Establishing Operating Expenses for a Lease

This topic discusses how to establish operating expenses for a lease.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

RE_LS_TRM_SEC |

Define an operating expense for the lease. When you establish your operating expense details, you can set up categories and minimum and maximum amounts for that operating expense. |

|

|

RE_LS_TRM_DST_SEC |

Override the accounting distributions defined at the business unit level. |

|

|

RE_LS_PRTA_SEC |

Use this page to enter prorata basis information for this operating expense. This link is available only if you select Gross Leasable Area, Occupied area, or Occupied Area with Floor as the Prorata Share Basis. |

|

|

RE_LS_OPX_CAP_SEC |

Use this page to enter caps detail information for this operating expense. This link is available only if you select Apply as the CAP/MIN. |

|

|

RE_LS_OPX_APP |

Approve operating expenses that exceed tolerances. |

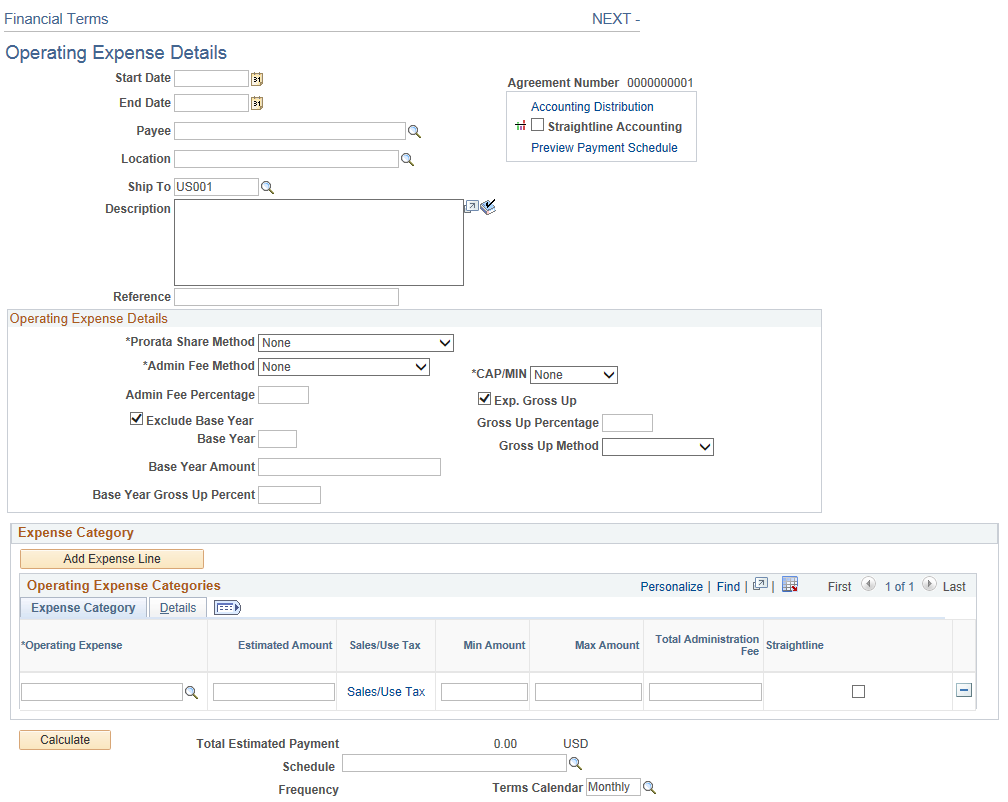

Use the Financial Terms - Operating Expenses Details page (RE_LS_TRM_SEC) to define an operating expense for the lease.

When you establish your operating expense details, you can set up categories and minimum and maximum amounts for that operating expense.

Navigation:

Click the Add Operating Expense button.

This example illustrates the fields and controls on the Financial Terms - Operating Expense page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Start Date |

Enter the begin date for the operating expense. The start date must occur on or after the lease start date. The system uses the lease start date as the default. |

End Date |

Enter the end date for the operating expense. The end date should occur on or before the lease termination date. The system uses the lease end date as the default. |

Payee |

Enter the entity who receives the operating expense payments. The default value is the landlord from the lease. This field appears only for operating expenses that are associated with payables leases. |

Location |

Enter the location. You can override the default location from the lease header for a financial term. |

Ship To |

Enter the supplier ship to location. This location will be used for VAT and SUT calculations by PeopleSoft Payables Voucher Build application. Applicable only for payables leases. This is not a required field and if this is left blank, Voucher Build will populate the default ship to location for the supplier. |

Payor |

Enter the entity who is responsible to make the operating expense payments. The default value is the tenant from the lease. This field appears only for operating expenses that are associated with receivables leases. |

Accounting Distribution |

Click this link to access the Accounting Distribution page and to override the operating expense details accounting distribution rules defined at the business unit level. |

