Understanding Source Tax

Switzerland is a confederation of 26 cantons with approximately 3,000 municipalities. Accordingly, it has an extremely complex taxation system, with taxes imposed at federal, cantonal, and communal levels. Tax rates can vary from one canton to another.

Source tax applies to specific categories of foreign employees. It is calculated according to the canton in which a worker is employed, and employers take source tax deductions directly from the earnings of these foreign nationals residing in Switzerland. Employers must withhold the tax due and pay this source tax to the cantonal tax administration. Source tax, levied at the source, pays off federal, cantonal, and communal tax liabilities.

Data inputs for the source tax calculation are generally the same for all Swiss cantons. The employee's work location is read from the job records, and other source tax information is read from the employee Tax Data page along with stored tax rates for each canton, which together provide the raw data to be used in the calculation.

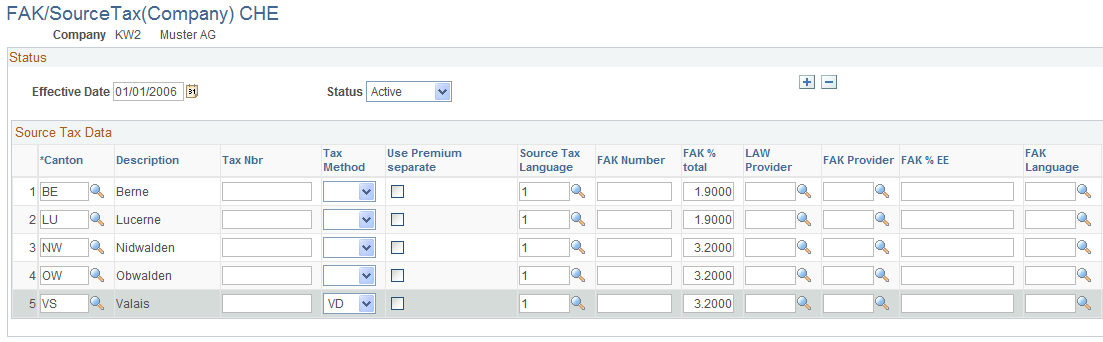

Not all cantons use the same mode for the regular calculation method to arrive at the source tax. For example, the regular calculation mode in cantons GE, FR, TI, and VD differs from the mode that applies in the 22 other cantons. User can decide (after agreed by canton) to apply one of the 4 different canton methods as well for any other canton. For example, in some cases the canton VD method is also used for other cantons. Then the user just needs to maintain the tax method override in FAK/Source Tax (Company) CHE page. In addition, the different selections on the employee Tax Data page determine what method applies to different employees (all methods are applicable to all cantons).

Note: The different calculation modes for the regular method are described in greater detail later in this chapter.

Note: There is special tax treatment for French Cross-Border workers in the following eight cantons: BE, BL, BS, JU, NE, SO, VD, and VS. Working in one of these 8 cantons, having a home address country equal to France, and having no assignment for source tax qualifies employees for this type of taxation. Cross-border employees are reported with their taxable gross on the Cross-Border Report for France. The employer then provides the list of employees to the tax administration which reports the gross to the location of residence. Thus the employees have their Swiss earnings taxed in France.

Note: With Swissdec 4.0, French Cross-Border workers for these 8 Cantons get reported as well in the standard source tax XML with TAG ‘specialAgreement’.

This section discusses:

Primary tax calculation methods.

Exceptions to the regular method.

Primary Calculation Methods (determined by selection on employee's Tax Data page )

There are four primary methods used to calculate an employee's monthly source tax deduction, which are managed on the Tax Data page. These methods are summarized as follows:

|

Method Name |

Description |

|---|---|

|

Regular |

A rate is selected from the tax table of the employee's tariff based on the applicable calculation mode. The system uses this rate to calculate the tax based on the employee's actual earnings. |

|

Fixed Percentage |

A rate is entered in the employee's Tax Data page. The system uses this rate to calculate the tax based on the employee's actual earnings. |

|

Fixed Deduction |

An amount is entered in the employee's Tax Data page. This amount is withheld monthly as the source tax deduction. |

|

Fixed Base |

An amount is entered in the employee's Tax Data page. Depending on the tax tariff, this amount determines the source tax rate. The system uses this rate to calculate the tax based on the employee's actual earnings. |

Calculation Modes for Regular and Fixed Base Methods (determined by assigned canton)

Within the regular source tax calculation method there are exceptions for cantons GE, FR, TI, and VD. Instead of calculating the tax on a monthly earning base, these cantons calculate source tax as explained in the following table(by maintaining tax method override in FAK/Source Tax (Company) CHE page, user can decide to apply these methods as well to any other canton):

|

Canton |

Mode |

|---|---|

|

GE |

An annual adjustment is made in the December payroll for employees who meet the following conditions: full-time (FTE = 100%) for the entire year, employed in GE the entire year, with the same tariff for the full year. For other employees the tax is calculated using the monthly mode as is done in the 22 other cantons. |

|

FR |

Each month the rate is calculated on the estimated yearly income, which is equal to: (actual regular earnings / actual months * 12) + actual bonus payments. Depending on the tax tariff, this amount determines the source tax rate. With this rate the tax is calculated using the employee's actual earnings (see CH_TX_07_YTD) within the tariff(s). Then the amount of tax paid is subtracted and the remaining amount is the source tax for the month. |

