Defining Annual Tax Adjustments

To define annual adjustments, use the Pay Groups MEX (GPMX_PARM_PYGRP) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPMX_PARM_PAYGRP |

Define the parameters to calculate the annual adjustment for each pay group in your company. |

Begin defining annual adjustments parameters on the Annual Adjustments page.

Once you've defined annual adjustment parameters, you can update annual tax adjustments by entering tax data from other employers and specify employees who are exempt from the process.

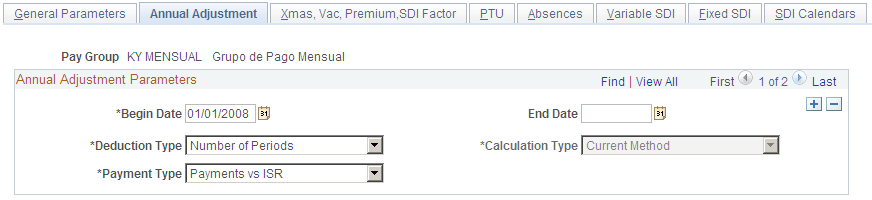

Use the Annual Adjustment page (GPMX_PARM_PAYGRP) to define the parameters to calculate the annual adjustment for each pay group in your company.

Navigation:

This example illustrates the fields and controls on the Annual Adjustment page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Begin Date and End Date |

Enter the date range of the annual adjustment parameters. Certain fields and field values are available only if the Begin Date and End Date are prior to 01/01/2008. |

Deduction Type |

Define how the system will handle the annual tax adjustment in case you have a debit at the end of the year. Values are Bracket, Number of Periods, and Single Deduction. If you select Number of Periods, the system will use the data in the bracket AA BR RNG DES PER in order to determine in how many pay periods the debit will be discounted. For example, if there is a 5000.00 MXN debit, based on the data of the bracket, the system will withhold 1000.00 MXN during five periods. If you select Bracket, the system will use the data in the bracket AA BR RNG DES SAL in order to determine the amount that needs to be withheld each pay period. The range will depend on the employee's daily rate. For example, if there is a 3000.00 MXN debit, and an employee has a 300.00 MXN daily rate, based on the data of the bracket, the system will withhold 100.00 MXN each pay period until it reaches the 3000.00 MXN amount. If you select Single Deduction, the system will withhold the complete debit amount in a single pay period. If the net pay is not enough to cover the amount of the deduction, the system will consider the remaining amount as an arrear and it will be deducted in future pay periods. |

Calculation Type |

Some companies calculate the annual tax adjustment with the method that existed in the year 1991. In this field, you'll specify which method to use when calculating the annual tax adjustment. Values are Both − Current & 1991, Current Method, and Method 1991. Once you've selected the Both − Current & 1991 method, the system then selects the method with the smaller tax. Note: The values Both − Current & 1991 and Method 1991 are available only if the Begin Date and End Date are prior to 01/01/2008. |

Payment Type |

If you have a tax credit at the end of the year, select one of the options to define how you will receive the credit. Values are Payments vs ISR and Single Payment. Either you'll select to get a payment or you'll have a credit applied to next year's ISR (federal taxes). If you select Payments vs ISR, it means that you'll get a credit on the regular tax versus the difference until this credit is covered. For example, let's say that an employee has 2400 MXN worth of taxes deducted for the year (100 MXN each semimonthly payroll). In the annual tax adjustment process, the system calculates that the real annual tax should be 2100 MXN. This means that there's a credit of 300 MXN due to the employee. If you calculate the next regular payroll, the system would ordinarily withhold 100 MXN (the regular tax for the employee's regular earnings). However, the system won't withhold any amount during 3 payroll periods (to make up for the difference between 2100 MXN and 2400 MXN). The system will cover the regular tax deduction with the credit that the employee has until it is covered. |

Return Credit |

Enter the date when the salary credit annual difference will be paid to the employee. Note: This field appears only if the Begin Date and End Date are prior to 01/01/2008. |