Setting Up Inter-Company Transfer Processing

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

ACTION_REASON_TBL |

Define or modify personnel action reasons. |

|

|

GPMX_INTERCOM_PARM |

Define which accumulators, earnings, and deduction elements from the prior company to carry over to the new company for employees with inter-company transfers. The Inter-Company Transfer process uses these mappings to move the employee's finalized payroll values for these elements between internal companies. |

The government requires that companies report employee's income from former and current employers separately on Form 37—the annual earnings and deductions legal report. This applies to employees who change jobs between unaffiliated companies as well as to employees who transfer from one internal company to another. Global Payroll for Mexico provides functionality to meet the Form 37 tax reporting requirements for inter-company transfers where the internal companies have a different employer RFC within the system. Use this feature to maintain the accumulators, earnings, and deductions for employees when the employees do inter-company transfers. After processing the data, you can generate the Form 37 report with separate company reporting data for employees with inter-company transfers.

Inter-Company Transfer Process

The Inter-Company Transfer feature centers around the Inter-Company Transfer Application engine process (GPMX_INTERC). The Inter-Company Transfer process:

Identifies which employees have qualifying inter-company transfers to process.

Confirms that the last payroll that includes the transferring employee is finalized.

Loads the specified earnings, deduction, and accumulator elements of the former company and their values based on the values last calculated by the payroll engine.

Inserts the specified elements and their values into the Define Prior Employer Data MEX page as former employer data.

Updates the values of the specified elements of the former company to zero.

Steps to Process Inter-Company Transfers

To process inter-company transfers:

Define the accumulators, earnings, and deductions to transfer from the former company to new company on the Inter-Company Parameters MEX page.

Define the action and reason code combinations that qualify for inter-company transfer processing by selecting the Inter-Company Transfer check box on the Action Reason page of HR.

Use the Job Data component in HR to add a new Job record on the Job Data component for the employee with: (a) an action and reason code combination that is set up for inter-company transfers, and (b) an updated Company field value for another internal company.

Whenever you enter a new row of job data for an employee in the Job Data component and the specified action and reason code combination is set up for inter-company transfers, the system sends the data from HR to Global Payroll for Mexico via the WORKFORCE_SYNC service operation in Integration Broker. The system transfers this data only when the action and reason code combination is set up for inter-company transfers and the Global Payroll for Mexico country extension is selected on the Installation Table page.

Verify that the system successfully transmitted the inter-company transfer data from HR to Global Payroll for Mexico for the employee on the Inter-Company Payee Detail MEX page.

The system loads data for the inter-company transfers into this table. If you do not see the employee in this table, the system has not transmitted the HR data. Verify that you have selected Global Payroll for Mexico on the Installation Table page, set up the action and reason code combination for inter-company transfers on the Action Reason page, entered correctly the job data for the employee's inter-company transfer on the Job Data component, and enabled PeopleTools Integration Broker to send the WORKFORCE_SYNC service operation.

Verify that the last payroll of the transferring employee is finalized through the Results By calendar Group component.

Within the same component, also note the calculated results for the earnings, deductions, and accumulators that you specified on the Inter-Company Transfer Mapping page.

Run the Inter-Company Transfer process on the Inter-Company Transfer MEX run control page to process the data for inter-company transfers.

Select to either adjust accumulator balances or undo processing. The process includes only the employees who are in the specified calendar group and pay group, who have a new Job record with a qualifying action and reason code combination for inter-company transfers, and who has their last payroll finalized.

Verify that the process updated the employee's inter-company transfer data on the Inter-Company Payee Detail MEX page.

Verify that the specified accumulators adjusted appropriately for the old company on the Adjust Accumulator Balance page by accessing the employee's data for the calendar involved in the inter-company transfer processing.

If you ran the process to adjust accumulator balances, the accumulators adjust to zero. If you ran the process to undo processing, the accumulators adjust to their original values.

Verify that the accumulators that you defined as part of the inter-company transfer mapping appear as former employer data for the employee on the Define Prior Employer Data MEX page.

The accumulator values should match the values from the last payroll run. If you ran the process to undo processing, the accumulator data for the employee is deleted from this page only.

Use the Action Reasons page (ACTION_REASON_TBL) to define or modify personnel action reasons.

Navigation:

Use the Inter-Company Transfer check box on the Action Reason page (Set Up HCM, Product Related, Workforce Administration, Action Reasons) in HR to indicate the action and reason code combinations that are valid for processing inter-company transfers within Global payroll for Mexico. To access the page, select

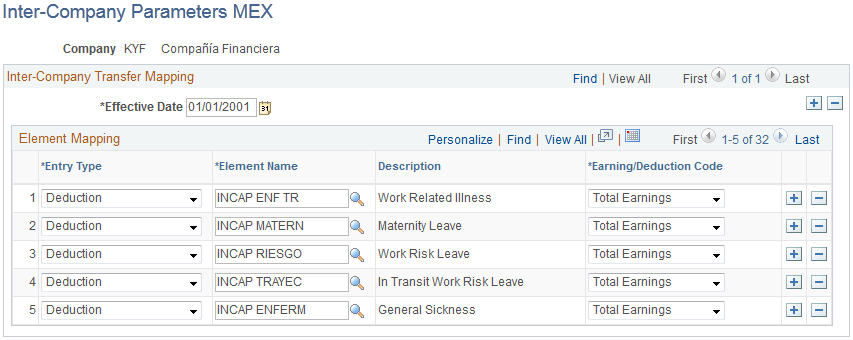

Use the Inter-Company Parameters MEX page (GPMX_INTERCOM_PARM) to define which accumulators, earnings, and deduction elements from the prior company to carry over to the new company for employees with inter-company transfers.

The Inter-Company Transfer process uses these mappings to move the employee's finalized payroll values for these elements between internal companies.

Navigation:

This example illustrates the fields and controls on the Inter-Company Parameters MEX page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Effective Date |

Enter the effective date on which the element mapping for inter-company transfers becomes valid. |

Entry Type |

Select the type of element that you are mapping from one company to another for inter-company transfers. This element mapping definition is used to insert specified earnings, deduction, and accumulator elements into the Define Prior Employer Data MEX page as former employer data. Your choices are Earnings, Deduction, orAccumulator. |

Element Name andDescription |

Select the element that you are mapping from one company to another for inter-company transfers. The system prompts you to select from elements based on the specified entry type. |

Earning/Deduction Code |

Select the earning or deduction code to which you are mapping the specified element to prior employer data. The Inter-Company Transfer process uses this mapping of accumulators to earning/deduction codes to populate the Define Prior Employer Data MEX page with the employee's accumulator values from the former company. |