Add Expense Line |

Click to add a new row to the Operating Expense Categories grid. |

Operating Expense Details

Field or Control |

Description |

|---|---|

Prorata Share Method |

This is the basis on which the tenant's share of expenses is calculated. Generally, it represents the ratio of the area of the tenant's premises to that of the building or property as a whole, or an appropriate part thereof. Select either:

|

Prorata Details |

Click this link to access the Prorate Share Details - Basis page. This link is only available if you select Gross Leasable Area, Occupied Area, or Occupied Area with Floor as the Prorata Share Method. |

Admin Fee Method (administration fee method) |

Choose either:

|

Admin Fee Percentage(administration fee percentage) |

Enter the admin fee percentage |

Exclude Base Year |

Select this check box to exclude a base year. The base year fields are informational only. |

Base Year |

Enter the year to be used as the base year. If you select Exclude Base Year, then you must enter a base year. |

Base Year Amount |

Enter the amount to be used for the base year. If you select Exclude Base Year, then you must enter a base year amount. |

Base Year Gross Up Percent |

Enter the base year gross up percentage. If you select Exclude Base Year, then you must enter a base year gross up percent. |

Cap/Min |

|

Caps Detail |

Click this link to access the Caps/Minimum Details page. This link appears only if Apply is selected as the Cap/Min value. |

Exp. Gross Up(expense gross up) |

Select this check box to enable expense gross up. |

Gross Up Percent |

Enter the gross up percentage to be applied to this operating expense. |

Gross Up Method |

Select either:

|

Expense Categories

Field or Control |

Description |

|---|---|

Operating Expense |

Enter or select the operating expense category for recoverable shared expenses. You can select from only active operating expense categories. |

Estimated Amount |

Enter the estimated amount for the operating expense. Use the estimated amount for monthly recurring invoices or payments. |

Sales/Use Tax |

Click this link to access the Sales/Use Tax Information page. For additional information on Sales/Use Tax Information page, refer Defining Lease Financial Terms |

VAT |

Click this link to access the VAT Information page. This field appears only for VAT enabled business units. For additional information on VAT Information page, refer Defining Lease Financial Terms |

Min Amount (minimum amount) |

Enter the minimum amount for the operating expense. Note: This field is for information use only. |

Max Amount (maximum amount) |

Enter the maximum amount to charge for the operating expense. Use this field to calculate audit alerts during the audit and reconciliation processes. |

Administration Fee |

Enter the administration fee. The system adds this amount to the operating expense charges after final calculations of all operating expenses for the lease. |

Straightline |

Select to apply straightline calculations to the operating expense. Note: If the rent amount or recurring expense amount for the operating expense is not evenly billed across periods, then those amounts must be reported in the general ledger on a straightline basis (an even distribution). |

Calculate |

Click the button to calculate the recurring monthly operating expenses. Note: This button is only available when the lease or amendment is in pending status. |

Total Estimated Payment |

Displays the total estimated payment amount for the operating expenses. |

Schedule |

Select a value from the prompt table to specify how often to invoice or pay the operating expenses. Use this field to determine the frequency of the invoice or payment. The values from which you select come from the Schedule component. Note: If the value you need is not available, to the Schedule component to add additional values. |

Frequency |

Displays the frequency that is associated with the schedule that you selected. |

Anticipated Process Date |

Displays the current anticipated processing date or the next date on which a transaction is available to be approved and sent to PeopleSoft Payables or PeopleSoft Billing. This field appears only after lease activation. Note: You must run the Transaction Generator to get the scheduled transactions into the transaction queue. |

Terms Calendar |

Enter the terms calendar, which determines the start date and end date of billing periods for the operating expense. The calendar ID from the business unit definition appears by default. You can override this value, but the frequency of the schedule and terms calendar must be the same. This is a required field. |

Details

Field or Control |

Description |

|---|---|

Caps |

Select this check box is caps apply to this expense. |

Fee |

Select this check box if fees apply to this expense. |

Gross Up |

Select this check box if grossing up applies to this expense. |

Anchor Contribution |

Enter any anchor contribution made by the tenant. |

Basis |

Select a basis for this operating expense. |

Catch Up |

Catch up payments are the adjustment payment for the first months of the new year. The difference between the estimated payment amount paid to date in a new lease year (which has been paid at the prior year estimated payment amount) and the amount due per the new estimated payment amount This catch up payment will be added to the first transaction that will be sent to the transaction queue after the amendment is activated. |

Accounting Distribution |

Click this link to access the Accounting Distribution page and override the operating expense category accounting rules defined at the business unit level. |

