Defining Accounting Rules

To define accounting rules, use the Accounting Rules component (PSA_ACCT_SETUP). Use the PSA_ACCT_SETUP_CI component interface to load data into the tables for this component.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

PSA_ACCT_SETUP |

Define the accounting rules to apply to rate-based transactions that originate in Project Costing, fee-based transactions that originate in PeopleSoft Contracts, or transactions that were not accounted for in feeder systems. The system uses these rules when you run the Process Project Accounting process. |

PeopleSoft Contracts Accounting Rules are used to generate billing and revenue accounting entries. You can create and test Accounting Rules in development or test databases, and then use the Data Migration Workbench to move them between development environments, test environments, and ultimately to your production environment.

See Understanding the PeopleSoft Data Migration Workbench.

See Using the Data Migration Workbench for PeopleSoft Accounting Rules.

See PeopleTools: Application Designer Lifecycle Management Guide.

Use the Accounting Rules page (PSA_ACCT_SETUP) to define the accounting rules to apply to rate-based transactions that originate in Project Costing, fee-based transactions that originate in PeopleSoft Contracts, or transactions that were not accounted for in feeder systems.

The system uses these rules when you run the Process Project Accounting process.

Navigation:

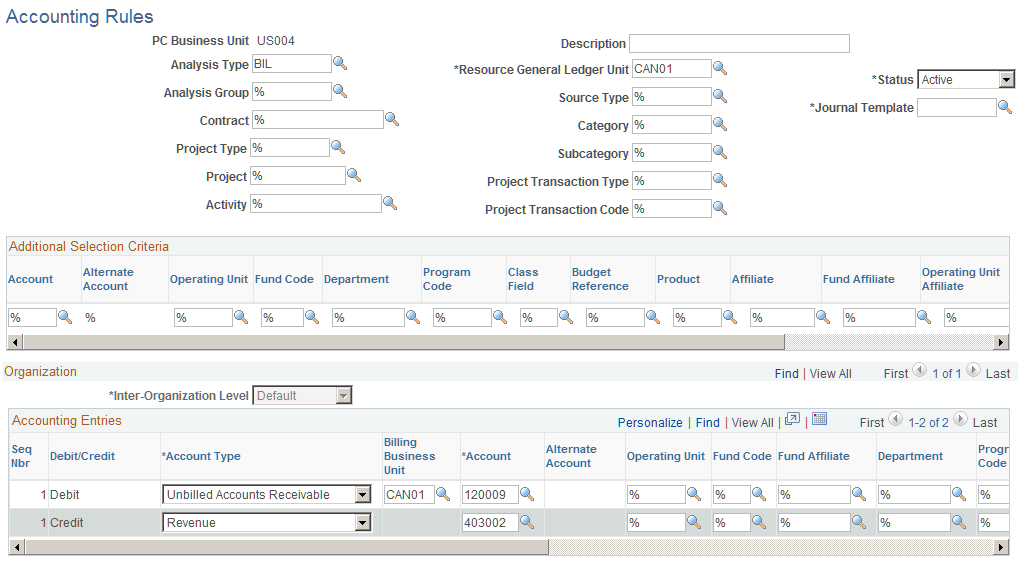

This example illustrates the fields and controls on the Accounting Rules page. You can find definitions for the fields and controls later on this page.

This page is divided into three sections. In the top section, you define the criteria for incoming transactions to which the accounting rules apply. In the Organization section, you specify the organizational relationship for which the rules apply, and in the Accounting Entries section, you define the accounting transactions that the system creates.

Note: On this page, you can enter a percent symbol as a wildcard, which indicates any possible value. You cannot use partial wildcards on this page, which is alphanumeric symbols in combination with the percent sign symbol.

Field or Control |

Description |

|---|---|

Project General Ledger Unit |

Enter the project GL business unit, which designates the business unit to which accounting entries are charged for the project. This field appears if the Enable Organization option is activated on the Installation Options - Project Costing page. |

Resource General Ledger Unit |

Enter the GL business unit that owns the resource. You must enter a value for this field. |

Analysis Type and Analysis Group |

Enter an analysis type or analysis group. You can enter a value in the Analysis Type field or the Analysis Group field, but not both. If an accounting rule is created by entering an analysis group then all the analysis types that are part of the analysis group are eligible to be considered while generating accounting entries. |

Journal Template |

Enter the journal template to attach to accounting entries when they are sent to the GL system. The CA_PC journal template is recommended for revenue-generating, accounting rules that PeopleSoft Contracts controls. |

Additional Selection Criteria |

Enter ChartField values to search for general ledger ChartFields. When a new accounting rule is added, all fields in this group box are wildcard symbols (%). The Alternate Account field is enabled or disabled based on the Enable Alternate Account option on the Installation Options page and then based on the Enable Alternate Account option on the General Ledger Business Unit Definition page. |

