(USA) Setting Up the Company State Tax Table

To set up the Company State Tax table, use the Company State Tax Table component (CO_STATE_TAX_TBL) or Agency State Tax Table USF component (CO_STATE_TAX_TBL) and Tax Collector Table component (TAX_COLLECTOR_TBL).

These topics discuss how to set up the Company State Tax Table.

Note: The tax tables discussed in these topics are required for both the Payroll for North America and Payroll Interface applications. The documentation for each of these applications discusses additional tax data setup that is specific to the application.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CO_STATE_TAX_TBL |

Set up an entry in the Company State Tax Table for each state where your organization collects or pays taxes. |

|

|

CO_STATE_TAX_TBL2 |

Identify the voluntary disability plans associated with the company. |

|

|

CO_STATE_TAX_TBL3 |

Enter your general ledger account numbers for state taxes. |

|

|

CO_STATE_TAX_TBL4 |

Configure company-specific tax parameters for other programs. |

|

|

Company State Tax Report Page |

PRCSRUNCNTRL |

Run TAX704 to print information from the Company State Tax Table, which identifies the states in which your company collects and pays taxes. |

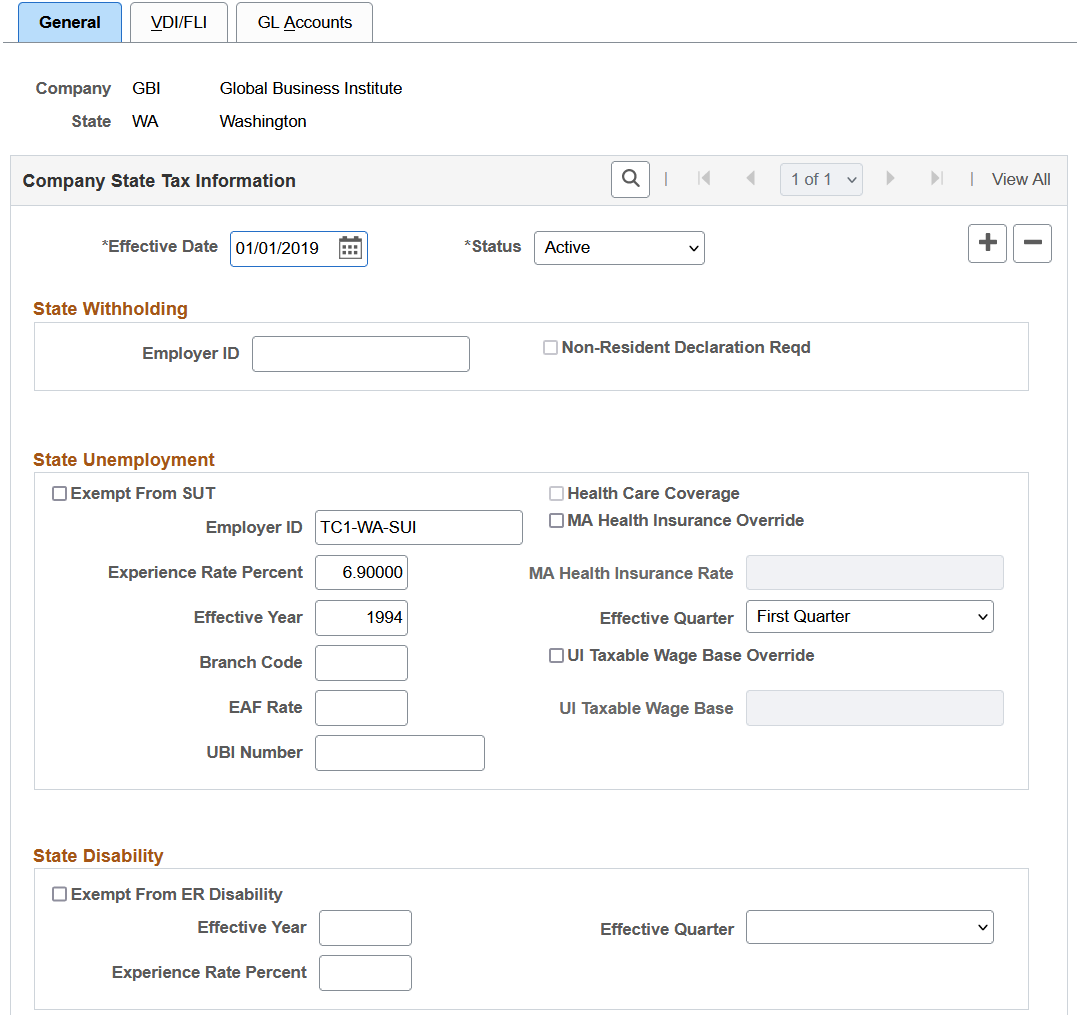

Use the General page (CO_STATE_TAX_TBL) to set up an entry in the Company State Tax Table for each state where your organization collects or pays taxes.

