_PNL_GBL).

For information about defining deal analytic functions on the Deal Analytics page, see Reevaluating Deals Analytics.

This flowchart illustrates the setup process for enterprise risk management:

Setup Process for Enterprise Risk Management

The first step to running analytics is establishing the analytic structures' definitions.

By the time you are ready to perform this step, you may have chosen your analytic solution vendor and gone through supplier-specific functional data requirements. Most analytic functions use structured parameters as inputs.

Analytic Parameters

Analytic parameters can range from generic yield curves with a maturity date and corresponding rate as component fields to complex cash flow sets and supplier-specific structures that have more than three fields as components. For example, a yield curve parameter that is being passed to a function could look like this:

|

Date |

Rate |

|---|---|

|

March 10, 2004 |

5.60000% |

|

March 11, 2004 |

5.60043% |

|

April 11, 2004 |

5.60210% |

|

July 11, 2004 |

5.60800% |

|

March 10, 2005 |

5.61000% |

|

March 10, 2006 |

5.80000% |

|

March 10, 2007 |

6.30000% |

Analytic Structures

To enable the use of such a parameter, we define it as a structure. Structures enable the definition of complex parameters required by the analytic solution functions in a specific format. PeopleSoft tables store the application and market data as normal fields and not as structures. This step enables you to combine the simple data types stored in the PeopleSoft rate tables and to build the complex data structures required by the analytic supplier that you specify.

In a later step, you can use SQL statements to retrieve complex data parameters from the application tables and incorporate these parameters into their respective functions.

Interface Methods

Set up parameters for communicating with third-party analytics using one of three methods:

Microsoft Excel.

Component Object Model (COM).

Flat File Export.

Field or Control |

Description |

|---|---|

Sequence |

Displays the numerical order in which a process runs. |

Character |

Enter an alphanumeric character. |

Structure |

Enter a predefined analytic structure. |

Data Type |

Select from Character, Date, or Number. The data type corresponds to the value of the characters in the data tables. |

MTM Func Comments (mark-to-market function comments) |

Enter comments about parameters, any limitations or exceptions to these parameters, and general comments about functions. |

Use the Define Structures page (MTM_STRUCTDEFN_PNL) to define the analytic structures that your organization uses when assigning valuation parameters.

Navigation:

This example illustrates the fields and controls on the Define Structures page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Field Name |

Displays the name associated with the data field extracted from the market rate or deal data tables. |

Data Type |

Corresponds to the value of the characters in the data tables. |

Use the Analytic SQL page (MTM_SQLCNTRL_PNL) to assign SQL statements to retrieve the discrete deal and market rate information.

PeopleSoft tables store these data.

Navigation:

This example illustrates the fields and controls on the Analytic SQL page. You can find definitions for the fields and controls later on this page.

You need to retrieve specific parameters from the deal and forward these parameters to the analytic function to use the analytic functions. Risk Management delivers a standard set of parameter SQL statements that retrieve the discrete deal and market rate information and store the data in PeopleSoft tables. You can use the SQL statements provided or devise and implement new parameter data, depending on your business requirements.

Field or Control |

Description |

|---|---|

SQL Type |

Select Select from Database if you wish to retrieve data from the database, or select Save to Database if you are saving data using an Update or Insert statement. |

Return Data Type |

This field is available only if you are creating a Select from Database SQL statement. Select a Number, Date, Structure, or Char (character). If you select Structure, the Structure field becomes available. Enter a structure that you defined on the Analytic Structures page. |

SQL Statement |

Displays discrete deal and market rate information. You can view and edit this SQL statement, as necessary. |

Use the Supplier Information page (MTM_PRODNM_PNL) to enter general information about third-party analytics suppliers.

Navigation:

This example illustrates the fields and controls on the Supplier Information page. You can find definitions for the fields and controls later on this page.

