Viewing Plan-Related Information

This topic discusses how to view plan-related information for an employee.

You use the Plan History component to view data calculated by Pension Administration during periodic processing or loaded into the system at implementation time. You cannot edit the data that appears on these pages. If you must adjust cash balances or employee accounts, use the adjustment pages on the Update Employee Plan Data menu.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PA_PLAN_INFO |

View significant dates in an employee's employment history and projected dates for retirement eligibility. |

|

|

PA_ELIG_PART_HIST |

View the history of an employee's changing eligibility and participation statuses. |

|

|

PA_SVC_HIST |

View an employee's service history, period by period. |

|

|

PA_CASH_BAL_HIST |

View the period-by-period credits given to an employee under a cash balance plan. |

|

|

PA_CONTR_HIST |

View the period-by-period contributions and interest credited to an employee's account under a contributory plan. |

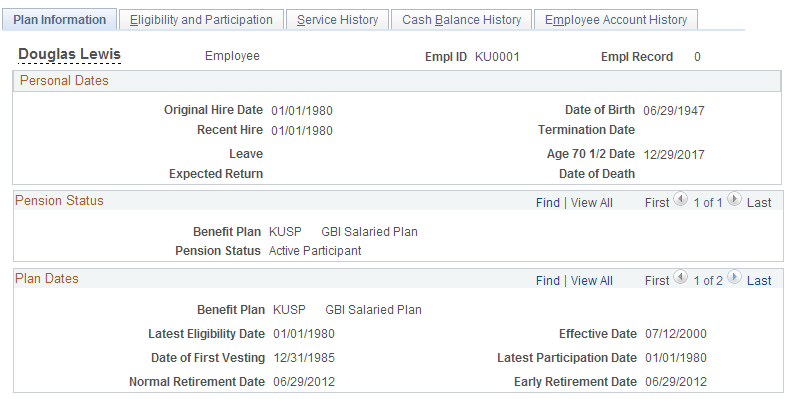

Use the Plan Information page (PA_PLAN_INFO) to view significant dates in an employee's employment history and projected dates for retirement eligibility.

Navigation:

This example illustrates the fields and controls on the Plan Information page.

Personal Dates

Field or Control |

Description |

|---|---|

Termination Date |

Displays the most recent termination date, if an employee is no longer at the company. |

Age 70 1/2 Date |

Displays the date on which pension payments must begin, unless the employee has not yet retired. |

Plan Dates

This group box enables you to scroll through each benefit plan for which the system has data. The dates are set during periodic processing.

Field or Control |

Description |

|---|---|

Effective Date |

Displays the date on which you ran the periodic process that calculated the other dates. |

Date of First Vesting and Normal Retirement Date |

These dates are calculated as defined in Plan Date Aliases. |

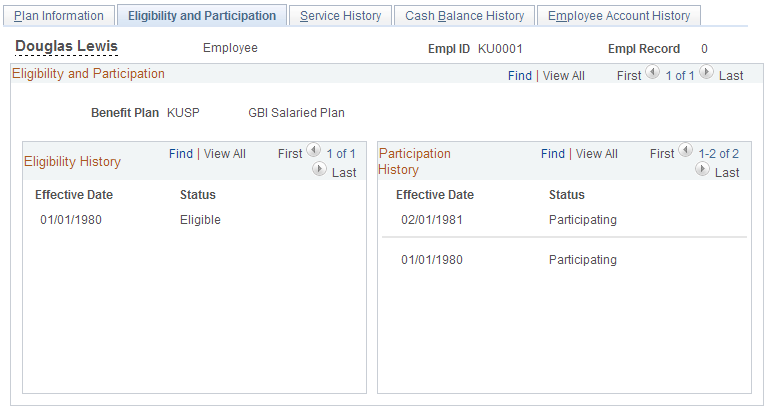

Use the Eligibility and Participation page (PA_ELIG_PART_HIST) to view the history of an employee's changing eligibility and participation statuses.

Navigation:

This example illustrates the fields and controls on the Eligibility and Participation page.

Field or Control |

Description |

|---|---|

Eligibility History |

Displays the eligibility history when an employee moves in and out of eligibility. |

Participation History |

If an employee with an accrued benefit leaves the company or becomes ineligible to accrue additional benefits, that person is still owed a benefit and is still considered an active plan participant. Because participation requirements are typically age and service, employees cannot lose their participation status except by losing prerequisite service credit. |

