(CAN) Entering and Maintaining Canadian Income Tax Data

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

TAX_DATA_CAN1 |

(CAN) Set up Canadian Income Tax (CIT), including specifying special CIT withholding status, TD1 exemptions and adjustments, and other tax credits. |

|

|

TAX_DATA_CAN3 |

(CAN) Enter QIT withholding status, exemption, and tax credit information for employees based in Quebec. |

|

|

TAX_DATA_CAN4 |

(CAN) Enter provincial TD1 personal tax credit amounts. |

|

|

Exemption Report Page |

RUNCTL_TAX100CN |

(CAN) Generate the TAX100CN report that lists all employees whose Canadian or Quebec Tax Data records indicate that they are exempt from income tax withholding, exempt from unemployment insurance payments, exempt from Quebec Parental Insurance Plan (QPIP) contributions, or have fewer than 12 months subject to Canada Pension Plan (CPP) or Quebec Pension Plan (QPP) contributions. |

|

Employee Tax Information Report Page |

RUNCTL_TAX019 |

(CAN) Run TAX019 to print employee tax withholding information. |

Field or Control |

Description |

|---|---|

Non-Indexed Amount |

Full indexation is in effect for federal, Quebec, and provincial taxes. Enter amounts not eligible for indexing such as pension income and tuition and education fees. The non-indexed amount is the component of the net claim amount that is not subject to indexing. For example, if the applicable taxing authority specifies an indexation factor of 3%, the new net claim amounts for all the affected employees would be recalculated as follows: Net claim amount + [ 0.03 (net claim amount – non-indexed amount)]. The Non-Indexed Amount field is not considered during the Pay Calculation COBOL SQL process (PSPPYRUN). However, it is required by the year-end Update Source Deductions SQR Report process (TAX103CN), which calculates and inserts new net claim amounts. This process applies a specified percentage and/or fixed amount increase or decrease as illustrated in the example noted above. In the case where an override is specified, the amount is used entirely as the net claim amount, and adjusted when a non-indexed amount exists. |

Other Tax Credits |

Enter other authorized tax credits for the year as approved by the relative government agency. If other tax credits are entered mid-year, the amount must be prorated by the number of pay periods remaining in the year. |

Prescribed Area |

Enter an annual deduction from gross allowed for those employees who live in designated areas of Canada (such as the Northwest Territories, Nunavut, and the Yukon Territory). If an amount is entered mid-year, it must be prorated by the number of pay periods remaining in the year. |

Special Letters |

If the employee is eligible for annual deductions authorized by a taxation office, but not deducted at source from the employee's pay (such as childcare expenses), enter that amount here. Note that if a special letter is entered mid-year, the amount must be prorated by the number of pay periods remaining in the year. |

