Understanding Savings Plan Management

The Savings Management (SAVINGS_PLANS) component enables the user to review, override, and extend government regulated limits for qualified savings plans. The Manage Base Benefits business process provides the following limit extensions and adjustments.

402(g) 15-year catch-up extension for 403(b) plans.

457 3-Yr catch-up extension for 457 eligible governmental plans.

402(g) Age-50 extension for 401(k) and 403(b) plans.

457 Age-50 extension for 457 eligible governmental plans.

401(a) eligible earnings adjustment for 401(k), 403(b), and 457 plans.

402(g) hardship withdrawal limit reduction.

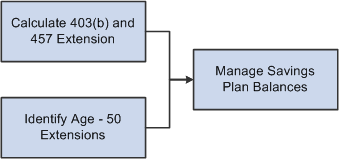

The following diagram illustrates the process flow for managing savings plans from calculating 403(b) and 457 extensions and identifying age-50 extensions:

For additional information, see:

Understanding the Core Tables for PeopleSoft Manage Base Benefits