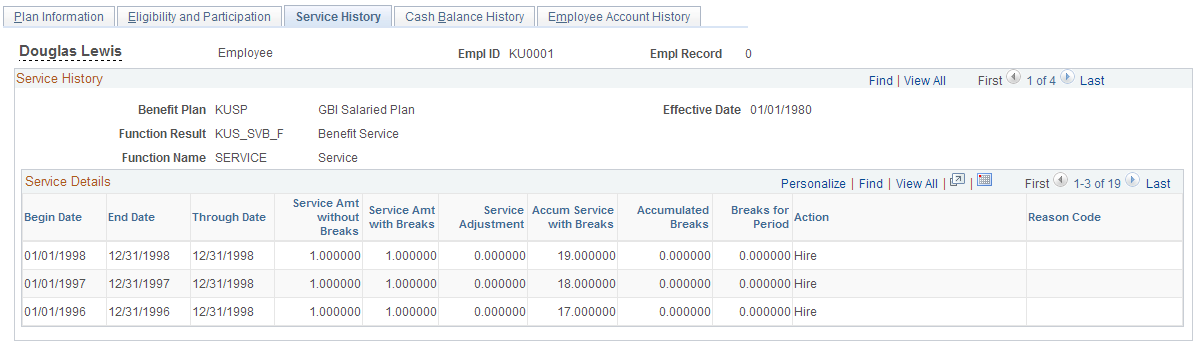

Use the Service History page (PA_SVC_HIST) to view an employee's service history, period by period.

Navigation:

This example illustrates the fields and controls on the Service History page.

Field or Control |

Description |

|---|---|

Benefit Plan |

Displays the ID and name of the benefit plan that identifies the rules used to generate the history. |

Effective Date |

Displays the date of hire—or, if you entered startup service data, the startup as of date. The effective date identifies the rules used to generate the history. If a plan uses several sets of service rules, scroll to see each one. |

Function Result |

Displays the name and description of the Service component, which identify the rules used to generate the history. |

Service Details

Field or Control |

Description |

|---|---|

Through Date |

Indicates when you ran the periodic processing job that calculated the service history. |

Service Amt without Breaks (service amount without breaks) |

Indicates how much service the employee earned during the period, based on the service definition only. |

Service Amt with Breaks |

Indicates how much of the original service for the period is used, after considering break rules and other reasons for forfeiture. |

Service Adjustment |

Indicates adjustments on the Service Adjustments page for the period. You can manually enter adjustments, or the system can automatically generate adjustments based on a withdrawal of contributions, service buyback activity (repayment of contributions), or service purchase activity. |

Accum Service with Breaks (accumulated service with breaks) |

Indicates how much service the employee has accumulated as of the end of the period. This is based on the previous accrued service amount and the activity (including adjustments) for the current period. |

Accumulated Breaks (accumulated breaks) |

Indicates how many consecutive break periods the employee has accumulated. |

Breaks for Period |

Indicates whether the period counted toward a break in service. |

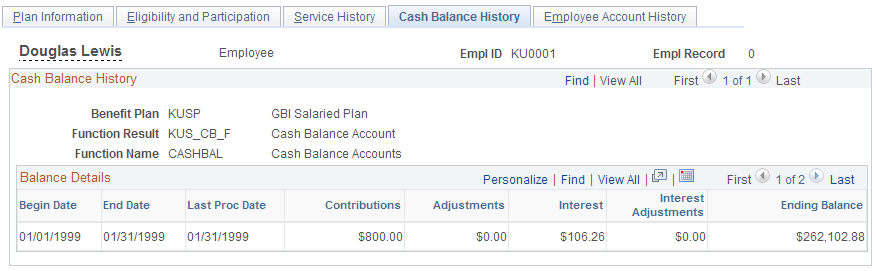

Use the Cash Balance History page (PA_CASH_BAL_HIST) to view the period-by-period credits given to an employee under a cash balance plan.

Navigation:

This example illustrates the fields and controls on the Cash Balance History page.

Field or Control |

Description |

|---|---|

Benefit Plan and Function Result |

Displays the plan and the name and description of the cash balance account, both of which identify the rules used to generate the history. If the plan maintains multiple accounts in a plan, scroll to see each one. |

Balance Details

Field or Control |

Description |

|---|---|

Begin Date and End Date |

The history includes only complete periods; partial period credits applied during a calculation do not become part of the permanent history. |

Contributions and Adjustments |

The Contributions column displays the non-interest credits applied to the account during the period. The Adjustments column displays additional credits that should be applied during the period, based on manual adjustments on the Cash Bal Adjustments page. |

Interest and Interest Adjustments |

The Interest column displays the total earned during the period (the sum of interest on the prior balance and interest on contributions made during the period). The Interest Adjustments column displays additional interest that should be applied during the period, based on manual adjustments on the Cash Bal Adjustments page. |

Ending Balance |

Displays the total accumulation as of the end of the period. This is the total of the ending balance from the prior period and all additional amounts credited during the current period. |

