Entering Hours or Amounts Using Rapid Entry Paysheets

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PYRE_AMT_ENTRY PYRE_HRS_ENTRY PYRE_BOTH_ENTRY |

Enter hours, amounts, or a combination of both for the earnings codes defined in a template. |

|

|

PYRE_INVALID |

View employee and earning code errors relating to rapid entry paysheets. Use this page to identify errors to be corrected. You are automatically transferred to this page upon save if you have selected the Validate on Save check box. If you do not validate entries when you save, the Load Paysheet Transaction process performs the validation. Invalid entries are not loaded and can be reviewed on the Validation Results page. |

|

|

Load Paysheet Transactions Page |

RUNCTL_PSHUP |

Load data from rapid entry paysheets into paysheets. |

Rapid entry paysheets enable you to quickly input hours worked, amounts, or a combination of both for any number of employees. These are the steps to use rapid entry paysheets:

Access the Rapid Entry Paysheet page using the template that has the earnings codes that you plan to enter.

Enter employees and their earnings.

Run the validation process and view validation results.

Use the Load Paysheets PSJob process (PYLOAD) to load this information into the standard paysheets created within Payroll for North America.

Fields Displayed on the Rapid Entry Paysheet Page

The fields available for entering earnings information on the Rapid Entry Paysheet page vary according to the type of template that you select to enter the page. The following table lists the important fields that vary by template type:

|

Rapid Entry Template Type |

Fields on the Rapid Entry Paysheet Page |

|---|---|

|

Hours |

Up to three columns for the earnings codes defined on the template. Optional Earnings Code field for an additional earnings code. Hours: Use with the optional additional earnings code. |

|

Amounts |

Up to two columns for the earnings codes defined on the template. Optional Earnings Code field for an additional earnings code. Earnings Amount: Use with the optional additional earnings code. |

|

Hours or Amounts |

Up to three columns for the earnings codes defined on the template. |

Before you can use rapid entry paysheets, you must:

Define the rapid entry paysheet templates for the type of earnings you are entering.

Define a Pay Run ID for the payroll that you're processing.

For example, if you're processing payroll for the month ending December 2009, you should have defined a Pay Run ID for this timeframe.

(Optional) If you plan to load employees into the rapid entry paysheet by groups, you must first create the groups using Group Build pages.

Field or Control |

Description |

|---|---|

Earnings Code |

(Optional) Use this field to select an additional earnings code not defined on the Rapid Entry Template. Note: You can add an additional earnings code to a Rapid Entry Template based on Hours only or Amounts only. |