Navigation:

This example illustrates the fields and controls on the Company State Tax Table - General page (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Company State Tax Table - General page (2 of 2). You can find definitions for the fields and controls later on this page.

The State field in State Tax Data 1 and Local Tax Data is edited against this table. You must create entries in this table before entering any state and local tax information for your employees.

State Withholding

|

Field or Control |

Description |

|---|---|

|

Employer ID |

Enter your state employer ID for state withholding. |

|

Non-Resident Declaration Reqd |

This check box is selected or deselected by default according to the Federal/State Tax Table 1 record for the state. Indicates whether the state requires a Non-Resident Declaration for non-resident employees. |

State Unemployment

|

Field or Control |

Description |

|---|---|

|

Exempt From SUT |

Select this check box if the company is not required to pay SUT for this state. Use this option if you've specified, on the Company table, that the company as a whole is not exempt from SUT. If you select it here, Exempt from SUT becomes the default at the employee level; employees hired in this state have this check box selected on the State Tax Data page. |

|

Employer ID |

Enter your state employer ID for state unemployment. |

|

MA Health Insurance Override |

(MA only.) The Massachusetts standard Health Ins Rate is set by default from the State Tax table. For Massachusetts, the Health Insurance Rate differs for newer employers. If you're a Massachusetts employer to whom a lower rate applies, select this check box and enter the correct Massachusetts Health Ins Rate. |

|

Experience Rate Percent |

The experience rate you enter in the State Unemployment group box should reflect the rate you receive from your state unemployment agency. Enter the year and quarter when the rate becomes effective in the Effective Yr/Qtr field. This enables you to have different rates within a single calendar year. Note: You must set up a record for Quarter 1, because the system assumes a Quarter 1 record exists. A record for a subsequent quarter is required only if the rate changes mid-year. If you set up a Quarter 2 record, and you don't have a Quarter 1 record, you receive the error 000013 - "The SUT rate for the company and state displayed below was not found in the Company State Tax Table” (as indicated on the message report) during Pay Calculation. This error occurs regardless of the pay end date you are processing. |

|

MA Health Insurance Rate |

(MA only.) If you select Override, enter the correct health insurance rate. |

|

Branch Code |

This field is informational for Arizona. TAX860AZ.SQR appends the branch code to the end of the state EIN. |

|

UBI Number (unified business ID number) |

If the company you're adding is in Washington State, enter the UBI number assigned. Used for quarterly reporting for companies in the State of Washington only. |

|

EAF Rate (employment administration fund rate) |

If the company you're adding is in Washington State, enter the EAF rate used to calculate an additional tax for the Employment Administration Fund, which finances work search assistance and training for the unemployed. Used for quarterly reporting for companies in the State of Washington only. |

|

UI Taxable Wage Base Override and UI Taxable Wage Base |

An employer’s unemployment taxable wage base may vary depending on its unemployment experience rating. To identify a company as subject to the higher unemployment taxable wage base, and override the standard (lower) taxable wage base delivered on the Other Rates page of the State Tax Table entry for the state, first select the UI Taxable Wage Base Override check box, and then, in the UI Taxable Wage Base field, specify the taxable wage base that applies to the company For example, the standard Rhode Island 2012 taxable wage base is $19,600 for most employers, but employers with an experience rate of 9.79% or higher must pay tax on a higher 2012 taxable wage base of $21,100. To identify the company as subject to the higher unemployment taxable wage base, select the UI Taxable Wage Base Override check box, and enter $21,000 in the UI Taxable Wage Base field. |

