State Tax Calculation

This topic discusses how to:

Calculate state income tax.

Calculate SWT.

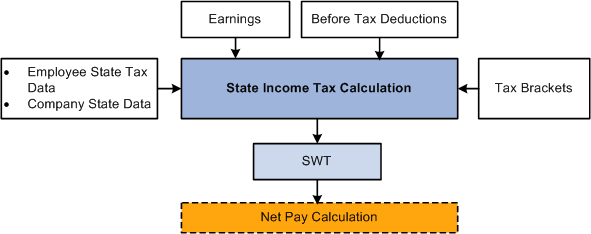

This diagram illustrates the flow of state income tax calculation:

This diagram illustrates the flow of state income tax calculation.

This diagram presents an overall view of the calculation of state income tax. It shows how the system uses employee data, company data, earnings, deductions, and supporting elements to calculate SWT for payees. The system then uses the taxes and credits to calculate net pay.

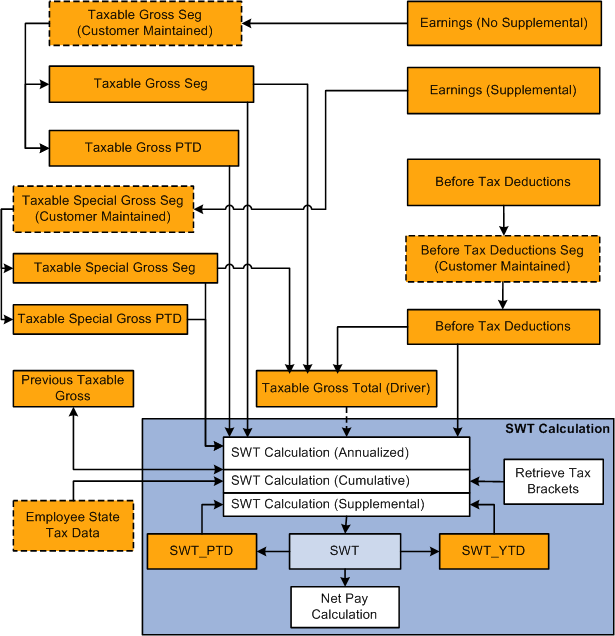

This diagram illustrates the flow of SWT calculation:

This diagram illustrates the flow of SWT calculation.

The system calculates SWT as a deduction (SWT) using the formula TAX FM SWT. The system includes this deduction in net pay calculation. Because a payee may possibly earn income from multiple states during the year, the system uses an accumulator driver (SWT GRS TOT) to generate multiple resolutions of the deduction. For every state that applies to a payee, SWT GRS TOT drives a separate resolution of the SWT deduction. The calculation has three phases, based on the tax method and payment method for supplemental wages:

Annualized

Cumulative

Supplemental (paid with regular wages or in a separate payment)

The calculations are based on the State Tax table that determines which formula to apply for each state.

This table returns:

The formula to apply for regular wages.

The formula to apply for supplemental income paid with regular wages.

The formula to apply for supplemental income paid separately.

The rounding rule to apply.

Note: You can override the tax method and payment method that the system uses to calculate SWT.