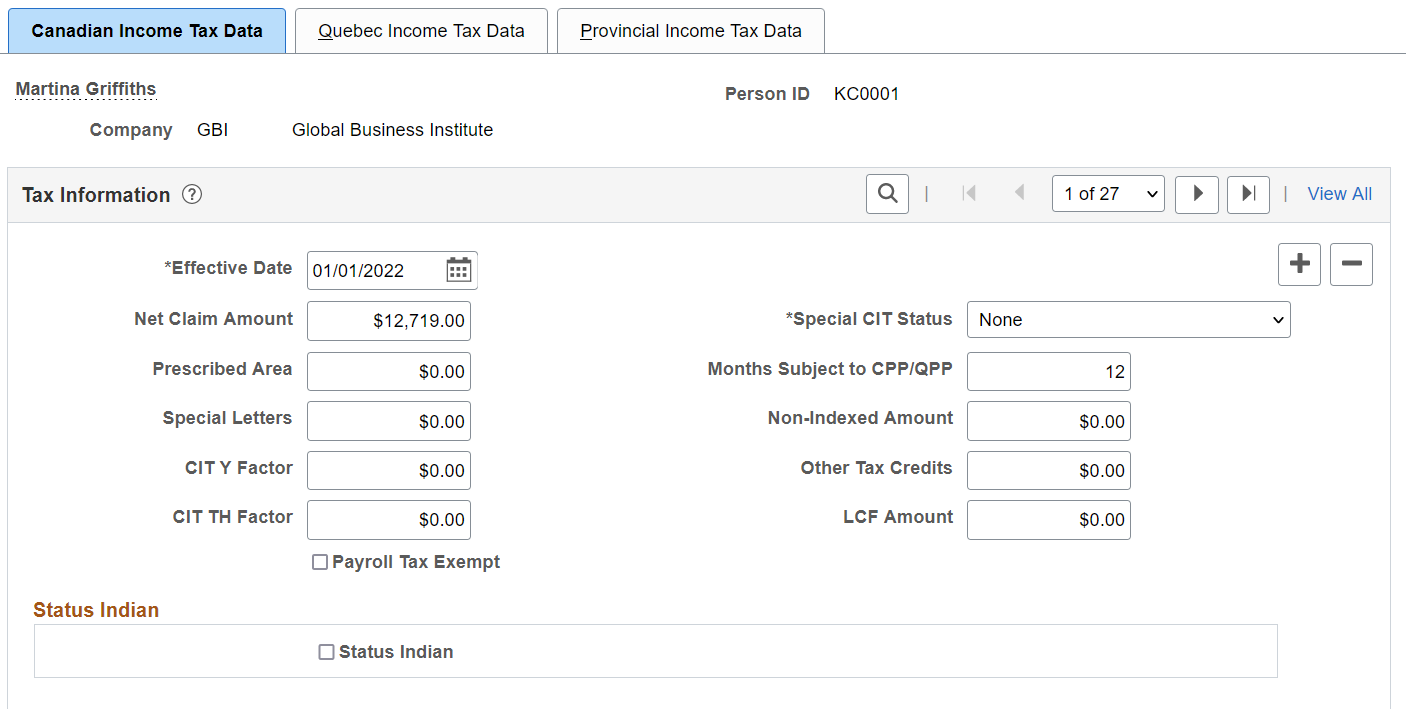

(CAN) Use the Canadian Income Tax Data page (TAX_DATA_CAN1) to set up Canadian Income Tax (CIT), including specifying special CIT withholding status, TD1 exemptions and adjustments, and other tax credits.

Navigation:

This example illustrates the fields and controls on the Canadian Income Tax Data page (1 of 3).

This example illustrates the fields and controls on the Canadian Income Tax Data page (2 of 3).

This example illustrates the fields and controls on the Canadian Income Tax Data page (3 of 3).

Field or Control |

Description |

|---|---|

Net Claim Amount |

Enter the total sum of all federal income tax exemption amounts from the employee's federal TD1 form (including the non-indexed amount). The system uses this field during the Pay Calculation COBOL SQL process. |

Special CIT Status (special Canadian income tax status) |

Select options in this field to indicate whether an employee's withholding tax status deviates from the norm: Exempt (Not Subject to CIT) (exempt [not subject to Canadian income tax]): Select if the employee is exempt from CIT. The taxable base for CIT, however, will still reflect the taxable pay the employee receives to ensure that proper employment income is reported on the year-end T4 slip. Maintain gross (maintain gross): Select to override the normal tax calculation with an amount or percentage indicated in the Additional Withholding group box. None: Select if no special status exists. If you select this option, the system calculates income tax based on the employee's net taxable gross (the norm). |

Months Subject to CPP/QPP (months subject to Canada Pension Plan/Quebec Pension Plan) |

Enter the month that represents the last month, in which the employee is eligible for CPP/QPP contributions. Use the number that corresponds with the desired month of the calendar year (for example 1 for January). For example, if an employee was subject to CPP/QPP for nine months of the calendar year ending in September, and exempt for the remaining three months, enter 9. If the employee was exempt for the entire year, enter 0. Because employees are usually subject to CPP/QPP contributions for the entire year, the default is 12. CPP/QPP contributions will continue to be collected until the month defined in the Months Subject to CPP/QPP field has been met, or the prorated yearly maximum contribution amount has been reached, whichever comes first. Note: The system will not take CPP/QPP contributions if the employee is under the minimum age of 18 or over the maximum age of 70, as determined by the birthdate entered on the Personal Data - Eligibility/Identity page, unless you specify months subject to CPP/QPP on this page. Effective January 1, 1998, the maximum age exemption of 70 has been removed for QPP contribution calculations. |