State Disability

|

Field or Control |

Description |

|---|---|

|

Exempt From ER Disability |

Select this check box if employees in this state are exempt from employer-paid state disability tax. This field is for informational purposes only and is not used by the system. |

|

Experience Rate Percent |

The experience rate you enter in the State Disability group box should reflect the rate you receive from your state disability agency. Enter the year and quarter when the rate becomes effective in Effective Tax Yr/Qtr. This enables you to have different rates within a single calendar year. Note: You must set up a record for Quarter 1, because the system assumes a Quarter 1 record exists. A record for a subsequent quarter is required only if the rate changes mid-year. If you set up a Quarter 2 record, and you don't have a Quarter 1 record, you receive the error 000097 – “The SDI Rate Table entry was not found for the state below” (as indicated on the message report) during Pay Calculation. This error occurs regardless of the pay end date you are processing. |

|

Employer ID |

(E&G) Enter the appropriate employer ID for state disability grouping in California, Michigan, and Minnesota. The T002CAHP, T002MIHP, and T002MNHP reports are grouped by employer ID if you enter the employer ID here and select the Separate Tax Report check box on the run control page. The report lists state withholding, state unemployment, and state disability. |

Setting Up SUT Exemptions To Generate Data for the TAX810 and TAX860 Reports

The TAX810, and TAX860 reports are generated based on SUT wages. When you select the Exempt From SUT field on this page, the system does not generate taxable wages, and the TAX810, and TAX860 reports will contain no data.

Perform the following to generate taxable earnings, enabling the TAX810, and TAX860 reports to produce the required wage detail reporting data, while still remaining exempt from State Unemployment Taxes:

Ensure that the Company Exempt from SUT field on the Company Table-FICA/Tax Details page is deselected.

Leave the Exempt From SUT field on the Company State Tax Table - General page deselected.

These steps should ensure that the Exempt From SUT field on the State Tax Data page remains clear for each employee. Verify that the Exempt From SUT field is clear on all three pages.

Enter a dummy number in the State Unemployment Employer ID field on the Company State Tax Table – General page.

Enter a value of 0 (zero) in the State Unemployment Experience Rate.

After you do these steps, the system can track taxable wages without calculating SUT tax dollars. The TAX810 or TAX860 report can report the SUT subject wages.

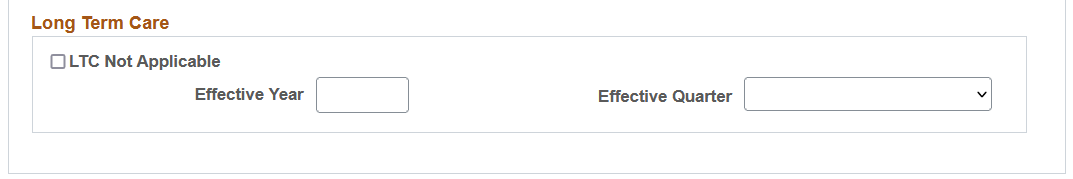

Long Term Care

This section appears and applies to Washington only.

See Understanding the Washington Long-Term Care Insurance.

|

Field or Control |

Description |

|---|---|

|

LTC Not Applicable (long-term care not applicable) |

Select this check box if employees in the company will not be covered by the WA Cares Fund. For employees to be covered the long-term care program, clear this check box. |

|

Effective Year and Effective Quarter |

Enter the year and quarter when the WA Cares Fund setup becomes effective. |

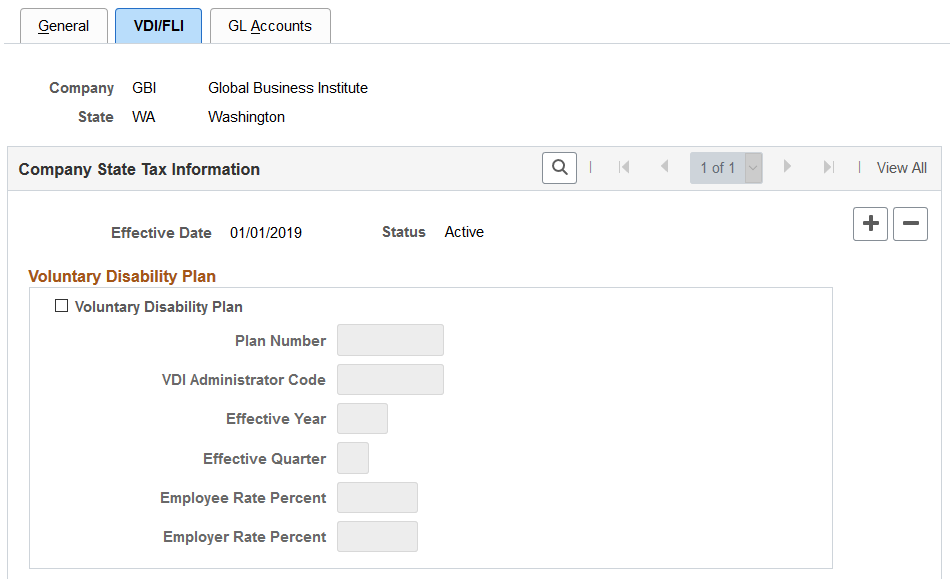

Use the VDI/FLI page (CO_STATE_TAX_TBL2) to identify the voluntary disability plans associated with the company.

