Setting Up Tax Statements

This topic discusses how to set up tax statements.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPCH_SI_PROVDR |

Define insurance providers. |

|

|

GPCH_AL_MSG_CAT |

Review messages and add individual ones (optional). |

|

|

GPCH_SI_COMPANY7 |

Override sender information (optional). |

|

|

GPCH_AL_COMPLOC |

Define default or override for the G Canteen field for specified company locations. |

|

|

GP_ACCUMULATOR |

Map customer earnings to standard accumulators. |

|

|

GPCH_FM_DEF |

Upload PDF forms. |

Use the Providers page (GPCH_SI_PROVDR) to define insurance providers.

Navigation:

For more information on defining insurance providers refer to the chapter on Managing Social Insurance for Switzerland.

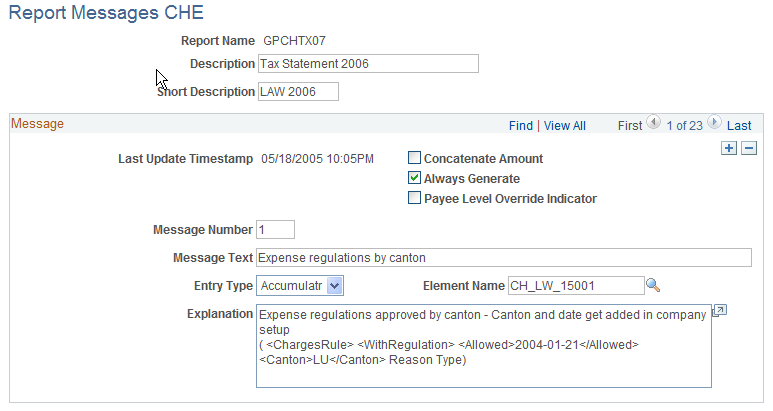

Use the Report Messages page (GPCH_AL_MSG_CAT) to review messages and add individual ones (optional).

Navigation:

Report Messages page

Field or Control |

Description |

|---|---|

Concatenate Amount |

Select this check box to append amount of the accumulator. |

Always Generate |

Select this check box to generate messages for every employee according to the message assignment in the Company SI Contributions CHE (GPCH_SI_COMPANY) component. |

Payee Level Override Indicator |

Select this check box to override text for this message on the employee level. |

Message Number and Message Text |

For each message, the system displays a unique message identifier (number) and message text for standard messages as defined by tax administration. Do not change the message number and message text for these messages:

|

Entry Type |

This field should always be set to Accumulator. |

Element Name |

Displays the accumulator name. |

Explanation |

Provides additional information about this message. Note: Standard message include the path in the official XML. |

Reserved ranges for messages |

1 – 19 certified standard 20 – 49 Oracle intern, line 15 50 – 99 Customer, line 15 100 – 8999 Customer, line 14 9000 – 9999 Oracle intern (technical) |

Use the Sender Details page (GPCH_SI_COMPANY7) to override sender information (optional).

Navigation:

If you enter a description in the Description field on the Sender Details page for the Tax Statement 2006 (GPCHTX07) report, the system overrides the default information from the HCM Company table and the Swiss Domain Set for the sender data in the lower right hand corner of the tax statement.

This tables displays the line number, default field from the Company table or the Swiss Domain Set, and the field that are overridden on the tax statement.

|

Line |

Default |

Sender Override Fields |

|---|---|---|

|

1 |

Company_Tbl.Descr |

Description |

|

2 |

Company_Tbl.Address1 |

Address Line 1 |

|

3 |

Company_Tbl.Address2 |

Address Line 2 |

|

4 |

GPCH_EG_STD.Signature |

Signature |

|

5 |

GPCH_EG_STD.Phone |

Telephone |

The default city and date come from the HCM Company table and Swiss Domain Set for the Field I in the lower left hand corner of the tax statement as shown in this table:

|

Field I |

Default |

Override |

Override in Run Conrol |

|---|---|---|---|

|

Ort |

Company_Tbl.City |

City |

n/a |

|

Datum |

CurrDate as of save of dashboard |

City |

Append to City (internal print only) |

Note: The Sender Detail override applies when the Description field is populated. In this case all fields get overridden, including those that did not get filled in. For printing the system populates the proposed date using the date entered in the Issue Date field on the run control page.