CIT Y Factor (Canadian income tax Y Factor) |

The CIT Y Factor is used in the calculation of the provincial tax reduction for employees in the provinces of Manitoba and Ontario. You must enter a dollar amount for the CIT Y Factor and not the number of dependents. If you leave this field blank for employees who work in Manitoba, the provincial tax will be based on the net claim amount that you have entered from the employee's TD1 form. If you leave this field blank for employees who work in Ontario, no provincial tax reduction is calculated. |

CIT TH Factor (Canadian income tax TH Factor) |

This field is no longer used, but is maintained for history data.. The CIT TH Factor is the threshold amount used to calculate the provincial net income surtax for employees in the province of Manitoba. If you leave this field blank for an employee in Manitoba, the threshold amount is based on the net claim amount that you have entered from the employee's TD1 form. Note: You should review the CIT Y Factor and CIT TH Factor amounts when provincial tax legislation changes the values of these factors or when a change in the employee's number of dependents would affect these amounts. |

LCF Amount (federal labour-sponsored funds tax credit) |

Enter the purchase amount of shares in Labour-Sponsored Venture Capital Corporations (LSVCC). This amount is used to calculate and apply the federal and provincial tax credits at source, for employees who purchase LSVCC shares. The PeopleSoft Canadian Tax tables maintain the maximum federal and provincial tax credit amounts and rates. |

|

Payroll Tax Exempt |

Select this check box if the employee should not be subject to the Northwest Territories or Nunavut payroll tax. Effective July 1, 1993, the Northwest Territories imposed a one-percent payroll withholding tax on specified remuneration paid for work performed in the Northwest Territories. Effective April 1, 1999, part of the Northwest Territories split off to form the new territory of Nunavut. Only employees who earn more than 5,000 CAD in one calendar year in the Northwest Territories or Nunavut are subject to this tax. The tax is payable on the full amount of specified remuneration earned while working in the Northwest Territories or Nunavut in the year. If an employee's Northwest Territories or Nunavut earnings will not be more than 5,000 CAD for the calendar year, they are eligible for exemption from this tax. You can stop the tax withholding for this employee by selecting the Payroll Tax Exempt check box. The system continues to maintain the payroll tax gross for the employee, but the tax is not withheld. If you find later in the year that the employee should be subject to the tax, deselect the Payroll Tax Exempt check box. On the next system-generated paycheque for the employee, the system will retroactively deduct the tax not previously withheld on all year-to-date Northwest Territories or Nunavut wages. Note: Before running the final payroll for the calendar year, review the tax balance records of any employees whose Northwest Territories or Nunavut payroll tax status may be in doubt. Employees whose total Northwest Territories or Nunavut earnings will be more than 5,000 CAD for the year should not be identified as exempt from the tax. Employees whose total earnings will be 5,000 CAD or less for the year, but for whom tax has been withheld, should be designated as exempt from the tax, and the tax already withheld should be refunded. |

Status Indian

|

Field or Control |

Description |

|---|---|

|

Status Indian |

Select this check box to identify an employee who claims First Nation Indian status. When this check box is selected, the Special CIT Status field on this page, becomes unavailable for entry and is automatically set to Exempt (not subject to CIT). Also, when the Status Indian check box is selected, the Percent Exempt field appears, with a default value of 100. If the employee works in Quebec, the Special QIT Status (special Quebec income tax status) field on the Quebec Income Tax Data (TAX_DATA_CAN3) page automatically changes to match the value in the Special CIT Status field here, and the exemption percentage in the Percent Exempt field here is applied to the calculation of Quebec income that is exempt from taxes on the Quebec Income Tax Data Page. The system calculates CPP and QPP contributions based on the employee’s taxable income. Payroll for North America provides system processing to support the year-end T4 and RL-1 reporting of employment income for Status Indian employees whose total remuneration received in the reporting year is based on Status Indian requirements. When the Status Indian check box is selected, the relevant tax form definition boxes on the T4 and RL-1 forms will facilitate the reporting of Status Indian tax-exempt employment income for year-end slip reporting purposes. For further information, refer to the document titled Year-End Processing: Canada located on My Oracle Support. Note: If your company does not elect to provide CPP coverage to the First Nation Indian status employees, update the Months Subject to CPP/QPP field to 0 (zero). |

