Understanding Consolidation and Equitization

These topics provide an overview of consolidations with related equitization functionality and discuss how to:

Determine consolidation ChartFields.

Select an approach to intercompany and intracompany transactions.

Define consolidation trees.

Set up elimination units.

Specify consolidation ledgers.

Define elimination sets.

Define subsidiary ownership and minority interest sets.

Set up consolidation sets.

Use ChartField value sets.

Perform consolidation.

Consolidate across summary ledgers.

Map dissimilar charts of accounts.

Use equitization.

Define business unit trees and elimination units for equitization.

Specify ledgers for each business unit in an equitization.

Define ownership sets for equitization.

Define equitization rules.

Define an equitization group and journal options.

Perform equitization.

Produce consolidation and equitization reports.

Use the ledger interface utility.

This section discusses:

Organizational structure and consolidations.

Elimination of intercompany transactions.

Elimination of intercompany investments and calculating minority interests.

Components of the consolidation process.

Incremental processing of Consolidations.

Equitization and Changes in Subsidiary Ownership.

TimeSpans in the Consolidation and Equitization Processes.

Effective Dates and Ownership Sets in Consolidation and Equitization.

Organizations often have complex structures with multiple business or operating units and legal entities with varying degrees of ownership. If your organization comprises more than one business unit or operating entity, you can consolidate these organizations when you report on overall operations, presenting financial statements that accurately describe your financial status.

For example, assume Consolidated Manufacturing is a multinational company that has a controlling interest in a United States business, as well as numerous other subsidiaries worldwide. The balance sheet for Consolidated Manufacturing lists its United States investment as an asset. Consolidated Manufacturing also owns several buildings used by subsidiaries that record the payment of rent to corporate headquarters through intercompany accounts. While these companies are separate legal entities, they represent one unified economic entity. To gain a complete picture of the entire organization, you combine (consolidate) all the assets and liabilities of each business unit, eliminating intercompany transactions and minority interest relationships by creating consolidation elimination journal entries.

You use trees to define the relationships among business units in a consolidation, creating a separate consolidation tree for each configuration. Included in each consolidation tree are the business units being consolidated and the elimination units to which eliminating journal entries are directed.

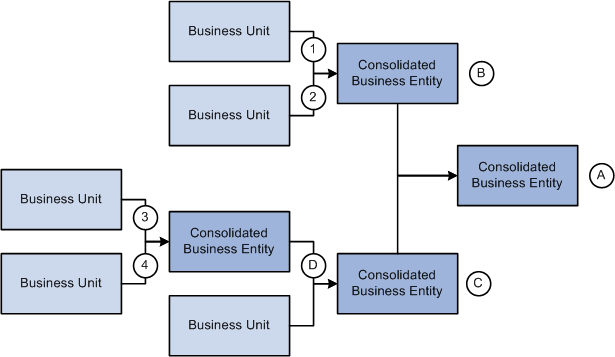

In the following example operating business units 1 and 2 are consolidated in consolidated business entity B and operating business units 3 and 4 are consolidated in business entity D. Consolidated entity D is further consolidated with an additional operating business unit not directly related to business unit 3 and 4 to consolidated business entity C. Finally, the consolidated business entities B and C are combined in the overall consolidation business entity A.

Consolidate Any Combination of Business Units

While there may be situations that require you to report gross consolidations (combining business unit ledger balances without eliminations), in most cases, you want to eliminate or cancel out the effect of intercompany transactions.

In General Ledger, you can track intercompany transactions using Due From and Due To accounts that are automatically created by the Journal Edit process, which calls the Inter/IntraUnit Processor. These Due From and Due To rows in the ledger are candidates for elimination when you run the Consolidations process. The following example shows such a transaction when company B0002 buys software for company B0001:

|

Business Unit |

Account |

Debit |

Credit |

|---|---|---|---|

|

B0001 |

651001—Software License Expense |

5,000 |

|

|

B0001 |

142000—Due From/To B2 |

5,000 |

|

|

B0002 |

141000—Due From/To B1 |

5,000 |

|

|

B0002 |

200000—Accounts Payable |

5,000 |

When the transactions are exclusively within the organization, you can eliminate the whole transaction when you set up your Consolidations process. In the following example, Company B0001 sold services to Company B0002. The Revenue and Expense accounts need to be eliminated in addition to the Due From and Due To accounts:

