Setting Up Limits for Qualified Savings Plans

To set up limits for qualified savings plans, use the Limit Table (LIMIT_TBL) component.

This section provides overviews of limits, lists common elements used in this section, and discusses how to set up limits.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Limit Table |

LIMIT_TBL1 |

Identify the rules that apply to the 401, 402, 403, 415, and 457 limits using the following Limit Table pages: |

Certain qualified benefit savings plans may be subject to government regulations. Limits are tied to deduction codes. When your payroll department runs the pay calculation process, the system checks whether a deduction has any limits associated with it. If it does, the system runs the testing calculations and makes the limit adjustments to every affected employee's records. If a deduction cannot be taken, it is reported with the appropriate reason-not-taken code.

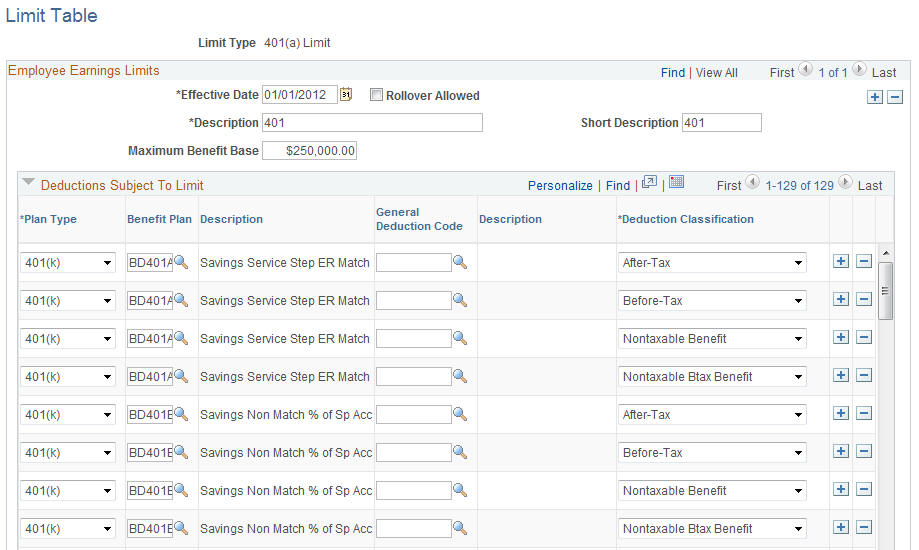

The 401 limit is designed to eliminate the tax advantage that highly compensated employees have by participating in qualified plans. This limit sets up a maximum cap on the employee's annual earnings during the calculation of the employee's contribution. When calculating the employee annual earnings, the system applies the 401 limit against the Special Accumulator field defined on the Savings Plan tables, not on the Special Accumulator field on the Limit Table.

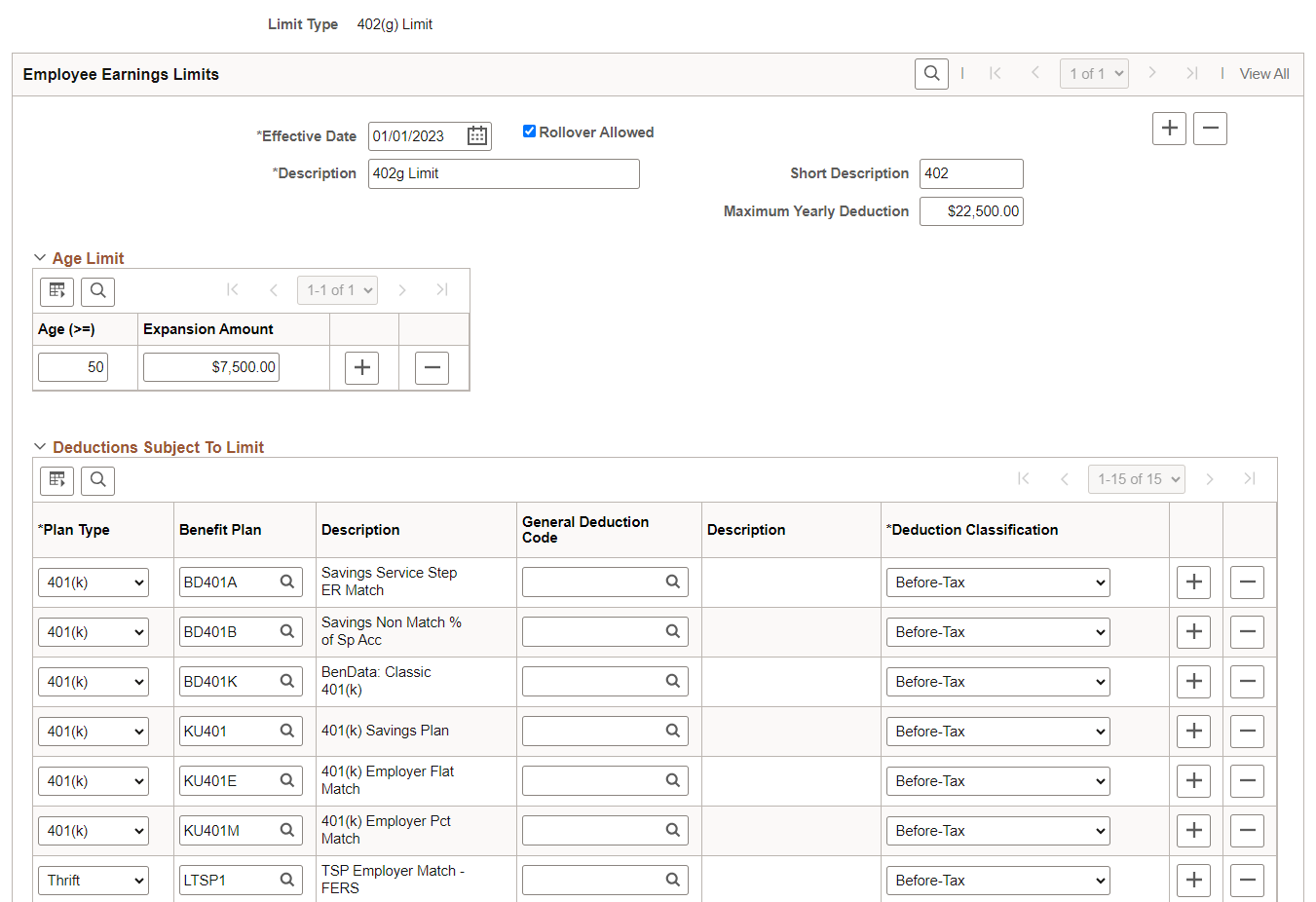

The 402 limit imposes a flat dollar annual limit on the amount an employee can contribute as an elective deferral.

