Setting Up and Managing Capitalization Thresholds

This topic provides an overview of Capitalization Thresholds and threshold validation, and describes the pages necessary to set up and manage Capitalization Thresholds.

Use the Capitalization Limits (DEPR_CAP_LIMIT) component to define and manage capitalization thresholds in PeopleSoft Asset Management.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

DEPR_CAP_LIMIT |

Set up capitalization limit codes by business unit by book, as necessary, especially Germany. |

|

|

CAP_THR_DEFN |

Establish capitalization thresholds by asset profile to be used in automatic classification of capital asset, non capital asset or expense asset. |

|

|

AM_CAPVAL_RQST |

Run the process to validate whether an asset still meets conditions to remain in the capitalization status that it was originally catalogued upon asset addition based on the capitalization threshold process. |

|

|

AM_CAPSUM_RQST |

Run a report to show the capitalization status of assets based upon criteria selection. |

PeopleSoft Asset Management can determine the capitalization status of an asset based on its total cost or unit cost, according to limits that you define. This can be accomplished by enabling the Capitalization Threshold feature. Capitalization Threshold is an optional feature that enables the system to automatically classify assets into one of the following categories: non-capital assets, capital assets, or expenses.

When setting up capitalization thresholds, you can further specify whether the threshold should be based on the asset itself or based on book. When you define capitalization threshold by asset, the capitalization status of an asset is determined using the cost parameters you define for the asset. Using this method, the asset can be classified as non-capital, capital, or expense.

When you define capitalization threshold by book, the asset will be capitalized according to the book’s capitalization status. Using this method, the asset is recognized as a regular financial asset. Using the capitalization threshold by book method, an asset can be capitalized in one book (for example, your primary book) and non-capitalized in another book (for example, your secondary book).

Capitalization threshold by book is useful for tangible property management and the ‘de minimis safe harbor’ election defined in Treasury Department regulation 9636. For example, assume you have a policy for your primary book that requires you to capitalize all items greater than $2500. The purchase of a piece of IT equipment for $3000 meets the capitalization criteria, so the asset will be capitalized in your primary book. However, Treasury Department regulation 9636 enables you to expense items under $5000. Thus, the asset will be non-capitalized in your secondary book.

With the Capitalization Threshold feature, assets are classified into one of the following categories:

Capital Assets - The system generates an asset ID and stores physical and financial information. Financial information is stored in the Cost table (COST). The system also stores acquisition details. Therefore, these assets are trackable from both a physical and financial standpoint. This term is interchangeable with Financial Assets. Assets using the capitalization threshold by asset and by book method may be placed into this category.

Non capital Assets - The system generates an asset ID and stores only physical information. The cost information is stored in the Non capitalized Cost table, (COST_NON_CAP). The system also stores acquisition details. Therefore, these assets are trackable from a physical standpoint only. This term is synonymous with Trackable Assets or Nonfinancial Assets.

Assets using the capitalization threshold by asset method may be placed into this category, will store physical information only and are tracked from a physical standpoint only. Assets using the capitalization threshold by book method are stored in tables normally designated as financial, but the system designates it as a physical cost, rather than financial.

Expense Assets - The system does not generate an asset ID. Assets using the capitalization threshold by asset method may be placed into this category. However, assets using the capitalization threshold by book method cannot be placed into this category. If an asset is entered online that does not meet the capitalization threshold, an error message appears saying that the asset has been catalogued as an expense due to its cost amount and could not be considered as an asset. If the asset is entered in batch, the system stores a message in an audit table that explains why that interface line was not processed. Because of their low cost, these assets are considered an expense when acquired and there is no interest to track them within the Asset Repository.

Note: You can review whether costs are physical or financial using the Review Cost component.

See Pages Used to View Cost History and Summarize Cost Rows

PeopleSoft Asset Management automatically catalogues the capitalization status for batch and online asset additions, provides processes to deal with adjustments to the original cost, balances out any potential clearing account with other feeder systems, and provides reports and audit trails to facilitate control of these transactions.

