Updating Employees' Tax Codes

This topic provides an overview of the Tax Uplift process and discusses how to change employees' tax codes.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

GPGB_TAXCDE_UPLIFT |

Run the Tax Uplift SQR process (GPGBTXUP) that changes the tax codes for employees with the same tax code letter. |

For the majority of employees, their tax code comprises a letter and a number:

The letter denotes the type of tax payer.

The number indicates the employee's tax free amount for the year.

Each time the UK government introduces changes to personal allowances, this has an impact on the number in employees' tax codes. Global Payroll for the UK provides the Tax Uplift process to automate the updating of employees' tax codes. This process updates tax codes for all employees with the same letter in their tax codes.

HMRC notifies employers of the tax code increases in the HMRC P7X document which is included in the Employer's Budget Pack.

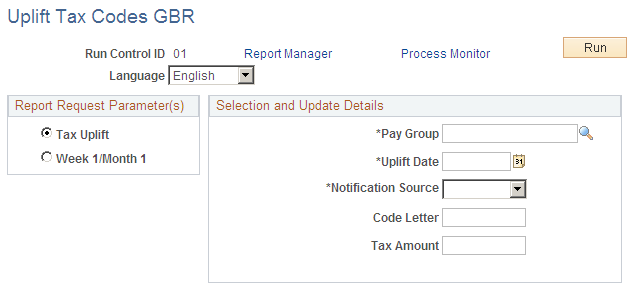

Use the Uplift Tax Codes GBR page (GPGB_TAXCDE_UPLIFT) to run the Tax Uplift SQR process (GPGBTXUP) that changes the tax codes for employees with the same tax code letter.

Navigation:

This example illustrates the fields and controls on the Uplift Tax Codes GBR page.

Field or Control |

Description |

|---|---|

Report Request Parameters |

Select one of these parameters: Tax Uplift to perform a tax uplift. Week 1 Month 1 to change all the Week1/Month1 indicators to a cumulative basis for the first processing period in a new tax year. If you select Week 1 Month 1, the Code Letter and Tax Amount fields become unavailable for data entry. Note: If the P9X document includes both Week1/Month 1 indicator and tax code uplift instructions, process the Week1/Month1 updates first with an effective date of April 6. Then process the tax code uplift with the same effective date. Specify P9X in the Notification Source field. You cannot process Week1/Month1 indicators and tax code uplifts on the same date if the notification source is P7X. |

Pay Group |

Select the pay group that is subject to the tax uplift, or for which Week 1/Month 1 indicators are being changed. |

Uplift Date |

Enter the date from which the Tax Code Uplift or Week 1/Month 1 changes are effective. The processes will apply this value to the Start Date of the new employee tax records. |

Notification Source |

Select the notification source code of the tax uplift that you are applying. This is either P7X or P9X. |

Code Letter |

Enter the letter or suffix of the tax code that needs to be increased (uplifted). |

Tax Amount |

Enter the amount to increase the tax code with the code letter specified in the Code Letter field. The increase is defined by HMRC in their Employer Budget Pack for each code letter. Note: You can also decrease the amount by entering a negative number. |

The Tax Code Uplift process creates a log file that you can check for error messages. Access the log by clicking the Process Monitor link, then click the Details link and click the Message Log link.