Reviewing and Maintaining Appendix 8A Forms

This topic provides an overview of Appendix 8A forms.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPSG_APP_8A_1 |

Review the employee's residence, occupation and rent details. |

|

|

GPSG_APP_8A_2 |

Review additional specific benefit item units and values for furniture or fittings. |

|

|

App 8A Furniture & Fittings Page |

GPSG_APP_8A_1_SEC |

Enter additional Appendix 8A furniture and fittings details. This page is editable only if the Issue Status field has to be set to Awaiting. |

|

GPSG_APP_8A_3 |

Review the values that are used in the calculation of the taxable value of hotel accommodation that is provided to employees and their families. |

|

|

GPSG_APP_8A_4 |

Review any additional gains or profits (benefits in kind) that the employee receives through employment. |

The Appendix 8A documents received benefits in kind. A field on the IR8A summarizes the value of benefits in kind that an employee receives and the Appendix 8A component, which enables you to capture and maintain the employee's benefits in kind details. The value of benefits in kind are calculated by using the effective-dated rates that are stored in the Benefit Rates table and viewed by using the IRAS Benefit Rates SGP page. These rates reflect the rates that are detailed in sections B and C of the Appendix 8A form. These values are used in the calculation of the taxable value of the employee's benefit in kind items. The system uses the Appendix 8A data in conjunction with the IR8A data to create the IR21 form, which is a compilation of two years of employee data, where applicable. All fields on the Appendix 8A pages populate the IR21 - Appendix 1 report.

Note: The Issue Status field on each of the pages in the component indicates the current status of the form and whether it has been issued to the employee. Values are Awaiting and Issued. The system sets the issue status to awaiting when you first create the record. Ensure that the status is set to awaiting before you print the Appendix 8A. When you print the Appendix 8A form, the system changes the status to issued. The status should be awaiting whenever you want to print or reprint an Appendix 8A, IR8A/IR8S or IR21 form. If you already issued one of the forms, change the status back to awaiting to reprint it, or you can select the Reprint Forms check box to reprint those that you already issued. You should also change the status to awaiting before printing where the setting is issued.

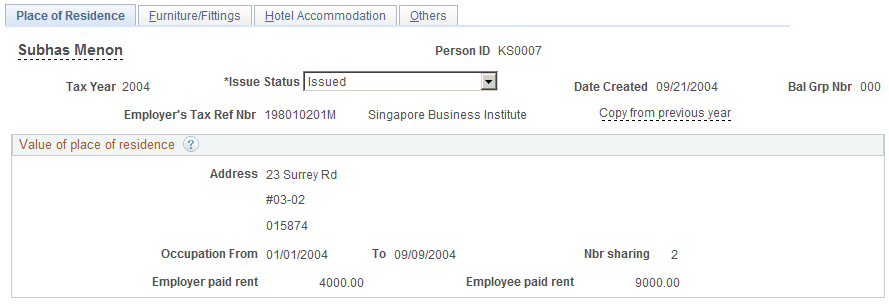

Use the Place of Residence page (GPSG_APP_8A_1) to review the employee's residence, occupation and rent details.

Navigation:

This example illustrates the fields and controls on the Place of Residence page.

The details that you enter on this page populate the fields on the IR21 Appendix 1 Details pages. You must run the Appendix 8A - calculation program before the details that you enter on this page populate the fields on the IR21 Appendix 1 Details.

Field or Control |

Description |

|---|---|

Copy from previous year |

When you click this link, the system searches for existing Appendix 8A data on the employee's previous year's form. If data is located, the system automatically populates the Appendix 8A fields. This link is active only if the Issue Status field is set to Awaiting. |

Value of place of residence

Field or Control |

Description |

|---|---|

Address |

If the employee's residence is part of an employment benefit in kind, enter the full address of the employee's residence that is provided by the employer. This is a required field. |

Occupation From and To |

Enter the dates that the employee occupied the residence during the year. These dates also automatically determine the total days occupied on the IR21 Appendix 1 Details 1 page. |

Nbr sharing (number sharing) |

Enter the number of employees that were living and sharing the residence during the year (excluding family members). |

Employer paid rent and Employee paid rent |

Enter the values for the year. These values also populate the fields on the IR21 Appendix 1 Details 2 page, and they are used in the calculation of the taxable benefit or taxable value of the employee's Place of Residence on the IR21 – Appendix 1 Form. The annual value is the estimated annual rent that a property can fetch and the amount that is to be declared is shown in the property tax bill. If the place of residence is or was rented by the employer and if the annual value is not available, the amount of rent that is paid by the employer should be declared. Note: If the place of residence is or was shared among employees, annual value and paid rent should be apportioned according to the number of employees that are staying in the place. |

