Setting Up the Dashboard

This topic provides an overview of the dashboard setup.

Global Payroll for Switzerland supports the XML generation as certified by Swissdec. In addition, you can create XML files for:

Year end source tax for the Geneva canton.

Quarterly source tax reporting for the Vaud canton(Passerelle).

FAK_CAF reporting, monthly as defined by Ausgleichskasse Banken AKB and Ausgleichskasse Versicherungen.

Year to date as defined by eAHV.

All required processes can run in one job. You can manage all these activities through the dashboard:

Run processes.

Review files via XML publisher.

Review files via ViewGen (for Swissdec domains)

Send files to the Swissdec distributor.

Manage files via robust file management. See also Robust File Management.

Archive files.

To prepare the dashboard processing, you need to prepare the system by following the instructions in this section.

See PeopleTools: BI Publisher for PeopleSoft PeopleBook

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPCH_EG_NM_VAL_PRS |

Define parameters to create, validate and send XML files through the dashboard. |

|

|

GPCH_EG_DOMAIN |

Define ELM domains. |

|

|

GPCH_SI_PROVDR |

Define insurance providers. |

|

|

GPCH_SI_COMPANY2 |

Map providers. |

|

|

GPCH_TX_FAK_STAX |

Map providers for Ausgleichskasse Banken #AKB. |

|

|

GPCH_SI_COMPANY4 |

Maintain UID and BUR numbers. |

Use the Online Processing Setup CHE page (GPCH_EG_NM_VAL_PRS) to define parameters to create, validate and send XML files through the dashboard.

Navigation:

For more information on defining online properties refer to the chapter on Defining Country Data.

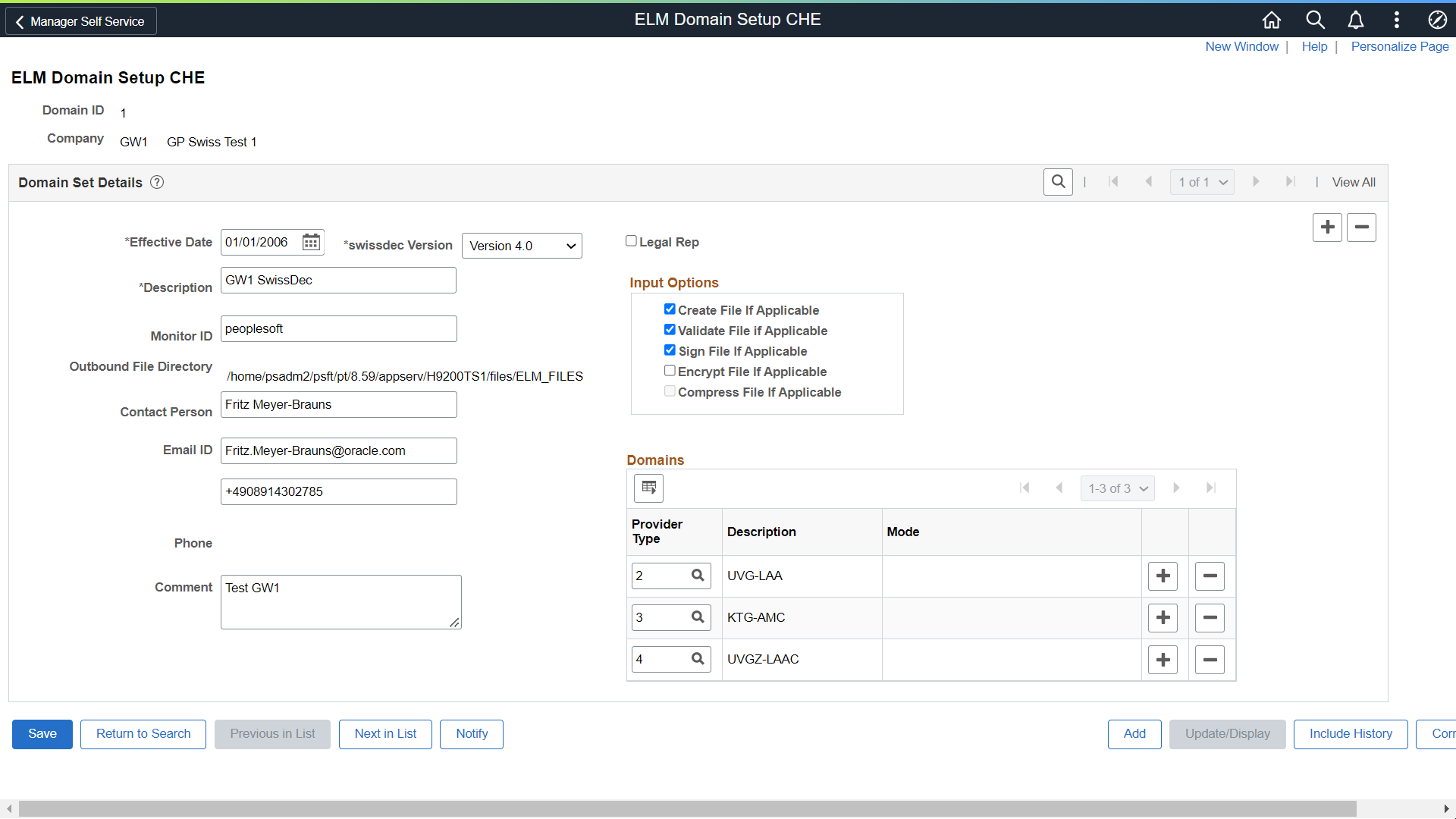

Use the ELM Domain Setup CHE page (GPCH_EG_DOMAIN) to define ELM domains.

