Treasury Report on Receivables (TROR) and Debt Collection Activities

This topic provides an overview of the Treasury Report on Receivables (TROR) and Debt Collection Activities, and describes how to generate the Treasury Report on Receivables.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

Treasury Report on Receivables - Receivables Item Type / Code Page |

AR_SF220_TYPES |

Assign an entity code and receivable type to an item. |

|

RUN_SF220_1 |

Select the range of periods to include in the processing to generate the TROR. |

|

|

RUN_SF220_2 |

Enter address information for the TROR. |

|

|

RUN_SF220_3 |

Enter debt disposition information for the TROR. |

Set up the following before processing the TROR:

Receivables Installation Options

TROR Templates

Reporting Entity Codes

Receivables Types

Customer Types

Delinquency Codes

The Treasury Report on Receivables and Debt Collection Activities is the U.S. Department of Treasury's means for periodically collecting data on the status and condition of the federal government's non–tax debt portfolio in accordance with the requirements of the Debt Collection Act of 1982 and the Debt Collection Improvement Act of 1996 (DCIA). The TROR report has been updated to implement the changes documented in the Digital Accountability and Transparency Act (DATA Act) of 2014.

This report creates a form used by the U.S. Department of Treasury to collect data on the status and condition of the federal government's non–tax debt portfolio. It is used if an agency has debts but is pursuing them through collection. The Department of Treasury shares the information in this report with other government agencies, some private sector organizations, and the public.

Processing the TROR

After completing the prerequisite setup, follow these steps to generate the TROR:

Assign an entity code and receivable type to an item in one of the following places:

Treasury Report on Receivables - Receivables Item Type / Code page, which you access from the Pending Item 1 page.

This assigns the codes to pending items.

View/Update Item Details - Detail 2 page.

This assigns the codes to posted items.

Post pending items by running the Receivables Update process.

Assign a delinquency code on the Item Delinquency page to items whose amounts you want to include in various report lines.

Access Treasury Report on Receivables, enter report parameters, and run the report.

View the XML and PDF report output in the Report Manager.

Treasury Report on Receivables Run Control

Run the Treasury Report on Receivables by entering the entity code on which to report. Select the range of periods to include in the processing on the Treasury Report on Receivables run control Preparer page. When the entity code is set up, the system verifies that all selected business units have the same calendar ID to ensure that the selected period range is valid. The beginning and ending dates for generating the report are determined by the begin date of the From Period and the ending date of the To Period.

The report output can be viewed in PDF format.

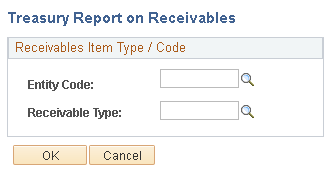

Use the Treasury Report on Receivables - Receivables Item Type / Code page (AR_SF220_TYPES) to assign an entity code and receivable type to an item.

Navigation:

Click the TROR Type link on the Pending Item 1 page.

This example illustrates the fields and controls on the Treasury Report on Receivables - Receivables Item Type / Code page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Entity Code |

Assign an entity code to an item. The entity code contains the TROR template to be used in reporting for all business units defined for this entity. |

Receivable Type |

Assign a receivable type to an item. |

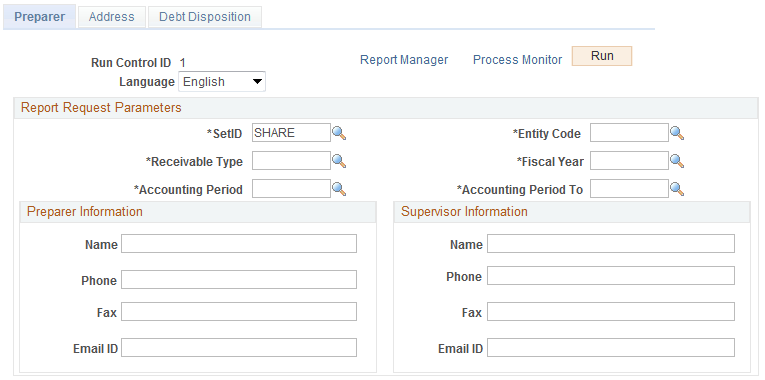

Use the Treasury Report on Receivables - Preparer page (RUN_SF220_1) to select the range of periods to include in the processing to generate the TROR.