|

Business Unit |

Account |

Debit |

Credit |

|---|---|---|---|

|

B0001 |

142000—Due From/To B0002 |

3,000 |

|

|

B0001 |

500200—Revenue-Services Sold |

3,000 |

|

|

B0002 |

653000—Expense-Computer Networks |

3,000 |

|

|

B0002 |

141000—Due From/To B0001 |

3,000 |

Using the Affiliate ChartField with a Single Due From/To Account

The Affiliate ChartField is specifically reserved to map transactions between business units when using a single intercompany account. This table provides an example of intercompany payables and receivables among three business units that each use the Affiliate ChartField:

|

Business Unit |

Account |

Affiliate |

Amount |

|---|---|---|---|

|

B0001 |

140000—Due From/To Affiliates |

B0002 |

<5,000> |

|

B0001 |

140000—Due From/To Affiliates |

B0003 |

1,000 |

|

B0002 |

140000—Due From/To Affiliates |

B0001 |

5,000 |

|

B0002 |

140000—Due From/To Affiliates |

B0003 |

<3,000> |

|

B0003 |

140000—Due From/To Affiliates |

B0001 |

<1,000> |

|

B0003 |

140000—Due From/To Affiliates |

B0002 |

3,000 |

Using Different Due From/To Account Values

Another method of tracking activity between business units is to use different ChartField values—typically different accounts—for intercompany transactions. Instead of using the Affiliate ChartField, you could use the following accounts to identify the same transactions that were shown in the previous exhibit:

|

Business Unit |

Account |

Amount |

|---|---|---|

|

B0001 |

142000—Due From/To B0002 |

<5,000> |

|

B0001 |

143000—Due From/To B0003 |

1,000 |

|

B0002 |

141000—Due From/To B0001 |

5,000 |

|

B0002 |

143000—Due From/To B0003 |

<3,000> |

|

B0003 |

141000—Due From/To B0001 |

<1,000> |

|

B0003 |

142000—Due From/To B0002 |

3,000 |

In both examples, the same accounting information is present, but fewer account numbers are required when the Affiliate ChartField is populated. This also means that you need to define fewer elimination sets. An elimination set represents a related group of intercompany accounts that record both sides of each transaction between units.

In the case of the following intercompany receivable and payable relationship, you require only one elimination set if you use the Affiliate ChartField:

|

Elimination Set |

Business Unit |

Account |

|---|---|---|

|

One |

NA |

140000—Due From/To Affiliates |

If you do not use the Affiliate ChartField, three elimination sets are required:

|

Elimination Set |

Business Unit |

Account |

|---|---|---|

|

One |

B0001 B0002 |

142000—Due From/To B0002 141000—Due From/To B0001 |

|

Two |

B0001 B0003 |

143000—Due From/To B0003 141000—Due From/To B0001 |

|

Three |

B0002 B0003 |

143000—Due From/To B0003 142000—Due From/To B0002 |

In consolidating the books of a subsidiary with those of the parent company, you credit the parent with the portion of the subsidiary that it actually owns and exclude what outside investors own. The value of minority interests is reported in terms of the aggregate net assets (equity) rather than in terms of a fractional equity in each of the assets and liabilities of the subsidiary.

To reflect minority interest, General Ledger generates an adjustments entry that debits the investment of the parent in the subsidiary account and credits a minority interest account. The system calculates the adjustment by multiplying the percentage of minority interest in the subsidiary by the total equity of the subsidiary.

Effectively, the combined result of the adjustments and eliminations entries is to express the value of the parent investment in terms of the assets and liabilities of the subsidiary offset by a minority interest liability. The equity ownership for each subsidiary in the consolidation is eliminated, with only the parent company's equity accounts and minority interest account remaining. Consolidated capital stock and retained earnings is equal to the balances of the parent.

Consolidations are made up of four elements: data, scopes, rules, and process.

Term |

Definition |

|---|---|

Data |

Ledger data is entered and posted through daily journal processing. Data also includes specifying which ledger to use during Consolidations for each business unit. Detail ledgers, as well as summary ledgers, can be used as the basis for consolidation. Ledgers outside of the General Ledger database can be loaded into the database for processing. |

Scopes |

Scopes define which business units are included during the consolidation process and how consolidation entries are created. Scopes are created using consolidation trees and elimination units. |

Rules |

Rules determine which ledger entries are identified and eliminated by defining elimination and minority interest sets. These are used in defining the consolidation set that specifies the elimination and minority interest sets to apply. |

Process |

Based on defined rules and scopes, the Consolidations background process generates consolidating journals and calculation log entries from source ledger data. New entries to the Ledger table are used to generate consolidated reports. The Undo feature enables you to reprocess consolidation as many times as necessary. |

PeopleSoft General Ledger provides incremental processing of consolidations by recognizing lower level tree nodes that were previously processed when running the current consolidation. The Consolidation process uses the Consolidation Set, As Of Date, currency, and tree name of the process request to identify the tree nodes that have been processed, thereby enabling processing of only the nodes under a specified higher-level tree node that have not yet been processed. Incremental processing of consolidations enables you to consolidate in stages while avoiding reprocessing of portions of the overall organization that have already been successfully consolidated.

