Defining State Taxes

To define earnings and deductions by state, use the Earn/Ded by State MEX (GPMX_STATE_TAXES) component. To define state and local taxes for a company, use the State Rates by Company MEX (GPMX_SP_ST_TAXES) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPMX_STATE_TAXES |

Define which earnings and deductions will be part of a state's tax base. |

|

|

GPMX_SPST_TAXES |

Define state and local taxes at the company level. This only applies to companies operating in Chihuahua and/or Ciudad Juarez. |

To define state taxes, you need to define earnings and deductions by state, state tax rates, and state tax rates by company.

Once you've defined state taxes, you can process state tax contributions during regular payroll runs and generate the State Taxes by Location report every month.

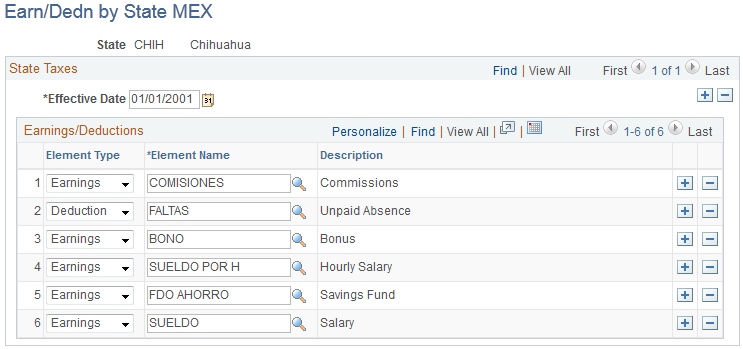

Use the Earn/Dedn by State MEX page (GPMX_STATE_TAXES) to define which earnings and deductions will be part of a state's tax base.

Navigation:

This example illustrates the fields and controls on the Earn/Dedn by State MEX page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Element Type |

Select the element type. Values are Deduction and Earnings. |

Element Name |

Select the earning or deduction element to be added to the state tax base. Note: This data is loaded into the payroll process with the IE AR ST TAX CNCPT array. |

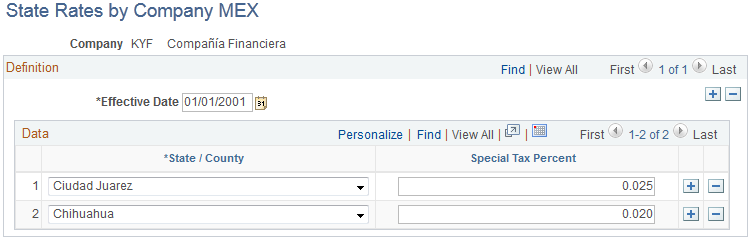

Use the State Rates by Company MEX page (GPMX_SPST_TAXES) to define state and local taxes at the company level.

This only applies to companies operating in Chihuahua and/or Ciudad Juarez.

Navigation:

This example illustrates the fields and controls on the State Rates by Company MEX page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

State/County |

Select Chihuahua, Ciudad Juarez, or Hidalgo. |

Special Tax Percent |

Enter the state tax rate for your company. |

Note: Chihuahua is the only state in Mexico that taxes a company's earnings based on the number of employees it has, so the state tax rates vary for each company.

It's difficult to determine the number of employees in a company before the payroll process, so you must determine the number of employees in your company and then the corresponding tax rates for your company individually.

You'll also define local tax rates for Ciudad Juarez on this page. The local tax rate varies depending on the amount of minimum wages of the entire payroll earnings in a month. This information can also be difficult to determine prior to running a payroll. Therefore, you can load this data into the payroll process with the IE AR ES CIA array.