Navigation:

This example illustrates the fields and controls on the Company State Tax Table - VDI/FLI page (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Company State Tax Table - VDI/FLI page (2 of 2). You can find definitions for the fields and controls later on this page.

This page includes nearly identical sections for setting up information for your voluntary disability plan, and voluntary and state paid leave insurance plans.

Note: Based on the state that is selected, some sections and fields on this page may be displayed or hidden to support state-specific requirements.

Voluntary Disability Plan

This section appears for all states.

|

Field or Control |

Description |

|---|---|

|

Voluntary Disability Plan |

Select this check box to indicate that the plan you're defining is a voluntary disability plan allowed by the state. |

|

Plan Number |

Enter the plan number of the voluntary disability plan. For New Jersey, this number appears on Form W-2. |

|

VDI Administrator Code |

Select the code that identifies the administrator of the plan. You maintain administrator codes on the VDI/FLI Administrator Table page. |

|

Employee Rate Percent |

Enter the employee-paid rate. Note: You must set up a record for Quarter 1, because the system assumes a Quarter 1 record exists. A record for a subsequent quarter is required only if the rate changes mid-year. If you set up a Quarter 2 record, and you don't have a Quarter 1 record, you receive the error 000304 – “The VDI Rate Table entry was not found for the state below” (as indicated on the message report) during Pay Calculation. This error occurs regardless of the pay end date you are processing. |

|

Employer Rate Percent |

Enter the employer-paid rate. Note: You must set up a record for Quarter 1, because the system assumes a Quarter 1 record exists. A record for a subsequent quarter is required only if the rate changes mid-year. If you set up a Quarter 2 record, and you don't have a Quarter 1 record, you receive the error 000304 – “The VDI Rate Table entry was not found for the state below” (as indicated on the message report) during Pay Calculation. This error occurs regardless of the pay end date you are processing. |

(CA, HI, NJ, NY, PR) To set up VDI with a rate of zero so that you can track the VDI wages, enter 99.99999 as the Employee Rate Percent and Employer Rate Percent on this page.

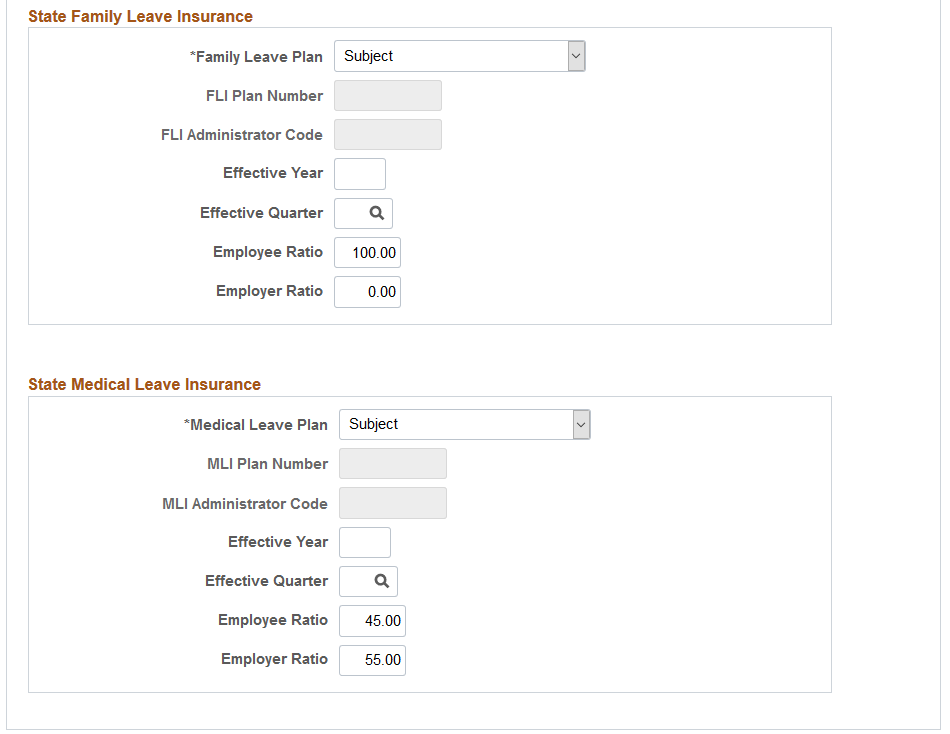

State Family Leave Insurance

This section appears for all states, and applies to Massachusetts, New Jersey, New York, and Washington.

