Understanding Tax Processing

This topic discusses about taxes, tax methods and tax processing in Mexico.

Employers are legally required to maintain and report a variety of tax data about their employees. Global Payroll for Mexico delivers much of the set up information needed to calculate taxes in the system.

With Global Payroll for Mexico, you can define the method for calculating employees' taxes on the General Parameters page.

The tax methods are:

For regular earnings where ISR Art. 113 is applicable, the following tax methods are available:

Annual projection method.

Semimonthly projected ISR.

Without adjustment.

Adjustment during the month.

Adjustment at the end of the month.

Article 112 LISR (Severance pay method).

Article 142 RISR (Vacation Premium, Profit Sharing, and Christmas Bonus method).

Article 148 RISR (Multiple months payment method).

This topic discusses each tax method.

Annual Projection Method

This method projects the taxable base of the pay period as well as projecting the annual taxable base that will accrue for the employee in the annual form. This projection is calculated using annual tables. Once the annual tax is determined, a factor is calculated that divides the taxable base of the pay period by the annual projected taxable base. To determine the tax for the pay period, the projected annual tax is multiplied by the factor and this is equal to the period tax.

Semimonthly Projected ISR

For employees who are on a semimonthly projected ISR payroll, the system projects their salaries for the next period, taking into account that the projection will be made in every pay period and subtracting the tax retained in the previous periods.

The semimonthly projected tax method applies to all types of employees (hourly and salaried) with a semimonthly pay frequency.

Without Adjustment

Depending on the pay frequency, the system will divide the taxable base by the number of worked days and the result will be multiplied by the Day Factor (defined on the General Parameters page). The result will be the monthly taxable base. Then, the system will calculate the taxes to this monthly taxable base. Immediately after calculating the taxes (Articles 113, 114, and 115), the system divides the resulting tax amounts by the Day Factor and multiply the result by the number of worked days. This result gives us the proportional taxes that correspond to the pay period taxable base.

Adjustment During the Month

This method works the same way as the Without Adjustment method, but takes into consideration all the accumulated taxable earnings for the month. For example, if your company is running a weekly payroll, and you are currently running payroll for the third week of the month, the system will consider the taxable earnings from the two previously paid periods of the month as well as the current pay period. The same consideration is applied to worked days.

Adjustment at the End of the Month

This method is the same as the Without Adjustment method for all pay periods that are not the final one in a single month. This method is also similar to the Adjustment During the Month method for the pay period that is the final one in a single month.

Article 112 LISR (Severance Pay Method)

The system calculates the tax of one month salary for the employee using the method from Article 113. Once calculated, this tax will be divided by the monthly salary in order to determine a Tax Factor. Then, the severance pay taxable base will be multiplied by this factor in order to determine the Article 112 LISR tax amount.

Article 142 RISR (Vacation Premium, Profit Sharing, and Christmas Bonus Method)

The Article 142 RISR method is calculated in this way:

The taxable base is divided by 365 and multiplied by 30.4 in order to determine a monthly taxable base.

The result of this calculation is added to the regular taxable base of the pay period (the one used for the Article 113 tax method). Then, the system calculates the tax to this new taxable base based on the Article 113 method.

The tax for one month salary for the employee is calculated using the Article 113 method.

The difference between the tax from Step 2 and Step 3 is calculated.

The result from Step 4 is divided by the result from Step 1. This results in the Tax Factor.

The taxable base for Article 142 RISR is multiplied by the Tax Factor calculated in Step 5 in order to determine the tax.

Article 148 RISR (Multiple Months Payment Method)

The Article 148 RISR method is calculated in this way:

The taxable base is divided by the number of days that corresponds to the earnings. For example, a quarterly bonus payment is divided by the number of calendar days in the quarter. The result is multiplied by 30.4 in order to determine a monthly taxable base.

The result from Step 1 is added to the regular taxable base of the pay period (the one used for the Article 113 tax method). Then the system calculates the tax to this new taxable base based on the Article 113 method.

The tax for one monthly salary for the employee is calculated using the Article 113 method.

The difference between the tax in Step 2 and Step 3 is calculated.

The result from Step 4 is divided by the result from Step 1. This results in the Tax Factor.

The taxable base for Article 148 RISR is multiplied by the Tax Factor calculated in Step 5 in order to determine the tax.

To process federal taxes:

Define general tax parameters on the General Parameters page.

Process tax contributions during regular payroll runs.

Run the Federal Taxes report at the end of the tax year.

During a calendar year, there may be times when too much or too little tax is paid because of varying incomes or other circumstances. The annual income tax adjustment process corrects this problem.

You can identify employees who don't qualify for an annual tax adjustment. This includes employees who have:

Terminated and were rehired and the company decides not to adjust taxes.

