Viewing and Updating SDI Data for Payees

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPMX_SDI_DATA |

View a payee's SDI data and override the Fixed SDI amount. |

The system automatically creates a new row of SDI data for a payee when:

A payee is hired, terminated, or has a salary change.

The Fixed or Variable SDI process is run and the system detects a change to SDI.

The SUA interfaces generate two flat files (one with payee data and one with transactions). The SUA system loads these files via a batch process and generates the payee and employer quotas every two months.

Then the employer calculates the corresponding quotas that need to be paid bimonthly and the quotas that are reported every two months. This is done with the SUA software. Once the quotas are calculated, the employer has to pay the corresponding amount to the bank.

You can view events that have caused changes to a payee's SDI data. You can also override a payee's Fixed SDI amount.

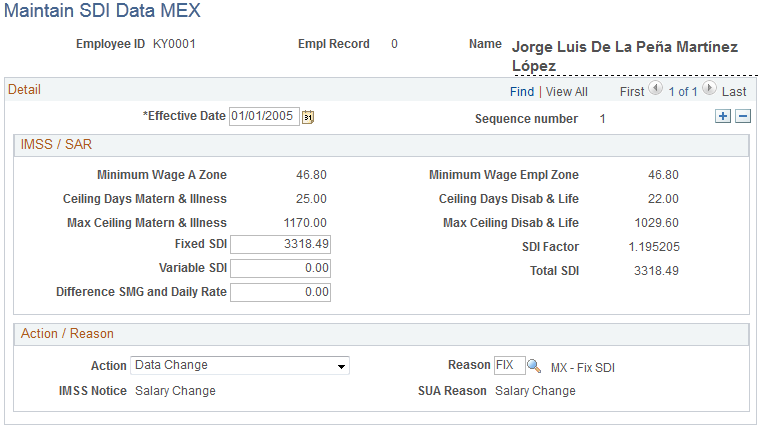

Use the Maintain SDI Data MEX page (GPMX_SDI_DATA) to view a payee's SDI data and override the Fixed SDI amount.

Navigation:

This example illustrates the fields and controls on the Maintain SDI Data MEX page. You can find definitions for the fields and controls later on this page.

IMSS/SAR

Field or Control |

Description |

|---|---|

Minimum Wage A Zone |

Displays the daily minimum wage for wage zone A, as defined on the Minimum Wages MEX page. |

Minimum Wage Empl Zone (minimum wage employee zone) |

Displays the daily minimum wage for the employee's zone. (The employee's wage zone is determined by the establishment that is associated with the employee's location.) |

Ceiling Days Matern & Illness (ceiling days maternity and illness) |

Displays the ceiling days that apply to social security contributions for maternity and illness. This number comes from the EYMPD row on the Quotas MEX page. |

Ceiling Days Disab & Life (ceiling days disability and life) |

Displays the ceiling days that apply to social security contributions for disability and life. This number comes from the IYV row on the Quotas MEX page. |

Max Ceiling Matern & Illness (maximum ceiling maternity and illness) |

Displays the maximum contribution base that the payee can have for maternity and illness. The system calculates this amount by multiplying the minimum wage for Zone A by the ceiling days for maternity and illness. |

Max Ceiling Disab & Life (maximum ceiling disability and life) |

Displays the maximum contribution base that the payee can have for disability and life. The system calculates this amount by multiplying the minimum wage for the employee's zone by the ceiling days for disability and life. |

Fixed SDI |

Displays the fixed SDI amount that is calculated by the SDI FIJO process. This amount is reported to Social Security when a payee is hired or the payee's salary changes. You can override the amount, if necessary. |

SDI Factor |

Displays the SDI factor that is defined for the payee's pay group on the Xmas, Vac, Premium, SDI Factor page. The system uses the SDI factor to calculate Fixed SDI. |

Variable SDI |

Displays the variable SDI amount that is calculated by the SDI VARIABLE process. Variable SDI is added to the Fixed SDI in the SDI Total. |

Total SDI |

Displays the total of the fixed and variable SDI amounts. This amount is reported to the IMSS, when there's a change. |

Difference SMG and Daily Rate |

Displays the difference between the minimum wage for Zone A and the employee's daily rate. |

Action/Reason

The information in this group box is populated automatically based on changes made in HR.

Field or Control |

Description |

|---|---|

Action andReason |

Displays the action and reason code that defines the action. This information comes from HR. |

IMSS Notice |

Indicates the type of IMSS notice that will be generated. You associate IMSS Notices with Action/Reason codes in the Mexico section of the Action Reason page in HR. |

SUA Reason |

Indicates the type of transaction that will be reported to IMSS. You associate SUA Reason with Action/Reason codes in the Mexico section of the Action Reason page in HR. |