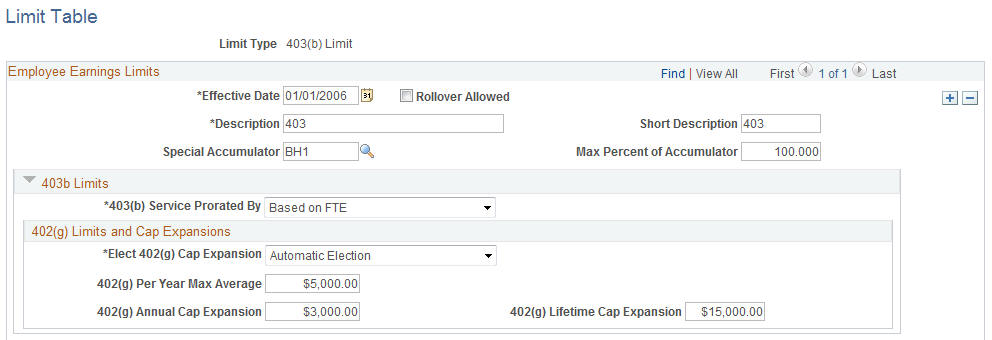

The 403 limit defines the parameters that extend the maximum amount of the elective deferrals that an employee (with 15 or more years of service) in a qualifying organization can contribute to the 403(b) savings plans. In addition to the 403 limit, 403(b) savings plans are also subject to 401, 402, and 415 limits.

To calculate this amount:

Multiply the employee's eligible earnings by 20%.

Multiply the figure by the employee's total years of service.

Subtract the prior year's pretax contributions.

The 415 limit restricts the total amount an employee as well as an employer can contribute to defined savings plans. 401(k) plans are the most common type of defined savings plans to fall under Section 415, but other types include profit-sharing, money purchase pensions, stock bonuses, thrift savings, and target benefit plans.

Employee year-to-date contributions cannot exceed either of the following amounts:

A specific percentage amount of the employee's eligible earnings.

A specific flat annual amount.

If, for a given payroll, the employee's and employer's contribution exceeds the limits, the contribution must be reduced to fall within the limits. Use an other common ID when you need to keep your companies separate for tax purposes but need to maintain accurate current employee balances across companies for calculating Section 415 limits.

