Viewing and Maintaining Source Tax Data

To view and maintain source tax data, use the FAK/SourceTax (Company) CHE (GPCH_TX_FAK_STAX) component.

This topic discusses how to view and maintain source tax data.

There are four steps to viewing and maintaining source tax data in Global Payroll for Switzerland.

Upload and view / update municipality code information for each canton.

Upload and view source tax data for each canton, to determine source tax rates that apply to foreign nationals in the individual Swiss canton.

Enter source tax data for foreign residents in Switzerland.

Update and view source tax percentage data, including withholding commission percentages.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPCH_LOAD_FILES |

Load Postal/Municipality Codes. Load Tax Rates. |

|

|

GPCH_TX_VILLAGE |

View and update municipality codes and their descriptions for a selected canton. User uploads the Municipality Code table, but you can modify the data if necessary. |

|

|

GPCH_TX_SETUP |

View source tax details such as source tax tariffs and basis, amounts and percentages. User uploads the Source Tax table, but you can modify the data if necessary. |

|

|

GPCH_TX_DATA |

Enter source tax data for a foreign employee. |

|

|

GPCH_TX_FAK |

View source tax details such as source tax tariffs and basis, amounts, and percentages. |

|

|

FAK/Source Tax (Company) CHE Page |

GPCH_TX_FAK_STAX |

View and edit source tax settings such as source tax language and source tax report frequency. |

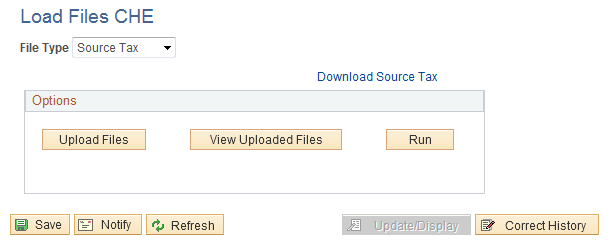

Use the Load Files CHE page (GPCH_LOAD_FILES) to insert data into the Source Tax Rates table.

Navigation:

Load Files CHE page

Field or Control |

Description |

|---|---|

Download Source Tax |

Link to legal site for tax rates download. |

Upload File |

Will open a popup to determine the source of your file. |

View Uploaded File |

Provides an overview of uploaded files. |

Run |

Triggers further processing for files that need further processing (Source Tax and Postal Codes). |

When Source Tax file has been uploaded, the Run button will open the following subpage.

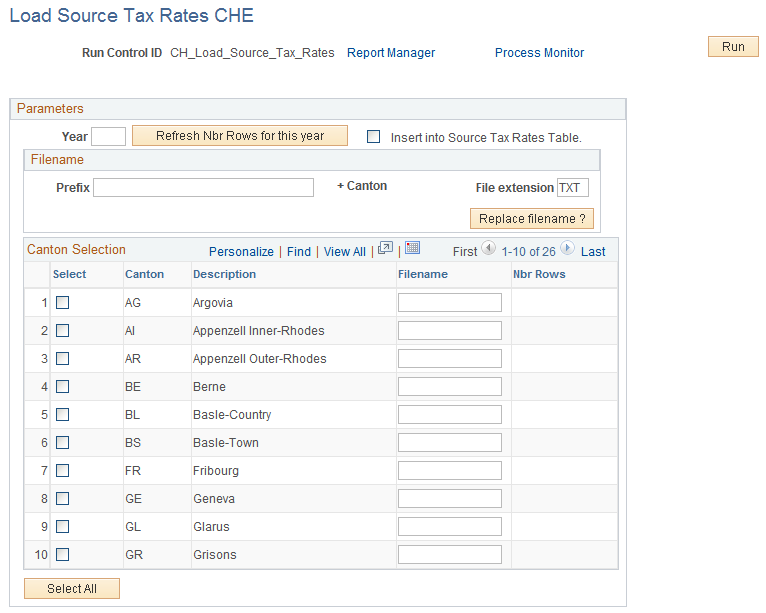

Load Source Tax Rates CHE page

Source tax rates are maintained by Oracle. However, you can load these rates directly into your application. As the cantons sometimes publish the new rates later than you might want them, you can use this feature to retrieve the rates in time for your current payroll.

To manage the upload you need to download the files from the internet and unzip them into a directory where the application has access to the files (usually a directory on the same machine as the application server).

See Swiss Federal Tax Administration Website.