|

Percent Exempt |

Appears only when the Status Indian check box is selected. The default value is 100. If the employee claims First Nation Indian status but does not meet the criteria for full 100% tax exemption, update the Percent Exempt field to show the percentage of employment income that should be exempt from income tax. When you click Save, the system changes the Special CIT Status field to None, and uses this Percent Exempt value to calculate the employee’s income that is exempt from taxes Note: Consult the Canada Revenue Agency (CRA) web site for examples, guidelines, and current proration rules for Indian Act Exemption for Employment Income. |

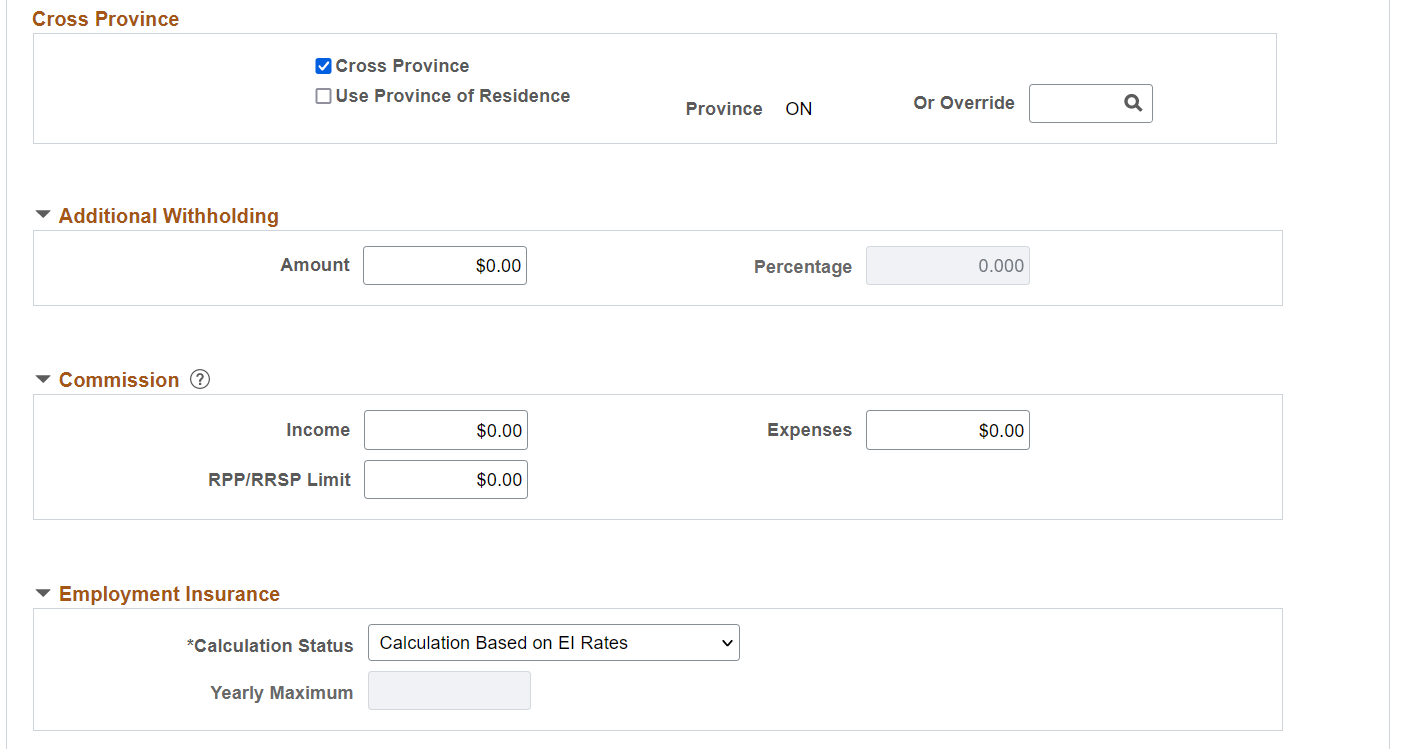

Cross Province

Field or Control |

Description |

|---|---|

Cross Province |

An employee who resides in one province or territory and is employed in another, may be subject to excessive tax deductions. If the CRA approves a written request for tax relief in this instance, the employer is required to limit the employee's tax liability to the amount based upon that employee's province of residence. Payroll for North America refers to this type of situation as cross-province taxation as it applies only between provinces or territories. Select this check box to generate cross-province tax processing. If you select this check box, the Use Province of Residence check box becomes available for selection. |

Use Province of Residence |

Appears when the Cross Province check box is selected. The system selects the Use Province of Residence check box by default. When this check box is selected, the system uses the employee's province of residence for calculating the employee's tax liability. When deselected, the Or Override field appears. |

Or Override |

Appears when the Cross Province check box is selected and the Use Province of Residence is deselected. Specify the applicable province to use to override the employee's province of residence for tax calculation. Note: When the province of employment for taxation purposes is Quebec (QC), the reduction in the tax liability is applied to the federal portion. |

Additional Withholding

Field or Control |

Description |

|---|---|

Amount and Percentage |

Indicate additional CIT taxes that should be taken. The affect of this field depends on the option that you select in the Special CIT Status field: If you select None, you can specify only an amount for additional withholding. The system calculates taxes based on the information on the tax table and adds the additional withholding amount indicated. The amount you enter is always applied against CIT(T4). If you select Maintain gross you can specify an amount or a percentage, or both, for withholding income taxes. The system overrides the normal tax calculation and takes only the amount and/or percentage entered in the Amount and/or Percentage fields. The amount you enter applies against the associated taxable gross on the paycheque. If multiple taxable grosses are applicable, the system allocates/distributes taxes (amount and/or percentage) based on total taxable grosses. |

