Defining Ship To Locations

To define ship-to codes, use the Ship To Codes component (SHIP_TO_CODES).

This section provides an overview of defining ship-to locations and discusses how to create ship to locations and specify ship to location sales and use tax defaults and exceptions. It also discusses how to specify ship to location supplier order locations.

|

Page Name |

Definition Name |

Usage |

|---|---|---|

|

SHIPTO_HDR |

Create ship to location IDs that designate existing location IDs as places where you receive goods from suppliers. You must specify an existing location ID as the ship to ID. |

|

|

SUT_DFLT_TBL |

Specify default sales and use tax information for each ship to location. The sales and use tax rates are normally based on the final destination of the shipment (the ship to location). Indicate exceptions to the normal tax rate for each ship to location, and indicate whether the tax exception status is Active or Inactive. |

|

|

SHIPTO_VNDR_LOC |

Specify a supplier order location for a ship to location, and indicate the applicable sales and use tax for the supplier order location. |

|

|

SHIPTO_CNTRCT_DOM |

View all contract domains to which the Ship To Location belongs. |

When you define the general options for the PeopleSoft system, you set up location definitions to store address information for the various locations of the organization. You can identify these locations as ship to locations, which are places where you receive goods from suppliers.

You can assign ship to locations to PeopleSoft Purchasing requesters and buyers to create default shipping information for requisition and purchase order schedules. This default information passes through the system when you create transaction documents. For example, the system passes the requisition ship to location to the purchase order schedules when the requisition is sourced.

You can also update the PeopleSoft Purchasing user preferences to create default shipping information for requisitions and purchase orders.

In the PeopleSoft Purchasing system, the ship to location carries the sales and use tax (SUT) information, specifying how sales and use taxes are handled for items shipped to that location. Normally, the SUT is based on the ship to location or the ultimate use of the items. However, different geographic locations have different SUT regulations. For this reason, different locations and different items can be taxed at varying rates. PeopleSoft Purchasing enables you to indicate tax exception information for each ship to location. You can also specify various combinations of ultimate use, supplier location, item category, and item ID data that are either taxable or nontaxable. When you create a purchase order or voucher, the system uses the SUT default information to determine the appropriate tax rate. The system uses the data that most closely matches the purchase order schedule line or voucher line.

The ship to location also carries supplier order location information so that you can associate specific supplier locations with each ship to location. This enables you to order goods from the closest or preferred supplier location. For example, suppose that most of the offices are located on the East Coast of the U.S. You normally order from the supplier's New York location, but you also have one office on the West Coast. For this office, you might want to place the orders with the supplier's San Francisco location. To do this, specify a supplier order location for the San Francisco office.

Note: In some cases, suppliers support only a single ship to location per purchase order. The PeopleSoft Purchasing system allows you to specify—at the business unit, supplier, or individual purchase order level—whether a purchase order may have multiple ship to locations or only one ship to location. The option to support one ship to location on a purchase order directs the Create Purchase Orders Application Engine process (PO_CREATE) or the PO Calculations Application Engine process (PO_CALC) to either split purchase orders by ship to location or allow only one ship to location on online purchase orders.

Note: When you need purchased goods drop-shipped to a one-time use site that is not one of the existing locations, you define a one-time ship-to address in either the requisition or the purchase order using the One Time Address Default page (header-level) and the One Time Address page (schedule-level). Because you use this address only once, you do not need to create a new location or ship-to location.