|

Field or Control |

Description |

|---|---|

|

Family Leave Plan |

Select the applicable family leave insurance tax status for the company and state. Values are: Exempt: Select if employees’ earnings are exempt from the family leave insurance tax. Not Applicable: Select if the state plan does not apply to the employee. Subject: Select if employees’ earnings are subject to family leave insurance tax. Voluntary: Select if the company has a voluntary family leave insurance plan that covers the employees. This option does not apply to Massachusetts. MA allows voluntary plans, but they are not supported in Payroll for North America. |

|

FLI Plan Number |

Enter the plan number of the family leave insurance plan. This field appears if the selected family leave plan is Voluntary. |

|

FLI Administrator Code |

Select the code that identifies the administrator of the plan. You maintain administrator codes on the VDI/FLI Administrator Table page. This field appears if the selected family leave plan is Voluntary. |

|

Employee Rate Percent |

(NJ and NY) Enter the employee-paid rate. |

|

Employee Ratio |

(MA and WA) Enter the maximum percentage of premium that can be deducted from employees. The total employee and employer ratio values must total to 100.00 percent. |

|

Employer Rate Percent |

(NJ and NY) Enter the employer-paid rate. |

|

Employer Ratio |

(MA and WA) Enter the percentage of premium to be contributed by employers. The total employee and employer ratio values must total to 100.00 percent. |

(NJ, NY) To set up FLI with a rate of zero so that you can track the FLI wages, enter 99.99999 as the Employee Rate Percent and Employer Rate Percent on this page.

State Medical Leave Insurance

This section appears and applies to Massachusetts and Washington only.

|

Field or Control |

Description |

|---|---|

|

Medical Leave Plan |

Select to indicate that the plan you're defining is a voluntary medical leave plan allowed by the state. Values are: Exempt: Select if employees’ earnings are exempt from the medical leave insurance tax. Not Applicable: Select if the state plan does not apply to the employee. Subject: Select if employees’ earnings are subject to medical leave insurance tax. (WA) Voluntary: Select if the company has a voluntary medical leave insurance plan that covers the employees. |

|

MLI Plan Number |

(WA) Enter the plan number of the family leave insurance plan. This field appears if the selected family leave plan is Voluntary. |

|

MLI Administrator Code |

(WA) Select the code that identifies the administrator of the plan. You maintain administrator codes on the VDI/FLI Administrator Table page. This field appears if the selected family leave plan is Voluntary. |

|

Employee Ratio |

Enter the maximum percentage of premium that can be deducted from employees. The total employee and employer ratio values must total to 100.00 percent. |

|

Employer Ratio |

Enter the percentage of premium to be contributed by employers. The total employee and employer ratio values must total to 100.00 percent. |

State Family Medical Leave Insurance

|

Field or Control |

Description |

|---|---|

|

Family Medical Leave Plan |

Select to indicate that the plan you're defining is a family medical leave plan allowed by the state. Values are: Exempt: Select if employees’ earnings are exempt from the family medical leave insurance tax. Not Applicable: Select if the state plan does not apply to the employee. Subject: Select if employees’ earnings are subject to family medical leave insurance tax. Voluntary: Select if the company has a voluntary family medical leave insurance plan that covers the employees. |

|

FMLI Plan Number |

Enter the plan number of the family medical leave insurance plan. This field appears if the selected family medical leave plan is Voluntary. |

|

FMLI Administrator Code |

Select the code that identifies the administrator of the plan. You maintain administrator codes on the VDI/FLI Administrator Table page. This field appears if the selected family medical leave plan is Voluntary. |

|

Effective Year and Effective Quarter |

Enter the year and quarter when the family medical leave plan setup becomes effective. Do not enter any value in these fields if the selected family medical leave plan is Subject. |

