Defining Earnings and Payments

To define earnings and payments, use the EARNINGS_TABLE component, the EARNS_PROGRAM_TBL component, and the SHIFT_TABLE component.

This topic provides an overview of earnings and earnings programs.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

EARNINGS_TABLE1_NL |

Establish earnings codes and enter information about your earnings methods. |

|

|

EARNINGS_TABLE3_NL |

Define the adjustment factors and tax classes for your earnings code. Your payroll system can use the adjustment factors and limits that you enter on this page to adjust calculations for earnings codes. |

|

|

EARNS_PROG_TBL_NLD |

Set up an earnings program. |

|

|

SHIFT_TABLE |

Set up work shifts for your company and define shift differential pay if you have work shifts and if shift differential pay is provided to your employees. |

|

|

Run Control |

PRCSRUNCNTL |

Use the Earnings report (INT004NL) to review all the valid earnings codes that you entered into the system, along with the payroll calculation characteristics that you assign to each. |

Earnings are payments made to employees, whether for regular salary or additional payments, such as sick pay, bonuses, and commissions. The information that you establish in the Earnings table is the basis for the way the system calculates and taxes earnings. Create a work sheet to map the way that you want to define earnings and shifts within the system before you set them up. Also determine the three-character codes that represent earnings codes, such as REG (regular), VAC (vacation), and HOL (holiday).

At a minimum, establish earnings codes to specify regular earnings and overtime pay. Regular earnings are normally associated with a regular salary or regular hours worked. Regular earnings are typically taxed by all taxing entities and consist of a simple rate-multiplied-by-time calculation, or a flat amount. Overtime pay uses a slightly different method of calculation based on regular earnings. For example, overtime, double time, or triple time earnings codes apply a multiplication factor to the earnings.

Also set up earnings codes for leave pay, such as sick pay, holiday pay, and vacation pay. Set up your earnings codes for these to process accrual accounting, as well. If you want your payroll system to track holiday, vacation, sick, jury duty, personal time off, and so on for leave accruals, set up earnings codes for these leave categories and report the applicable hours.

Depending on your organization's requirements, you may want to create other types of earnings to do the following:

Record non-hourly earnings, such as bonuses, commissions, or automobile allowances.

Differentiate between earnings that should or shouldn't be taxed, such as automobile allowances or expense advances.

Identify the earnings codes you use to pay earnings resulting from late paperwork or collective bargaining.

An earnings program is a set of valid earnings codes for one or more pay groups. A single company may have any number of earnings programs. An individual employee belongs to only one earnings program, based upon the individual's pay group, and the codes for that program are the only valid earnings codes for that employee.

For example, executives ordinarily do not get overtime pay, so their pay group's earnings program shouldn't include overtime as a valid earnings code. You might also want to exclude part-time employees who work less than 30 hours a week from holiday pay eligibility.

Normally, employees are assigned to earnings programs through their pay groups. The earnings programs that you enter on the Company Table - Default Settings page become the default earnings programs for the pay groups that you set up on the Pay Group Table - Definition page. To override this default, specify a different earnings program for a pay group. You cannot override the pay group earnings program at the employee level if an employee belongs to a certain pay group.

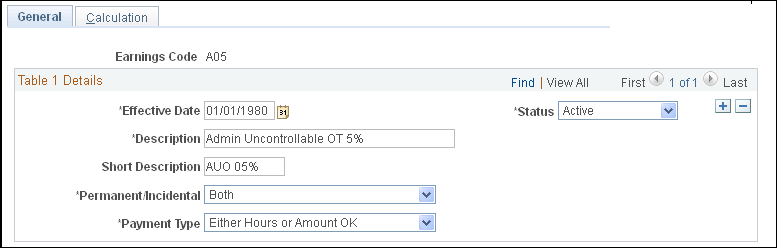

Use the Earnings Table - General page (EARNINGS_TABLE1_NL) to establish earnings codes and enter information about your earnings methods.

Navigation:

This example illustrates the fields and controls on the Earnings Table - General page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Permanent/Incidental |

Select whether the earnings code is Permanent, Incidental, or Both. |

Payment Type |

Select the payment type. Values are: Amts Only (amounts only): Select if you want to enable the entry of amounts for earnings. Both: Some companies need the ability to enter both hours and an amount for earnings. Select this option to record an employee's hours (for your records only) and to enter the actual amount of pay that you want the employee to receive. Either: Select if you want to enable the entry of either hours or amount, but not both, for earnings. Flat Amt (flat amount): Select to define an earnings code as a flat amount and also specify the amount. For example, you want to give multiple employees a specific flat amount of additional pay. You can maintain this type of flat amount and make mass changes to the flat amount on the Earnings table, instead of changing multiple additional pay records at the employee level. Hours Only: Select if you want to enable the entry of hours for earnings. Sal System (salary system): Select if a third-party payroll system defines the way to process the payment for earnings. Units/Ovr (units/override): Select and specify a rate if you want to set up your payroll system to override the hourly rate on the employee's job record, or if you want to provide an earnings code for piecework earnings. |

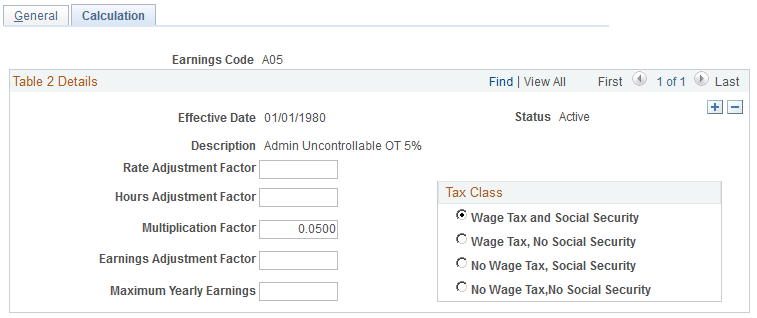

Use the Earnings Table - Calculation page (EARNINGS_TABLE3_NL) to define the adjustment factors and tax classes for your earnings code.