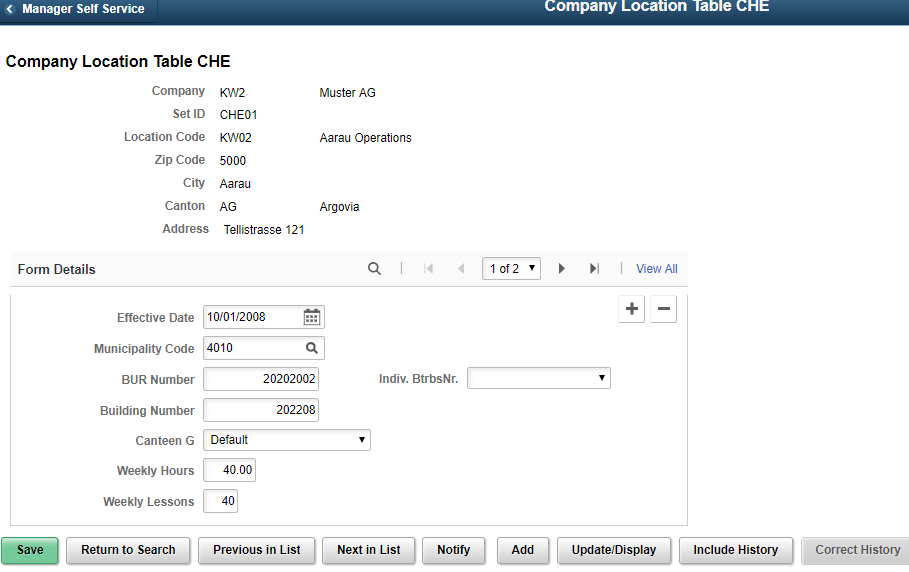

Use the Company Location Table CHE page (GPCH_AL_COMPLOC) to define default or override for the G Canteen field for specified company locations.

Navigation:

Company Location Table CHE page

Field or Control |

Description |

|---|---|

Canteen G |

In the tax statement form there is a G check box. This indicates if the person receives canteen benefits, with a portion paid by the employer, or if the person receives a tax free meal allowance. Select one of these values to indicate how you want the system to process canteen benefits for the company location that is displayed:

|

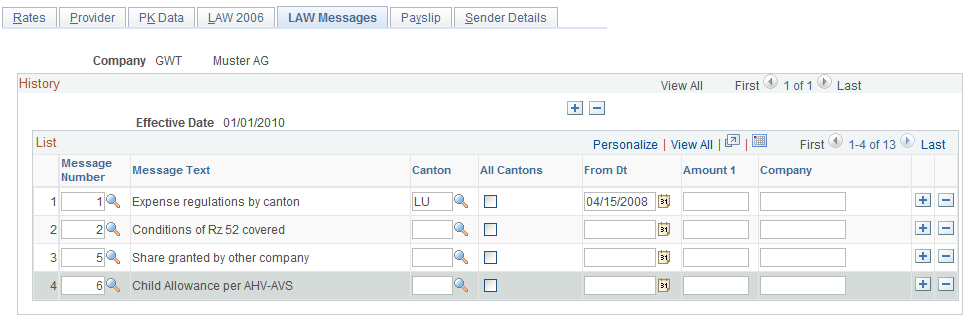

Control FTE and Work Location Display in Line 15

Creation of FTE% - Postion and Worklocation - Message is controlled by activating the message in company-/message mapping

Control FTE and Work Location Display

Comments and Observations

Use the Accumulator Name page (GP_ACCUMULATOR) to map customer earnings to standard accumulators.

Navigation:

The Accumulators page maps customer earnings to standard accumulators. This table lists the accumulators for the LAW 2006 Tax Statement report for the Global Payroll for Switzerland application:

|

Accumulator |

Description |

Custom Entry |

Comment |

|---|---|---|---|

|

CH_LW_10 |

LAW 2006, line 1 |

CH_LW_C10 |

Do not change unless employees do not contribute through the Taxable (AHV,ALV,UV,Tax) segment accumulator (CH_00_0) or if income needs to be reversed as they contribute through CH_00_0. |

|

CH_LW_101 |

LAW 2006, line 10.1 |

CH_LW_C101 |

|

|

CH_LW_102 |

LAW 2006, line 10.2 |

CH_LW_C102 |

|

|

CH_LW_120 |

LAW 2006, line 12 |

CH_LW_C120 |

Only use for deductions that are not included in CH_TX_10. The default is CH_TX_10. |