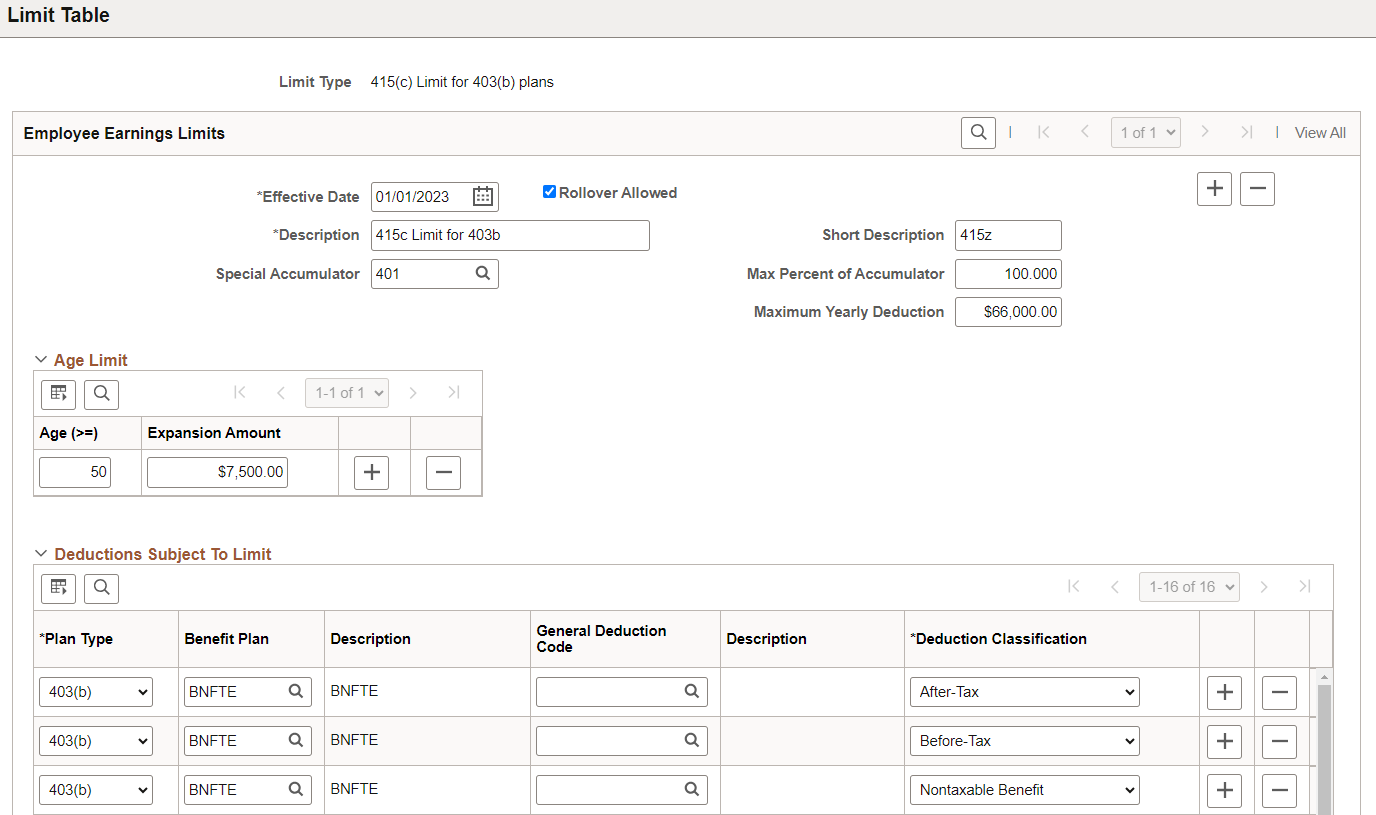

This is identical to the 415 limit with the exception that it applies to 403(b) plans only.

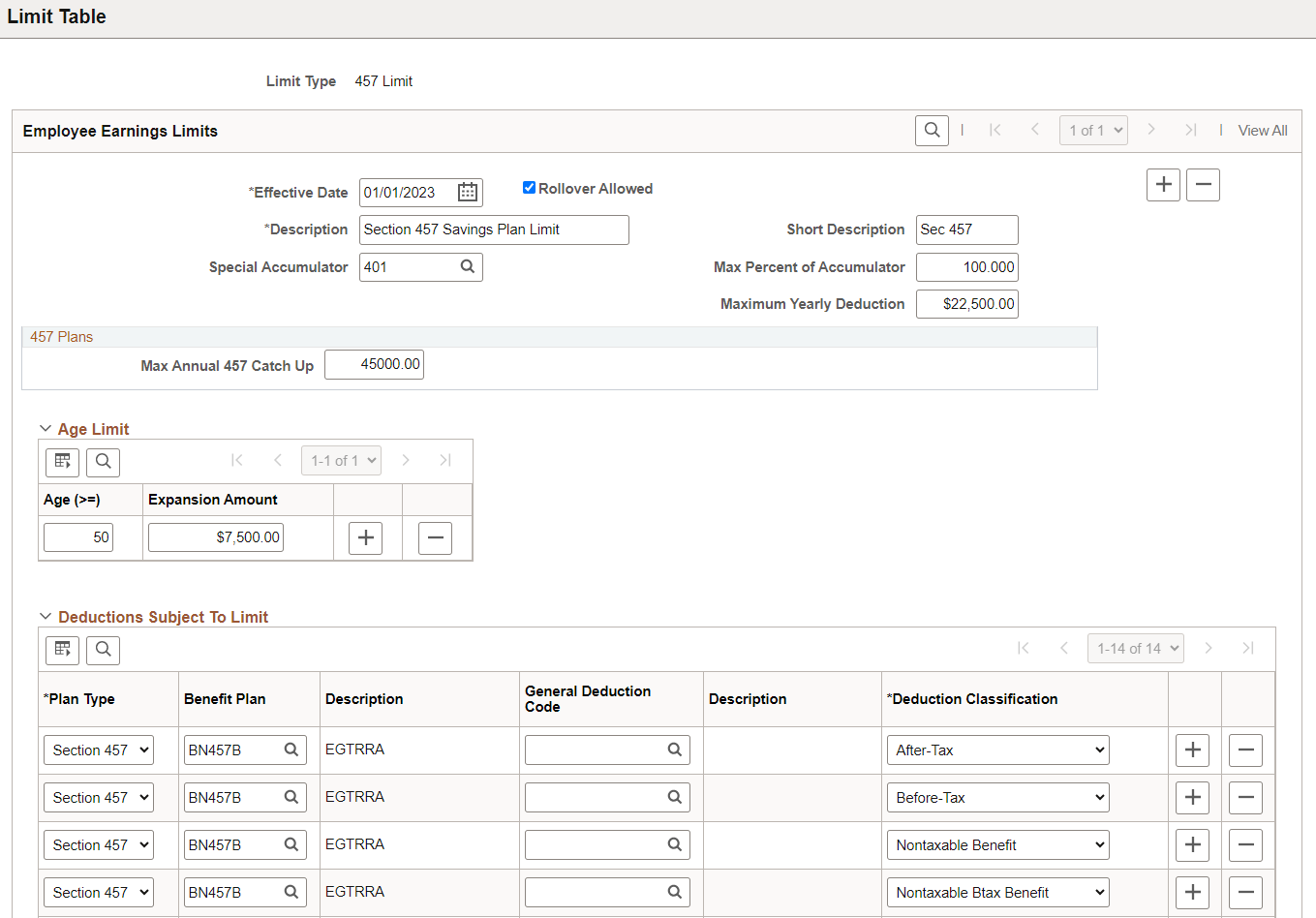

Section 457 plans are deferred compensation plans offered by state and local governments and employers that are exempt from federal income tax. The amount deferred annually by an employee cannot exceed a specific flat amount or 100% of the employee's taxable income, whichever is less.

Note: Section 457 plans are not qualified plans and are not subject to the tax code's nondiscrimination and related requirements. However, they are subject to deferral limits and mandatory distribution rules that apply to qualified plans.

