Viewing and Modifying Interest and Payment Details

This topic provides overviews of modifications you can make to deal interest and payments and discusses how to adjust margins, apply manual rates, and add or delete paydowns or drawdowns.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TRX_INTEREST_TR |

View and modify detailed information about interest and payment dates. Adjust margins on floating-rate deals, update rates and interest amounts, and add or delete paydowns or drawdowns. |

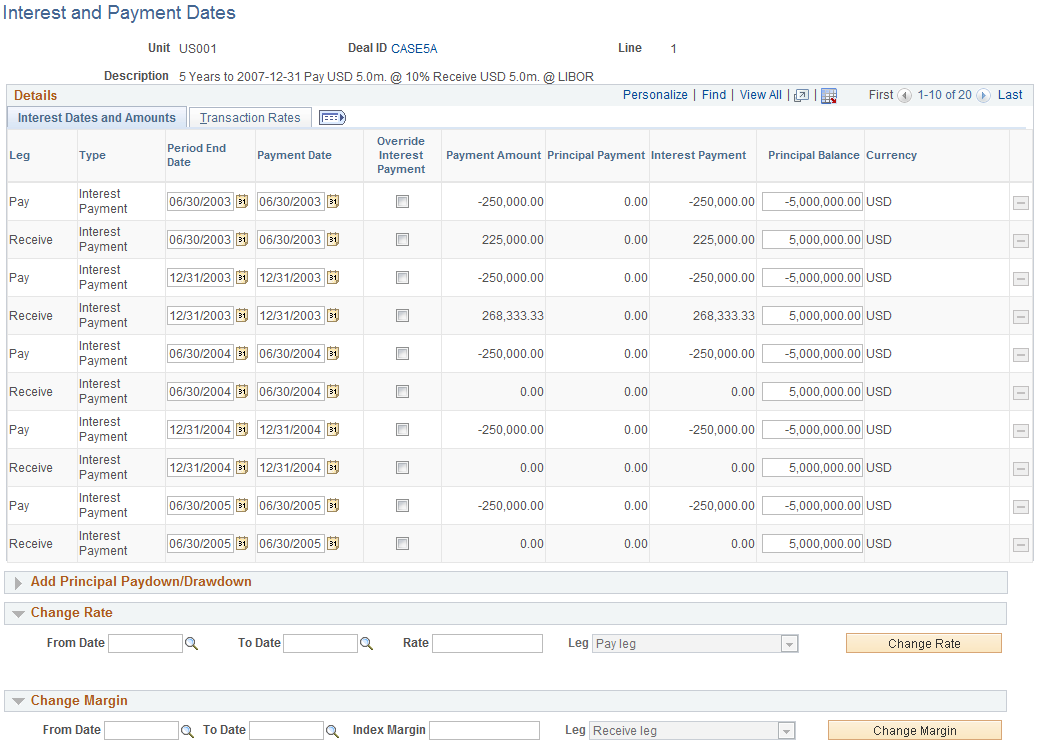

Use the Interest and Payment Dates page (TRX_INTEREST_TR) to view and modify detailed information about interest and payment dates.

Adjust margins on floating-rate deals, update rates and interest amounts, and add or delete paydowns or drawdowns.

Navigation:

Click the Interest Dateslink on the Deal Detail page.

This example illustrates the fields and controls on the Interest and Payment Dates page - Interest Dates and Payments tab for a fixed-rate deal. You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Interest and Payment Dates page - Transaction Rates tab for a fixed-rate deal. You can find definitions for the fields and controls later on this page.

If the deal is unlocked and you attempt to edit the existing fields to add principal or apply reset rates, you will receive a message indicating that making a change will lock this deal. After the deal is locked, you cannot change your selections on the Deal Details page. For IRP and IR swap deals, you can review and modify interest payment dates, amounts, and reset dates on the Interest and Payment Dates page. If the deal is amortized, this page shows the amortization schedule.

Initially, all the details on the Interest and Payment Dates page are system-generated. Use this page to view and manage interest information for a specific deal. The types of changes you can make depend on the type of deal and whether payments have been already paid, reconciled, or accounted for.