Copy Accounting Entries To |

Click to copy the accounting entries that you specify in the Accounting Entries group box for use with another set of header criteria. |

Organization

Field or Control |

Description |

|---|---|

Inter-Organizational Level |

Specify the organizational levels that the system uses to define the accounting entries that the system creates. This field is used for setting up accounting rules for transorganizational or organizational-sharing accounting. This field is available if you select Enable Organization on the Installation Options - Project Costing page and define the organizational hierarchy. As an example, if you define the organization to include GL business unit, operating unit, and department, in that order, then the field values are: Level 1 (GL business unit): Use accounting entries that are specified under this inter-organizational level when an employee is in a different GL business unit than the project's GL unit. Level 2 (operating unit): Use accounting entries that are specified under this inter-organizational level when an employee from one operating unit works on a project or activity that is owned by another operating unit, and both operating units belong to the same GL business unit. Level 3 (department): Use accounting entries that are specified under this inter-organizational level when an employee from one department works in another department, and the GL business unit is the same as the operating unit. Default: Use when the resource and project or activity organizations are the same, or when you do not need to distinguish organizational levels from one another. After analyzing the relationship between the resource organization and the project or activity organization, the Process Project Accounting process looks for a rule that is established for that relationship. If none exists, it uses the default rule. If no default rule exists, it does not generate any accounting entry lines. For example, when an employee working in another department within the same GL business unit submits an expense transaction, the system checks to see if there is an accounting rule at the department level. If no rule exists, the system checks to see if a default rule exists. A default accounting rule should always be in place for inter-organizational level accounting entries. To set up accounting rules for straight accounting, deselect the Enable Organization field on the Installation Options - Project Costing page to disable the Inter-Organization Level field, which tells the system to use the default Inter-Organization Level entries. |

Accounting Entries

Use this grid to define the accounting debits and credits to create for specified project transactions. There must be an equal number of debits and credits. When defining accounting rules for billable activity, you must specify one UAR accounting distribution. This accounting distribution is stamped on the row when it is sent to PeopleSoft Billing. If you do not establish a UAR distribution, the system does not send the row to Billing.

Field or Control |

Description |

|---|---|

Seq Nbr (sequence number) |

Displays the sequence in which the system applies these accounting entries. The sequence number groups the debit and credit together and is used to determine if interunit entries should be created. Note: Do not specify interunit entries on the Accounting Rules page. This results in double entries. |

Debit/Credit |

Displays whether this accounting line is a debit or a credit. |

Account Type |

Select the type of accounting entry. Note: The system sends unbilled accounts receivable to PeopleSoft Billing. |

Billing Business Unit |

This field appears only if the account type is Unbilled Accounts Receivable. Enter the same business unit that you entered in the Resource General Ledger Unit field to ensure that the receivables accounting entries are booked to the same GL business unit as the unbilled receivables account. You must set up rows with analysis types of BRT (Billing Retainage), RRT (Released Billing Retainage), DEF (Deferred Amount), and OLT (Over Limit Amount) for these types of processing. These rows are not accounted for in the Process Project Accounting process, but they require a UAR accounting distribution to be sent to PeopleSoft Billing. |

Note: Prepaid utilization rows—rows with an analysis type of UAJ (Prepaid Utilization Adjustment) and UTL (Prepaid Utilization for Billing)—are costs that are prepaid by the customer and used over a period of time. Prepaid utilization rows are not handled in the accounting rules setup. PeopleSoft Contracts generates UTL rows and sends them to the PeopleSoft Billing system when a prepayment is used. PeopleSoft Billing generates UAJ rows. The Process Project Accounting process handles the accounting for utilization rows separately. Contract liability is debited from the prepaid accounting setup, and UAR is credited. The UAR is populated on the UTL and UAJ rows from the BIL rows that are sent to PeopleSoft Billing.

Field or Control |

Description |

|---|---|

Account |

Enter an account number or enter a percent symbol as a wildcard. A percent symbol indicates any possible value. When entering a percent symbol, the system generates accounting entries with the account that is used on the transaction. Therefore, it is possible to use either the account on the accounting rule or the account on the transaction to generate accounting entries. If both debit and credit ChartField values on this page have a percent symbol, then both entries go to the same account, which is entered on the transaction. If a ChartField value is a percent symbol on the Accounting Rules page and the account is not entered on the transaction, then an error message is created in the Message Log and the transaction is placed on hold. Note: Additional ChartField values on this page operate in the same way . |

Organization to Book |

Select either Resource or Project to specify which business unit to book the accounting line. This field appears on the page if the Enable Organization option was selected on the Installation Options - Project Costing page. |

Project Value |

Select an option that determines if the project ID appears on the accounting entry when it is created. The options for this required field are:

|