This table describes the Interface methods:

|

Interface Method |

Description |

Conditions |

|---|---|---|

|

COM (Component Object Model) |

Creates objects that can be accessed and used by another COM-compliant application. Uses analytic functions provided by third-party tools. |

Selecting this option disables the Valuation Method, Workbook Required, and EDI Staging Table fields. |

|

Excel Add-In |

Calculates analytics for the deal using third-party Microsoft Excel calculations. |

Selecting this option enables the Valuation Method and Workbook Required fields and disables the EDI Staging Table field. Select a valuation method of either Function or Macro, and select the Workbook Required check box, if applicable. The options you set depend upon the third-party vendor that you are using. |

|

File Format |

Provides a staging table location for deal attributes. Risk Management stores the attributes in a staging table and exports them in a flat file. Uses analytic functions provided by third-party tools. |

Selecting this option disables Valuation Method and Workbook Required fields and enables the EDI Staging Table field. Identify the location of the EDI staging table where you plan to store the deal data for export. |

Field or Control |

Description |

|---|---|

EDI Staging Table |

Used when the File Format Interface method is selected. This is the staging table used to store deal attributes that are to be used to create the file to be exported. |

Valuation Method |

Used when the Excel Add-In Interface method is selected. Directs the system to either call a specified Macro or built-in Excel function. |

File Path |

The directory where an exported file will be placed. |

Fields in the Contact Information group box are optional.

Use the Supplier Parameters page (MTM_PARMNM_PNL) to establish parameters used by functions associated with a specific supplier.

Navigation:

This example illustrates the fields and controls on the Supplier Parameters page. You can find definitions for the fields and controls later on this page.

The field attributes for this page vary depending on the values you select in the Data Type and Evaluation Type fields. Use this table as a guide:

|

Data Type |

Evaluation Type |

Available Fields |

|---|---|---|

|

Character |

Use Constant. |

Constant |

|

(blank) |

Use SQL. |

Analytic SQL ID, Translate Y/N |

|

Date |

Use Constant. |

Constant |

|

(blank) |

Use SQL. |

Analytic SQL ID |

|

Number |

Use Constant. |

Constant |

|

(blank) |

Use SQL. |

Analytic SQL ID, Translate Y/N |

|

Structure |

If you select Structure as the data type, you cannot select an evaluation type. |

Structure, Analytic SQL ID |

Field or Control |

Description |

|---|---|

Use SQL |

Select SQL statements in the Analytic SQL ID field from those provided by Risk Management or additional statements that you created. |

Use Constant |

Select a value in the Constant field. You can use a constant value not associated with PeopleSoft tables, or use the same value for all deals regardless of the instrument type or any other conditions. |

Translate Y/N (translate yes/no) |

Select to enable the Parameter Value X-Ref group box, which provides a field for PeopleSoft- and Supplier-specific entries. Enter information specific to Risk Management in the PeopleSoft field and information provided from the third-party supplier in the Supplier field. For example, PeopleSoft tables store an option Buy or Sell as a Purchase (P) or Write (W) XLAT value. Supplier "X" wants to see and use the values as a Buy (B) or Sell (S). The PeopleSoft system translates the stored values (P) or (W) to Supplier "X" accepted values of (B) or (S). |

File Export Field |

Enter the mapping sequence used to map the parameter to a specific field in the staging table for file exports. This field is available only if you select a supplier with File Format as the interface method on the Supplier Information page. |

Use the Analytic Functions (Excel) page (MTM_FUNC_HDR_EXL_P) to map your analytics to Microsoft Excel formatting.

Navigation:

This example illustrates the fields and controls on the Analytic Functions (Excel) page. You can find definitions for the fields and controls later on this page.

If you specified an interface method of Excel Add-In for a vendor, you can add extra functions to apply to the same or different parameters, thereby increasing the complexity of analysis.