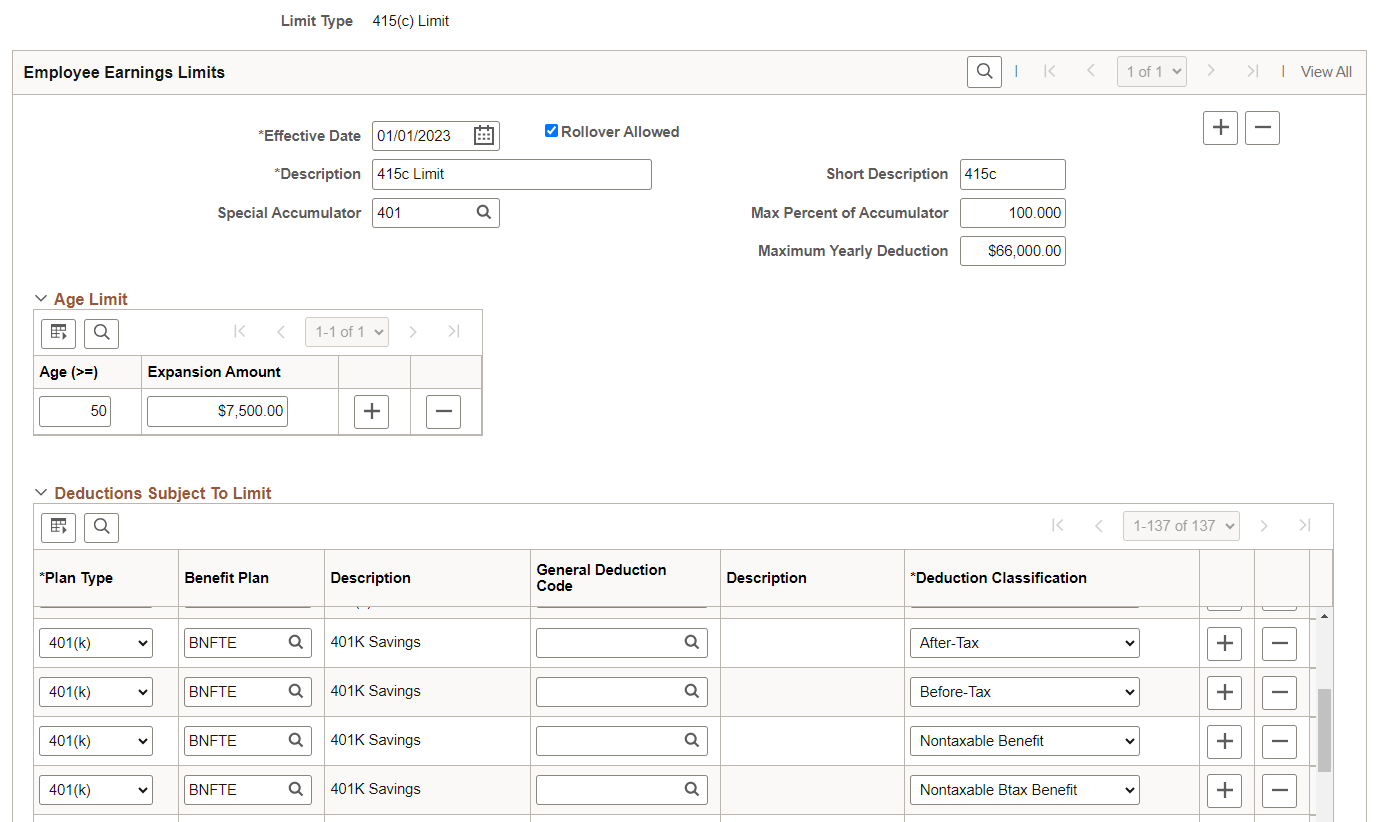

Employees who meet specific eligibility criteria and elect the applicable option can increase their elective deferrals in savings plans subject to certain limits. The increase is handled with limit extensions for the age range and extension amount defined in the Limit table for each limit. Limit extensions are stored on the Savings Management (SAVINGS_MGT_EE) record.

The limit extensions are:

402 – Catch Up, for employees with 15 or more years of service in a 403(b) plan.

457 – Catch Up, for employees within three years of retirement in a 457 plan.

402 – Extensions per age range defined in the Limit table for a 401(k) and, a 403(b) plan, or both.

415 – Extensions per age range defined in the Limit table for a 401(k) plan.

415z – Extensions per age range defined in the Limit table for a 403(b) plan.

457 – Extensions per age range defined in the Limit table for a 457 eligible governmental plan.

401(a) – Adjust Eligible Earnings for 401(k), 403(b), and 457 plans.