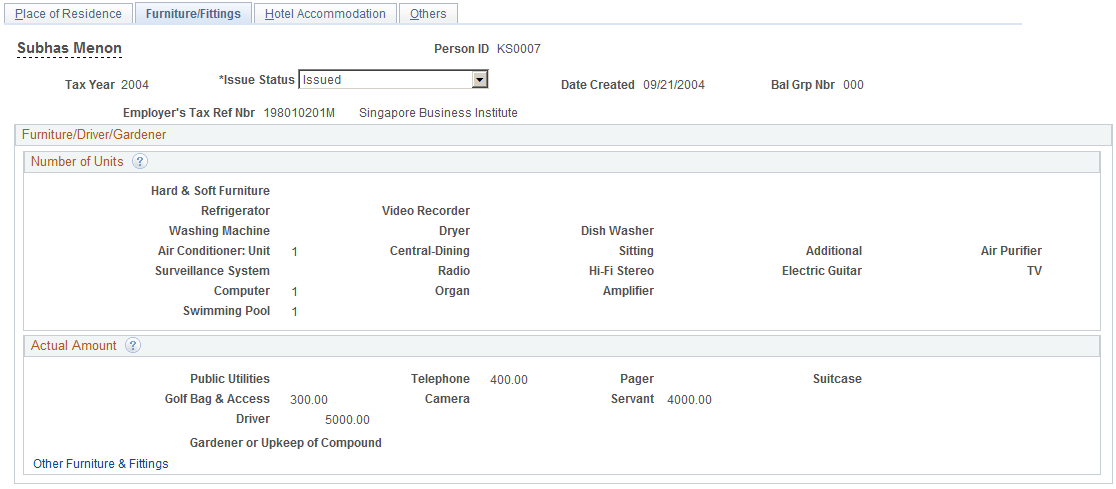

Use the Furniture/Fittings page (GPSG_APP_8A_2) to review additional specific benefit item units and values for furniture or fittings.

Navigation:

This example illustrates the fields and controls on the Furniture/Fittings page.

You can enter the number and monetary value of each of the furniture and fitting, driver, and gardener benefit items within the employee's residence. The system calculates the value of the benefits in kind by using effective-dated rates that are stored in the Benefit Rates table. These rates reflect the rates that are detailed in sections B and C of the Appendix 8A form. These values are used in the calculation of the taxable value of the employee's benefit in kind items.

Click the Other Furniture & Fittings link to access the App 8A Furniture & Fittings page.

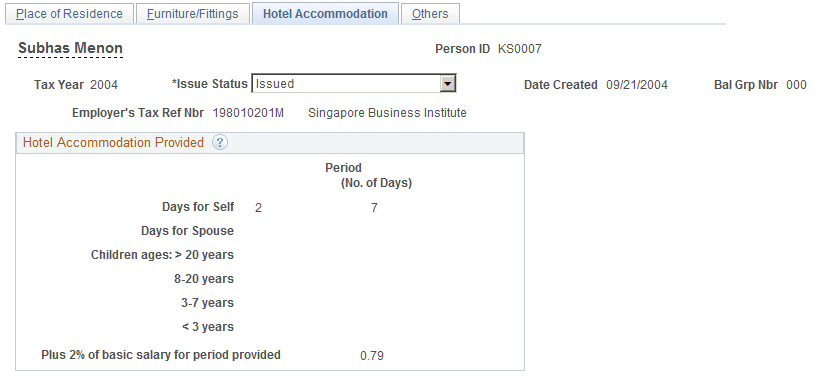

Use the Hotel Accommodation page (GPSG_APP_8A_3) to review the values that are used in the calculation of the taxable value of hotel accommodation that is provided to employees and their families.

Navigation:

This example illustrates the fields and controls on the Hotel Accommodation page.

The self; spouse; children under 20 years old; and children ages 8 to 20 years, three to seven years, and under three years values populate the fields on the IR21 Appendix 1 Details 2 page. You use these values in the calculation of the taxable value of hotel accommodation that is provided to employees by using the rate per person that is stored in the Benefit Rates table (or in Section C of the Appendix 8A Form). You enter the total number of persons (self, spouse or child) and the period during which the accommodation was provided to these persons.