Navigation:

This example illustrates the fields and controls on the Treasury Report on Receivables - Preparer page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

SetID |

Select the SetID that is associated with the entity code selected for this report. |

Entity Code |

Select the reporting entity code that will be included in this report. The selected entity code contains the TROR template to be used for this report and all business units defined for this entity. |

Receivable Type |

Select the receivable type to apply to this report. The possible receivable types for this entity are set up on the Reporting Entity Code page. |

Fiscal Year |

Select the fiscal year to apply to this report. The fiscal year that you select is based on the Calendar ID setup for the selected entity code. |

Accounting Period From, Accounting Period To |

Enter the accounting period range that you want to include in this report. |

Preparer's Information |

Enter the name, phone number, fax number, and e-mail address of the preparer depending on the information that is available. |

Supervisor Information |

Enter the name, phone number, fax number, and e-mail address of the preparer's supervisor depending on the information that is available. |

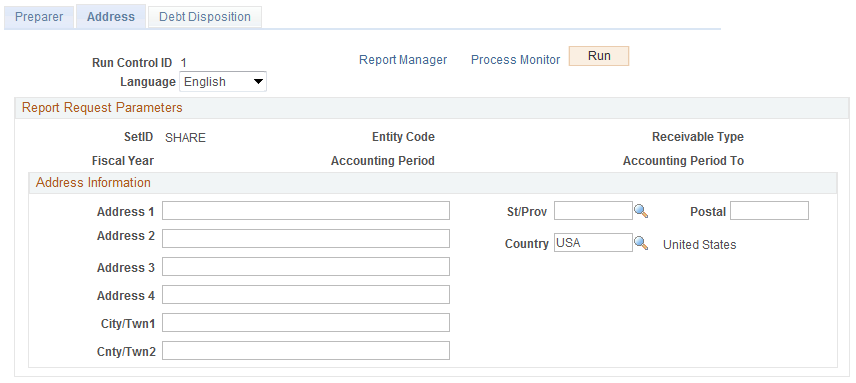

Use the Treasury Report on Receivables - Address page (RUN_SF220_2) to enter address information for the TROR.

Navigation:

This example illustrates the fields and controls on the Treasury Report on Receivables - Address page. You can find definitions for the fields and controls later on this page.

Enter the Address Information for the entity associated with this report.

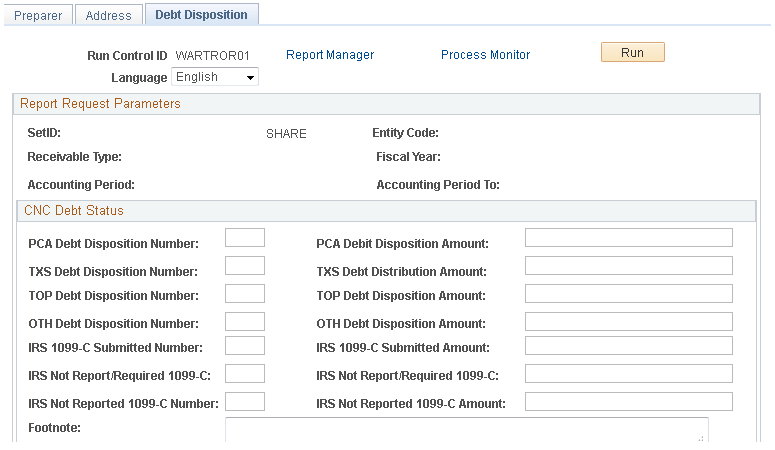

Use the Treasury Report on Receivables - Debt Disposition page (RUN_SF220_3) to enter debt disposition information for the TROR.

Navigation:

This example illustrates the fields and controls on the Treasury Report on Receivables - Debt Disposition page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

PCA Debt Disposition Number, Amount (private collection agency debt disposition number, amount) |

Enter the number and amount of written-off delinquent debts that are still being pursued by the U.S. Department of Treasury or a private collection agency. |

TXS Debt Disposition Number, Amount (Treasury or debt collection center debt disposition number, amount) |

Enter the number and amount of written-off delinquent debts that are still being pursued by the U.S. Department of Treasury or a designated debt collection center. |

TOP Debt Disposition Number, Amount (Treasury for offset debt disposition number, amount) |

Enter the number and amount of written-off delinquent debts that are still being pursued by the U.S. Department of Treasury for offset. |

OTH Debt Disposition Number, Amount (other debt disposition number, amount) |

Enter the number and amount of written-off delinquent debts that are still being pursued by means other than those listed. |

IRS 1099-C Submitted Number, Amount |

Enter the number and amount of written-off delinquent debts that have been reported to the IRS on Form 1099-C. |

IRS Not Report/Not Reqd 1099-C Number/Amount |

Enter the cumulative number and dollar amount of debts that were closed-out during the previous calendar year, but were not reported to the IRS on Form 1099-C because of the dollar value being less than the IRS requirement for reporting. |

IRS Not Reported 1099-C Number/Amount |

Enter the cumulative number and dollar amount of debts that were closed out during the previous calendar year, in which collection actions have ceased, but were not reported to the IRS on form 1099-C. |

Footnote |

This field does not print to the Treasury Report on Receivables. |

The PeopleSoft Application Engine processing (AR_TROR_XML) generates the Treasury Report on Receivables using BI Publisher based on the selected information. See also PeopleSoft Receivables Reports: A to Z.