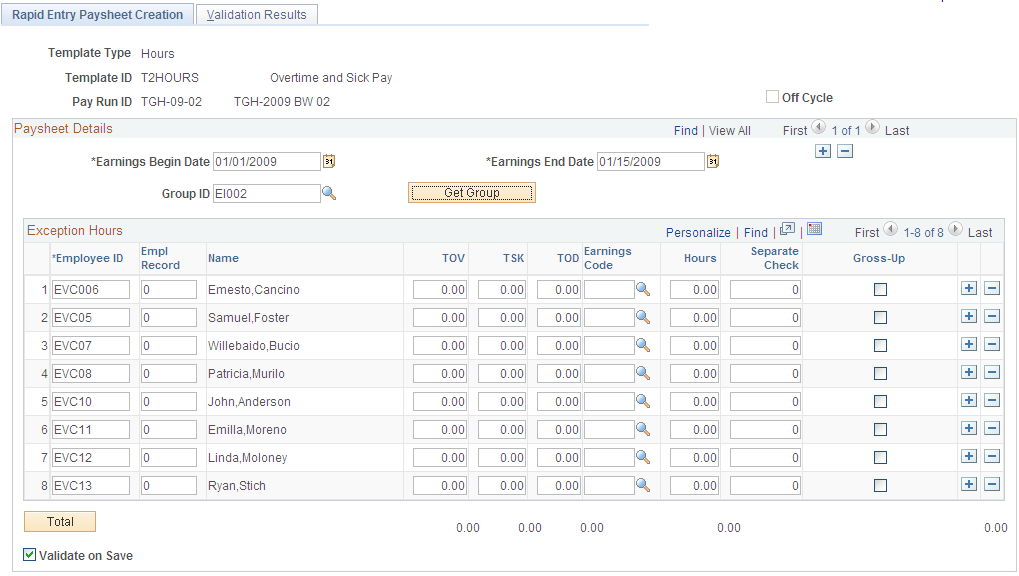

Earnings Begin Date and Earnings End Date |

Enter applicable dates in these fields. Both are required fields. Note: For FLSA employees, the beginning and end dates must fall within the same FLSA period. When adding entries to on-cycle paysheets from rapid entry paysheets, the earnings begin/end dates entered here must match the existing paysheet. If there is not a match, then a new pay earnings row will be created using these earnings beginning and ending dates. |

Group ID |

(Optional) To load the employees in a group that has been defined in Group Build pages, select a predefined group ID. After you've entered the Group ID, select the Get Group button to populate the EmplID, Empl Rcd#, and Name fields. |

EmplID (employee ID) |

To load individual employees, manually enter the EmplID. |

Sep Chk # (separate check number) |

Enter a check number from 1 to 99 in this field if you want the earnings to be paid on a separate check. In one payroll run, the system can produce up to 99 separate checks per employee in addition to the regular paycheck. The earnings are put on the check that you specify here. If you leave this field blank, the earnings are included with regular pay in one paycheck. |

Gross-Up |

Select this check box to gross-up a check for this pay earnings. |

Validate on Save |

Select this check box to have the system validate entries for each employee when you save. After the validation process is complete, the Validation Results page displays. Note: If you do not validate entries when you save, the Load Paysheet Transaction process performs the validation. Invalid entries are not loaded and can be reviewed on the Validation Results page. The validation process will not run a second time if you select the Save button after a Validate on Save has just been performed. If you update the Rapid Paysheet rows after the validation, then you can re-validate on save as many times as you need. |

Use the Rapid Entry Paysheet Creation page (PYRE_AMT_ENTRY) to enter hours, amounts, or a combination of both for the earnings codes defined in a template.

Navigation:

This example illustrates the fields and controls on the Rapid Entry Paysheet Creation page.

The group boxes and fields appear on the page based on the template type you enter. Use the Hours or Amounts combination template type if you want to include earnings defined as Hours Only and earnings defined as Amounts Only in the same template.

Exception Hours

Field or Control |

Description |

|---|---|

Hours |

Enter the number of hours for the additional earnings code. |

Exception Amount

Field or Control |

Description |

|---|---|

[Various columns on the right of the Name column] |

Enter dollar amounts in the columns for earnings codes defined on the template. |

Earnings Amount |

Use this column to enter the appropriate dollar amount that is associated with the additional earnings code. |

FLSA Employees Being Paid Bonuses

When bonuses paid to FLSA employees must be spread over several FLSA periods, enter the earnings begin and end dates to reflect the entire period covered by the bonus. The Pay Calculation process spreads the bonus amount over the FLSA periods encompassed by the earnings begin and end dates.

Exception Amount

Enter the appropriate hours or amounts for each earnings code.

Use the Validation Results page (PYRE_INVALID) to view employee and earning code errors relating to rapid entry paysheets.

Navigation:

This example illustrates the fields and controls on the Validation Results page.

Use this page to identify errors to be corrected.

Note: If no errors are found, a No errors found in validation process message displays on this page.

You are automatically transferred to this page upon save if you have selected the Validate on Save check box on the Rapid Entry Paysheet Creation page (PYRE_AMT_ENTRY). If you do not select Validate on Save, the Load Paysheet Transaction process performs the validation. Invalid entries are not loaded and can be reviewed on the Validation Results (PYRE_INVALID) page.