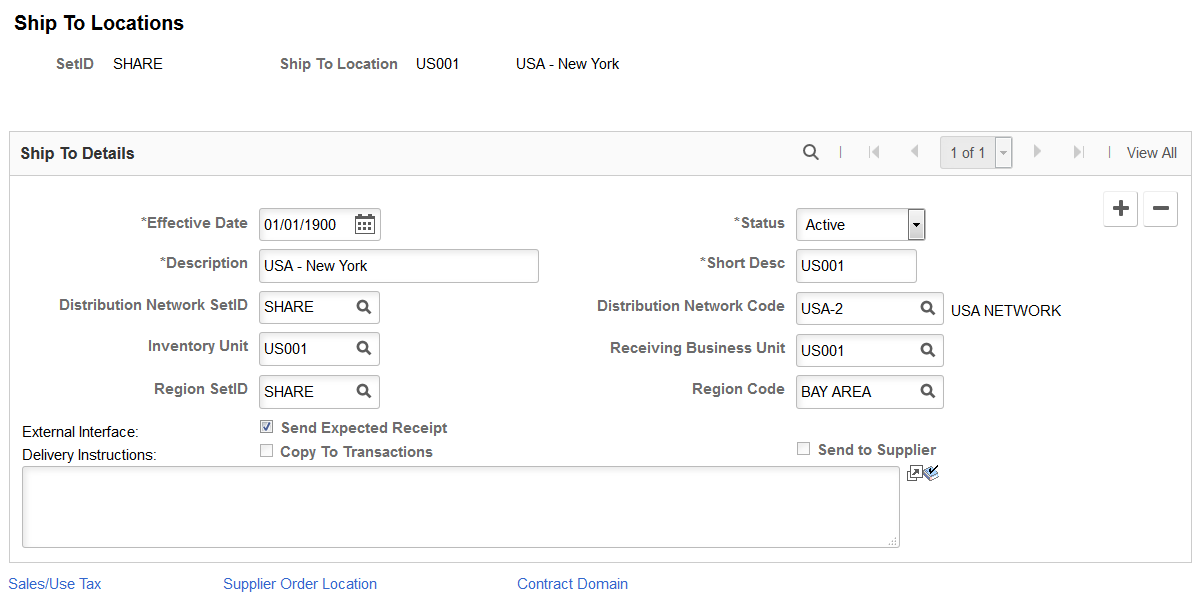

Use the Ship To Locations page (SHIPTO_HDR) to create ship to location IDs that designate existing location IDs as places where you receive goods from suppliers.

You must specify an existing location ID as the ship to ID.

Navigation:

This example illustrates the fields and controls on the Ship To Locations page. You can find definitions for the fields and controls later on this page.

Field or Control |

Description |

|---|---|

GLN (global location number) |

Displays the global location number that is specified for the corresponding ship to location on the Location Detail page (if available). |

Ship To Details

Field or Control |

Description |

|---|---|

Status |

Specify a status for this ship to location. The status takes effect on the effective date. Values are Active and Inactive. |

Distribution Network SetID |

Displays the distribution network SetID for the ship to location. The distribution network SetID identifies the entire distribution network. |

Distribution Network Code |

Displays the distribution network code for this ship to location. The distribution network code identifies a subset of the entire distribution network. |

Inventory Unit |

Displays the inventory business unit for this ship to location. The inventory business unit is where items shipped to the ship to location are actually stocked. |

Receiving Business Unit |

Displays the default receiving business unit for use by the Receive Load process (PO_RECVLOAD). |

Region SetID and Region Code |

Select a region SetID and region for this ship to location. |

Send Expected Receipt |

Select to send purchase orders that you expect to receive at the ship to location to the location by using XML. |

Copy to Transactions |

Select to copy delivery instructions text for this ship to location to the purchase order. |

Send to Supplier |

Select to send delivery instructions text for this ship to location to the supplier. |

Sales/Use Tax |

Click this link to access the Sales/Use Tax page, where you can specify default sales and use tax information for each ship to location. |

Supplier Order Location |

Click this link to access the ShipTo Supplier Order Location page, where you can specify a supplier order location for a ship to location. |

Contract Domain |

Click this link to access the Contract Domains page, where you can view all contract domains to which the Ship To Location belongs. Contract domains are setup on the Region Codes Page. |

Use the Sales/Use Tax page (SUT_DFLT_TBL) to specify default sales and use tax information for each ship to location.

The sales and use tax rates are normally based on the final destination of the shipment (the ship to location).Indicate exceptions to the normal tax rate for each ship to location, and indicate whether the tax exception status is Active or Inactive.

Navigation:

Click the Sales/Use Tax link on the Ship To Locations page.

Tax Exception

Field or Control |

Description |

|---|---|

Exception Type |

Select an exception type. This field designates whether the ship to location is a tax exception. Options are: Direct Pay: For this location, tax is paid directly to the tax agency rather than to the supplier. Exempt: This location is not subject to sales or use tax. None: This location does not have a tax exception. |

Excptn End Date (exception end date) |

Displays the exception end date. Required if the exception type is Direct Pay. |

Sales/Use Tax Exception Certif (sales and use tax exception certificate) |

Required if the exception type is Direct Pay. Applies to PeopleSoft, Taxware, and Vertex calculations. |

Calculation Parameters

Calculation parameters are applicable only to Taxware and Vertex, providing these third-party tax applications with tax calculation rules for the ship to location. These applications use the GeoCode for the ship to location to apply these rules to the appropriate tax calculation algorithms. They may also use the GeoCode for the order acceptance location, ship from location, and (Taxware only), the place of order origin.