|

Employee Rate Percent |

Enter the rate for the voluntary plan. The rate for the state plan is stored in the State Tax Table for Connecticut. |

|

Employer Rate Percent |

Enter the rate for the voluntary plan to be contributed by employers. |

Supported Paid Leave Plans

|

Tax Class |

CT |

DC |

NJ |

NY |

MA |

WA |

|---|---|---|---|---|---|---|

|

Medical Leave Insurance - EE |

x |

x |

||||

|

Medical Leave Insurance - ER |

x |

x |

||||

|

Voluntary Med Leave Ins EE |

x |

|||||

|

Voluntary Med Leave Ins ER |

x |

|||||

|

Family Leave Insurance - EE |

x |

x |

x |

x |

||

|

Family Leave Insurance - ER |

x |

x |

x |

|||

|

Voluntary Family Leave Ins EE |

x |

x |

x |

|||

|

Voluntary Family Leave Ins ER |

x |

x |

x |

|||

|

Family Medical Leave Ins EE |

x |

|||||

|

Vol Family Med Leave Ins EE |

x |

|||||

|

Vol Family Med Leave Ins ER |

x |

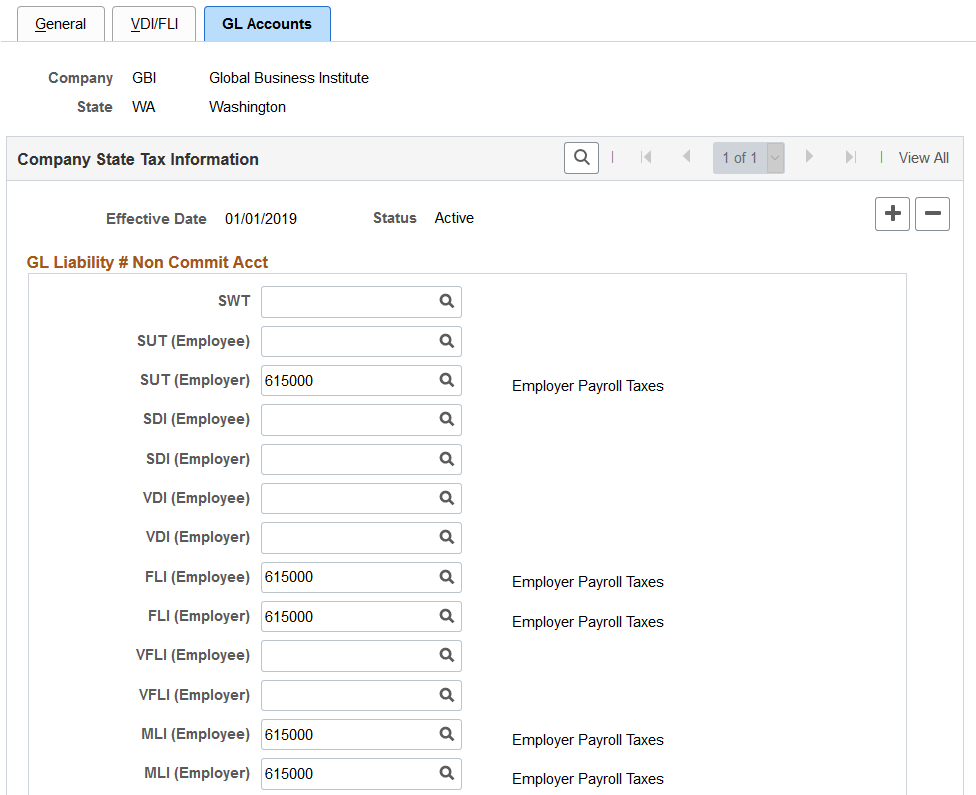

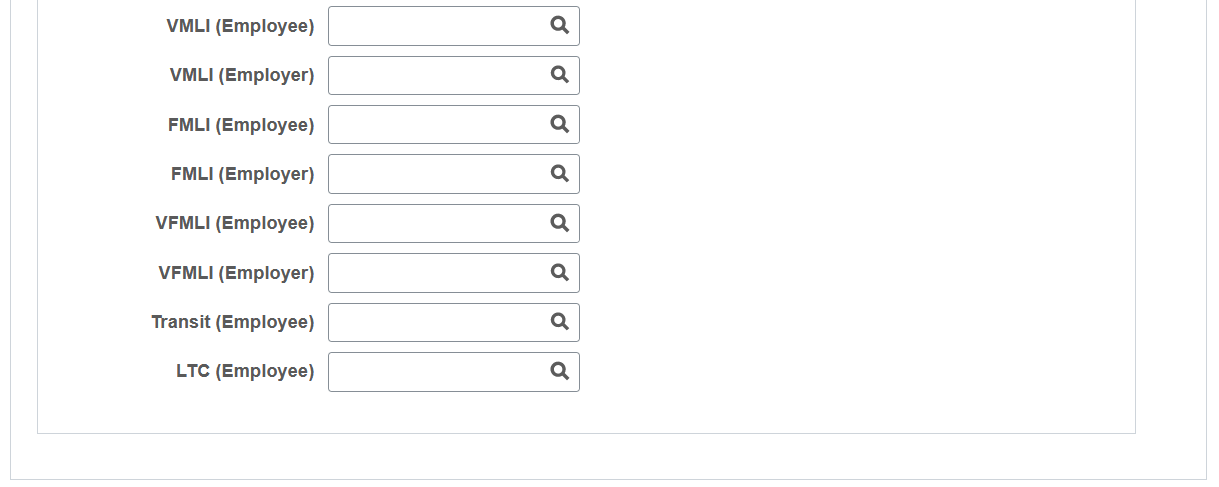

Use the GL Accounts page (CO_STATE_TAX_TBL3) to enter your general ledger account numbers for state taxes.

Navigation:

This example illustrates the fields and controls on the Company State Tax Table - GL Accounts page (1 of 2). You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Company State Tax Table - GL Accounts page (2 of 2). You can find definitions for the fields and controls later on this page.

Enter the general ledger account numbers, if applicable, for the following company liabilities:

GL Liability # Non Commit Acct

|

Field or Control |

Description |

|---|---|

|

SWT |

State Withholding liabilities. |

|

SUT (Employee) |

State Unemployment employee liabilities. |

|

SUT (Employer) |

State Unemployment employer liabilities. |

|

SDI (Employee) |

State Disability employee liabilities. |

|

SDI (Employer) |

State Disability employer liabilities. |

|

VDI (Employee) |

Voluntary Disability employee liabilities. |

|

VDI (Employer) |