Field or Control |

Description |

|---|---|

|

Age Limit |

Enter the catch-up amount for different age range. |

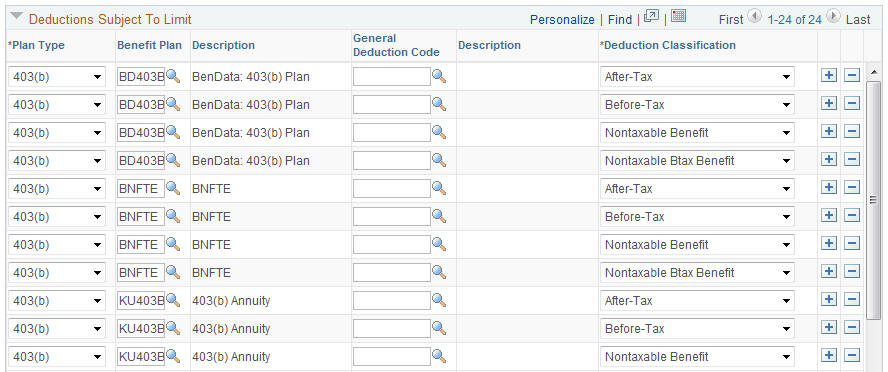

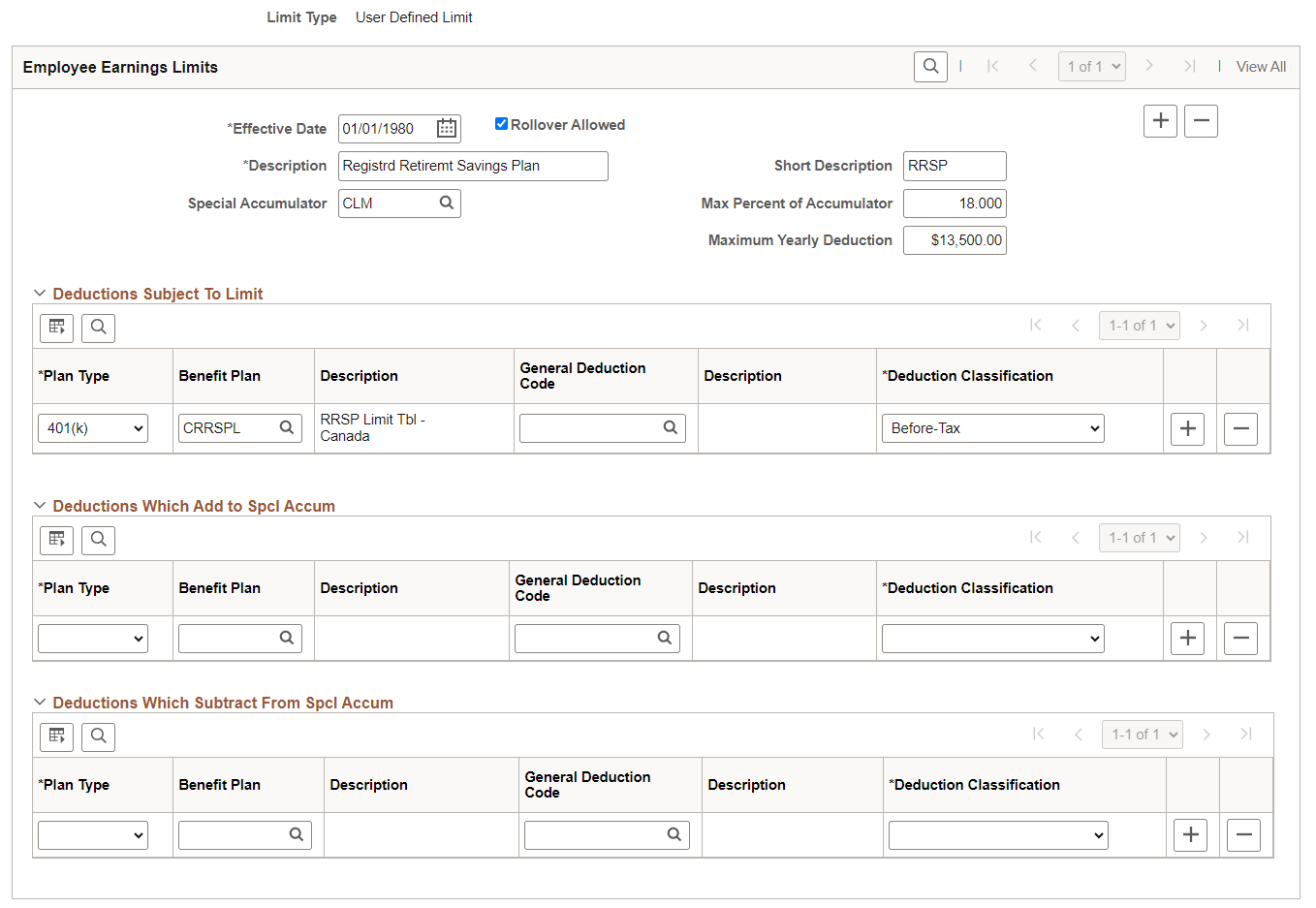

Deductions Subject To Limit |

Select the deduction codes for any and all benefit plans that fall under the specified limit. This list should be as comprehensive as possible. Both general deductions and benefit plans can be specified. To associate a limit with a deduction, enter the plan type, benefit plan, general deduction code, and deduction class. A single plan type may require more than one deduction classification. You may have to insert rows for after-tax, before-tax, nontaxable benefit, and nontaxable pretax benefit classifications for a single 401(k) plan. Note: 401(a) limit processing is supported on savings plan deductions only. A general deduction will not enforce 401(a) limits. |

