Defining Miscellaneous Charges and Landed Costs

To define miscellaneous charges and landed costs, use the Misc Charge/Landed Cost Defn component (miscellaneous charge and landed cost definition component) (CM_LC_COMPONENT).

This section discusses how to set up miscellaneous charges and landed costs.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

CM_LC_COMPONENT |

Set up miscellaneous charges, along with their purchasing attributes and landed cost component information. |

Use the Misc Charge/Landed Cost Defn (miscellaneous charge and landed cost definition) page (CM_LC_COMPONENT) to set up miscellaneous charges, along with their purchasing attributes and landed cost component information.

Navigation:

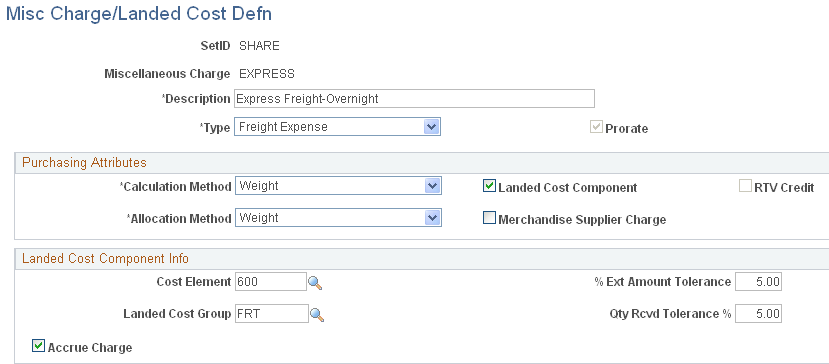

This example illustrates the fields and controls on the Misc Charge/Landed Cost Defn page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

Type |

Select a charge type for the miscellaneous charge. Values are: Freight Expense: Freight charges calculated by the PeopleSoft Structure Freight/Transport menu. Miscellaneous Charge Expense: Miscellaneous charges set up for PeopleSoft Purchasing item and category supplier relationships. Sales Tax Expense: System-calculated sales tax that needs to be accounted for as a landed cost. Use Tax Expense: System-calculated use tax that needs to be accounted for as a landed cost. VAT Input Non-Recoverable (value added tax input nonrecoverable): System-calculated VAT that needs to be accounted for as a landed cost. |

Prorate |

Select to prorate this miscellaneous charge among invoice lines according to the distribution proportions established on the purchase order schedule. If you choose not to prorate the charge and then subsequently choose to use the landed cost component, the system selects this option and renders the check box unavailable for entry. Nonprorated charges are written to a general ledger account as per the accounting entry template and are, therefore, not included as part of the landed cost component. |

Purchasing Attributes

Field or Control |

Description |

|---|---|

Calculation Method |

Select a calculation method for the system to use to derive the charge when the charge is defined for an item or category. The calculation method determines the expected charge for the landed cost component. Values are: % Value (percent of value): Miscellaneous charges are a percentage of the total value of the items. Flat Amt (flat amount): Supplier charges a flat amount. Free: No miscellaneous charges. Freight: Supplier charges for freight costs. Sales Tax: Default value when the charge type is set to Sales Tax Expense. Unit Amt (unit amount): Miscellaneous charges are calculated by unit of measurement. Use Tax: Supplier charges a system-calculated use tax. This is the default value when the charge type is set to Use Tax Expense. VAT (value added tax): The nonrecoverable portion of VAT is included in the inventory value. This is the default value when the charge type is set to VAT Input Non-Recoverable. Volume: Miscellaneous charges are calculated by volume. Weight: Miscellaneous charges are calculated by weight. |

Allocation Method |

Select an allocation method for this miscellaneous charge. The system uses the allocation method to create line and schedule estimates when the landed cost component is attached to a purchase order header. Values are: Matl Value (material value): Allocation estimates are based on the material value of the items. Quantity: Allocation estimates are based on the quantity of items. Volume: Allocation estimates are based on the volume of items. Weight: Allocation estimates are based on the weight of items. |

Landed Cost Component |

Select if the miscellaneous charges have a landed cost component. If you select this option, the system selects the Prorate and the Accrue Charge check boxes by default. The Prorate check box is then unavailable for selection because you cannot use the landed cost component without prorating the cost. The Accrue Charge check box remains active unless you also select the Merchandise Supplier Charge check box, in which case it is unavailable for selection. Also, when you select this check box, the fields in the Landed Cost Component Info group box become active. |

RTV Credit (return to supplier credit) |

Select if you will receive credit from the supplier for these miscellaneous charges if you return any of the items. This check box is active only if the Merchandise Supplier Charge option is selected. |

Merchandise Supplier Charge |

Select if the miscellaneous charges are typically charges by the merchandise supplier. If this check box is selected, the charge appears on the purchase order when it is dispatched to the supplier. Do not select this check box if the charge is typically billed by a third-party supplier. When you select this check box, the RTV Credit check box becomes active. If you have selected the Landed Cost Component check box and subsequently select the Merchandise Supplier Charge check box, the system selects the Accrue Charge check box by default and makes it unavailable for selection. You cannot use the landed cost component and merchandise supplier charges without accruing the charges to an expense account. |

Landed Cost Component Info

Field or Control |

Description |

|---|---|

Cost Element |

Select a cost element for the miscellaneous charge. A cost element is a type of cost such as freight or handling costs. |

Landed Cost Group |

Select the landed cost group to which this miscellaneous charge belongs. Landed cost groups are defined on the Misc Chg/Landed Cost Template page. |

% Ext Amount Tolerance (percent extended amount tolerance) |

Select a total amount tolerance percentage. The tolerance amount is used to automatically close purchase orders and receipts for landed costs if the invoice amount is within tolerance of the purchase order amount. |

Qty Rcvd Tolerance % (quantity received tolerance percent) |

Select a percent tolerance for received quantities. The tolerance is used to automatically close purchase orders and receipts for landed costs if the invoice quantity is within tolerance of the purchase order. |

Accrue Charge |

Select if the miscellaneous charge is to be included in inventory value at putaway. If this check box is deselected, the charge is expensed upon invoicing. |