Field or Control |

Description |

|---|---|

Period End Date |

Displays period end date for each coupon period calculated based on deal parameters. |

Principal Balance |

Displays the principal balance amount calculated based on parameters selected on the deal. |

Dates and Amounts Tab

Field or Control |

Description |

|---|---|

Payment Date |

Displays scheduled payment dates for the life of the deal, calculated based on values selected on the deal. |

Payment Amount |

Displays scheduled payment amounts for the life of the deal, calculated based on values selected on the deal. |

Principal Payment |

Displays the total principal amount outstanding on the deal. Principal balance will include the original amount of the deal, any adjustments made to the deal amount, and any interest capitalized on the deal. |

Interest Payment |

Displays the interest amount calculated as a percentage of the principal amount of the deal. |

Override Interest Payment |

Select to override the calculated interest. When you select the Override Interest Payment check box, the Payment Amount field is editable. When you update the Payment Amount field, the system will adjust the interest calculated amount as well as the payment amount. |

Currency |

Displays the currency entered on the deals page. |

Transaction Rates Tab

Field or Control |

Description |

|---|---|

Rate Set |

The Rate Set check box is automatically selected for interest periods for which the rate is set. Set rates exist for all interest periods for fixed legs. You set reset rates for floating legs as you reach reset dates. When you reach floating-leg reset dates, select the Rate Set check box, enter the rate, and click Save. The system uses the rate to calculate a payment or receipt amount. If the cash flow is Firm, an accounting event is generated if you select Rate Set. If the cash flow is Provisional and the Reset Rate Set check box on the Reset Rates page is deselected, no accounting event is generated if you deselect Rate Set. These attributes will change only after the real rate comes in from the market. Accounting payments will all occur only after the real rate is set. Note: The Rate Set check box may not be available for a deal, depending on the setting that you have specified with the Allow Fixed Rate Change check box at the instrument level. |

Reset Date |

The date that interest rate is reset. This is available for IR swap deals and IRP floating-rate deals only. |

Rate from Source |

Initially, the Rate populated on the Deal Detail page is defaulted to all interest periods in the future. Modify the rate from source as applicable. The system uses the rate to calculate a payment or receipt amount. |

Index Margin |

For interest calculations, the index margin is the value that is added to the Rate from Source, or the value by which the Rate from Source is multiplied. You can override the margin for one or more interest periods. |

Rate |

This field shows the adjusted interest rate inclusive of the margin. |

This section discusses viewing and editing margins. You can view the interest rate for a period without the margin applied, view and adjust the margin applied to each interest period, and adjust the index margin for one or more interest periods.

When you save margin adjustments, the margin is used to recalculate interest payments for the affected interest period(s).

Note: The information in this section is relevant only for floating-rate IRP and IR swap deals.

Changing Margins on IRP Floating-Rate Deals

Use the Interest and Payment Dates page (TRX_INTEREST_TR) to change margins for a floating-rate IRP deal.

Navigation:

This example illustrates the fields and controls on the Interest and Payment Dates page - Interest Dates and Payments tab for a floating-rate deal.

This example illustrates the fields and controls on the Interest and Payment Dates page - Transaction Rates tab for a floating-rate deal.

Field or Control |

Description |

|---|---|

Change Margin |

Use this section to override the margin for one or more interest periods. Enter a range of dates and the desired index margin. Click the Change Margin button to recalculate interest payments for the interest periods within the designated range of dates. The recalculated values appear on the Interest and Payment Dates page as well as on the cashflows detail page. |

Modifying Margins on IR Swap Deals with Floating-Rate Legs

Use the Interest and Payment Dates page (TRX_INTEREST_TR) to modify margins on IR Swap deals with floating-rate legs.

Navigation:

This example illustrates the fields and controls on the Interest and Payment Dates page - Interest Dates and Amounts tab for an IR swap deal.

This example illustrates the fields and controls on the Interest and Payment Dates page - Transaction Rates tab for an IR swap deal.

Field or Control |

Description |

|---|---|

Change Margin |

Use this section to override the margin for one or more interest periods. Enter a range of dates and the desired index margin. For an IR swap deal, select the pay or receive leg, if required. Click the Change Margin button to recalculate interest payments for the interest periods within the designated range of dates. The recalculated values appear on the Interest and Payment Dates page as well as on the cashflows detail page. |

Leg |

Displays the pay or receive leg associated with the floating rate type. If both legs are floating, you can pick the leg to which the change margin applies. |

From Date |

Select the earliest date to which the change margin should apply. |

To Date |

Select the last date to which the change margin should apply. |

This section discusses how to specify Rate from Source. You can update the Rate from Source for a fixed-rate deal, a floating-rate deal, or an IR swap deal.

Updating Rates for Fixed-Rate Deals

Use the Interest and Payment Dates page (TRX_INTEREST_TR) to update rates for fixed-rate deals.

You can update rates for fixed-rate deals or legs by editing individual rows on the Transaction Details tab or by using the Change Rate section.

