Calculating the Cost of Purchased Components

This section provides an overview of component costs and discusses how to forecast purchase costs.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Cost Types Page |

CE_TYPE |

Define the method that is used to calculate the cost of purchased components. |

|

GEN_ATTRIB_INV |

Enter the current purchase cost. This page displays the item's average purchase price and last price paid. |

|

|

CE_FCST |

Enter forecasted purchase costs. |

The standard cost of all purchased components must be accurate when rolling up the cost of a manufactured item. For standard cost items, the cost type that is entered in the Cost Rollup page determines how these costs are calculated. For actual and average cost items, the cost type is applied through the cost book that is defined at the inventory business unit definition. Select the method of calculating the purchased component's cost on the Purchased Cost Used field of the Cost Types page. Component costs include:

Term |

Definition |

|---|---|

Average Purchase Price |

A weighted average of all purchases of this item that are calculated by the system. |

Current Purchase Cost |

Cost manually entered on the Define Business Unit Item - General: Common page. |

Forecasted Purchase Cost |

Cost manually entered on the Forecasted Purchase Costs page. |

Last Price Paid |

The purchase price recorded with the last receipt of this item. This price appears on the Define Business Unit Item - General: Common page. |

It is possible that the system might not find a purchase cost for a component. For example, if you select the average or last price methods and the purchased item is new with no receipts, then the cost is zero. For items using standard costing, use the Cost Rollup page to select the Use Current Cost When No Price check box to use the current purchase cost whenever the calculated purchase cost is zero. If you select this check box, be sure to enter a value in the Current Purchase Cost field on the Define Business Unit Item - General: Common page.

To define forecasted purchased costs, use the Forecasted Purchase Cost (CE_FCST) component. Use the Forecasted Purchase Rates component interface to load data into the tables for this component.

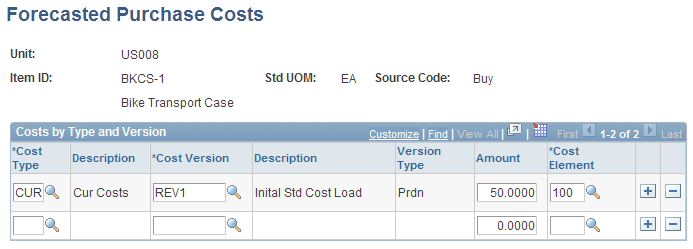

Use the Forecasted Purchase Costs page (CE_FCST) to enter forecasted purchase costs.

Navigation:

This example illustrates the fields and controls on the Forecasted Purchase Costs page. You can find definitions for the fields and controls later on this page.

Use the Forecasted Purchase Costs page to use negotiated prices for the purchased components in the calculation of makeable items. This enables you to perform what-if scenarios or simulations by changing the material cost assumptions for each cost type and version combination. The amount that is entered should be the cost of the item only, exclusive of any freight, duty, or procurement expenses. The cost element that is selected must have a cost category of Material assign on the Cost Elements page.

Field or Control |

Description |

|---|---|

Amount |

Enter the cost of the item only, exclusive of any freight, duty, or procurement expenses. |

Field or Control |

Description |

|---|---|

Cost Element |

Enter a cost element with a cost category of material assign on the Cost Elements page. |

Note: Be sure that the cost type that you enter designates forecasted purchase costs as the purchase cost that is used. If you use forecasted purchase costs, you must define a cost for every purchased item.