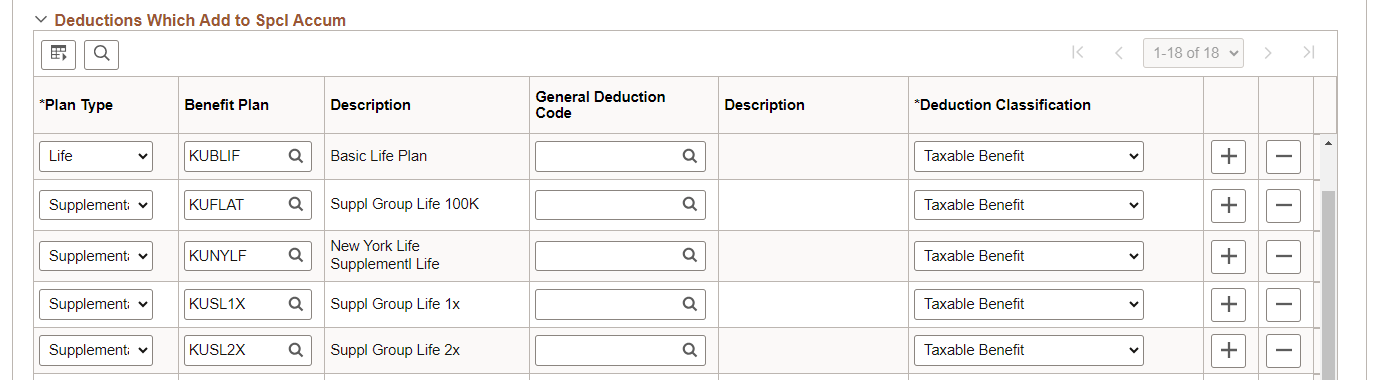

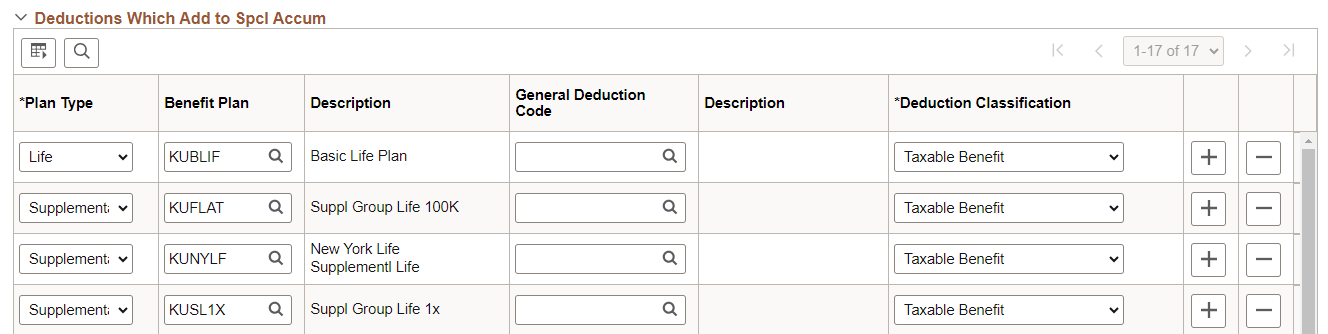

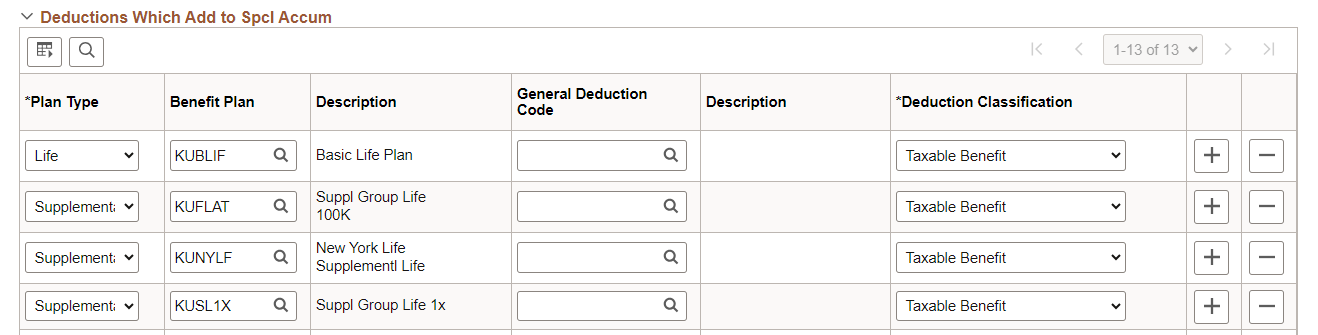

Deductions Which Add to Spcl Accum (deductions which add to the special accumulator) |

Enter deductions to add to the special accumulator. These are the taxable benefits that the IRS stipulates can be included in the calculation of the limits. The system increases the employee's eligible earnings by the total year-to-date plus the current amount of the taxable benefits that you enter here before calculating the employee's current limit. To add a deduction to a special accumulator, enter the plan type, benefit plan, general deduction code, and deduction class. |