Field or Control |

Description |

|---|---|

Year |

Enter the year for which you need to upload the rates |

Refresh Nbr Rows for this year |

Click to display the number of rows that already exist in the database under the Nbr Rows column in the grid. |

Insert into Source Tax Rates Table |

Select if you want to update the final data; otherwise the process will only populate temp tables to allow a test run. |

Prefix |

This is always TARxx, where xx is the current year. |

File extension |

Always enter TXT as the file extension. |

Directory |

The directory from where you load the data. |

Replace filename? |

Click to populate filename entries in the Filename column in the grid. |

Select |

Select the cantons that you need to upload. |

Canton |

Displays a list of all 26 cantons with 2 character abbreviations. |

Description |

Displays the names of the 26 cantons. |

Filename |

The entries in this column are automatically created based on your previous entries. |

Nbr of Rows |

Displays the number of existing rows, if you clicked the Refresh Nbr Rows for this year button. |

Use the Municipality Codes CHE page (GPCH_TX_VILLAGE) to view and update municipality codes and their descriptions for a selected canton.

Municipality Codes get loaded along with Postal Code, but you can modify the data if necessary.

Navigation:

Warning! Postal Code load fills Municipality Codes. When modifying this data if necessary, you should carefully consider the impact of these changes.

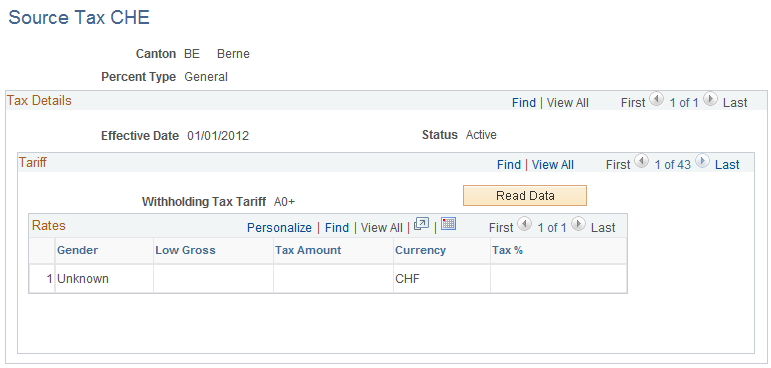

Use the Source Tax CHE page (GPCH_TX_SETUP) to view source tax details such as source tax tariffs and basis, amounts and percentages.

Navigation:

Source Tax CHE page

Tariff

Field or Control |

Description |

|---|---|

Withholding Tax Tariff |

Displays the Withholding Tax Tariff code. |

Read Data |

Click to display details about the rates for source tax. |

Rates

Field or Control |

Description |

|---|---|

Gender |

Since 2014, there are no separate rates for Male or Female. Thus you will always see ‘unknown’ here. |

