Changing Payment Amounts

This topic provides an overview of reasons for changing payment amounts and provides examples of payment amount changes. It then discusses how to work with cost of living adjustments (COLAs).

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RUNCTL_PASCOLA |

Change COLA payment information for retirees. |

Individual pension payments can change for various reasons. A retiree may have elected a form of payment that provides for a different amount under specific circumstances. For example, a level income option provides for a reduced payment when the retiree attains social security retirement age, a pop-up payment provides for an increased benefit if the beneficiary predeceases the retiree, and a last to survive annuity provides for a reduced benefit when the beneficiary predeceases the retiree.

A plan can also grant a cost of living adjustment that increases pension benefits for all pension payees who meet specified criteria.

Use the Calculate COLA and Payee Payment Schedule pages to change payment amounts.

Adjusting Level Income Forms of Payment

If a retiree selects a level income form of payment, you need to decrease payments when the retiree reaches the level income age, normally the social security retirement age (SSRA). Use the Payee Payment Schedule page to adjust the payments.

The level income form of payment has both pre-SSRA and post-SSRA retiree amount options. Because you already know an employee's SSRA, you do not need to wait for the employee to attain that age in order to set up the payments. Instead, you can set up both the pre- and post-SSRA payments when you initially schedule payments. The effective date controls the amount that the retiree receives and ensures that payments automatically decrease at the right time.

To change a retiree's regularly scheduled payment amount, modify the fields described below:

Term |

Definition |

|---|---|

Effective Date |

Insert a new effective date, when the payments should be decreased. |

Payment Choice |

Change the payment choice to 2 (the post-SSRA amount). |

Administering Pop-up and Last to Survive Options

Under the pop-up form of payment, a retiree has a joint and survivor annuity with an extra provision: If the beneficiary predeceases the retiree, the retiree's pension payment pop ups to an equivalent single life annuity amount (normally there is a penalty for the pop-up insurance).

Under the last to survive form of payment, when either the retiree or the beneficiary dies the annuity is reduced to the specified percentage.

The pop-up form of payment has retiree amount and pop-up amount options. When a beneficiary predeceases a retiree, you change the retiree's payments from the retiree amount to the pop-up amount.

For a last to survive annuity, there are retiree and survivor amounts. If the retiree dies first, set up the beneficiary just as you would for a normal joint and survivor annuity. If the beneficiary dies first, change the retiree's schedule so that the retiree receives the beneficiary amount.

To change a retiree's regularly scheduled payment amount, modify the fields described below:

Term |

Definition |

|---|---|

Effective Date |

Insert a new effective date, when the payments should be increased. |

Payment Choice |

Change the payment choice to the pop-up amount. |

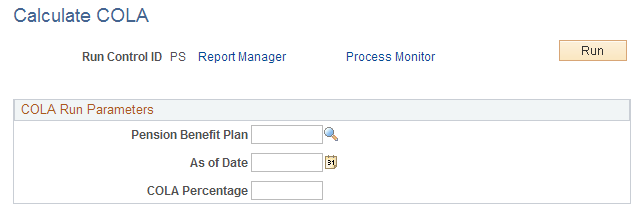

Use the Calculate COLA page (RUNCTL_PASCOLA) to change COLA payment information for retirees.

Navigation:

This example illustrates the fields and controls on the Calculate COLA page.

A COLA for a retiree typically takes the form of a percentage increase in a benefit. Pension Administration enables you to calculate and schedule the new payment amount for all employees receiving benefits from a particular plan.

COLA Run Parameters

Field or Control |

Description |

|---|---|

Pension Benefit Plan |

Identify the pension benefit plan granting the COLA for the increased payments. |

COLA Percentage |

The COLA percentage is the increase factor for the adjustment. This percentage is always applied to the current pension payment, a compound COLA. If you need to apply the COLA to the original amount, you must modify the COLA SQR. |

Click Run to run this request. The Process Scheduler runs the COLA Program (PASCOLA) SRQ process at user-defined intervals.

After you run the COLA Program process, you can see the COLA for any individual payee in that person's payment schedule. To do this, access the Payee Payment Schedule page.

This page contains a new row with an effective date that matches the COLA date. The Payment Reason field contains the value Result of COLA Adjustment. Both the retiree amount and any additional amounts—for example, a beneficiary amount—reflect the new, higher pension payment.

Because the beneficiary amount has been adjusted, if the retiree dies and you schedule payments to the beneficiary, the system automatically copies the adjusted amount to the beneficiary's schedule.