|

CH_LW_1311 |

LAW 2006, line 13.1.1 |

CH_LW_C1311 |

|

|

CH_LW_1311A |

LAW 2006, line 13.1.1 Check box |

CH_LW_C1311A |

|

|

CH_LW_1312 |

LAW 2006, line 13.1.2 |

CH_LW_C1312 |

|

|

CH_LW_1321 |

LAW 2006, line 13.2.1 |

CH_LW_C1321 |

|

|

CH_LW_1322 |

LAW 2006, line 13.2.2 |

CH_LW_C1322 |

|

|

CH_LW_1323 |

LAW 2006, line 13.2.3 |

CH_LW_C1323 |

|

|

CH_LW_133 |

LAW 2006, line 13.3 |

CH_LW_C133 |

|

|

CH_LW_140 |

LAW 2006, line 14 |

||

|

CH_LW_15xxx |

LAW 2006, line 15 |

CH_LW_C15xxx |

Triggers a corresponding message. |

|

CH_LW_21 |

LAW 2006, line 2.1 |

CH_LW_C21 |

|

|

CH_LW_22 |

LAW 2006, line 2.2 |

CH_LW_C22 |

|

|

CH_LW_23 |

LAW 2006, line 2.3 |

CH_LW_C23 |

|

|

CH_LW_30 |

LAW 2006, line 3 |

CH_LW_C30 |

|

|

CH_LW_40 |

LAW 2006, line 4 |

CH_LW_C40 |

|

|

CH_LW_50 |

LAW 2006, line 5 |

CH_LW_C50 |

|

|

CH_LW_60 |

LAW 2006, line 6 |

CH_LW_C60 |

|

|

CH_LW_70 |

LAW 2006, line 7 |

CH_LW_C70 |

|

|

CH_LW_90 |

LAW 2006, line 9 |

CH_LW_C90 |

|

|

CH_LW_F |

LAW 2006, check box F |

CH_LW_CF |

|

|

CH_LW_G |

LAW 2006, check box G |

CH_LW_CG |

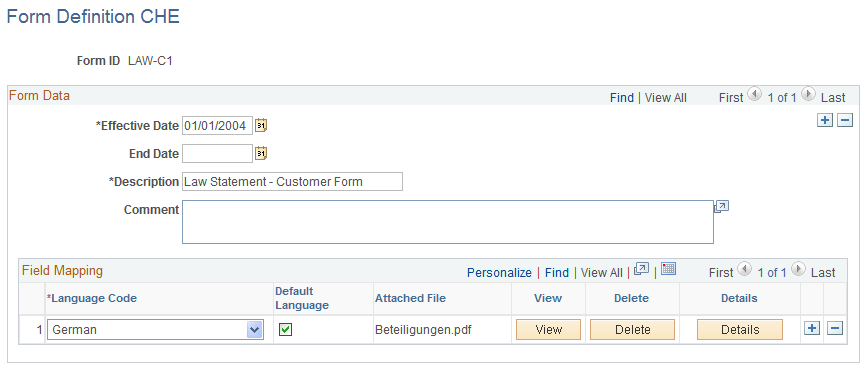

Use the Form Definition CHE page (GPCH_FM_DEF) to upload PDF forms.

Note: The recommended way to manage Tax Statement is to report through Swissdec and use ViewGen to print. The classic reporting described here may be still used for internal purpose only.

Navigation:

Form Definition CHE page

For each of the five forms delivered with the application, click the Delete button, then click Add to upload the corresponding form from your environment. By default you'll find these forms inside your SQR directory.

Note: Never use the -/+ to change lines, then you'll lose the setup and need to reload tables GPCH_FM_FORMOPT and GPCH_FM_FLD and do not introduce new Effdt for new forms.

This table lists the forms the are delivered with the Global Payroll for Switzerland application for the LAW 2006 Tax Statement:

|

Form ID |

Description |

Comment |

|

|---|---|---|---|

|

LAW-C1 |

Law Statement - Customer Form |

Customer Form (optional) |

beteiligungen.pdf |

|

LAW-P1 |

LAW Statement - Part 1 |

LAW Statement – Standard Page |

_11lohna_3-dfi_25-08-06.pdf |

|

LAW-P1B |

LAW Statement - Part 1 |

LAW Statement – Form for Pensioners. |

_11lohna_3-dfi_25-08-06b.pdf |

|

LAW-P1EDIT |

Edit Tax Statement |

Edit Tax Statement – Edit Page |

_11lohna_3-dfi_250806_edit.pdf |

|

LAW-P2 |

LAW Statement - Part 2 |

LAW Statement (2nd page if messages don't fit in first page) |

_11lohna_3-dfi_25-08-06_x.pdf |