Field or Control |

Description |

|---|---|

Include VAT |

Indicates that the VAT amount must be taxed and added to the net extended amount before calculating SUT. This field is informational only. Tax applicability of VAT amounts is determined as part of VAT setup. |

Include Freight |

Indicates that the freight amount must be taxed and added to the net extended amount before calculating SUT. This option is used for Taxware only. |

Include Discount |

Indicates that PeopleSoft calculates any applicable discount and passes the discount amount to Taxware or Vertex. |

Include Misc Charges (include miscellaneous charges) |

Indicates that any other charges must be taxed and added to the net extended amount before calculating SUT. |

Sales/Use Tax Info

When creating sales and use tax information in this section of the page, you must first create at least one row that will represent the default sales and use tax information for the ship to location. Each ship to location has to have either a row that is Taxable with no qualifiers (ultimate use code, category, item ID, supplier ID, and supplier location) or a row that is Exempt with no qualifiers. After you create the default sales and use tax information you can then create additional sales and use tax information with the specific qualifiers (ultimate use code, category, item ID, supplier ID, and supplier location). The system will use the default sales and use tax information if no specific sales and use tax information exists for a ultimate use code, category, item, supplier, or supplier location.

Use these fields to specify further tax information for the ship to location. The value in the Sales/Use Tax Applicability field must match the value in the Exception Type field as follows:

If the exception type is Direct Pay, then SUT applicability must be Direct Pay.

If the exception type is Exempt, then SUT applicability must be Exempt.

If the exception type is None, then SUT applicability must be Taxable.

These rules apply to PeopleSoft, Taxware, and Vertex calculations. All values are copied to the payables voucher.

Supplier Order Location

Field or Control |

Description |

|---|---|

Supplier SetID |

Displays the supplier SetID. This field value determines the values available for the supplier ID. |

Apply to All Suppliers |

Select to indicate that the SUT Flag option applies to all suppliers. |

Supplier ID |

Displays the supplier ID. Only values for the selected supplier SetID are available. This field determines the values available for the order supplier location. |

Order Supplier Loc (order supplier location) |

Displays the supplier order location that you want to associate with the ship to location. The supplier location that you select here is the primary attribute used for calculating item pricing. |

SUT Flag (sales and use tax flag) |

Designate the SUT applicability for the ship to supplier order location. Values are: None, Sales, and Use. |

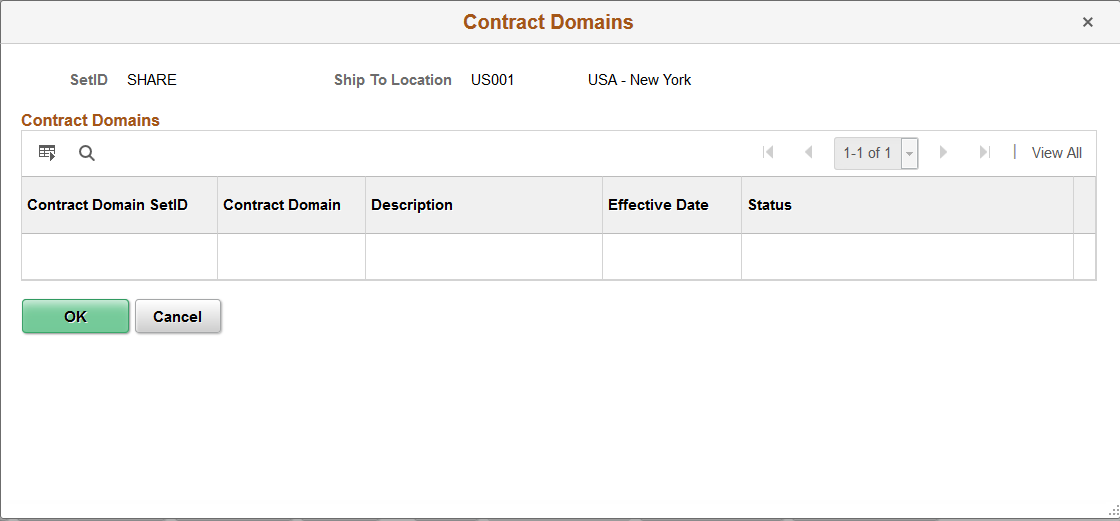

Use the Contract Domains page (SHIPTO_CNTRCT_DOM) to view all contract domains to which the Ship To Location belongs.

Contract domains are setup on the Region Codes Page.

Navigation:

Click the Contract Domain link on the Ship To Locations page.

This example illustrates the fields and controls on the Contract Domains page.