Field or Control |

Description |

|---|---|

Return Data Type |

Select Number, Date, Structure, or Char (character). If you select Structure, the Structure field becomes available. Enter a structure that you defined on the Analytic Structures page. |

Addin |

Select to incorporate an add-in to the Microsoft Excel third-party analytics. If you selected Macro on the Vendor Information page, complete the Workbook and Worksheet fields. Enter the value of the Cell Location field (on the Analytic Functions (Excel) - Parameters page) in the Output Range field. |

Use the Analytic Functions (Excel) - Parameters page (MTM_FUNC_DFN_EXL_P) to assign parameters to the Microsoft Excel-based analytics.

Navigation:

Select the Parameters tab on the Analytic Functions (Excel) page.

This example illustrates the fields and controls on the Analytic Functions (Excel) - Parameters page. You can find definitions for the fields and controls later on this page.

Each third-party analytic function requires parameters to calculate an analytic value for a deal. Suppliers provide functions, and the PeopleSoft system uses the deal attributes stored in tables as parameters.

Specifying Function Calls

Field or Control |

Description |

|---|---|

Function Call |

If a supplier uses functions, you must concatenate &P with the sequential parameter number by separating each parameter with a comma in the Function Call field. The function call expands into a Microsoft Excel-compatible function call when you save. For example, if the function call is Func (&P1, &P2, &P3), the values in the Cell Range field for these parameters are C1, C2, and C3. Internally, this cell range converts into Func (R1C3:R1C3, R2C3:R2C3, R3C3:R3C3). This field is hidden, and Microsoft Excel uses it. The length of the field is equivalent to the maximum permissible character limit allowed for a Microsoft Excel cell (254 characters). |

Cell Location |

Displays the output sheet name. Enter this value in the Output Range field on the Analytic Functions (Excel) page. |

Mapping Parameters

Field or Control |

Description |

|---|---|

Parameter Name |

Select a parameter name value associated with the specified function. |

Required |

Indicates those function parameters that are required. Certain third-party vendor applications fail if you do not export specific required function parameters to their application. |

Absolute |

Select to convert a signed numeric value to an absolute numeric value. |

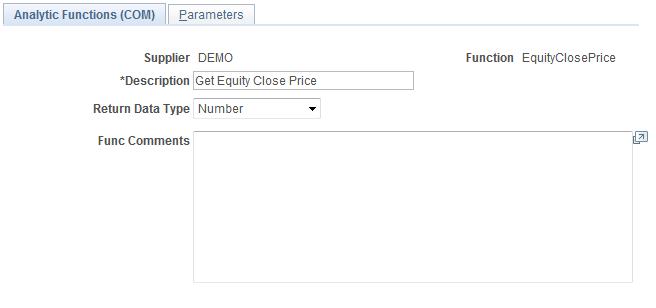

Use the Analytic Functions (COM) page (MTM_FUNC_HDR_COM_P) to set up analytics using the Component Object Model (COM) format.

Navigation:

This example illustrates the fields and controls on the Analytic Functions (COM) page. You can find definitions for the fields and controls later on this page.

This method uses analytic functions provided by third-party tools. If you specified a COM interface method, you can add extra functions to apply to the same or different parameters, thereby increasing the complexity of analysis.

Field or Control |

Description |

|---|---|

Return Data Type |

Select Number, Date, Structure, or Char (character). If you select Structure, the Structure field becomes available. Enter a structure that you defined on the Analytic Structures page. |

Use the Analytic Functions (COM) - Parameters page (MTM_FUNC_DFN_COM_P) to assign parameters to COM-based analytics.

Navigation:

Select the Parameters tab on the Analytics Using COM page.

This example illustrates the fields and controls on the Analytic Functions (COM) - Parameters page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Object Name |

Enter the component object model name. |

Method/Property |

Specify whether to call a method, set or get a property. If you select Get Property or Set Property, enter the Property name. If you select Method, enter the Method name. |

Use the Analytic Calculations - Steps page (MTM_PROG_STEPS) to establish instrument to analytic program mapping.

Navigation:

This example illustrates the fields and controls on the Analytic Calculations - Steps page. You can find definitions for the fields and controls later on this page.

This page enables you to further define analytic rules for a specific supplier using existing predefined calculations. You can create relationships between mathematical operands using mathematical operators. To do this:

Define the step number.