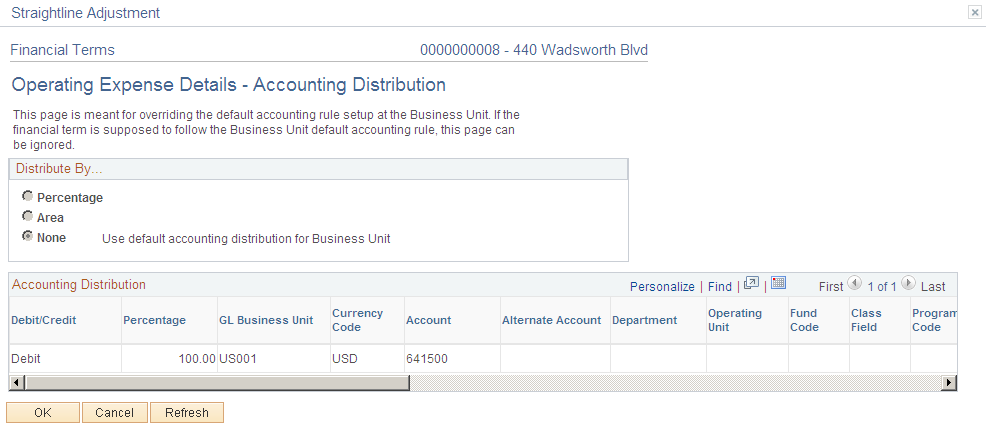

Use the Accounting Distributions page (RE_LS_TRM_DST_SEC) to override the accounting distributions defined at the business unit level.

Navigation:

Click the Accounting Distributions link on the Financial Terms - Operating Expenses Details page.

This example illustrates the fields and controls on the Accounting Distributions page. You can find definitions for the fields and controls later on this page.

The fields on this page differ depending upon the distribution selected. When you select a value other than None, the ChartField values become available for edit.

Field or Control |

Description |

|---|---|

Distribute By |

Select either:

|

Add Distribution |

This button appears if you select Percentageor Area for the distribute by value. Click this button to insert a new distribution row. |

Delete Distribution |

This button appears if you select Percentage or Area for the distribute by value. Select a row and click this button to delete it from this page. |

Select |

This option appears if you select Percentage or Area for the distribute by value. This option is used to delete distribution rows. Select this option and click the Delete Distribution button to delete the rows. |

Percentage |

This field appears if you select Percentagefor the distribute by value. Enter a percentage amount for this distribution line. Percentage amounts must equal 100% to be valid. |

Area |

This field appears if you select Areafor the distribute by value. Enter the area for this distribution line. All lines must add up to the total rentable area for the lease to be valid. |

Valid |

Used to indicate a valid combination of chartfields. When activating the lease, edit checking will be provided and the option will be selected for each row representing a valid combination of chartfields. A lease cannot be activated until every accounting distribution is marked as valid. |

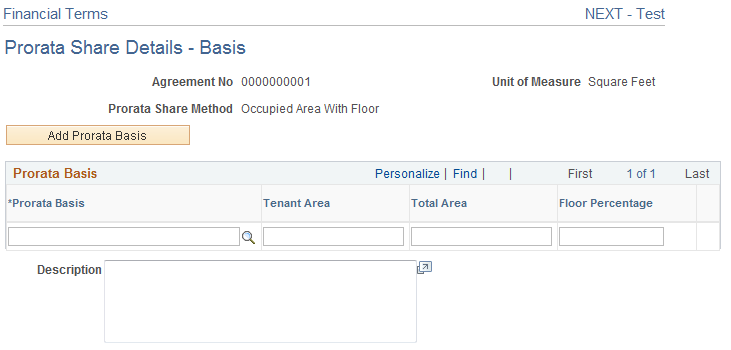

Use the Prorata Share Basis page (RE_LS_PRTA_SEC) to use this page to enter prorata basis information for this operating expense.

Navigation:

Click the Add Operating Expense button.

Click the Prorata Detailslink.

This example illustrates the fields and controls on the Prorata Share Details - Basis page. You can find definitions for the fields and controls later on this page.

The fields on this page vary depend on which prorata share basis is selected on the Operating Expense page.

Field or Control |

Description |

|---|---|

Prorata Share Method |

Displays the prorata share method selected on the Operating Expense Details page. |

Unit of Measure |

Displays the unit of measure. |

Agreement No(agreement number) |

Displays the agreement number for the prorata share details. |

Prorata Basis |

Enter a prorata basis. |

Tenant Area |

Enter the tenant's area. |

Total Area |

Enter the total area to be considered for this prorata basis. The total area of the property selected on the lease will be defaulted here. The user can override this value here. |

Floor Percentage |

Enter the percentage of floor to be considered for this prorata basis. This field is only available if you select Occupied Area With Floor as the Prorata Basis option on the Operating Expense Details page. |

