Understanding Banking

This topic discusses:

The banking process

Setup requirements

Batch processing

Banking process flow

Country-specific processing.

In Global Payroll, the banking process includes:

Setup.

Batch processing.

Tasks for local country extensions.

This topic discusses setup and batch processing. For more information about how banking works with local country extensions, see the banking topic in the corresponding Global Payroll country extension documentation.

Note: If your organization doesn't have direct deposit or electronic transfer for payees, you may not need to use the banking feature.

This topic discusses:

Bank setup requirements

Funding setup requirements

Disbursement setup requirements

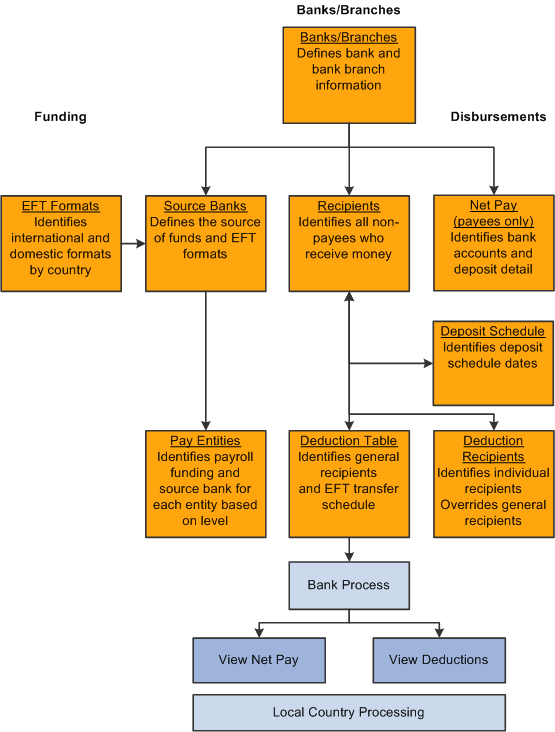

Bank Setup Requirements

Banks and branches are financial institutions that fund payroll or receive payroll calculations.

To set up banks:

Define bank information on the Bank Table page.

Set up banks on the Bank Table page, including basic information for all financial institutions involved in the payroll funding and disbursement process. You must complete this page before a bank can be identified as a source bank account or as a recipient.

Specify branch information on the Branch Table page (optional).

Define which branches apply to the banks. A bank can have one or more branches.

Note: Not all countries require bank branch information.

Funding Setup Requirements

Funding refers to the source of payroll money.

To set up funding:

Define electronic funds transfer (EFT) formats, by country, on the Electronic Transfer Formats page.

Specify source banks for payroll on the Source Bank Accounts page.

Source banks are where payroll disbursements come from. For each source bank, you identify the appropriate bank/branch, account number, and EFT format.

Define the level of funding on the Pay Entities - Source Bank Link page.

Each organization can have various levels of funding sources (source banks). One organization might fund its entire payroll from a single bank; another might define funding at a lower level, such as by company.

See Setting Up Funding.

Disbursement Setup Requirements

Disbursement refers to payroll amount destinations. Net pay disbursements can go to payees, and deduction amounts can be disbursed to recipients, such as a health care provider or a government agency.

To set up disbursements:

Define deposit schedules on the Deposit Schedules page.

Define recipients on the Deduction Recipients page.

Recipients can be entities (general recipients) or individuals (individual recipients).

Assign recipients to deductions.

This procedure varies with recipient type.

Identify an individual's bank account information and disbursement details on the Bank Account Information page and the Net Distribution page.

This is necessary for disbursing an individual's net pay electronically.

See Defining Deposit Schedules, Defining Recipients, Assigning Recipients to Deductions and Payees, and Defining Payee Net Pay Elections.

Batch processing for banking occurs in the Global Payroll core application and in the country extension.

To process bank payment information:

Finalize the pay run on the Payroll/Absence Run Control page.

Before running the banking process, you must finalize the payroll run or approve the items to pay.

Run the banking process, using the Payment Preparation page.