Voluntary Disability employer liabilities. |

|

FLI (Employee) |

State family leave insurance employee liabilities. |

|

FLI (Employer) |

State family leave insurance employer liabilities. |

|

VFLI (Employee) |

Voluntary family leave insurance employee liabilities. |

|

VFLI (Employer) |

Voluntary family leave insurance employer liabilities. |

|

MLI (Employee) |

State medical leave insurance employee liabilities. |

|

MLI (Employer) |

State medical leave insurance employer liabilities. |

|

VMLI (Employee) |

Voluntary medical leave insurance employee liabilities. |

|

VMLI (Employer) |

Voluntary medical leave insurance employer liabilities. |

|

FMLI (Employee) |

Family medical leave insurance employee liabilities. |

|

FMLI (Employer) |

Family medical leave insurance employer liabilities. |

|

VFMLI (Employee) |

Voluntary family medical leave insurance employee liabilities. |

|

VFMLI (Employer) |

Voluntary family medical leave insurance employer liabilities. |

|

Transit (Employee) |

(OR) State transit tax employee liabilities. |

|

LTC (Employee) |

(WA) State long-term care insurance employee liabilities. |

Other Programs – GL Liability Acct

This section is applicable to the Program Funding Configuration only. It appears if one or more programs are associated with the listed state on the Program ID Association Page. It lists all tax classes of the state’s program that are available as of the effective date.

Note. If changes are made to the program’s list of tax classes, you need to add a new row on this page to see the updates. The updates will not show if you just modify the effective date of an existing row in Correct History mode.

|

Field or Control |

Description |

|---|---|

|

Liability Account |

Select the general ledger account number for the corresponding tax class. It is the customer’s responsibility to update this information. Tax class rows of inactive programs are read-only. |