Low Gross |

Displays the lower limit for the tax increment. |

Tax Amount |

Displays the amount of source tax that is deducted. |

Tax % (tax percentage) |

Displays the percentage of source tax deducted. |

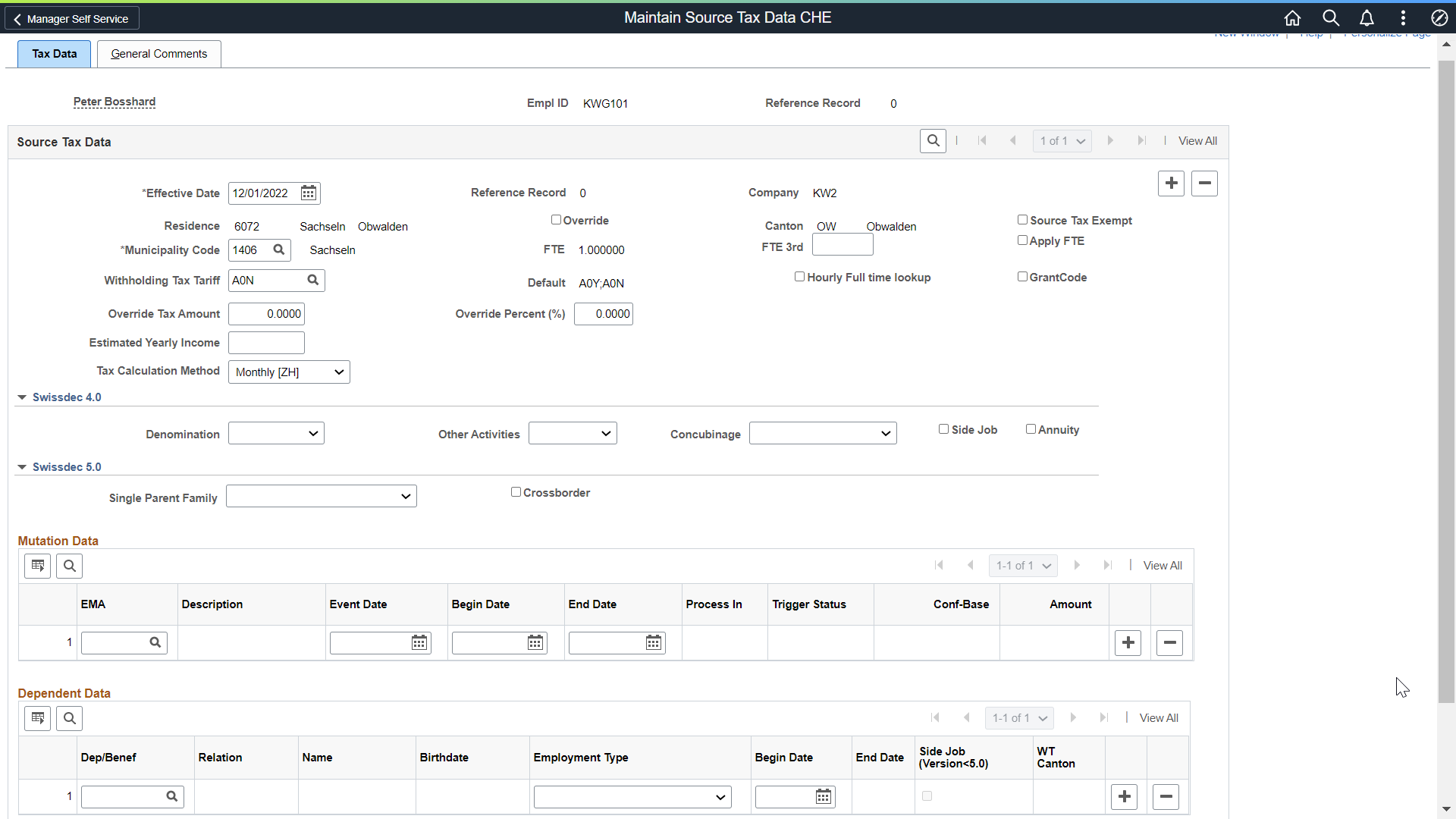

Use the Tax Data CHE page (GPCH_TX_DATA) to assign, update and view employee source tax details such as source tax tariffs, mutations, spouse and children data.

Navigation:

This example illustrates the fields and controls on the Tax Data page.

Field or Control |

Description |

|---|---|

Residence or Work Location |

If the address of the employee is in Switzerland, the system displays the Residence field label. If the address of the employee is not in Switzerland, the system changes the field label to Work Location and displays the corresponding Postal, City and Canton. |

Municipality Code |

Select the code of the municipality in which the employee lives. Prompt values are the municipality codes that correspond to the canton. |

Withholding Tax Tariff and Default |

Select a tariff from the list of valid tariffs for the canton. This tariff is used to calculate the source tax under the regular or standard method. The system defaults source tax tariff codes based on civil status, number of children, and work permission. This information is usually available in HCM. PeopleSoft, however, provides a default tariff code and an override option in its Global Payroll for Switzerland application. For example if the default list shows the tariff code B0Y and B0N in the Default field, and both codes are also available in the prompt list, the system displays B0Y in the edit box. Note: If the tax tariff code is not present in the prompt list when you click the Lookup button, the system displays an error message and the page cannot be saved. If you enter a tariff code that is not in the default list but is present in the prompt list, the system also displays a warning message. You can, however, save the page because the tariff code is present in the prompt list. |

Override Tax Amount |

Use this field to override the selected tariff and apply the source tax using a fixed deduction. |

Estimated Yearly Income |

Enter an amount to override the annual income used in the regular source tax calculation. This amount is used to calculate the source tax under the fixed base method. |

Tax Calculation Method |

Select the required source tax calculation method. Possible values are:

|

Override |

Select to override the canton. The Canton field becomes available, in which you can select a canton. |

FTE |

Displays the data stored in Job Data records. |

Override Percent (%) |

Use this field to override the selected tariff and calculate the source tax using a fixed percentage. |

|

FTE 3rd |

FTE in the external company to calculate the source tax. This field is applicable in multi employment scenarios. For Canton VD user defines whether for an employee with FTE < 1 tax look up considers FTE or not. Note: The field is read by array CH_TX_AR100 and the formula CH_TX_FO110 is taken into account the Apply FTE flag (DB field: FTE_INDICATOR, variable:CH_TX_APPLY_FTE). The excerpt from the formula shows that the field is not tied to any canton except for the rounding. |

|

Hourly Full time lookup |

Select the checkbox, if the employees work hours will be grossed upto 180 hours. This field determines the tax rate for hourly paid employees who have more than 50 hours in one employment and have multiple employments then the hours should be grossed up to 180 hours. |

|

Source Tax Exempt |

Select if the employee is exempt from source tax. |

|

Grant Code |

Check box Canton assigned a special tariff. |

|

Apply FTE |

For Canton VD user defines whether for an employee with FTE < 1 tax look up considers FTE or not. |

|

Swissdec 4.0 |

|

|

Denomination |

Religion Values are:

|

Other Activities |

Other activities. Possible values are:

|

Concubinage |

Employee life is in a state of concubinat; values are:

|

|

Side Job |

Check box Part Time Job. |

|

Annuity |

Check box Pension |

|

Swissdec 5.0 |

|

|

Single Parent Family |

Select the required value from the drop-down list. Available values are:

|

|

Crossborder |

Select the checbkox to indicate that the employee is a cross-border commuter. |

For more details on the following fields, see Swissdec guidelines, Source Tax chapter.