Notified you in writing that they plan to present their tax adjustment themselves (self-presentation).

This could be based on several reasons. One reason is when an employee has earned more than the government-allowed income limit and must self-present their tax adjustment data.

To process tax annual adjustments:

Define annual adjustment parameters on the Annual Adjustments page.

Define an annual period and create the calendar for the pay groups that you will run on the Calendar Definition page in the core application.

Enter tax data from Form 37 on the Define Prior Employer Data MEX page.

Form 37 details tax data for employees you hire mid-year who worked for another company earlier in the same tax year. The system processes this information during the annual tax adjustment and that's why it's important to have this information entered prior to the annual adjustment process.

Identify payees who don't qualify for an annual tax adjustment on the Payees Without Adjustment page.

Run the Form 37 report for employees who are going to present their own annual adjustment tax data.

You can also run this report at other times of the year. For example, you may also want to provide this information to terminating employees.

Run the Annual Adjustment Tax process (PL AJUSTE ANNUAL) at the end of the year.

Run the Annual Tax Adjustment Results process (GPMXAA02) through the Annual Adjustment report to view annual tax adjustment results.

(optional) Run the Subsidio Acreditable process (GPMXAA04) through the Annual Adjustment report to display tax subsidy data and have the details of how the system calculated the Subsidio Acreditable for those employees who had multiple employers during the year.

Run the Minimum Wage Salary Level process (GPMXAA01) through the Annual Adjustment report to create an addendum to the annual tax adjustment process.

In Mexico, only employers pay state taxes. Each state defines which earning and deduction types are part of its taxable income and the applicable rates.

To process state taxes:

Define which earnings and deductions are eligible for state taxes on the State Taxes Earn/Ded page.

View and verify state tax rates on the State Taxes Rates page.

(optional) Define state and local tax rates at the company level for Chihuahua and Ciudad Juarez on the State Rates by Company MEX page.

Note: You have to define these taxes only if you have operations in these states or cities.

Get the state tax base by company; this is the sum of the tax base per employee working for such company during the payroll period.

GP Mexico processes payroll by employee, therefore there’s no way to get the State Tax base unless it is manually entered or calculated in a separate process after all payrolls are calculated. If your company goes with the second option then you’ll need to recalculate the payroll in order to calculate State Taxes and store the information in the writable array IE WA REPORTE.

There are two options to get the Total Base State Tax:

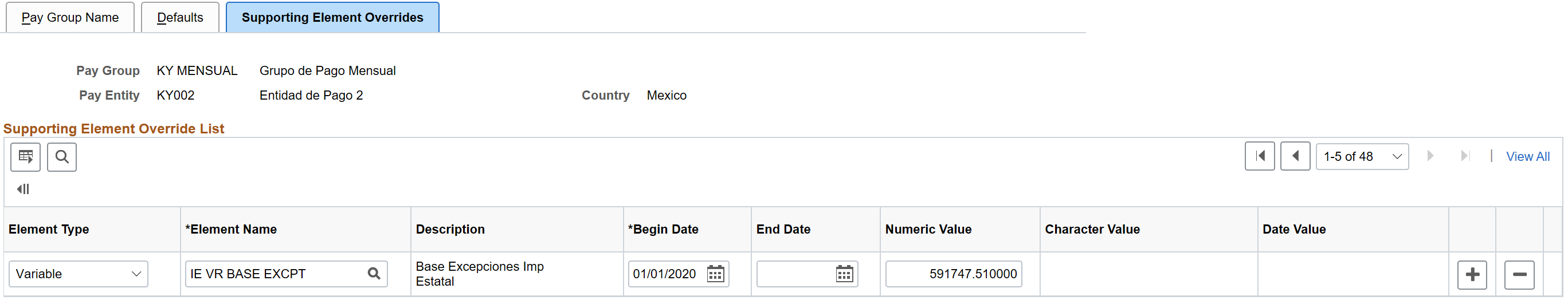

Enter value for variable IE VR BASE EXCPT at Supporting Element Overrides by Pay Groups or any other level, the payroll will take this value as Total Base State Tax.

Supporting Element Overrides

Calculate all payrolls with employees in the given company and then run SQR process GPMXIE01 with the option Generate Positive Input checkbox turned on; the process will generate Positive input for employees in open payrolls working in the selected state and that belong to the company during the selected period.

Note: Step 4 is only applicable for Campeche, Hidalgo, Queretaro, Oaxaca and Durango states.

Process tax contributions during regular payroll runs.

Run the State Taxes by Location report every month after the last payroll process of that month.

Note: The State Taxes Earn/Ded page, the State Taxes Rates page, and the Spec. Taxes Rates page are described in other topics.