Adjustment transactions (ADJ) from feeder systems are also assessed for capitalization. The adjustments are not compared individually against the capitalization threshold to assess the capitalization action; rather, they follow the existing capitalization status that is assigned when the asset is added. For example, if an asset was catalogued as trackable, all of its adjustments, regardless of costs, are treated as non-capital adjustments. Adjustments processed in conjunction with its corresponding FAD, CAP is considered for the total cost of the asset as the preferred approach. Although, if this approach had a large impact in performance, it is acceptable to process the adjustments without checking the capitalization threshold. Subsequent negative adjustments and retirements coming from other sources follow the capitalization status of the asset.

Defining and Using Capitalization Thresholds

To define and use capitalization thresholds:

Select the ‘Cap Threshold Processing’ option on the Installation Options - Asset Management page.

Select the ‘Use Cap Threshold’ option on the AM Business Unit Definition page.

Create capitalization threshold definitions using the Capitalization Thresholds page.

For capitalization threshold by asset: Specify the Threshold ID and related information on the Asset Profile – Definition page.

For capitalization threshold by book: Specify the Threshold ID and related information on the Asset Profile – Depreciation page.

See:

For capitalization threshold by asset: Add an asset using the Express Add – Cost/Asset Information page or the Basic Add – General Information page. If you defined threshold information for the asset profile, the asset will inherit the Threshold ID from the profile. You can override the Threshold ID if needed. If no threshold was defined for the profile, you must select an asset based threshold ID.

For capitalization threshold by book: Add an asset using the Express Add – Depreciation Information page. If you defined threshold information for the asset profile, the asset will inherit the Threshold ID from the profile. You can override the Threshold ID if needed. If no threshold was defined for the profile, you can select an asset based threshold ID. If you need to modify an existing asset to use the capitalization threshold by book method, use the Book – Depreciation page to do so.

See:

For capitalization threshold by asset: Use the Non-Capitalized Cost components in the application to perform adjustments, transfers, retirements, and other financial transactions to assets that use this capitalization method. The Non-Capitalized Cost components include the Update Non-Capitalized Cost and Retire/Reinstate Non-Fin Asset pages.

For capitalization threshold by book: Use the Financial components in the application to perform adjustments, transfers, retirements, and other financial transactions to assets that use this capitalization method. This applies to capitalized and non-capitalized books.

The Capitalization Threshold Validation process validates whether assets still belong to the capitalization brackets to which they were initially catalogued after adjustments are made to the original cost. If an asset is in the same bracket as originally classified, then this process takes no further action; however, if it is not, the asset is moved to its respective capitalization bracket.

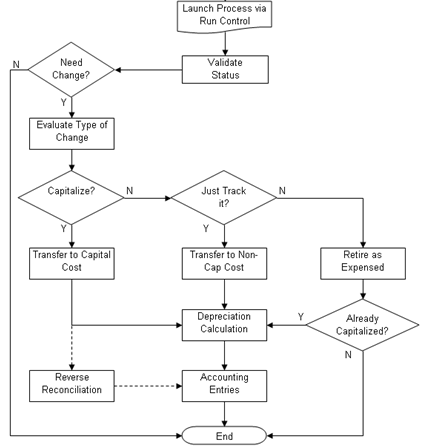

The following graphic represents the process flow for the capitalization threshold validation process:

Capitalization Threshold validation process flow:

Use the Capitalization Limits page (DEPR_CAP_LIMIT) to set up capitalization limit codes by business unit by book, as necessary, especially Germany.

Navigation:

This example illustrates the fields and controls on the Capitalization Limits page. You can find definitions for the fields and controls later on this page.

Create a cost limit code, complete the applicable fields, and select the Low Value Switch check box to identify which limit amount triggers low value asset reporting. This is used only in certain countries.

