Defining Transaction Routing Codes

To define transaction routing codes, use the Transaction Routing Code components (RE_TXN_ROUTE).

This topic provides an overview of transaction routing codes and discusses how to define transaction routing codes.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RE_TXN_ROUTE |

Define transaction routing codes. |

Use transaction routing codes to define the routing of transactions to PeopleSoft Billing, Payables, and General Ledger. The transaction routing codes also provide the default ChartFields and taxation rules to be used by each financial application. You can associate a transaction routing code with one or more transaction types or transaction groups, providing default handling for any transaction item that belongs to a group that does not have an explicit routing code assigned.

Use the Transaction Routing Codes page (RE_TXN_ROUTE) to define transaction routing codes.

Navigation:

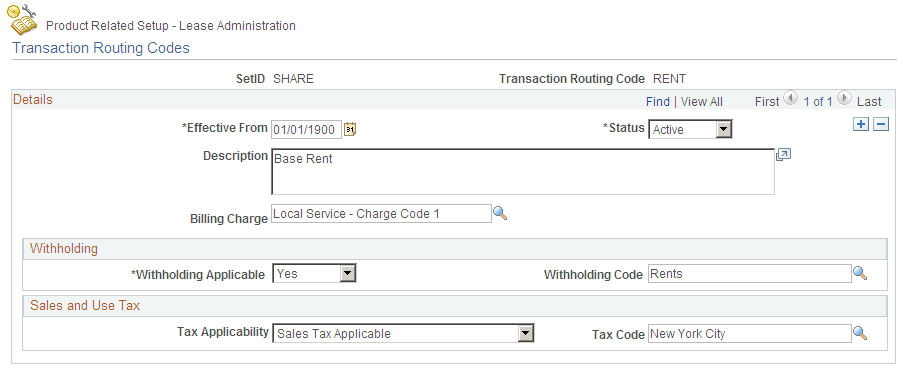

This example illustrates the fields and controls on the Transaction Routing Codes page. You can find definitions for the fields and controls later on this page.

Details

Field or Control |

Description |

|---|---|

Billing Charge |

Select a billing charge. PeopleSoft Billing uses the billing charge code to process transactions for PeopleSoft Lease Administration. The billing charge classifies lease administration transactions. Note: Billing charges apply only to receivables lease transactions. |

Withholding Code

Field or Control |

Description |

|---|---|

Withholding Applicable |

Select whether withholding is applicable. The withholding applicable determines whether the voucher that is generated in PeopleSoft Payables is applicable to tax withholding. Values are: Yes: Select if withholding applies on transactions associated with this transaction routing code. Withholding does not apply if the supplier on the lease does not withhold. Withholding from PeopleSoft Lease Administration overrides the withholding in PeopleSoft Payables. No: Select if withholding does not apply. Note: Withholding applies only to payables lease transactions. |

Field or Control |

Description |

|---|---|

Withholding Code |

Select the withholding code for the associated withholding applicable. The system applies the withholding code to the voucher in PeopleSoft Payables to determine the withholding amount for the lease transaction. If Withholding Applicable is set to Yes, and no value is selected for the withholding code, PeopleSoft Payables applies the standard default when the supplier is set up for withholding. |

Note: Set up supplier information accordingly on the Procurement Control - Withholding page for proper withholding defaults.

Sales & Use Tax Default

Field or Control |

Description |

|---|---|

Tax Applicability |

Select the tax that is applicable to payables transactions. Use this field to determine the excise duty and sales tax applicability details. Values are Direct Pay, Exempt, Exonerated, Sales Tax, and Use Tax. Note: Tax applicability applies only to payables lease transactions. |

Tax Code |

Select the tax code to determine the tax percentage for a county. If Tax Applicability is set to Yes, and no value is selected for the tax code, PeopleSoft Payables applies the standard default from supplier. |

See Understanding PeopleSoft-Only Sales and Use Tax Processing.