|

TI |

Each month the rate is calculated on the monthly salary. In case of the following events, a tax adjustment is made: December payroll or termination, or departure from the TI canton. For the TI canton, the rate is calculated on the estimated yearly income, which is equal to: (actual regular earnings / actual months * 12) + actual bonus payments. Depending on the tax tariff, this amount determines the source tax rate. With this rate the tax is calculated using the employee's prorata actual annual earnings within the tariff(s) (by days within the tariff—see CH_TX_08_YTD). Then the amount of tax paid is subtracted and the remaining amount is the source tax adjustment. |

|

VD |

Each month the rate is calculated on the estimated yearly income, which is equal to: (actual regular earnings / actual months * 12) + actual bonus payments. Depending on the tax tariff, this amount determines the source tax rate. With this rate the tax is calculated using the employee's actual earnings (see CH_TX_07_YTD) within the tariff(s). Then the amount of tax paid is subtracted and the remaining amount is the source tax for the month. Besides the regular tariffs, in Canton Vaud there is a special source tax tariff for artists. You may have employees that should be taxed by this special tariff. After you implement the changes regarding the source tax tariff for artists, assign earnings specific to artists (standard earning 1012). Then check to see if the tax is calculating correctly and being reported on the Earnings and Deductions page (select Global Payroll & Absence Mgmt, Absence and Payroll Processing, Review Absence/Payroll Info, Results by Calendar, Earnings and Deductions).

Tax deductions:

Users can view and print the official forms by clicking the View button from the Source Tax Month run control page (the system calls BI Publisher when you click the View button). |

Override Source Tax Method

Override Source Tax Method

In addition to supporting the generation of PDF files to report source tax calculations (which we no longer ‘actively’ support, Global Payroll for Switzerland supports primarily the generation of a Swissdec ELM file to be sent to the authorities via SOAP messaging. The resulting XML file can be validated, viewed and transmitted to the authorities using the Dashboard architecture (see Swissdec WebService Call – Page Process files).

See Generating and Managing Dashboard XML.

Use these steps to generate the source tax interface files:

|

Step |

Action |

Navigation path |

|---|---|---|

|

1 |

Create a new provider for each canto for reporting source tax. !! Naming convention is #XX, where XX stands for the standard 2 digit Canton abbreviation. |

|

|

2 |

Add the new provider(s) you created in step 1 to a company and check for each canton box and map to the canton = XX. |

|

|

3 |

Create a new domain for the source tax with mode = ‘Swissdec’. |

|

|

4 |

Assign the source tax to employees. |

|

|

5 |

Run the payroll for the company. |

|

|

6 |

For a Swissdec source tax domain, the monthly mode and the first month of the selected year are default. |

|

|

7 |

Click Run. Then check the Process Monitor to make sure the process runs to success. |

|

|

8 |

Validate the created file. |

|

|

9 |

Review validation results. |

|

|

10 |

Send the file using send&Request button. |

|

|

11 |

Run GetStatus using send&Request button. |

|

|

12 |

Run GetResult using send&Request button. |

|

The following tables contain the delivered elements used for source tax calculations:

|

Customer Maintained Accumulators |

Description |

|---|---|

|

CH_TX_02 |

Source Tax Base. Captures all taxable earnings, as well as ones that need to go into CH_TX_03 or CH_TX_04. |

|

CH_TX_03 |

Includes earnings considered to be regular for annual estimation, but not prorated in case of mid month hire or termination. |

|

CH_TX_04 |

Includes earnings considered to be bonus payments for annual estimation. |

|

CH_TX_05TI |

Lump Expenses TI. Up to an annual limit of 12, 000, only half of the payment is taxed. |

|

CH_TX_12 |

Earnings in this accumulator contribute to the lookup amount that determines the rate. The following 2 scenarios can be addressed using this accumulator:

Functional requirement for other possible combinations are not known. |

|

System Maintained Accumulators |

Description |

|---|---|

|

CH_TX_07_YTD |

Taxable Gross in Tariff YTD. Used in calculation mode for VD and FR to split the actual yearly salary in case of tariff changes. |

|

CH_TX_08_YTD |

Taxable Days in Tariff YTD. Used in calculation mode for TI to split the actual yearly salary in case of tariff changes. |

|

CH_TX_10 |

Source tax per month. Sum of all different source tax deductions (see Source Tax Deductions). |

|

Source Tax Deductions |

Description |

|---|---|

|

CH_TX_D10 |

Premium artists and sportsmen. Source tax artists and sportsmen. |

|

CH_TX_D12 |

Regular or fixed base method: Source tax contribution (except VD and FR). |

|

CH_TX_D31 |

Regular or fixed base method: Source tax contribution VD and FR. |

|

CH_TX_D51 |

Regular method: Yearly adjustment GE and TI. |

|

CH_TX_M00 |

Manual entry of deduction via positive input (manual corrections) all cantons. |

|

CH_TX_M01 |

Fixed percent method: Source tax contribution all cantons. |

|

CH_TX_ M02 |

Fixed amount method: Source tax contribution all cantons. |

The PeopleSoft system delivers a query that you can run to view the names of all delivered elements designed for Switzerland. Instructions for running the query are provided in the PeopleSoft Global Payroll PeopleBook.