Note: If you do not want to take additional withholding from a particular cheque, deselect the Additional Taxes check box on the By Paysheet - One-Time Taxes Page.

Commission

Field or Control |

Description |

|---|---|

Income |

For individuals paid on a commission basis, enter the employee's annual estimated commission income. |

Expenses |

For individuals paid on a commission basis, enter the employee's annual expenses. |

RPP/RRSP Limit (Registered Pension Plan/Registered Retirement Savings Plan limit) |

Enter the RPP/RRSP limit. This limit overrides the legislated annual RPP/RRSP limit maintained by PeopleSoft on the Canadian Tax table. These fields are used during the commission tax method calculation to arrive at taxable gross. Note: To complete this information, the employee must complete the required government form (TD1x). |

Employment Insurance

Field or Control |

Description |

|---|---|

Calculation Status |

The only options applicable as of January 1, 1997 are EI Rules (Employment Insurance rules) and EI Exempt (Employment Insurance exempt). The Pay Calculation process uses this field to determine whether to deduct EI premiums. Pre-January 1, 1997 the only options available were the UI Yearly (unemployment insurance yearly) and UI Period (unemployment insurance period) options. Select EI Rules if the employee is subject to EI premiums. This is the default premium calculation formula. Select El Exempt if the employee is exempt from paying EI premiums. |

Yearly Maximum |

When a calculate status of UI Yearly is selected, the system displays the current year's annual maximum insurable earnings amount in the Yearly Max field as listed in the Canadian Tax table. Note that you must review and update this value if the employee starts after the beginning of the year or terminates before the end of the year. |

Note: UI Yearly and UI Period cannot be selected on records dated later than January 1, 1997. The only valid calculate status selections effective after January 1, 1997 are EI Rules and El Exempt.

Balances from Previous Company

If the employee meets the guidelines set forth by the CRA for the continuation of CPP/QPP contributions and EI premiums as the result of a merger, acquisition, or company restructuring, use the fields in the Balances from Previous Company group box to enter the employee's year-to-date carryover amounts that were brought forward to the new company.