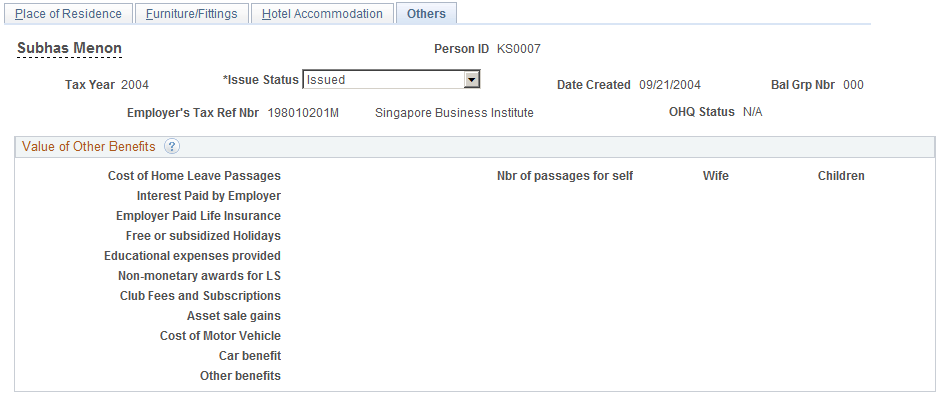

Use the Others page (GPSG_APP_8A_4) to review any additional gains or profits (benefits in kind) that the employee receives through employment.

Navigation:

This example illustrates the fields and controls on the Others page.

Value of Other Benefits

Enter the number or monetary value of each of the other benefit items. The system calculates the value of the benefits in kind by using effective-dated rates that are stored in the Benefit Rates table. These rates reflect the rates that are detailed in sections B and C of the Appendix 8A form. Use these values in the calculation of the taxable value of the employee's benefit in kind items.

Field or Control |

Description |

|---|---|

Cost of Home Leave Passages, No. of passages for self (number of passages for self), Wife, and Children |

Enter the total cost of home-leave passages and incidental amounts only if the operation is considered to be an overseas headquarters as identified on the IRAS Employer SGP page. These fields are only available when the IRAS Employer SGP page states that the company is an overseas headquarters. As an IRAS concession, the taxable benefit of leave passages is computed as 20 percent of their value if the passages are to the employee's home country. This is limited to only one passage each for the employee and spouse and two passages for each child, annually. To satisfy this requirement, enter the number of passages for self (the employee), spouse, and children. The amounts that are in the fields (representing sections 4b to 4k) change by default to the categories and their elements that you set up on the IRAS Tax Forms SGP page for the Appendix 8A form. |

Interest Paid by Employer |

Enter the amount of Interest that the employer pays as the result of an employee's free or subsidized loan. For example, the company may obtain loans at market rates and provide loans to its staff interest free or at subsidized rates. It includes the values from the accumulators for the category App 8A Interest Paid. |

Employer Paid Life Insurance |

Enter the total amount of life insurance premiums that the employer pays. Premiums that an employer pays on an insurance policy where the employee is a beneficiary are taxable to the employee. In effect, this is a reimbursement of personal expense. It includes the values from the accumulators for the category App 8A life insurance. |

Free or subsidized Holidays |

Enter the amount of holidays fares or costs that are paid or subsidized by the employer, or paid by the employee in conjunction with the employment. It includes the values from the accumulators for the category App 8A holiday passages. |

Educational expenses provided |

Often employers require that their employees attain a certain degree of academic knowledge, as part of the requirements of the position. The courses may lead to academic and professional qualifications or vocational qualifications relating to the employee's trade, business or employment. Enter the full amount of educational expenses that the employee incurs as part of employment. It includes the values from the accumulators for the category App 8A educational expenses. |

Non-monetary awards for LS (non-monetary awards for long service) |

Enter the total value of any non-monetary awards that the employee receives for long service. For example, the employee may receive a gift such as a painting or a gold watch. It includes the values from the accumulators for the category App 8A long service award. |

Club Fees and Subscriptions |

Enter the total fees amount that the employee pays for membership in or subscriptions to any clubs or associations. It includes the values from the accumulators for the category App 8A club subscriptions/fees. |

Asset sale gains |

Enter the total amount of money that the employees receives through the sale of any assets. It includes the values from the accumulators for the category App 8A gain on sale of assets. |

Cost of Motor Vehicle and Car benefit |

The employee may be provided with a new car for use by the employer. Enter the total cost of the motor vehicle to the employee. It includes the values from the accumulators for the category App 8A motor vehicle cost. An employee who is provided with a car by the employer is assessable to tax on the value of benefit that they enjoyed. Enter the total amount of this car benefit. For example, the employer may pay for gas. It includes the values from the accumulators for the category App 8A car benefit. |

Other benefits |

Enter any other miscellaneous benefit amounts that the employee receives. It includes the values from the accumulators for the category App 8A other benefit. |