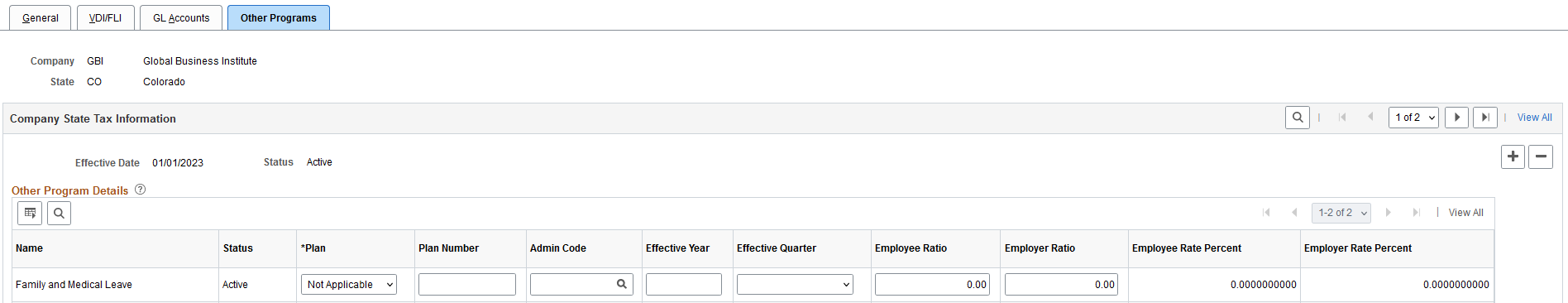

Use the Other Programs page (CO_STATE_TAX_TBL4) to configure company-specific tax parameters for other programs.

Navigation:

This example illustrates the fields and controls on the Company State Tax Table - Other Programs page. You can find definitions for the fields and controls later on this page.

Note: This page is applicable to the Program Funding Configuration feature only.

This page appears if one or more programs have been set up and in effect for the state on the Program ID Association Page. It lists all the state’s programs that are available as of the effective date.

Note: If changes are made to the program definition or program association details, you need to add a new row on this page to see the updates. The updates will not show if you just modify the effective date of an existing row in Correct History mode.

Inactive program rows are displayed as read-only.

|

Field or Control |

Description |

|---|---|

|

Name |

Displays the funding program associated with the state. |

|

Plan |

Displays or select the plan type the employees are enrolled in. Values are Subject, Voluntary, Exempt, and Not Applicable (default). Employers with private or equivalent plans must use Voluntary as the plan type. When a value is specified in this field for a program and you have selected the Automatic Employee Tax Data option on the Installation Table - Products Page, the system will automatically default the program's Tax Status field in the Other Programs - Details section of the State Tax Data Page for newly hired or transferring employees to match this value that is specified for the associated company. |

|

Plan Number |

Displays or select the plan number. |

|

Admin Code |

Displays or select the code that identifies the administrator of the plan. You maintain administrator codes on the VDI/FLI Administrator Table Page. |

|

Effective Year and Effective Quarter |

Displays or enter the year and quarter when the plan setup becomes effective. Do not enter any value in these fields if the selected plan is Subject. |

|

Employee Ratio and Employer Ratio |

Displays or enter the ratio of premium to be contributed by the employee and the employer. The sum of ratio values specified on this page must be 100. These fields become editable if the Company State Tax Data Option field is set to Ratio on the Program ID Association Page. Default values specified from the Program ID Association page are prepopulated in these fields when the program appears for the first time on this page. For any new row that is added, data is prepopulated from the previous row. |

|

Employee Rate Percent and Employer Rate Percent |

Displays or enter the employee-paid rate and employer-paid rate. These fields become editable if the Company State Tax Data Option field is set to Rate Percent on the Program ID Association Page. Default values specified from the Program ID Association page are prepopulated in these fields when the program appears for the first time on this page. For any new row that is added, data is prepopulated from the previous row. Important! If you have an equivalent or a private plan, you must set up the Employee Rate Percent and Employer Rate Percent values in these fields. Do not set up these values on the State Tax Table entry for the state. If you do, your values will be overridden the next time PeopleSoft delivers updates to the State Tax Table entry for the state. |

Supported Paid Leave Plans

This table lists state and voluntary paid leave plans and the states in which these plans are supported using the data defined on the Other Programs page on the Company State Tax Table.

These paid leave plans are implemented using Program Funding Configuration. For more information about the Program Funding Configuration feature, see Working with Program Funding Configuration.

|

Tax Class |

CO |

OR |

|---|---|---|

|

Paid Fam Med Leave Ins EE |

x |

x |

|

Paid Fam Med Leave Ins ER |

x |

x |

|

Vol Paid Fam Med Leave Ins EE |

x |

x |

|

Vol Paid Fam Med Leave Ins ER |

x |

x |

See Also

Understanding the Colorado Family and Medical Leave Insurance Program