For example, you might set up capitalization limits for Germany. Using the Cap Limit table, you can set up your system so that assets with a cost less than 800.00 EUR could be added, but the system would generate a warning that the cost was below the capitalization limit; likewise, assets with a cost less than 100.00 EUR could not be added and would generate an error message.

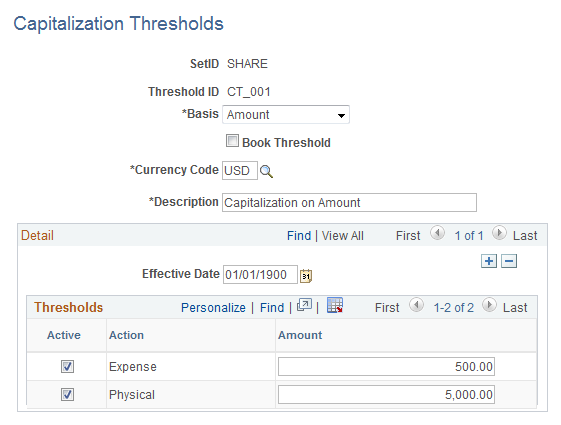

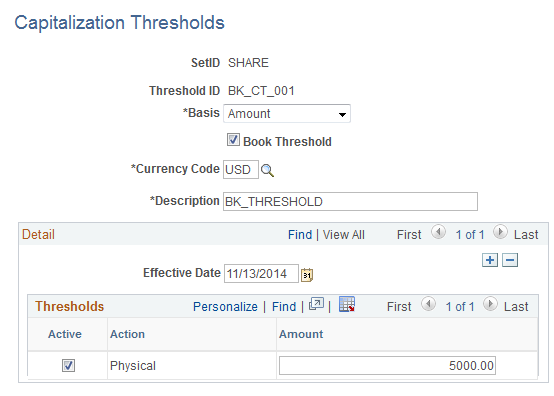

Use the Capitalization Thresholds page (CAP_THR_DEFN) to establish capitalization thresholds by asset profile to be used in automatic classification of capital asset, non capital asset, or expense asset.

Navigation:

This example illustrates the fields and controls on the Capitalization Thresholds page. You can find definitions for the fields and controls later on this page.

This example illustrates the fields and controls on the Capitalization Thresholds page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Threshold ID |

Supply a meaningful threshold ID when creating capitalization thresholds to assign them to asset profiles or assets. |

Basis |

Select the basis to be used for calculating the appropriate capitalization action to take. Select from the following options:

|

Book Threshold |

Select this option to define capitalization threshold by book. When you select this option, only the Physical Action option is available in the Thresholds group box. |

Currency Code |

Enter the currency code of the amounts reflected in the Amount fields. |

Effective Date |

Enter the date when the threshold becomes applicable. |

Active |

Activate each threshold bracket. When deselected, the amount becomes unavailable. |

Action |

Select to activate and set thresholds for the following brackets:

|

Amount |

Enter the ceiling amount for each bracket. Amounts that are less than or equal to the amount entered are included in that bracket. |