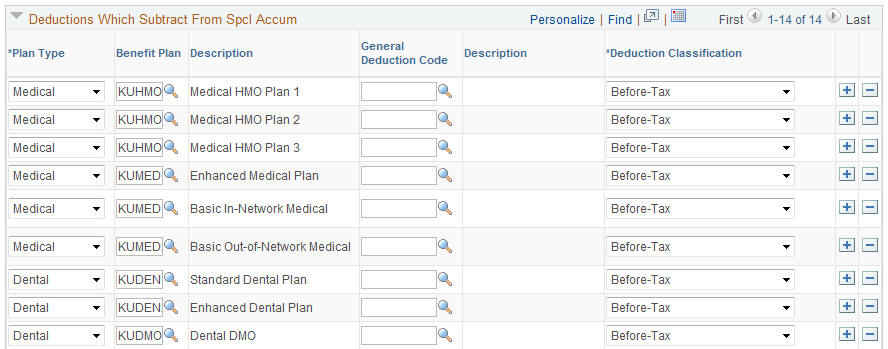

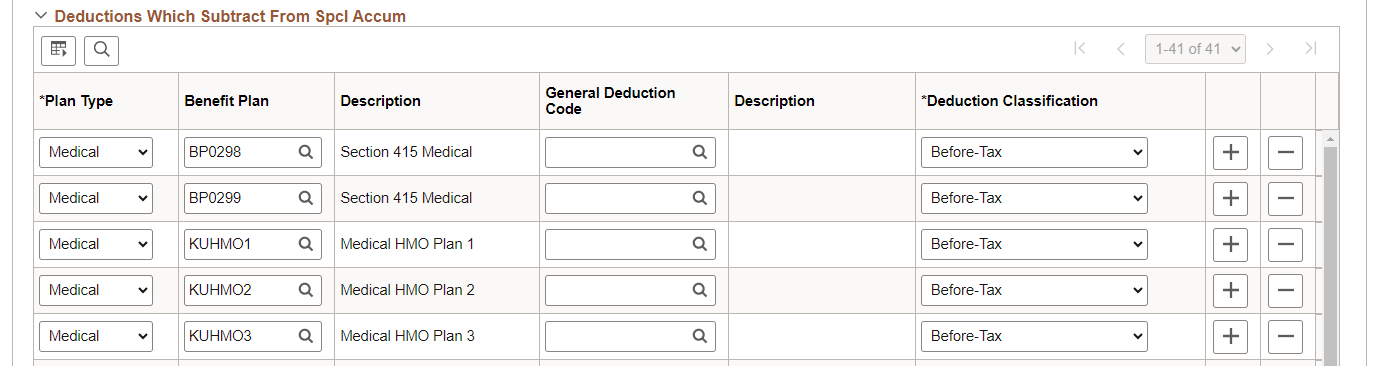

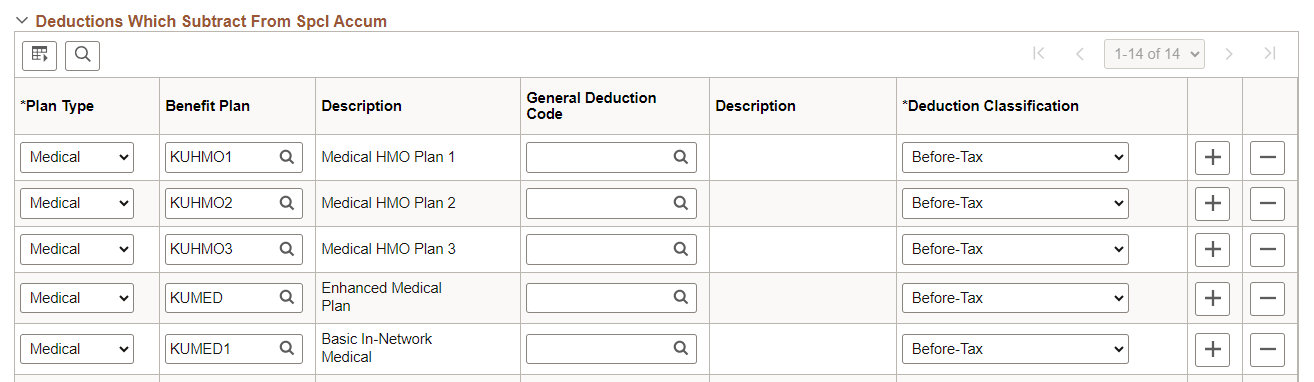

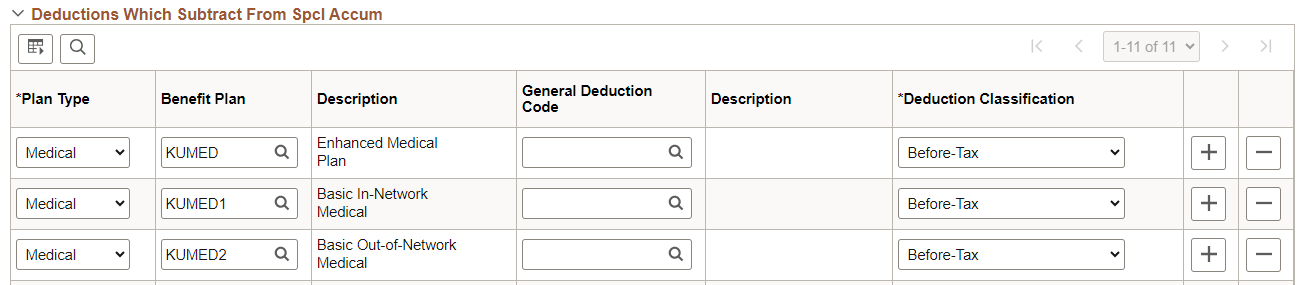

Deductions Which Subtract From Spcl Accum (deductions which subtract from the special accumulator) |

Enter the deductions that subtract from the special accumulator. These are deductions that the IRS stipulates must be excluded from the calculation of the limits. (Ordinarily, these are before-tax deductions, but you may encounter exceptions.) The system reduces the employee's eligible earnings by the total year-to-date plus current amount of the deductions that you enter here before calculating the employee's current limit. For each taxable benefit, fill in the plan type, benefit plan, deduction code, and deduction class. |

Maximum Benefit Base |

The amount that you enter in this field is determined by IRS regulations. It determines the maximum cap on the employee's annual earnings during the calculation of the employee's contribution. |

Max Percent of Accumulator (maximum percentage of accumulator) |

Enter the percentage amount to use when the system calculates the maximum amount that the employee can contribute. |

Maximum Yearly Deduction |

Enter the flat cap on yearly contributions. |

Rollover Allowed |

Select if you want any contribution amount that exceeds the limit to roll over to another plan type or tax class. The actual destination of the excess funds is defined on the Savings Plan Table. |

Special Accumulator |

Used to determine which year-to-date and current employee earnings are eligible for limit testing. |

Use the Limit Table page (LIMIT_TBL1) to identify the rules that apply to the 401(a) limits.

Navigation:

Access the Limit Table page for 401(a) limits.

This example illustrates the fields and controls on the Limit Table page for 401(a) limits.

Use the Limit Table page (LIMIT_TBL1) to identify the rules that apply to the 402(g) limits.

Navigation:

Access the Limit Table page for 402(g) limits

This example illustrates the fields and controls on the Limit Table page for 402(g) limits.

Use the Limit Table page (LIMIT_TBL1) to identify the rules that apply to the 403(b) limits.

Navigation:

Access the Limit Table page for 403(b) limits

This example illustrates the fields and controls on the Limit Table page for 403(b) limits (1 of 3).

This example illustrates the fields and controls on the Limit Table page for 403(b) limits.

This example illustrates the fields and controls on the Limit Table page for 403(b) limits.

This example illustrates the fields and controls on the Limit Table page for 403(b) limits.

Field or Control |

Description |

|---|---|

403(b) Service Prorated By |

Select the proration method to use for the 403(b) service year calculation in the Projection process. This information is taken from the employee's job record. |

Elect 402(g) Cap Expansion |

Select either Automatic Election, No, or Yes. |

402(g) Per Year Max Average, 402(g) Annual Cap Expansion, and 402(g) Lifetime Cap Expansions |

All of these fields are determined by IRS regulations. Enter the current approved standards. |

Use the Limit Table page (LIMIT_TBL1) to identify the rules that apply to the 415 limits.

Navigation:

Access the Limit Table page for 415 limits.