Enter the employee's year-to-date CPP and EI contribution amounts from the previously acquired/merged company into the appropriate fields.

Wage Loss Plan Information

Field or Control |

Description |

|---|---|

Wage Loss Plan |

Select the appropriate wage loss plan code. This applies the correct employer EI premium rate as determined by the benefit coverage level of the wage loss replacement plan for short-term disability. You define valid wage loss replacement plan codes in the Canada Wage Loss Plan Table component (WAGELS_PLN_TBL) in Define Payroll Taxes. You must create these codes before you use them elsewhere in the system. Note: If the Multiple Jobs feature is enabled, you can enter multiple wage loss plans per employee. If the Multiple Jobs Allowed check box is deselected, you can enter only one wage loss plan per employee. If the Automatic Employee Tax Data check box on the Installation Table - Product Specific Page is selected, the system automatically creates employee tax data records whenever you hire an employee or transfer an employee to a new company. The wage loss plan default that you specify on the Pay Group Table - Definition page becomes the default wage loss plan on the Canadian Income Tax Data page whenever the system automatically creates employee tax data records. |

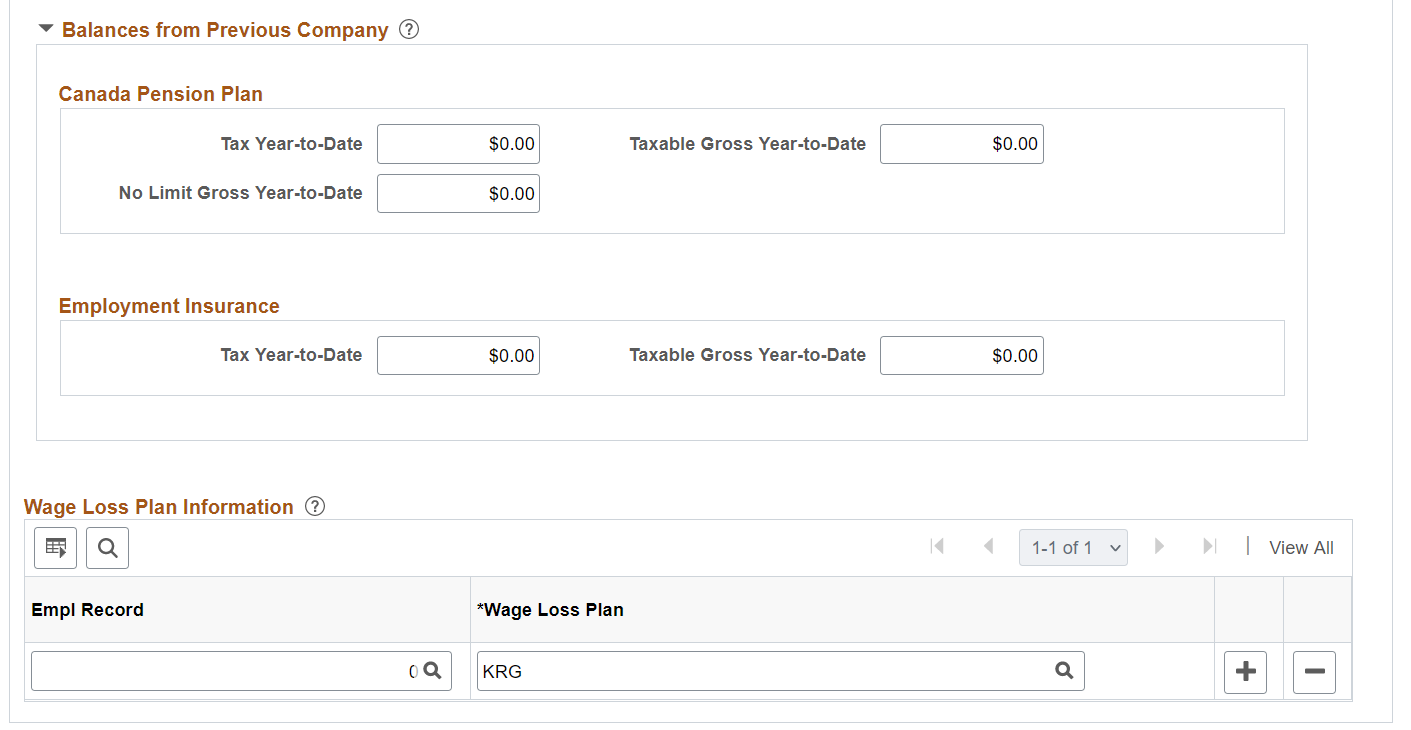

(CAN) Use the Quebec Income Tax Data page (TAX_DATA_CAN3) to enter QIT withholding status, exemption, and tax credit information for employees based in Quebec.