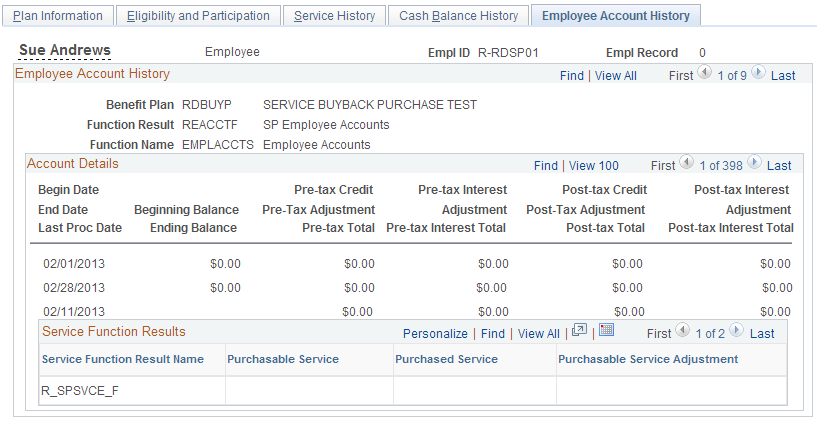

Use the Employee Account History page (PA_CONTR_HIST) to view the period-by-period contributions and interest credited to an employee's account under a contributory plan.

Navigation:

This example illustrates the fields and controls on the Employee Account History page.

Field or Control |

Description |

|---|---|

Benefit Plan and Function Result |

Displays the plan and the name and description of the employee account, both of which identify the rules used to generate the history. If you maintain multiple balances in a plan, scroll to see each one. For example, you may offer service buyback or service purchase programs, or track activity through withdrawal, repayment, and purchase subaccounts that roll up to the plan's main employee contributory account. In this case, scroll to see the activity in each of the accounts and subaccounts. |

Begin Date, End Date, and Last Proc Date (last processed date) |

When you run periodic processes, the employee accounts function applies contributions and interest for complete accumulation periods only. Therefore, there is no process through date. When you run a calculation, partial period credits are applied, but those results do not become part of the permanent history. Note: Do not process employee accounts beyond the event date. If you do, the post-event date accruals are included in the calculations final account balance, and this is meant to be the balance at the event date. The account keeps separate accumulations for pretax and posttax contributions. Each accumulation tracks contributions (also called credits), interest, and adjustments to the contributions or interest. Warning! With this scheme, posttax interest is interest on posttax contributions; the interest itself has not yet been taxed. |

Beginning Balance and Ending Balance |

Display the total value of the account (the sum of all pretax and posttax contributions and interest). |

Pre-Tax Credit/Adjustment/Total, Pre-Tax Interest/Adjustment/Total, Post-tax Credit/Adjustment/Total and Post-Tax Interest/Adjustment/Total |

In each of these columns, the first value is the credit or interest for the period. The second value is the portion of the credit determined by adjustments. Adjustments can come from two places:

The third value is the running balance after adding credits for the period to the prior balance. Note: In a withdrawal subaccount, amounts withdrawn appear as negative values. As an employee repays the contributions, the negative balance approaches zero. A service purchase subaccount displays a negative balance to show the amount that an employee needs to pay into the plan. However, in this case, the initial debt is based on the plan administrator's determination of the price of the service being purchased. |

Viewing Service Buyback and Purchase Information

Sometimes activity in an employee account affects service. This happens in one of three ways:

The employee withdraws contributions and forfeits the corresponding service. This typically occurs at termination.

The employee repays the withdrawn contributions and buys back the service originally forfeited. This typically occurs after a rehire.

The employee makes contributions for times when he or she was not accruing service and thus purchases service credit for that time. The purchased service period is typically time when an employee was employed but not eligible for the plan. Plans might also enable service purchase for time spent on military leave or other qualified leaves.

The Service Function Results grid includes three fields for tracking the effect of the employee account activity on the service function results that are associated with the employee account.

Note: These fields apply only to withdrawal and service purchase subaccounts. Although the monetary activity in these accounts rolls up to the plan's main contributory account, the service information does not.

Field or Control |

Description |

|---|---|

Purchasable Service |

Displays the service that an employee can get if the employee repays previously withdrawn contributions or sets up a service purchase arrangement. The value is the remaining amount of purchasable service at the end of the period. The value is zero until either a contribution, withdrawal, or service purchase arrangement establishes an initial amount of purchasable service. As the service is restored, which can be all at once or gradually, the purchasable service amount is reduced. For example, if Lucia withdraws 2,000 USD of contributions and thus forfeits three years of service, the withdrawal account has an ending balance of -2,000 USD and a purchasable service amount of 3.000000. The adjustment to the account balance rolls up to the plan's main contributory account, but the purchasable service does not. Therefore, the main contributory account still displays zero purchasable service. For a service purchase arrangement, a plan administrator must establish the initial amount of purchasable service and enter it (and the monetary amount necessary to purchase the service) on the Employee Account Adjustments page. |

Purchased Service |

Displays the service that was restored during the period, as defined by the Begin/End Date fields. |

Purchasable Service Adjustment |

Displays manual adjustments made to purchasable service during the period. For example, if you set up a service purchase program incorrectly and must change the amount of purchasable service, enter a manual adjustment on the Employee Account Adjustments page. During the next periodic processing, the purchasable service is adjusted by that amount, and the results for the period display both the adjustment amount in this field and the adjusted amount in the Purchasable Service field. |