Field or Control |

Description |

|---|---|

Mutation Data |

|

EMA |

Events, that cause a tariff change E = Start, M = Change, A = End, values are:

|

Description |

Description of the event. |

Event Date |

Date of the event. Defaults to Effdt. |

Begin Date |

First day of the month for reporting this event (last day of month). Defaults to last day of Event Date. |

End Date |

last day of month for reporting this event (last day of month). Defaults for events 11,12 and 13 to Next open payroll. For other events to last day of Event Date. |

Process In |

Next open payroll. |

Trigger Status |

Status of the event. Values are open or processed. |

Conf-Base and Amount |

These two fields are enabled if the EMA is CC – Correction Confirmed. These fields are used to manage correction responses from the Canton authorities. Note: Currently, Canton do not send back the confirmed correction information hence user can ignore it. These are needed for future certifications. |

Dependent Data |

|

Dep/Benef |

Dependent ID. Prompts only for existing Dependents. |

Relation |

Dependent Relation, for source tax we use C and SP. |

Name |

Name of the dependent. |

Birthdate |

Birthdate of dependent. |

Employment Type |

Spouse Employment. The values in the list are

|

Begin Date |

Begin of counting for tax reporting. |

End Date |

End of counting for tax reporting. |

SideJob (unchecked = Full) |

Full-/Part Time |

WT Canton (26 Cantons + EX ) |

Work Location ( 26 Cantons + EX ) |

Oracle terminology and the corresponding Swissdec terminology

|

Oracle |

Swissdec |

|---|---|

|

Employment Type

|

Spouse employment

|

|

SideJob (unchecked = Full) |

Full/Part Time |

|

WT Canton (26 Cantons + EX ) |

Work Location ( 26 Cantons + EX ) |

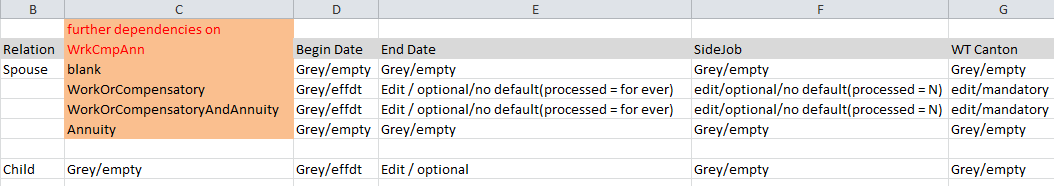

The following fields are visible, mandatory or hidden depending on Relation and employment type. See the synopsis below:

Synopsis

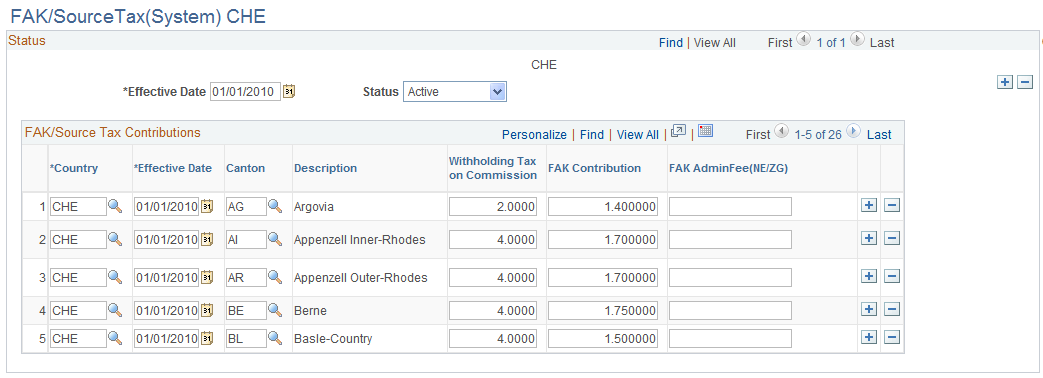

Use the FAK/Source Tax (System) CHE page (GPCH_TX_FAK) to view source tax details such as source tax tariffs and basis, amounts, and percentages.

Navigation:

FAK/SourceTax(System) CHE page

Field or Control |

Description |

|---|---|

Withholding Tax on Commission |

Enter a percentage, between 2% and 4%, that the employer deducts from paid taxes for administrative work involved in supporting source tax. See Entering FAK Data. Loading Source Tax Rates updates this percentage as well (creates a new Effdt along with the rates upload). |