Navigation:

This example illustrates the fields and controls on the Quebec Income Tax Data page.

Tax Information

Field or Control |

Description |

|---|---|

Special QIT Status (special Quebec income tax status) |

These options are similar to those on the Canadian Income Tax Data page. Your selection indicates whether the employee has any special tax status for QIT purposes. If the employee works in Quebec, and the Status Indian check box is selected on the Canadian Income Tax Data page, the Special QIT Status field here automatically changes to match the value in the Special CIT Status field on the Canadian Income Tax Data page, and the exemption percentage in the Percent Exempt field on the Canadian Income Tax Data Page is applied to the calculation of Quebec income that is exempt from taxes here, on the Quebec Income Tax Data page. |

Net Claim Amount |

Enter the total sum of all Quebec income tax exemption amounts from the employee's Source Deductions Return (form TP-1015.3-V). |

Other Deductions |

Enter other authorized Revenu Quebec annual deductions—such as the deduction representing alimony or maintenance payments. |

QPIP Exempt (Quebec Parental Insurance Plan exempt) |

Select if the employee is exempt from QPIP premium deductions. |

Subject to CPP |

Select this check box to calculate CPP, rather than QPP, contributions. Note: According to the Canadian Federal and Quebec income tax laws, a federally appointed judge in Quebec must contribute to CPP, not QPP. |

Exempt from Quebec Health |

Select this check box if the employee is exempt from contributing to the Quebec Heath tax. With the check box selected, the system does not include health tax contributions in tax calculations for the individual. Note: Employers must withhold the health contributions of any individual who is over 18 years old or who turns 18 years old during the year, unless a Source Deductions Return (form TP-1015.3V) has been processed for that individual. |

Additional Withholding

Field or Control |

Description |

|---|---|

Amount and Percentage |

Indicate additional QIT taxes that should be taken. The effect this field has depends on the option you select in the Special QIT Status field: If you select None, you can only specify an amount for additional withholding. The system calculates taxes based on the information on the tax table and adds the additional withholding amount indicated. If you select Maintain gross, you can specify an amount or a percentage, or both, for withholding Quebec income taxes. The system overrides the normal calculated tax and takes only the amount and/or percentage entered in the Amount and Percentage fields. |

Note: If you do not want to take additional withholding from a particular check, deselect the Additional Taxes check box on the By Paysheet - One-Time Taxes page.

Commission

Field or Control |

Description |

|---|---|

Income |

For individuals paid on a commission basis, enter the employee's estimated annual commission income. |

Expenses |

For individuals paid on a commission basis, enter the employee's estimated annual expenses for individuals paid on a commission basis. Note: To complete this information, the employee must complete the required government form (TP-1015.R.13.1–V). |

Balances from Previous Company

For merged or acquired companies that have employees that worked in Quebec, enter the employee's year-to-date carryover amounts to the Quebec Pension Plan (QPP) and the Quebec Parental Insurance Plan (QPIP) in the appropriate fields in the Balances from Previous Company group box.

Note: Enter the federal portion of the year-to-date Employment Insurance premiums on the Canadian Income Tax Data page.