When reprocessing a consolidation that was previously run (commonly done for late transactions or discovery of errors) and you need to reprocess lower-level nodes, you can select the Undo Previous Process and the Include All Lower Level Nodes check boxes on the Consolidation Request page. When you select the Include All Lower Level Nodes check box, the undo process identifies all previously processed lower-level nodes and reverses them. If this option is not selected, the undo process only reverses the entries that were created from a single process by matching Consolidation Set, As Of Date, currency, tree name, tree level, and tree node as indicated on the current run control.

The Equitization process generates the entries to reflect the equity pickup of subsidiary earnings on the parent's books. It updates the value of the parent's investment and equity income accounts for changes in the subsidiary's value. When the value of an investment in a subsidiary changes for a parent company during the fiscal year, often it is without a physical event (transaction) having been recorded; however, the value of the investment of the parent in the subsidiary must be modified. You can use the PeopleSoft Equitization process when no physical accounting event will have occurred, but the value of the parent investment in the subsidiary has changed.

For example, net income or net loss of a subsidiary increases or decreases the investment value and affects the equity of the parent in that subsidiary.

PeopleSoft General Ledger enables you to set up multiple equitization rules for multiple business units that have complex parent-subsidiary relationships and create journal entries to record the changes within a single process. A ledger for a parent entity can be different from that of its subsidiary but you have the option to generate elimination entries for consolidated reporting.

Equitization can be run alone or in conjunction with consolidation and can share the consolidation tree with the Consolidations process, as well as the ownership sets.

Note: Equitization supports only the Business Unit field as the processing entity. This is unlike the Consolidation process, which allows consolidation of fields other than business unit, such as the Operating Unit field.

You can specify a TimeSpan on the Consolidation Set and the Equitization Group to indicate the type of balances to be posted for consolidation and equitization. If the TimeSpan is a year-to-date type of TimeSpan (for example, BAL), then a valid Journal Reversal Option should be selected; otherwise, there should be no reversal of the consolidation or equitization entries if they are intermediate periods. This is because distinct periods are consolidated that do not include prior periods in the current process. A warning message is issued by the system if the reversal option is selected with a TimeSpan option other than BAL.

Using intermediate TimeSpans (other than year-to-date types) is generally more efficient for processing consolidation and equitization; however, exercise caution when using non-year-to-date type TimeSpans. If changes have been made in ledgers for accounting periods that were previously processed for intermediate periods, it will be necessary to reprocess consolidation and equitization for those periods.

The following conditions must be met to have valid TimeSpans for Consolidation or Equitization:

The TimeSpan calendar must be the same as the Calendar for the Business Unit and Ledger Group to be processed.

The TimeSpan must be for the current year, that is, the Start Year and End Year must be 0, with Type defined as Relate to Current Year.

If the Time Span is a year to date time span for the Consolidation Set and the Equtization Group, then the reversal option must be either the Beginning of Next Period or the End of Next Period. For any TimeSpan other than BAL or YTD, the reversal option must be Do Not Generate Reversal.

Note: Incremental processing of consolidations occurs regardless of what TimeSpan is selected for processing. Incremental processing is not available for the equitization process.

Consolidation and Equitization support the use of multiple effective-dated subsidiary ownership sets. Effective dates dictate to which period of the fiscal year a certain ownership set is applied. There are two options for selecting the dates within the Consolidations Set and Equitization Group:

By Period End Dates.

By Process Request as of Date.

If you choose to select ownership sets by Period End Dates, the process selects the effective ownership date to use based on each accounting period being processed.

Adjustment Periods are processed with the current (latest) accounting period.

The effective ownership date can also be determined By Process Request As of Date and only the most recent Ownership Set definition is used. Regardless of the option selected, the journals that are created by the consolidation process are dated as of the process request date.

When changing parents and percentages, always add a new effective dated row for the new ownership set so as not to change history. That is to say, do not change the effective date on an existing ownership set that has been used in a previous run if you want to retain the consolidated information, nor should you change the subsidiary entity on an existing ownership set.