Navigation:

ELM Domain Setup CHE page

The system builds the domain package that you can run using the dashboard in one process. Depending on your requirements, you can combine all Swissdec domains or create several packages. For Source Tax and FAK_CAF AKB and FAK_CAF eAHV (all monthly and not Swissdec domains) you need dedicated domains.

Use the ELM Domain Setup CHE page to enter a set of values that you use on the Dashboard page to run the various legally required reports for the Swiss eGovernment.

You can save these values and reuse them whenever you have to run government required reports.

Field or Control |

Description |

|---|---|

Effective Date |

Enter or select the date the ELM domain becomes effective. |

Swissdec Version |

Specify the version of the Swissdec file you want to send. Available options are:

|

Description |

Enter an appropriate description for the domain |

Monitor ID |

Enter the monitor ID that you want to use to communicate with your Swissdec distributor. The default is peoplesoft. |

Outbound File Directory |

Displays the directory path for the outbound files that the system creates. |

Contact Person, Email ID, Phone and Comment |

Enter the names of the person responsible for the reports and how they can be contacted. |

Create File If Applicable |

Select this check box if you want the system to create a file. |

Validate File If Applicable |

Select this check box if you want the system to validate the file. |

Sign File If Applicable |

Select this check box if you want the system to sign the file. |

Encrypt File If Applicable |

Select this check box if you want the system to sign the file. |

Compress File If Applicable |

Not currently supported. |

Domains |

For domains of type monthly (and GE ISEL) the grid allows only 1 domain type. User may however combine yearly (except GE ISEL) domains to create the XML in one run.

|

Provider Type and Description |

Select a provider type (for example UVG-LAA, KTG-AMC, UVGZ-LAAC and so on) for which you want to run reports. The description appears in the next field. Abbreviations for Provider Types — See Abbreviations for Swiss Domains Element Naming Conventions |

Mode |

Modes are:

|

You can find more information about the meaning of these fields in the Swissdec guidelines and the Swissdec tech doc that describes the full ELM XML process.

Use the Providers CHE page (GPCH_SI_PROVDR) to define insurance providers.

Navigation:

For more information on defining insurance providers refer to the chapter on Managing Social Insurance for Switzerland.

Use the Provider page (GPCH_SI_COMPANY2) to map providers.

Navigation:

For more information on mapping providers refer to the chapter on Managing Social Insurance for Switzerland.

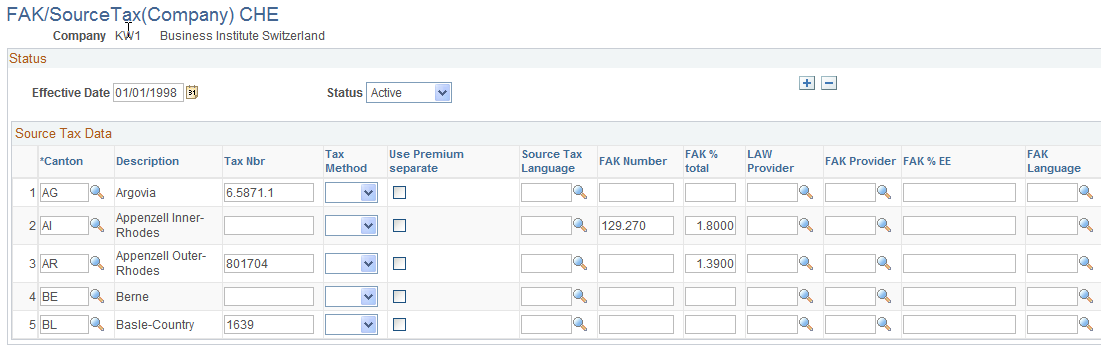

Use the FAK/Source Tax (Company) CHE page (GPCH_TX_FAK_STAX) to map providers for Ausgleichskasse Banken#AKB.

Navigation:

FAK/Source Tax (Company) CHE page

Field or Control |

Description |

|---|---|

FAK Provider |

Enter provider #AKB for those cantons where you want to create the FAK_CAF monthly XML file. |

Use the LAW 2006 page (GPCH_SI_COMPANY4) to maintain UID and BUR numbers.

Navigation:

Access the LAW 2006 page (Set Up HCM, Product Related, Global Payroll & Absence Mgmt, Social Security/Insurance, Company SI Contributions CHE, LAW 2006).

For more information on mapping providers refer to the chapter on Managing Social Insurance for Switzerland.