This example illustrates the fields and controls on the Limit Table page for 415 limits (1 of 3).

This example illustrates the fields and controls on the Limit Table page for 415 limits (2 of 3).

This example illustrates the fields and controls on the Limit Table page for 415 limits (3 of 3).

Use the Limit Table page (LIMIT_TBL1) to identify the rules that apply to the 415(c) Limits for 403(b) plans.

Navigation:

Access the Limit Table page for 415(c) Limits for 403(b).

This example illustrates the fields and controls on the Limit Table page for 415(c) Limits for 403(b) (1 of 3).

This example illustrates the fields and controls on the Limit Table page for 415(c) Limits for 403(b) (2 of 3).

This example illustrates the fields and controls on the Limit Table page for 415(c) Limits for 403(b) (3 of 3).

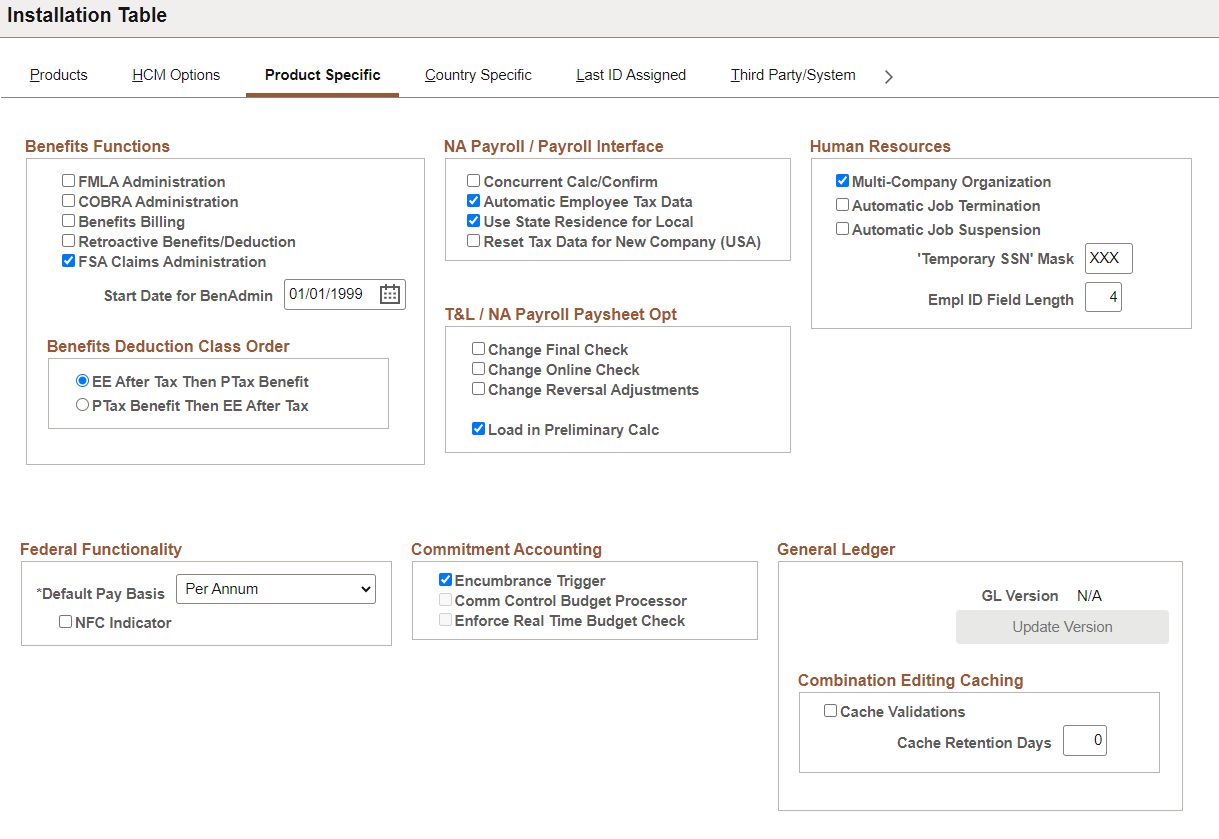

If you are setting up the 415 Limit Table, access the Installation Table to set the deduction class order.

Access the Installation Table

Navigate to the Product Specific tab.

This example illustrates the fields and controls on the Installation Table - Product Specific page.

Benefits Deduction Class Order

Field or Control |

Description |

|---|---|

EE After Tax Then PTax Benefit |

When applying the 415(c) limit, the system applies the reduction first to the employer before tax contribution, then to the employee after tax contribution. |

Field or Control |

Description |

|---|---|

PTax Benefit Then EE After Tax |

When applying the 415(c) limit, the system applies the reduction first to the employee after tax contribution, then to the employer before tax contribution. |

Use the Limit Table page (LIMIT_TBL1) to identify the rules that apply to the 457 limits.

Navigation:

Access the Limit Table page for 457 limits.

This example illustrates the fields and controls on the Limit Table page for 457 limits (1 of 3).

This example illustrates the fields and controls on the Limit Table page for 457 limits (2 of 3).

This example illustrates the fields and controls on the Limit Table page for 457 limits (3 of 3).

Field or Control |

Description |

|---|---|

Max Annual 457 Catch Up (maximum annual 457 catch up) |

Section 457 plans have a catch-up rule. Within three years of retirement, a participant can increase the amount contributed to the savings plan. This field is determined by IRS regulations. |

Use the Limit Table page (LIMIT_TBL1) to identify the rules that apply to User Defined limits.

Navigation:

Access the Limit Table page for User Defined limits.

This example illustrates the fields and controls on the Limit Table page for User Defined limits page.

User Defined Per Check Limit can be used to limit a deduction across two plans. For example, the table can be set up to limit the employer contribution across two plans.

Note: Unlike the other limits, User Defined Per Check Limit is set to limit in one pay check period. The others are set to limit plan balances.