Description |

Enter a description for the prorata share details. |

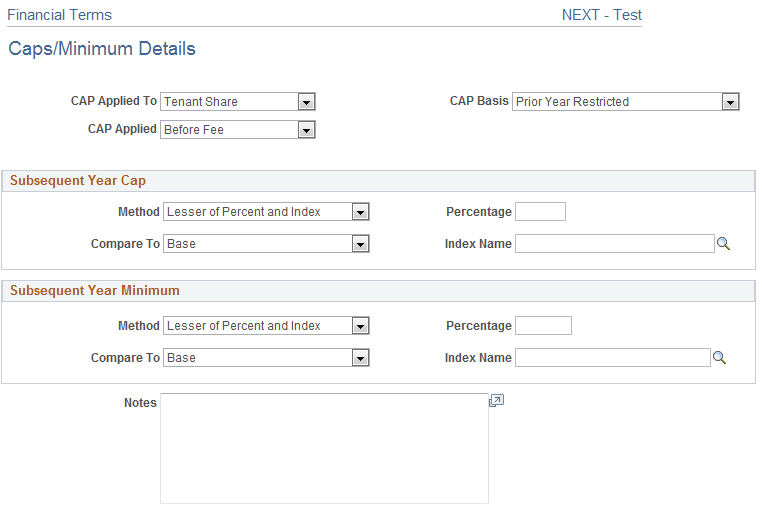

Use the Caps/Minimum Details page (RE_LS_OPX_CAP_SEC) to use this page to enter caps detail information for this operating expense.

Navigation:

Click the Add Operating Expense button.

Click the Caps Detailslink.

This example illustrates the fields and controls on the Caps/Minimum Details page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Caps Applied To |

Select whether the caps are applied to Tenant Share or Landlord Expense. |

Caps Basis |

Select either:

|

Cap Applied |

Select either:

|

Subsequent Year Cap

Field or Control |

Description |

|---|---|

Method |

|

Percentage |

Enter the percentage to be used in calculation. |

Compare To |

Select a comparison value:

|

Index Name |

For Indexed or Least of Percent or Index, specify the index value to be used. |

Subsequent Year Minimum

Field or Control |

Description |

|---|---|

Method |

|

Percentage |

Enter the percentage to be used in calculation. |

Compare To |

Select a comparison value:

|

Index Name |

For Indexed or Least of Percent or Index, specify the index value to be used. |

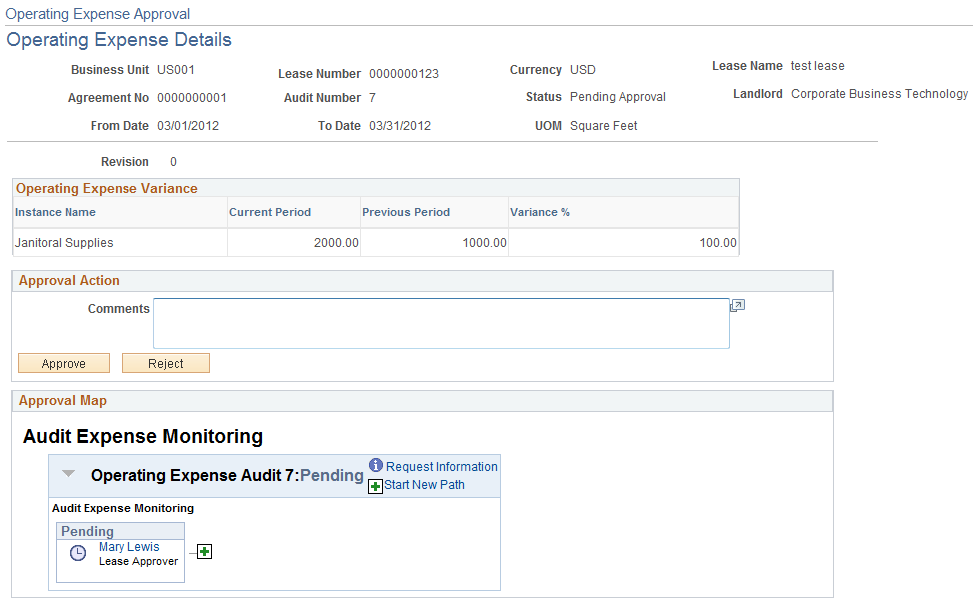

Use the Operating Expense Approval page (RE_LS_OPX_APP) to approve operating expenses that exceed tolerances.

Navigation:

Select a task item from your worklist.

This example illustrates the fields and controls on the Operating Expense Approval page.

If operating expenses are outside tolerance limit, the system will:

On Processing, set the operating expense worksheet to Pending Approval.

Create tasklist for the approver

Route the approver from the tasklist to the approval page

If the transaction is approved, send the transactions to the TQM and change the status of the Worksheet to Processed.

If the transaction is denied, change the status of the worksheet to Pending so that the worksheet can be edited and the whole process can be repeated.

The Approval map displays the path and status of approvals. Ad-Hoc approvers can be added by clicking on the Add button.