Your payroll system can use the adjustment factors and limits that you enter on this page to adjust calculations for earnings codes.

Navigation:

This example illustrates the fields and controls on the Earnings Table - Calculation page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Rate Adjustment Factor |

The amount that applies to adjustments in pay rates. For example, if your collective labor agreement included an hourly cost of living adjustment, enter the value in this field for any applicable earnings (such as regular, overtime, vacation, and sick). Any employee getting this type of earnings is paid that hourly amount in addition to the compensation rate specified on that employee's job record. |

Hours Adjustment Factor |

Enables you to indicate the adjustment to the number of hours associated with an earnings code, such as 40 hours for regular earnings. This number can be positive or negative. |

Multiplication Factor |

To calculate hourly earnings, such as overtime or double time, for which a specific number or factor (such as 1.5 or 2.0 for double time) multiplies the earnings for overtime. |

Earnings Adjustment Factor |

If you want to indicate a specific amount that doesn't affect pay rates or hours, enter it as a flat amount here. Use this type of definition for earnings codes for which the amount always remains the same for all employees, such as an 50.00 EUR Christmas bonus. When you set up this type of earnings, also set the multiplication factor to zero. |

Maximum Yearly Earnings |

Enter a value to set a yearly ceiling on the earnings code. |

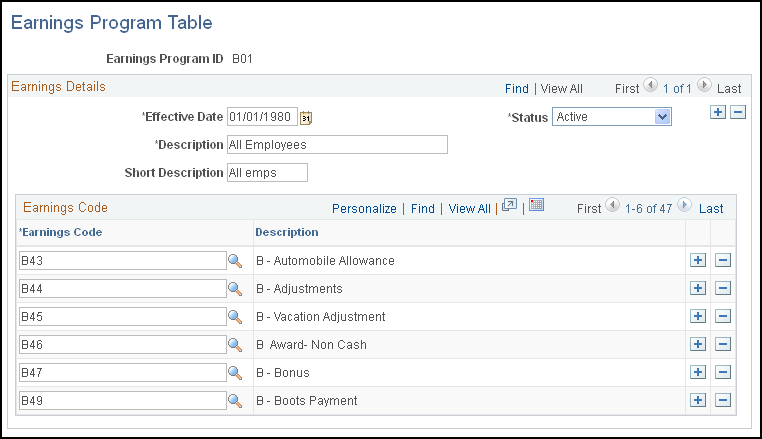

Use the Earnings Program Table page (EARNS_PROG_TBL_NLD) to set up an earnings program.

Navigation:

This example illustrates the fields and controls on the Earnings Program Table page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Earnings Code |

Select each earnings code that you want in the program. Insert additional data rows if necessary. |

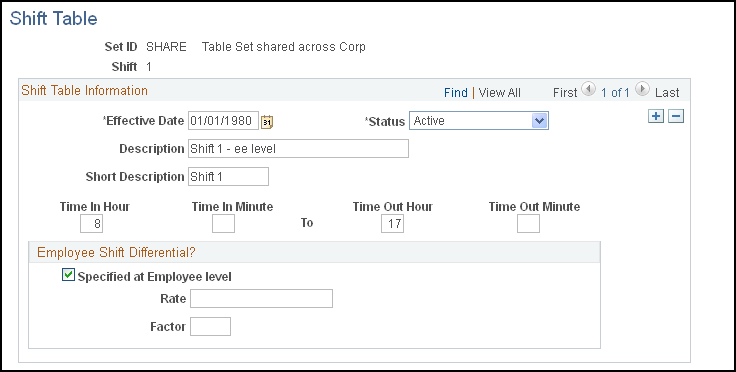

Use the Shift Table page (SHIFT_TABLE) to set up work shifts for your company and define shift differential pay if you have work shifts and if shift differential pay is provided to your employees.

Navigation:

This example illustrates the fields and controls on the Shift Table page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Time In Hour, Time In Minute, Time Out Hour and Time Out Minute |

The time format uses a 24-hour clock, so if you're setting up a shift from 8 a.m. to 4 p.m., enter 8 and 00 to 16 and 00. |

Specified at Employee level |

Select this check box if shift premiums vary from employee to employee. This enables you to define the shift premium rate or factor for employees assigned to the shift at the employee level. To define shift premiums at the employee level, use the Shift/Rate/Factor fields on the Job Data - Job Information page. |

Rate |

If you didn't select Specified at Employee Level, enter the rate. |

Factor |

If you didn't select Specified at Employee Level, enter the factor. |