Understanding the Withholding Process

This section discusses:

Withholding general processing overview.

PeopleSoft Payables and PeopleSoft Lease Administration withholding behavior.

Withholding General Processing Overview

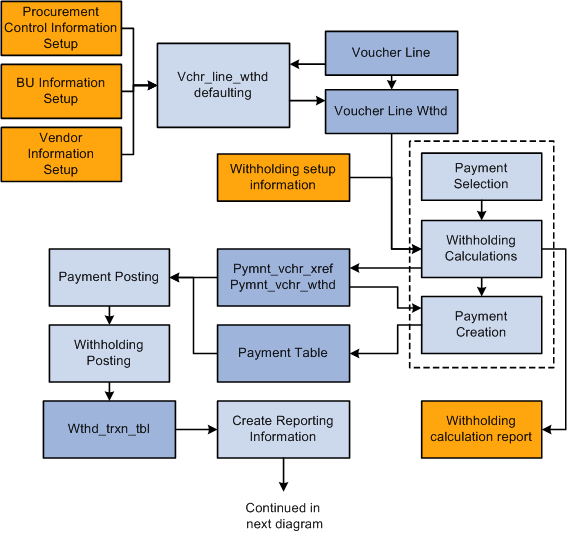

Our withholding architecture enables you to meet the varying withholding requirements of different countries. To use withholding in PeopleSoft Payables, you must set up your withholding environment, complete your business unit withholding setup, and set up your withholding suppliers. The setup information you provide defaults onto the applicable voucher lines.

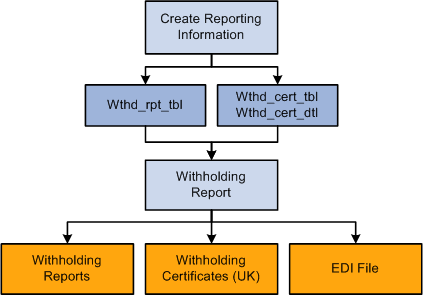

The system calculates the actual withholding amounts as part of the Payment Posting Application Engine process (AP_PSTPYMNT) or the Voucher Posting Application Engine process (AP_PSTVCHR) depending on your withholding entity setup or withholding override options at the voucher. To generate withholding reports, you need to post your payments (either using the Voucher Posting process or the Payment Posting process) and then post your withholding transactions. The system creates reporting information from the posted withholding transactions, enabling you to generate withholding reports, withholding certificates, and/or files as applicable.

The following diagrams illustrate the general process flow for withholding in PeopleSoft (the withholding process for your location may differ slightly).

The following diagrams illustrate the general process flow for withholding in PeopleSoft (part 2).

You complete the withholding process as follows:

Set up your withholding environment.

Set up the appropriate withholding rules, classes, types, jurisdictions, and entities. Under the withholding entity, define the withholding remit supplier or suppliers, assign the combination of withholding types, jurisdictions, classes, and rules that apply, and define the type of control information required from the supplier to process the withholding. You apply combinations of withholding entities, types, jurisdictions, classes, and rules to your withholding suppliers when you define them. You can assign more than one combination to a supplier. For example, a U.S. Supplier may be subject to both 1099–G and 1099–MISC withholding.

You can also define withholding codes, which you can use to override the withholding information that defaults onto the voucher from the supplier; these, too, are combinations of withholding entities, types, jurisdictions, and classes.

As a final step, set up the withholding reports to meet your reporting requirements.

Enter withholding suppliers.

Make any supplier a withholding supplier by selecting the Withholding check box on the Supplier Information - Identifying Information page, and by transferring to the Withholding Supplier Information page from the Supplier Information - Location page, on which you select the appropriate withholding entities and enter the associated withholding control information.

Enter withholding vouchers.

The type of withholding that you define for the supplier defaults to each voucher line. Therefore, any vouchers you enter for a supplier that you have defined as a withholding supplier are subject to withholding. If the voucher is for a withholding supplier, you can click the Withholding link on the Voucher - Invoice Information page to access the Withholding Information page, where you can view the withholding for each voucher line and make the lines not withholding applicable, or make adjustments as needed.

Pay the vouchers.

Depending on your withholding setup, the system may generate a separate withholding payment to the tax authority when the voucher is paid, or just calculate the withholding for reporting to the tax authority. During payment posting, a liability is created for the withholding portion. As you pay the withholding portion, the liability is reduced based on your general ledger setup.

Post the withholding.

Posting combines voucher and payment information into transaction tables.

View withholding balances online.

Complete the required set up for generating your withholding reports by entering your withholding control information and running a withholding control report.

Once you have completed these steps you can run your withholding reports based on the requirements of your tax authority.

PeopleSoft Payables and PeopleSoft Lease Administration Withholding Behavior

If you implement withholding functionality between PeopleSoft Payables and PeopleSoft Lease Administration, the system does or does not default the withholding code onto the voucher, depending on the particular scenario. This table illustrates the scenarios:

|

Withholding Established in PeopleSoft Payables |

Withholding Applicable in PeopleSoft Lease Administration |

Withholding Code |

Voucher Results |

|---|---|---|---|

|

Yes |

Yes |

Same code defined for the PeopleSoft Payables supplier and PeopleSoft Lease Administration. |

The system determines that the withholding codes are the same, and defaults the PeopleSoft Lease Administration withholding code onto the voucher. |

|

Yes |

Yes |

Different codes defined for the PeopleSoft Payables supplier and PeopleSoft Lease Administration. |

The system defaults the PeopleSoft Lease Administration withholding code onto the voucher. |

|

No |

Yes |

The system creates the voucher without a withholding code. |

|

|

Yes |

No |

The system creates the voucher without a withholding code. |

Important! Note that you must establish withholding in both PeopleSoft Payables and PeopleSoft Lease Administration for the system to default a withholding code. If not, the system creates the invoice without a withholding code.

Field or Control |

Description |

|---|---|

Entity |

Tax authority. |

Type |

Defines withholding at the highest level in PeopleSoft Payables. For example, in the U.S. 1099 is a withholding type. |

Jurisdiction |

Jurisdictions introduce an additional level of classification between the withholding type and class. |

Class |

For each withholding type, you can define classes or activities, such as Rent, or Royalties. |

Withholding Class Combination |

For the sake of brevity, sometimes it is referred to the combination of withholding entity, type, jurisdiction, and class as a withholding class combination. |