Define the variable.

Variables symbolically refer to figures, which must be generated through calculations. Use of variables improves system performance when rendering complex mathematical operations. The available mathematical operations that you can symbolize through variables are determined by the operands that you select.

Select an operand type.

Operands are the components of mathematical operations. There are four types of operands:

Constant: Brings a particular figure into the formulations.

Function: Runs provided functions, such as executing valuation models or setting up yield curves.

The Function operand can be used only as the first operand, the primary mathematical process, which is then adjusted by given quantities. Selecting Function as an operand activates the Parameter link, which enables you to edit a provided function according to your business needs.

SQL: Uses SQL.

Variable: Uses a specified variable.

Define an operator.

Operators refer to the symbols of mathematical relationships linking operands. In addition to the four standard math operators (+ = Add, - = Subtract, x = Multiply, / = Divide), five additional operators are provided:

Log: Any base logs.

Exp: Enables you to calculate discount rates.

Min: Lowest operand.

Max: Creates operand.

Return: Enables you to make the result of that step to return to the underlying calculation (PeopleCode) for further use.

Define an operand value.

Select the Save check box to store that step's data as temporary data in a table.

Use the Program Function Details page (MTM_PROG_FUNC_DETL) to establish evaluation type values for functions.

Navigation:

Click the Function Details/Parameters link on the Analytic Calculations - Steps page.

This example illustrates the fields and controls on the Program Function Details page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Evaluation Type |

You can edit the evaluation type of a function's sub-function parameters, according to your business needs.

|

Use the Instrument Analytics page (INSTR_MTMDEFN_PNL) to map analytic functions to specific instrument types.

Navigation:

This example illustrates the fields and controls on the Instrument Analytics page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Fair Value Adjustment Type |

Select the fair value adjustment type to be used for each instrument type. Values are:

If the instrument requires a cumulative fair value adjustment, the system determines whether accounting reversals are needed for rows that have an associated accounting event. For more information, see Reevaluating Deals Analytics and Understanding Reverse Accounting. |

VaR Export SQL |

This is the SQL used to generate the VaR export file. The results of the SQL are used to create a comma delimited file to be used by the VaR process to calculate VaR. |

Details

Field or Control |

Description |

|---|---|

Function Usage |

Select the function usage for this instrument. If you have more than one function sequence, the sequences must be from the same vendor. Select from the following: Convexity: Represents the amount that an instrument's price sensitivity differs from that implied by the instrument's duration. Mathematically, it is the second derivative of price with respect to yield. For a bond, it measures the curvature of the price/yield relationship of a bond's cash flows. Credit Risk: Describes the credit risk associated with an instrument. Delta: Describes an option premium's sensitivity to changes in the price of the underlying asset. It is the amount of the underlying necessary to hedge small changes in the option price for small movements. Duration: Represents the average life of the present values of future cash flows from an instrument. Mathematically, it is the first derivative of price with respect to yield. File Export: Processes deal attributes into a flat file for use by third-party applications. If you select File Export, the fields in the Rate/Index Type group box are unavailable. MTM (mark-to-market): Calculates the value of the financial instrument based on the current market price of the underlying asset. MTM-A (mark-to-market accounting): Calculates the clean value of the financial instrument based on the current market price of the underlying asset for accounting purposes. This value does not contain any accrued interest. Pricing: Values an instrument to observe and analyzes its worth. This may or may not involve using current market prices. Market Risk: Analyzes the impact of changes in market conditions on the firm. Operational Risk: Measures the risk arising out of operational conditions and human interaction. Other: Indicates any other type of risk; for example, legal, political, and so on. |

Calculation |

Specify an analytic calculation. |

Rate/Index Type

Field or Control |

Description |

|---|---|

Data Purpose |

Select Cmdty (commodity), Credit, FX (foreign exchange), Other, Price, VO (volatility), or Yield. |

Market Rate Index and Rate Type |

Specify options for these fields to dictate the mapping of market rates to the instrument types. |