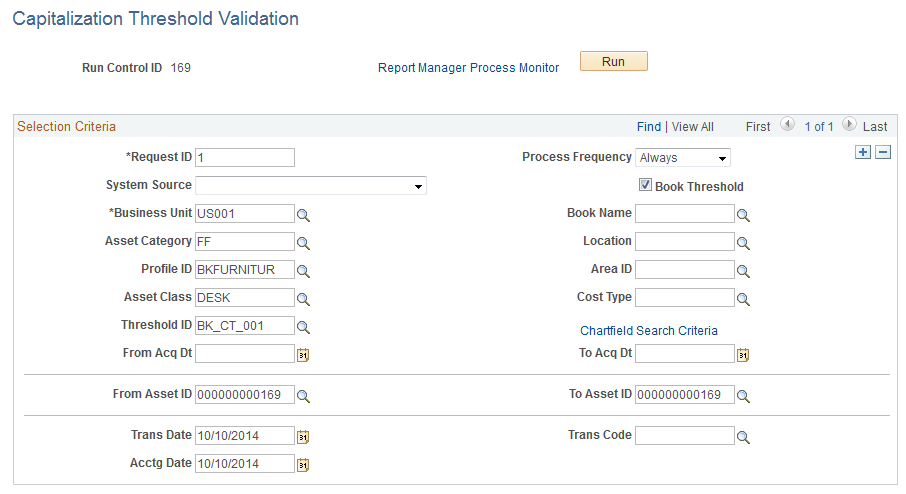

Use the Capitalization Threshold Validation page (AM_CAPVAL_RQST) to run the process to validate whether an asset still meets conditions to remain in the capitalization status that it was originally catalogued upon asset addition based on the capitalization threshold process.

Navigation:

This example illustrates the fields and controls on the Capitalization Threshold Validation page. You can find definitions for the fields and controls later on this page.

Supply the selection criteria for assets to be evaluated for capitalization threshold validation.

Field or Control |

Description |

|---|---|

Book Threshold |

Select this option to process capitalization validation for asset book. When you select this option, the Validation Basis field is unavailable and only Threshold IDs associated with asset books are available for selection. |

Chartfield Search Criteria link |

Access the Chartfield Search Criteria page to supply ChartField filter information for those assets that have particular ChartFields active. |

Trans Code (transaction code) |

Select this criteria, which is useful for assets that are converted from trackable to capitalized. If you want to identify them or perform a different accounting entry, you can define and utilize a transaction code for that purpose. |

Validation Basis |

Select the criteria to use in order to evaluate the total cost of the asset against the threshold. The following options are available:

|

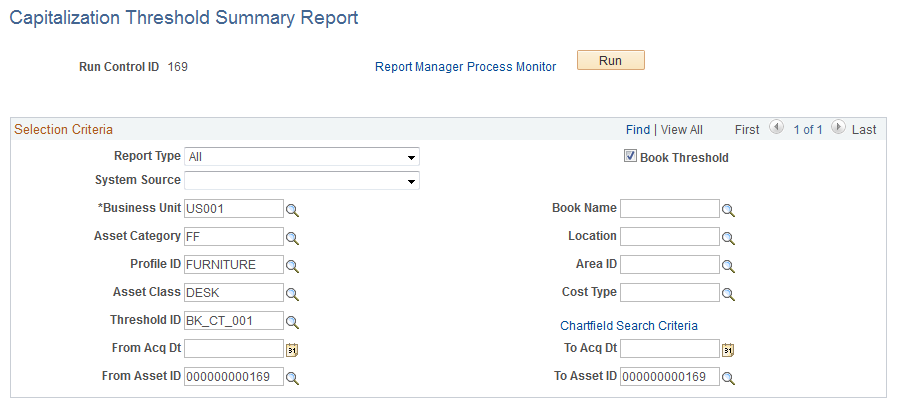

Use the Capitalization Threshold Summary Report page (AM_CAPSUM_RQST) to run a report to show the capitalization status of assets based upon criteria selection.

Navigation:

This example illustrates the fields and controls on the Capitalization Threshold Summary Report page. You can find definitions for the fields and controls later on this page.

Select criteria to report assets as they are classified according to the Capitalization Threshold process. The report displays the acquisition date, asset ID, description, quantity, tag number, serial ID, capitalized cost and non capitalized cost.

Field or Control |

Description |

|---|---|

Book Threshold |

Select this option to process the capitalization status report for asset book. When you select this option, the Validation Basis field is unavailable and only Threshold IDs associated with asset books are available for selection. |

Report Type |

Select to report only the assets that are candidates for recategorization or select to report all assets. |

Validation Basis |

Select to report assets that are capitalized (from the cost table) or select to report both capital and non capital assets. Note: This field is unavailable when the Book Threshold option is selected. |