Maintaining Garnishment Proration Rules

To maintain garnishment proration rules, use the Proration Formula USA (GPUS_GRN_PRORUL) component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPUS_GRN_PROUL |

Define proration formulas by state and garnishment type. |

Because garnishments cannot go into arrears, some states require that employers prorate an employee's garnishments when insufficient funds are available to cover all garnishments of the same type. Proration rules are used to calculate the amount to be deducted for each garnishment.

Note: If multiple garnishments of the same type exist and you enter positive input for one of them, proration does not occur automatically. You must manually calculate the proration based on the initial row of positive input and insert a row of positive input for all garnishments of that type.

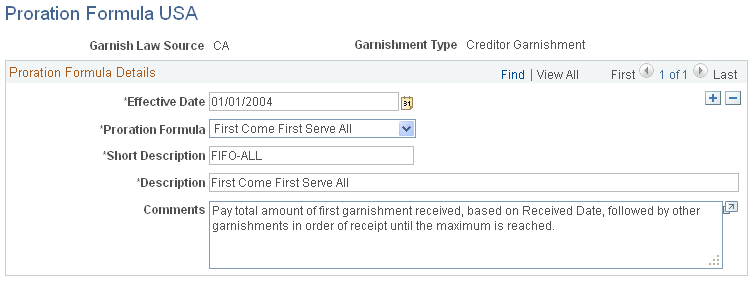

Use the Proration Formula USA page (GPUS_GRN_PRORUL) to define proration formulas by state and garnishment type.

Navigation:

This example illustrates the fields and controls on the Proration Formula USA page.

Note: PeopleSoft Global Payroll for United States delivers and maintains garnishment proration rules for support and creditor garnishments.

Field or Control |

Description |

|---|---|

Proration Formula |

Select the formula to use to prorate garnishments for the state and garnishment type displayed at the top of the page. Valid values are all formulas with a category of GPR (Garnishment Proration Formula). Note: In Global Payroll you define formulas using the Formulas component (GP_FORMULA). |