Field or Control |

Description |

|---|---|

Change Rate |

Use this section to update the rate for one or more interest periods. After you enter a rate and specify a range of periods, the system applies the new rate to the chosen range of periods. This functionality is allowed only for instruments that have the Allow Fixed Rate Change check box selected. |

Rate Set and Rate |

Enter a rate. The Rate Set check box is automatically selected for interest periods for which the rate is set. Set rates exist for all interest periods for fixed legs. The system uses the rate to calculate a payment or receipt amount. If the cash flow is Firm, an accounting event is generated if you select Rate Set. If you deselect Rate Set, the cash flow is Provisional, and the Reset Rate Set check box on the Reset Rates page is deselected, no accounting event is generated. These attributes will change only after the real rate comes in from the market. Accounting payments will all occur only after the real rate is set. Note: The Rate Set check box may not be available for a deal, depending on the setting that you have specified with the Allow Fixed Rate Change check box at the instrument level. |

Manually Resetting Rates for Floating-Rate Deals

Use the Interest and Payment Dates page (TRX_INTEREST_TR) to manually reset rates for floating rate deals.

Navigation:

Field or Control |

Description |

|---|---|

Rate Set and Rate |

Enter a rate. The Rate Set check box is automatically deselected for interest periods for which the rate is floating. If the rate is fixed, the Rate Set check box is selected. Set rates exist for all interest periods for fixed legs. You reset rates for floating legs as you reach reset dates. When you reach floating-leg reset dates, select the Rate Set check box, enter the rate, and click Save. The system uses the rate to calculate a payment or receipt amount. If the cash flow is Firm, an accounting event is generated upon selecting the Rate Set check box. If the cash flow is Provisional and the Reset Rate Set check box on the Reset Rates page is deselected, no accounting event is generated if you deselect Rate Set. These attributes will change only after the real rate comes in from the market. Accounting payments will all occur only after the real rate is set. |

Reset Date |

Displays the date on which the floating rate is set or reset; the entered rate calculates the payment amount. You must specify a rate for each interest period. |

This section discusses how to add and delete principal paydowns and drawdowns. You can:

Add multiple paydowns and drawdowns on a single day or on different days.

Change a paydown or drawdown amount.

Delete a paydown or drawdown.

Add a paydown or drawdown before the first interest payment.

Note: Paydowns and drawdowns that have been paid, reconciled, or accounted for cannot be changed.

Adding Multiple Paydowns and Drawdowns

Field or Control |

Description |

|---|---|

Add Principal Paydown/Drawdown |

Use these fields to modify principal information:

The system creates a new row in the Details grid with the payment type you have created. Deal processing recalculates the payment schedule based on the new paydown or drawdown. |

Changing Paydown or Drawdown Amounts on a Fixed-Rate Deal

Use the Interest and Payment Dates page (TRX_INTEREST_TR) to change paydown or drawdown amounts on a fixed-rate deal.

Navigation:

This example illustrates the fields and controls on the Interest and Payment Dates page for fixed-rate, IRP deal—with added Paydown/Drawdown amounts on the Interest Dates and Amounts tab. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Payment Amount |

Enter a paydown or drawdown amount. The Payment Amount field becomes editable for new paydown or drawdown rows. Only rows that have not been paid, reconciled, or accounted for can be modified. You can change the amount for each paydown or drawdown row. Only rows that have not been paid, reconciled, or accounted for can be modified. |

Deleting Paydowns or Drawdowns

Field or Control |

Description |

|---|---|

|

Click to delete the row. The delete icon becomes active for new paydown or drawdown rows. Only rows that have not been paid, reconciled, or accounted for can be deleted. |

Adjusting Principal on Amortized Deals

For amortized deals, the Interest and Payment Dates page displays a comprehensive, payment-information schedule for the method of amortization that is selected in the Amort Method field on the Deal Detail page.

If you select the Constant Payment or Constant Term method of amortization, you can adjust the principal amount and payment date in the Add Principal Paydown/Drawdown section as follows:

In the Payment Type field, select Drawdown or Paydown.

Add the Payment Date.

Enter the amount in the Principal Amount field.

Click the Add Paydown/Drawdown button.

The system creates a new row in the Details grid with the payment type you have created. Deal processing recalculates the payment schedule based on the new paydown or drawdown.

If you select a Factored or Fixed Paydown method, however, you must enter additional values so that the system can correctly calculate the factored or fixed paydown amortization amount.

Fixed Paydown Amortization

If the amortization method is fixed paydown, you can add a paydown/drawdown by percentage or amount.

To enter a fixed paydown value in the Add Principal Paydown/Drawdown section:

Enter a value in the Percentage field or the Principal Amount field.

Add the payment date.

For IR swap deals, select Pay or Receive in the Leg field.

Click the Add Paydown/Drawdown button.

Factored Amortization

To enter a factored value in the Add Principal Paydown/Drawdown section:

In the Payment Type field, select Drawdown or Paydown.

To establish accreting factors, select Drawdown. The system then uses the factor as an accreting (not amortizing) factor.

Enter a value in the Amortizing Factor field.

Add the payment date.

Click the Add Paydown/Drawdown button.