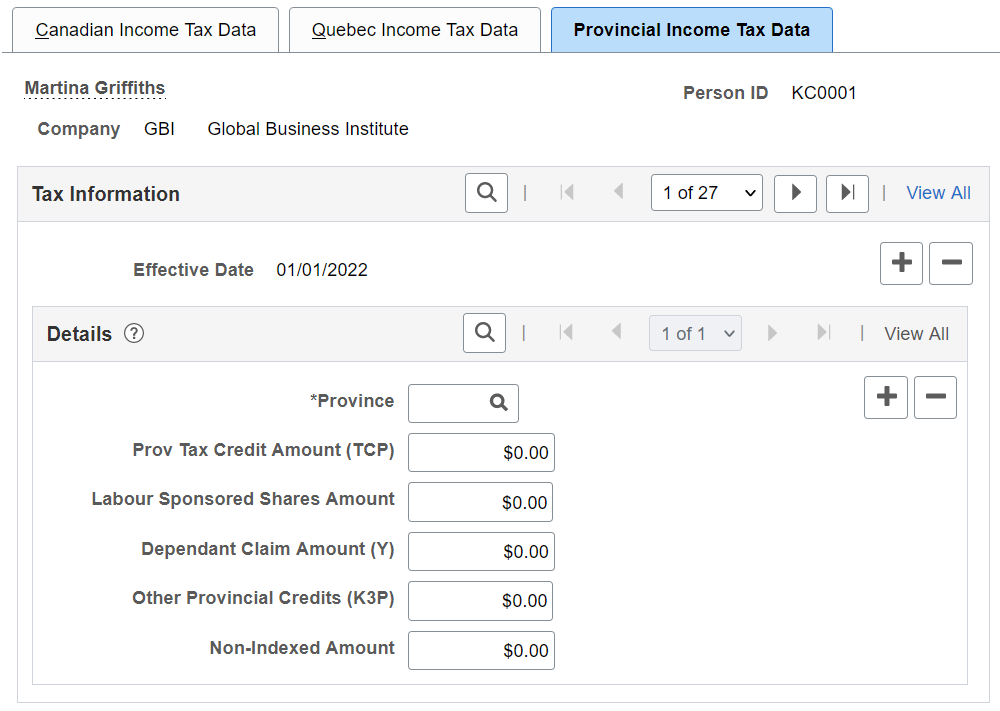

(CAN) Use the Provincial Income Tax Data page (TAX_DATA_CAN4) to enter provincial TD1 personal tax credit amounts.

Navigation:

This example illustrates the fields and controls on the Provincial Income Tax Data page.

Field or Control |

Description |

|---|---|

Province |

Enter the employee's tax location province for calculating provincial income taxes. |

Prov Tax Credit Amount (TCP) (provincial tax credit amount) |

Enter the total net claim amount from the employee's or pensioner's provincial or territorial Form TD1. This is the sum of all of the individual personal tax credit amounts reported on the provincial Form TD1 contributing to the total claim amount. |

Labour Sponsored Shares Amount |

Enter the provincial or territorial labour-sponsored funds tax credit amount. Note: If a Provincial Income Tax Data record exists, the value that specified in the Labour Sponsored Shares Amount field (including zero) is used for the provincial income tax calculation and the LCF Amount field on the Canadian Income Tax Data page is used for the federal income tax calculation. If no Provincial Income Tax Data record exists, by default the system uses the federal labour-sponsored funds tax credit amount indicated in the LCF Amount field of the Canadian Income Tax Data page for both federal and provincial income tax calculations. Note: (Employers Paying Employees in the Province of Saskatchewan). Investment amounts in venture capital corporations that are registered federally only must be entered into the LCF Amount field of the employee's Canadian Income Tax Data page. Investment amounts in venture capital corporations that are registered in Saskatchewan must be entered into the Labour Sponsored Shares Amount field of the employee's Provincial Income Tax Data page. |

Dependant Claim Amount (Y) |

Where applicable, calculate and enter the total dependent claim amount (Y). This is the total sum of the calculated reduction factor Y amounts applicable to Manitoba and Ontario used in determining the provincial tax reduction (factor S). |

Other Provincial Credits (K3P) |

Enter the employee’s other provincial or territorial non-refundable tax credits (such as medical expenses and charitable donations) authorized by a tax services office or tax centre. |

Important! For cross-province taxation to be calculated correctly, entries should be created on the Provincial Income Tax Data page for both the province of employment and the province of residence. If entries do not exist for one or both provinces, the provincial basic personal amounts from the Canadian Tax table will be applied.