The banking process is a batch job that takes the results of payroll calculations and populates the payment table (GP_PAYMENT), which includes details on each recipient. It identifies the recipient, the amount owed, the source bank, and the account number.

Note: You must run the banking process in the same order in which you run your payrolls. For example, if you have finalized a payroll for both November and December and try to run the banking process on the December payroll before running it on the November payroll, the process will result in an error.

Run the local country batch process.

Each country has unique file format requirements for transmitting data electronically. Individual processes have been developed for each country that extract data from the payment file and format it appropriately.

Note: For more information about local country batch processing, see the banking section in the corresponding Global Payroll country extension documentation.

You can view the results of the banking process (step 2) and the results of the local country batch process (step 3) using the Review Payments by Cal Group component.

This diagram illustrates the flow of the banking process.

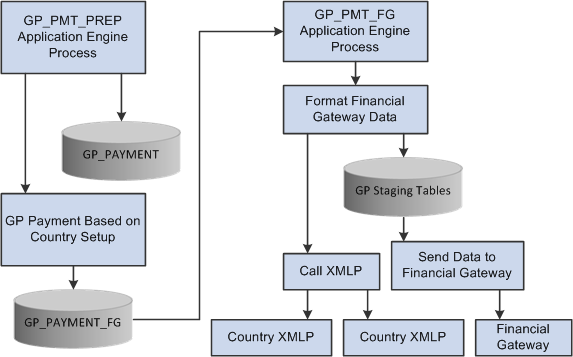

Global Payroll provides a flexible, generic banking framework that enables organizations with multinational operations to use PeopleSoft Financial Gateway as a single point of distribution for all of their payments. You define application packages and SQL statements for each country in your organization. The existing banking process, GP_PMT_PREP, uses this country-specific setup to generate country-specific payments. The Payment for FG (GP_PMT_FG) process sends the country-specific payments to PeopleSoft Financial Gateway.

PeopleSoft Financial Gateway sends a message to the HCM database when an error occurs that displays the status in the Payment Transactions page of the Results by Calendar Group component in PeopleSoft Global Payroll. This streamlines the maintenance of the Financial Gateway Payment Preparation table. You can view more information in the Payments transactions page through multiple tabs and are able to review errors from Financial Gateway in the Errors tab.

This topic discusses:

Country-specific data process flow.

Country-specific setup requirements.

Country-specific batch processing.

Integration with PeopleSoft Financial Gateway.

Country-Specific Data Process Flow

The process flow for country-specific payments is slightly different than the regular banking process flow.

This diagram illustrates the process flow for country-specific data.

Country-Specific Setup Requirements

In addition to the normal banking setup requirements, to process country-specific payments you must also:

Define application packages for a country on the Banking Country Setup Page.

Generate a country-specific SQL statement on the Banking Preparation Definition Page.

Define payment process settings on theInstallation Settings Page.

See PeopleTools: Integration Broker Service Operations Monitor product documentation for both Global Payroll and Financial Gateway.

See Setup Prerequisites.

Country-Specific Batch Processing

You process country-specific payments using the same Global Payroll Banking Process (GP_PMT_PREP) that you use for non-country-specific banking. When a row of data exists for a country on the Banking Country Setup component, however, GP_PMT_PREP executes country-specific logic.

If the country uses the delivered CORE_BANK:SQL application package, then the system references the banking preparation definition for that country and for each defined sequence processes the country-specific SQL statement using the country, calendar run ID, and employee ID range selected on the Run Payment Prep Process run control page. The system loads the results into the GP_PAYMENT_FG record.

If the country does not use the delivered CORE_BANK:SQL application package, then the system uses the application package defined for the country in the Banking Country Setup component to load results into the GP_PAYMENT_FG record for the country, calendar run ID, and employee ID range selected on the Run Payment Prep Process run control page.

Integration with PeopleSoft Financial Gateway

PeopleSoft Global Payroll enables you to send generated payment details from PeopleSoft Global Payroll to PeopleSoft Financial Gateway. Financial Gateway then dispatches the payments to banks.